01/19/2026: Ideas For The Upcoming Week

The SPY still remains over the 8-week daily MA, but only just. I think it’s quite clear momentum is slowing as it has been for quite some time, but we still keep going. We have earnings season kicking off in a few days so that’s ultimately the next big catalyst as well as the markets reaction to Trump’s new 10% tariffs on 8 European countries.

As I’ve said before, I remain bullish and I think earnings will back this bias up, but expectations are high. If we remain bullish, I think the upside move will be far less than the potential downside moves if that does start to happen. I remain focused on letting the charts dictate my activity. As long as we remain above the 8 and 21 MA’s it’s hard to be bearish. If we flip, then I have a clear plan that I’ll follow that my paid subscribers know about.

If you want real time updates from me throughout the week then consider becoming a paid subscriber. Definitely worth a try for a month and if you don’t like it you can cancel. I suspect you’ll find far more value in it than $16 a month though.

With it you get:

Access to my portfolio (with real monetary amounts)

Access to my spreadsheet. One of the most in-depth and helpful resources out there.

Access to the paid chat where I send ~5-20 messages per day.

Real time buy, add, trim, and sell alerts.

Defensive

My more defensive play to watch this week is Novo Nordisk (NVO) which jumped 9% on Friday showing some very strong signs of a reversal down at a 56% drawdown from highs.

The move was mainly due to momentum on Wegovy with the UK approving a 7.2 mg weekly dose (tripple the previous maximum dosage). We also saw some positive data on NVO’s Wegovy pill which is a nice differentiator for NVO over peers like LLY currently, though LLY are close to competing here as well.

I think by the end of 2026 we should see EPS start to grow significantly again with 2027 likely heading towards 10% growth again. Based on 10-12% EPS CAGR from here ~$3.70, I suspect we hit $5 EPS by FY28 and then based on a return to 25x PE over time as sentiment improves, price wars improve, and the Wegovy pill success, we then see a potential $125 stock price which is 100% from today.

I do think this will be a slow burner. There’s still fierce competition and growth is still fairly slow, but over time I have little doubt NVO is a winner. So if you’re a bit more defensive and want to lower the beta of your portfolio though larger cap, slower growth plays, I think NVO is a good play.

From a technical point of view, NVO just flipped the 200 daily for the first time since September 2024.

The only reason I’d be a bit cautious with NVO today is Trump’s tariff threats which could hit NVO, though they are shielded far more than many European companies because of their US production. I suspect there should be no issues here but it’s something to track.

Neutral Risk

A stock that I’ll definitely be looking to add this week when price action starts to consolidate is PATH. We’re now down 28% from December 10th high of $19.80 on pretty much no news aside from CEO stock sales (pre-planned 90+ days in advance via SEC Rule 10b5-1 and nothing out of the ordinary) and competition from Anthropic’s Claude. The bearish response to Claude signals a complete misunderstanding of PATH’s Maestro product. Maestro is not meant to compete with Claude…it’s meant to act as the overarching manager that allows all these AI agents (Claude, Gemini etc) to work together simultaneously. Advancements in Claude is bullish for PATH.

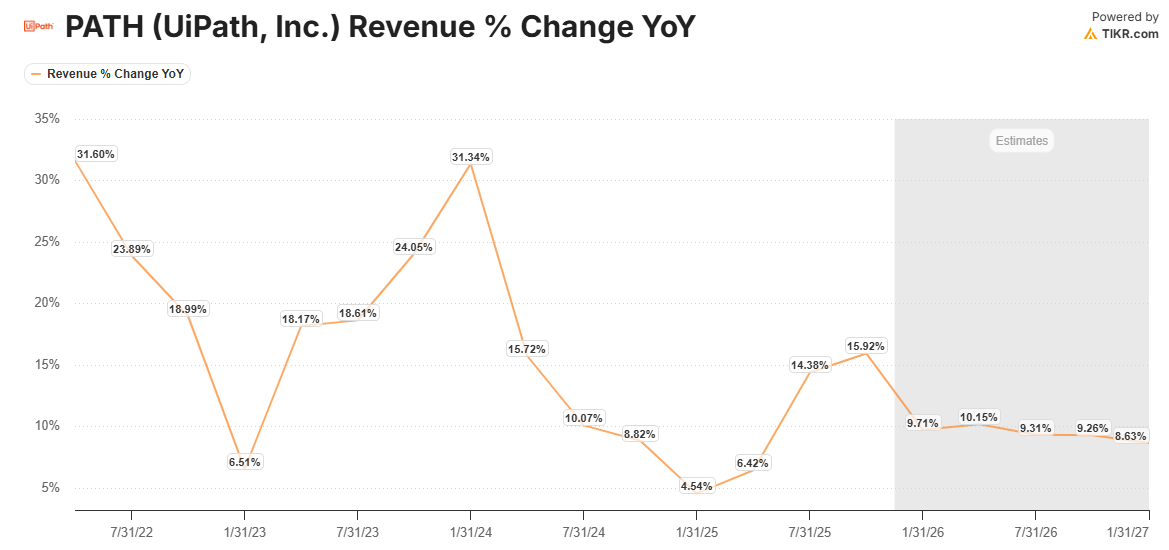

Below you can see current analyst estimates for PATH’s quarterly revenue growth over the next 2-3 years. I expect these numbers get revised very quickly over the next few months.

