10 Quality Dividend Stocks

The best stocks for income

Hi fellow investor👋

I’m enjoying the Monday screen articles quite a lot and I hope you are as well? If you have any feedback (positive or negative) please do leave a comment or message me to tell me.

I mainly like to invest in high growth companies with the potential to beat the market over a 3-5 year time frame. However, I also invest some of my funds into dividend stocks for income purposes.

Before we get into the stocks, make sure you haven’t missed the below articles:

Today we are focusing purely on high quality dividend stocks.

I used StocksGuide to find these stocks. They have one of the best in-built screeners on the market in my opinion. For example, for this screener I used their Dividend Top Scorer screen and only chose companies with a score of more than 13 out of 15.

Here’s 10👇

10. United Parcel Service (UPS)

Introduction

UPS is the global leader in logistics and package delivery. They operate in 220 countries and offer a wide range of logistics and transportation services. Most revenue (65%) comes from US domestic package delivery and is driven by the surge in e-commerce.

About 20% of revenue comes from international shipping which has much higher margins than domestic packaging.

Finally, 15% of revenue comes from supply chain and freight which includes freight transportation, logistics services, and specialized solutions like healthcare logistics.

Numbers

Revenue growth: -7%

Net margin: 6.46%

Dividend yield: 4.77%

Payout ratio: 46.64%

Visual

Source: StocksGuide

9. Chevron (CVX)

Introduction

CVX is one of the largest energy companies in the world, involved in upstream (exploration, production), and downstream (refining, marketing, and distribution) of oil and natural gas.

They also invest heavily in renewable energy and alternative energy technologies.

Numbers

Revenue growth: -8%

Net margin: 8.87%

Dividend yield: 4.01%

Payout ratio: 45.06%

Visual

Source: StocksGuide

8. Verizon Communications (VZ)

Introduction

VZ is a US leading telecommunications company providing wireless, internet, and digital communication services. They generate revenue through mobile data plans, broadband, and enterprise communication. They’re also investing heavily into 5G.

I used to own VZ until earlier this year. It was more of a swing trade where I made about 20% but I decided to use the cash for companies like SOFI, PYPL, and BABA. Turned out quite well.

Numbers

Revenue growth: -1%

Net margin: 14.00%

Dividend yield: 5.99%

Payout ratio: 59.02%

Visual

Source: StocksGuide

7. Prudential Financial (PRU)

Introduction

PRU is a global financial services provider specializing in insurance, investment management, and retirement through offerings such as life insurance, mutual finds, pensions, and annuities.

Numbers

Revenue growth: -6%

Net margin: 8.05%

Dividend yield: 3.92%

Payout ratio: 66.18%

Visual

Source: StocksGuide

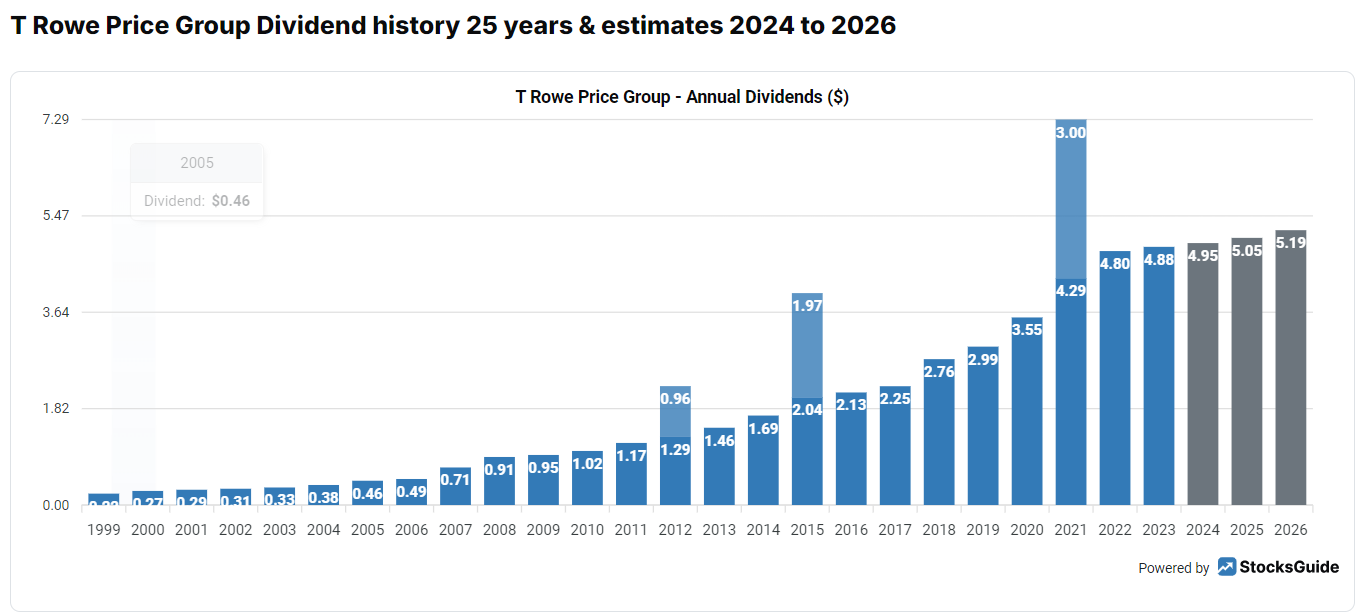

6. T Rowe Price Group (TROW)

Introduction

TROW is a investment management firm managing many asset classes such as equities, fixed income, and multi-asset solutions.

