10 Wide Moat Businesses You Probably Haven't Heard About

You'll want to own some of these after this article

It's #SundaySpecial!

Economic Moats

Moats are vital for quality investing. This chart shows you all you need to know.

This chart shows how big the difference is between Morningstar’s Wide Moat Focus Index and the S&P 500.

Now imagine we extracted all the wide moat businesses from the S&P 500 and left the S&P 500 with all those businesses that didn’t have a moat. Imagine the difference then…

This is why it’s so important to invest in businesses that have a moat.

But what exactly is a moat?

If you’re not sure what an economic moat is, have a quick look at this article I wrote.

The most misunderstood part of investing in companies with economic moats is that it is only beneficial when the moat is protecting something that is quality.

Quality companies are everywhere and there’s many factors that determine if a company has quality characteristics.

Here’s a quick (and basic) screen to give you a quick idea of whether a company is quality:

Revenue growth >8%

Earnings growth >10%

Inside ownership >10%

ROIC >15%

Gearing <0.75

FCF margin >10%

I won’t go into more detail here about exactly what constitutes a quality business. But it’s fundamental to understand that a moat is only valuable when it’s protecting a quality company.

“We think of every business as an economic castle. And castles are subject to marauders. And in capitalism, with any castle…you have to expect that millions of people out there are thinking about ways to take your castle away.” - Warren Buffett

Companies with an economic moat generally have large margins due to the lack of competition around them, and subsequent pricing power they’re able to achieve.

Here’s 4 quantitative characteristics that suggest an economic moat may be present (according to Buffett).

Gross Margin > 40%

Net Margin > 20%

Interest Expense < 15%

Liabilities to Equity < 0.90

10 Quality Companies with Strong Economic Moats (that you likely haven’t considered)

1. Rollins ROL 0.00%↑

Company Description:

A pest control company known for brands such as Orkin, HomeTeam, and Western Pest Services.

Investment Case:

Market leader of pest control services in the United States with a 24% market share.

Consistently growing revenues and free cash flow

A steady, and high ROIC ~18%

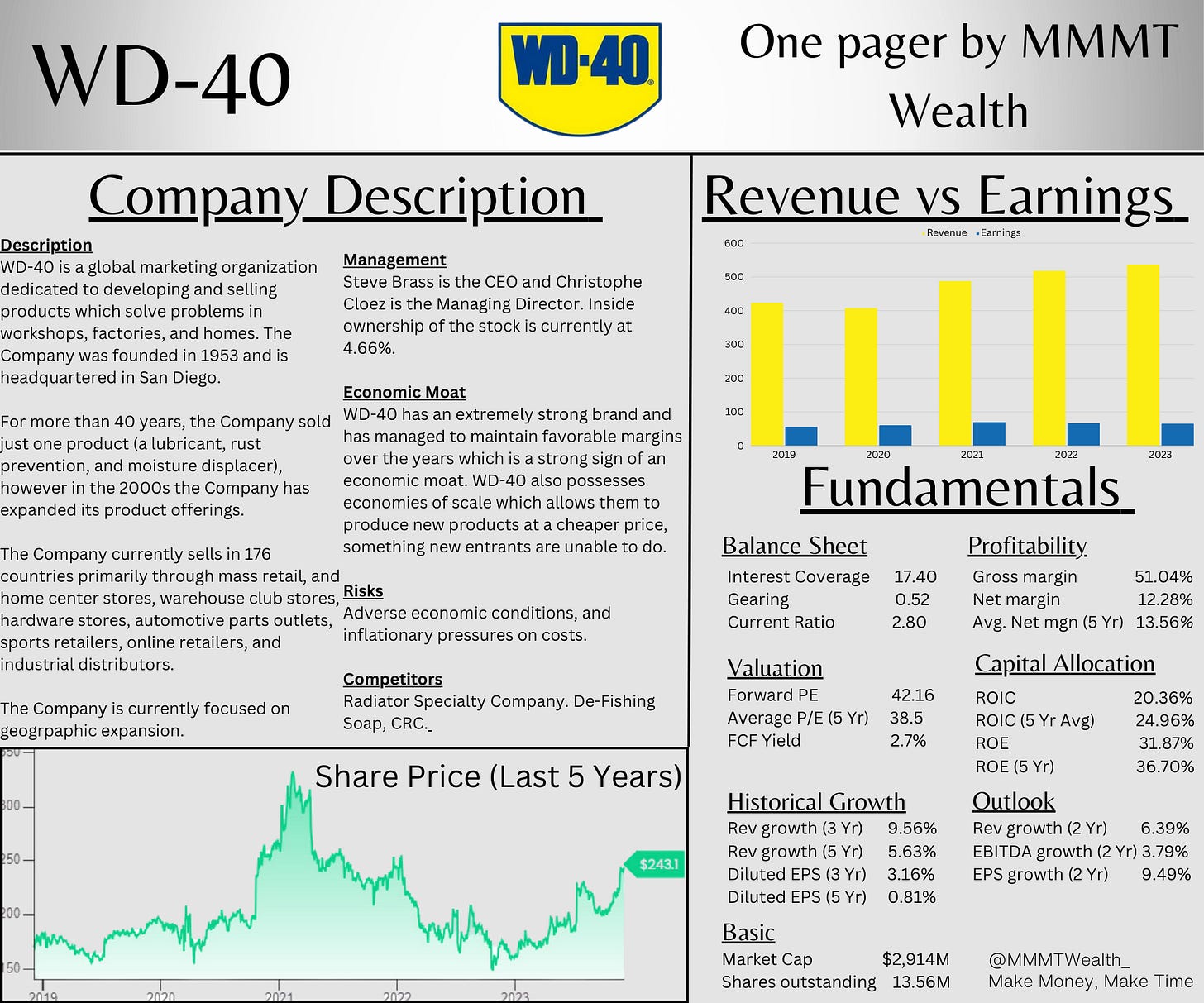

2. WD-40 Company WDFC 0.00%↑

Company Description:

WD-40 is a global marketing organization who develop and sell products which solve problems for workshops, factories, and homes.