PATH currently trades at an EV/Sales of 3.66x and a look through EV/earnings of ~10x. I’ll share my model on my spreadsheet soon but here’s my basic assumptions:

I expect ARR to grow at a minimum of 15% CAGR over the next 5 years to $3.71B in 2030 (from $1.844B which is expected as at 31.12.25). If we then assume net margins ramp up from 21% to 30% by 2030, we should see a net income of $1.113B. PATH currently trades at 19.7x NTM PE, but this is far too low if growth happens at the rate I think it will and if PATH creates a moat as strong as I believe they will.

If we go fairly basic and assume a PE multiple of 30x (2x the implied CAGR and still below previous averages), we end up with a market cap of $33.39B. PATH currently is a $7.67B business so this would offer a 335% increase from today…and I think that’s being fairly conservative.

If Maestro turns into what I think it will, then I think we look more at a 5x return.

As always, I won’t add to my current PATH position until price action starts to consolidate/turn bullish.

Higher Risk

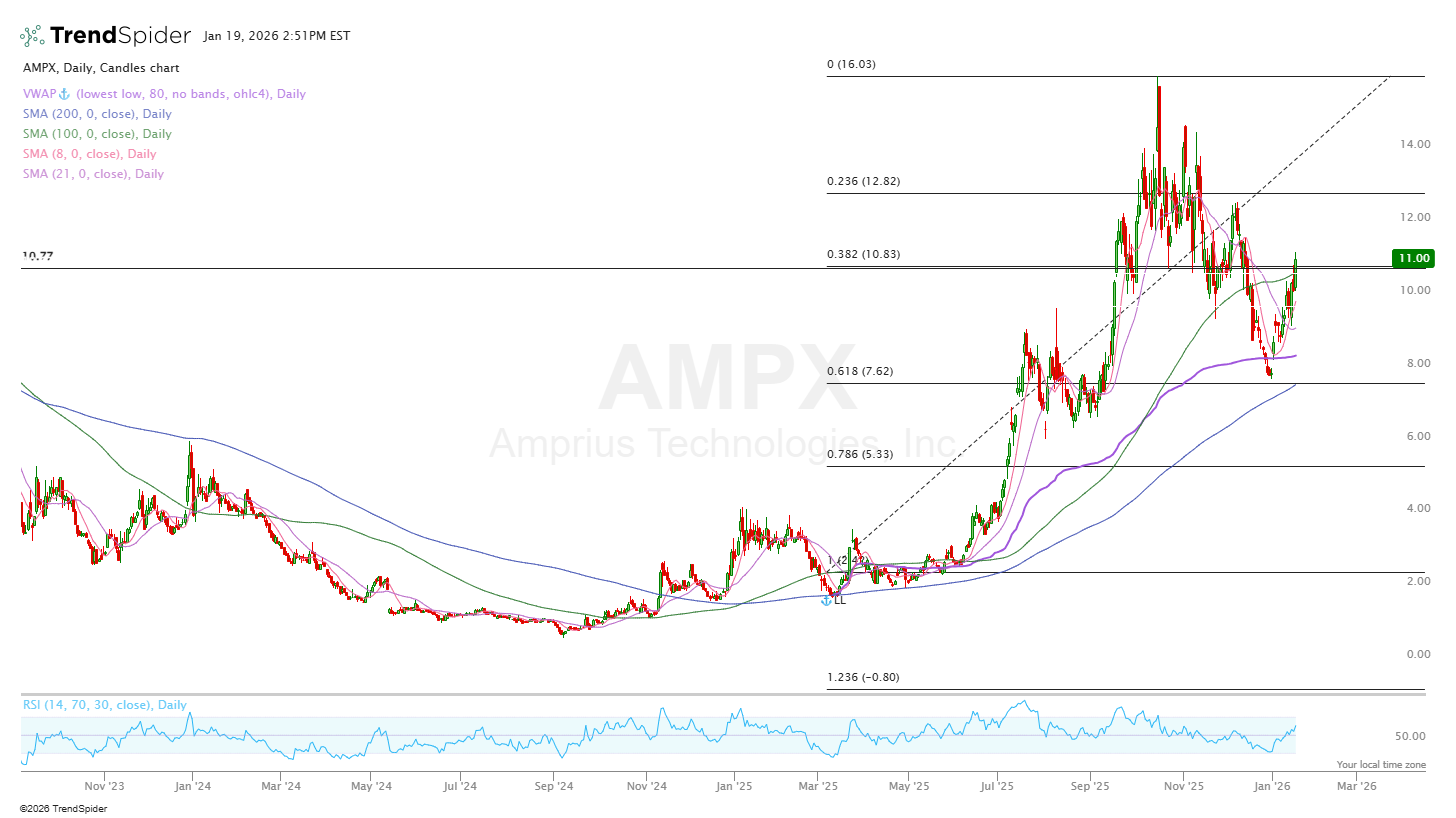

The higher risk, smaller cap play that I have my eyes on is AMPX. First, a quick introduction to AMPX:

AMPX designs high-performance lithium-ion batteries for drones and the electric aerospace niche making this is a nice dual theme play on batteries (mainly) but also on the rising demand from the drone and aerospace markets.

AMPX is one of the few companies building a 100% Silicon Anode. Some competitors are trying to still use a graphite battery but with silicon as well whilst AMPX have completely jumped this step and become a pure silicon play. With 74% estimated revenue growth for the next 2 years and an EBITDA profitability inflection point in FY27, I think AMPX is going to start flashing up on a lot of people’s screeners very quickly.

Technically, it looks really nice as well. I suspect if we see a red week posts Trump’s European tariffs, AMPX will drop back into the $8-$10 range in which case I will strongly consider an entry.

Will be keeping an eye out for AMPX from now on