They generate revenue through fees associated with AUM (assets under management).

Numbers

Revenue growth: 9%

Net margin: 27.89%

Dividend yield: 4.22%

Payout ratio: 61.52%

Visual

Source: StocksGuide

5. Franklin Resources (BEN)

Introduction

BEN is another investment management company offering mutual funds, ETF’s and institutional investment solutions. Revenue comes from fees on assets under management (AUM).

Numbers

Revenue growth: 5%

Net margin: 8.20%

Dividend yield: 5.72%

Payout ratio: 44.50%

Visual

Source: StocksGuide

4. Everygy (EVRG)

Introduction

EVRG is an electric utility company providing energy generation, transmission, and distribution services in Kansas and Missouri.

They focus on sustainable energy production, mainly wind and solar, but they also have traditional energy sources.

Numbers

Revenue growth: -3%

Net margin: 14.30%

Dividend yield: 4.06%

Payout ratio: 68.04%

Visual

Source: StocksGuide

3. Lyondelbasell Industries (LYB)

Introduction

LYB is one of the largest plastics, chemicals, and refining companies globally.

They manufacture products used in packaging, automotive parts, electronics, and construction. Revenue streams are split into:

Olefins and Polyolefins: The building blocks of the petrochemical industry. Olefins and polyolefins are used to create plastics, chemicals, and other synthetic materials.

Intermediates and Derivatives: Produces intermediates like propylene oxide, ethylene oxide, and acetyls used to manufacture detergents, textiles, and adhesives (and much more).

Refining: LYB operates a refinery in Houston which processes crude oil into refined products like gasoline, diesel, and jet fuel.

Numbers

Revenue growth: -3%

Net margin: 8.74%

Dividend yield: 5.40%

Payout ratio: 54.35%

Visual

Source: StocksGuide

2. Regions Financial (RF)

Introduction

RF is a regional bank in Southern US that provides retail and commercial banking services, wealth management, and mortgage products.

They generate revenue mainly through interest income on loans and deposits, as well as fees from financial services like asset management and insurance.

Numbers

Revenue growth: 3%

Net margin: 30.75%

Dividend yield: 4.11%

Payout ratio: 32.99%

Visual

Source: StocksGuide

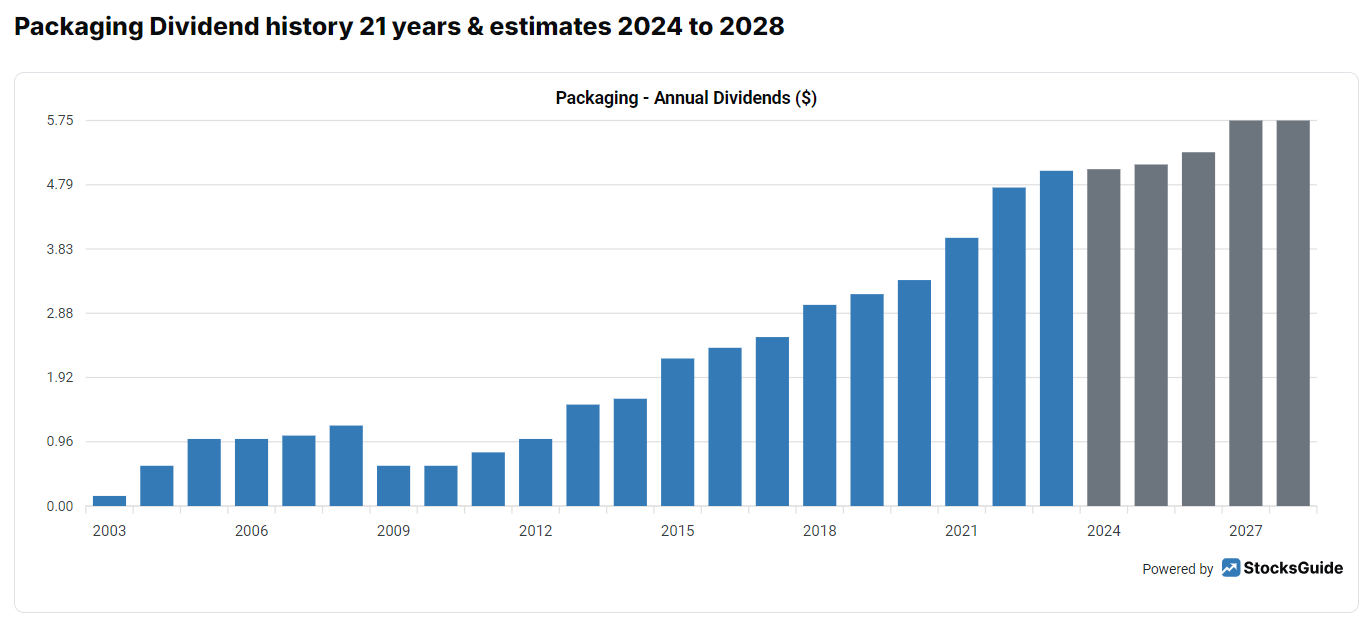

1. Packaging (PKG)

Introduction

KPG is one of the largest producers of containerboard and corrugated packaging products serving in industries such as food, beverage, agriculture, and consumer goods.

Numbers

Revenue growth: -1%

Net margin: 9.58%

Dividend yield: 2.27%

Payout ratio: 48.54%

Visual

Source: StocksGuide

That’s it for the day

I hope you loved this article. Please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

I like your stack here.. thanks for the share, man

Price T Rowe is my favorite from the list because it's an asset management company