The Company originally sold just one product (a lubricant and rust prevention spray) but today WD-40 have a wide product offering.

The Company currently sells in 176 countries and is very focused on further geographic expansion.

Investment Case:

WD-40 has one of the strongest brand images in the entire world, making it the “go-to” product for its niche

Continued revenue growth with strong margins and free cash flow of $109M annually

A high ROIC and ROE (34.2)

One-Pager:

3. MSC Industrial Direct MSM 0.00%↑

Company Description:

MSC Industrial Direct distributes metalworking and maintenance, repairs, and operations products and services throughout the US, Canada, Mexico, and UK.

Operations products include cutting tools, measuring instruments, raw materials, abrasives, plumbing supplies, power transmission components, and electrical supplies.

Investment Case:

Insider buying over 2023 and a total of 18% shares owned by insiders.

Current valued attractively at an FCF Yield of 9.2% (5 yr average: 6.2%)

High cash flow vs debt showing the financial strength of MSC.

4. Copart CPRT 0.00%↑

Company Description:

Copart is a global leader of online vehicle auction and remarketing services by connecting sellers from varying industries such as insurance, finance companies, rental companies to buyers all around the globe.

Investment Case:

This is an owner-operated stock with insiders owning 11.1% of the company. If you don’t understand why this is important, read my article here.

Network effects and economies of scale lead to a very high ROIC and net profit margins.

Consistent and strong revenue and earning growth

5. Moody’s MCO 0.00%↑

Company Description:

Owned by Buffett, Moody’s Corporation rates the creditworthiness of companies, governments, and fixed income debt securities. This is all done within the Moody’s Investors Service segment of the business. This is a very regulated industry with extremely high barriers to entry making the economic moat very strong.

Moody’s Analytics develops a range of products and services that support the risk management activities of institutional participants in the financial markets.

Investment Case:

Very strong ROIC, ROE, and a gross profit margin of 70.7%.

Growing analytics business to diversify revenue streams.

$1.7B in free cash flow.

6. IDEXX Laboratories IDXX 0.00%↑

Company Description:

IDEXX Laboratories is an American multinational in the niche of pet healthcare innovation. IDEXX operates through three segments: Companion Animal Group, Water Quality Products, and Livestock, Poultry, and Dairy.

Investment Case:

Seven successful international commercial expansions since 2020 have led to double-digit earning gains.

Very successful implementation of cloud based software enabling IDEXX to streamline and make the business much more efficient.

Very high margins, ROIC, ROE, and reduction in debt since 2022.

7. Stryker Corporation SYK 0.00%↑

Description:

Stryker operates as a medical technology company through two segments: MedSurg and Neurotechnology, and Orthopedics and Spine. The O&S division is a leading provider for implants for hip and knee replacements and other extremity surgeries.

The M&N division distributes surgical equipment and surgical navigation systems used in a variety of medical specialties. The Company sells products to doctors, hospitals, and other healthcare facilities.

Investment Case:

Very high switching costs as, for example, a surgeon would have to forego the familiarity of using a specific product. This is one of the leading reasons for the economic moat that Stryker possesses.

Double digit revenue growth and successful innovations.

Very successful acquirer of businesses in the medical device, enterprise tech, and life sciences industries.

8. LVMH

Description:

LVMH operates as a luxury goods company offering wines, spirits, fashion and leather products, perfumes and cosmetics, watches and jewelry, and custom design yachts.

Investment case:

Consistent increase in revenue, margins, ROIC, and ROE over the last 5 year period.

Very well diversified portfolio of brands.

Huge potential growth in China with analysts expecting Chinese consumers to represent 40% of the global luxury market by 2030.

9. Old Dominion Freight Line ODFL 0.00%↑

Description:

Old Dominion Freight Line is an American regional and national less than truckload shipping company. They also offer expedited, logistics and household moving services.

Investment Case:

Leader in an industry with very high ROIC and ROE.

Growing gross and net profit margin.

Family run business that is very resilient even in market downturns.

10. VeriSign

Description:

VeriSign provides domain name registry services and internet infrastructure that enables internet navigation for various domain names worldwide such as .com and .net. It also back-end systems for .cc, .gov, .edu, and .name domain names as well as operating in networking, security, and data integrity services.

Investment Case:

Huge monopoly on the most valuable domain names making it extremely difficult for new players to enter the market.

An extremely high ROIC and net profit margin (44.2% and 49.4% respectively).

Fairly valued with the PE ratio at a low for 5 years and FCF Yield at a 5 year high.

One- Pager:

That’s all for today!

I hope you enjoyed this article. If you did, please do give it a like, share, comment, restack etc! It all helps me in my goals to get this newsletter out to thousands of people.

About the author

Make Money, Make Time is written by Oliver, a qualified CA, and investor who has read over 300 investment books, and spends more than 50 hours per week researching stocks so that you don’t have to.

You can also follow me on X here!

Hey Oliver, I really didn't about the companies you presented except for Copart and LVMH. Well done.