3 Quality Stocks That Have Fallen More Than 40%

PAYC CELH DLO

Hi fellow investors 👋

I recently started releasing a short article every Monday with a few quick screens and the results of those screens. Last week I focused on quality stocks trading at their lowest valuations ever such as AMZN, ULTA, and BABA. The aim isn’t to dive deeply into each stock (although I do provide some information on them), but it’s to introduce ourselves to some potential new gems.

Apologies that this article hasn’t been released until now. I had a bit of time off last week in New York with my parents so only got around to starting this on Sunday morning.

The narrative on the stocks won’t be in depth because I want to keep these article short and snappy and save the details for my deeper dives. Of course if any of these stocks that come up in my screens really interest me, then I’ll do a deeper dive on them at a latter date.

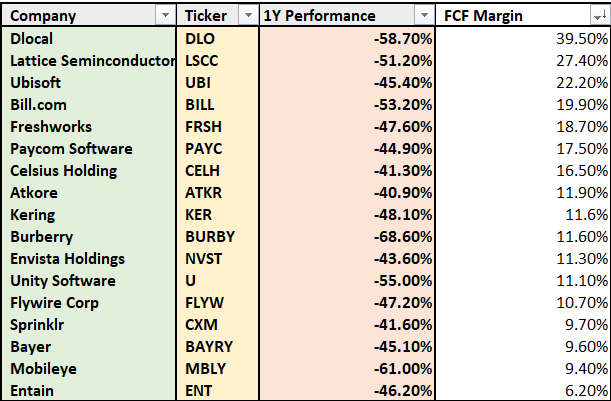

This week I focused on high quality stocks with the following criteria:

Market cap > $2B

Equity ratio > 25%

FCF margin > 5%

1Y Performance > -40%

Here’s the results:

Note: I do not include any Biotech or Pharma companies because I don’t know much on these industries and deem them too risky for my portfolio

The 3 companies I have decided to focus on today are:

Celsius Holdings

DLocal

Paycom Software

Celsius Holdings (CELH)

Company: Celsius Holdings

Ticker: CELH

Website: https://ir.celsiusholdingsinc.com/overview/default.aspx

Current Stock Price: $33.50

52-Week High: $96.11

52- Week Low: $31.69

Market Cap: $8.54 billion

Headquarters: Boca Raton, Florida

Number of Employees: 765

Numbers

Revenue growth: 23.4%

Gross profit margin: 52%

Net profit margin: 19.8%

Commentary

CELH is a frustrating one for me as I have been a buyer in the $70s, $60s, $50, $40s, and now in the $30s. I really don’t understand why it has dropped this much but I have a strong sense that CELH will return to the high $100s over time.

CELH has dropped for a few reasons, the main being revenue growth contraction and wider energy drink market growth contraction. At triple digit revenue growth, CELH deserved high multiples because they were literally growing above 100% for three straight years. That is no longer the case, and nobody should have thought that would have ever been the case so people shouldn’t use this argument as a bear case for the stock.

Here’s why I am bullish:

CELH is crushing the online sales channels on Amazon. They now have a 22.1% share on Amazon, which is higher than Monster (21.8%) and Red Bull (13.8%). This is a strong sign that there’s some loyal customers consistently buying in bulk.

Where CELH needs to improve is in the U.S. MULOC (multi-outlet with convenience store) which grew at 36.5% this year. For me, this is the segment where people come in for smaller one-off purchases, maybe those trying CELH for the first time. Clearly growing this segment at 36.5% is strong, but we need more. What I will say on this is that these growth rates of 36.5% of likely understated right now due to delays in store resets and delayed promotional activities.

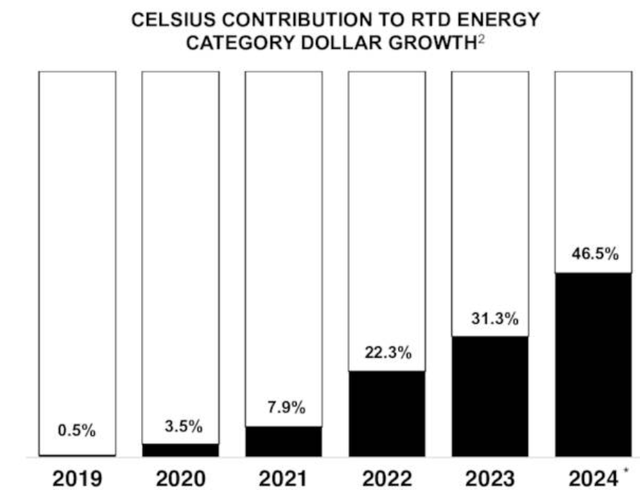

One of the main reasons I love CELH is because of this graph:

This shows how much CELH contributes to the growth in the energy drink category. CELH essentially grew ten times more than the total growth in the sector. But the reason for this is important to understand.

Many bears have said that market share has decreased recently and Red Bull and Monster are getting further ahead again. Firstly, this isn’t true. Market share dropped by ~0.1% in one 4 week period.

Secondly, management are not focused on taking market share from competitors. Management are focused on attracting new customers to the energy drink market meaning the rate at which they take market share won’t necessarily be that high because the market is growing exponentially.

“We’re driving the category growth rate. The category is not growing. We’re over-indexing with “new to category.” - Fieldy, CEO

CELH international revenue is tiny at just $20 million but it’s growing nicely YoY at 30%. We still lack information on the international expansion, but we do know that Canada is still very strong and beating expectations, whilst inroads have been made in the UK and Ireland. Australia and France are likely on track for later this year.

Finally, CELH have the growth opportunities of new products in 2025. On the earnings call, management said that they want to push into water and food products (such as protein bars). The international and product opportunities going forward for CELH are very good. I don’t think investors should be surprised if revenue growth rates remain in the 20% range or even start to increase a bit over time. This won’t be over the next year, but I see some very strong growth when looking at a 5-year time frame.

DLocal (DLO)

Company: DLocal

Ticker: DLO

Website: https://investor.dlocal.com/

Current Stock Price: $8.52

52-Week High: $21.52

52- Week Low: $7.15

Market Cap: $2.46 billion

Headquarters: Montevideo, Uruguay

Number of Employees: 901

Numbers

Revenue growth: 6.3%

Gross profit margin: 40.8%

Net profit margin: 27%

Commentary

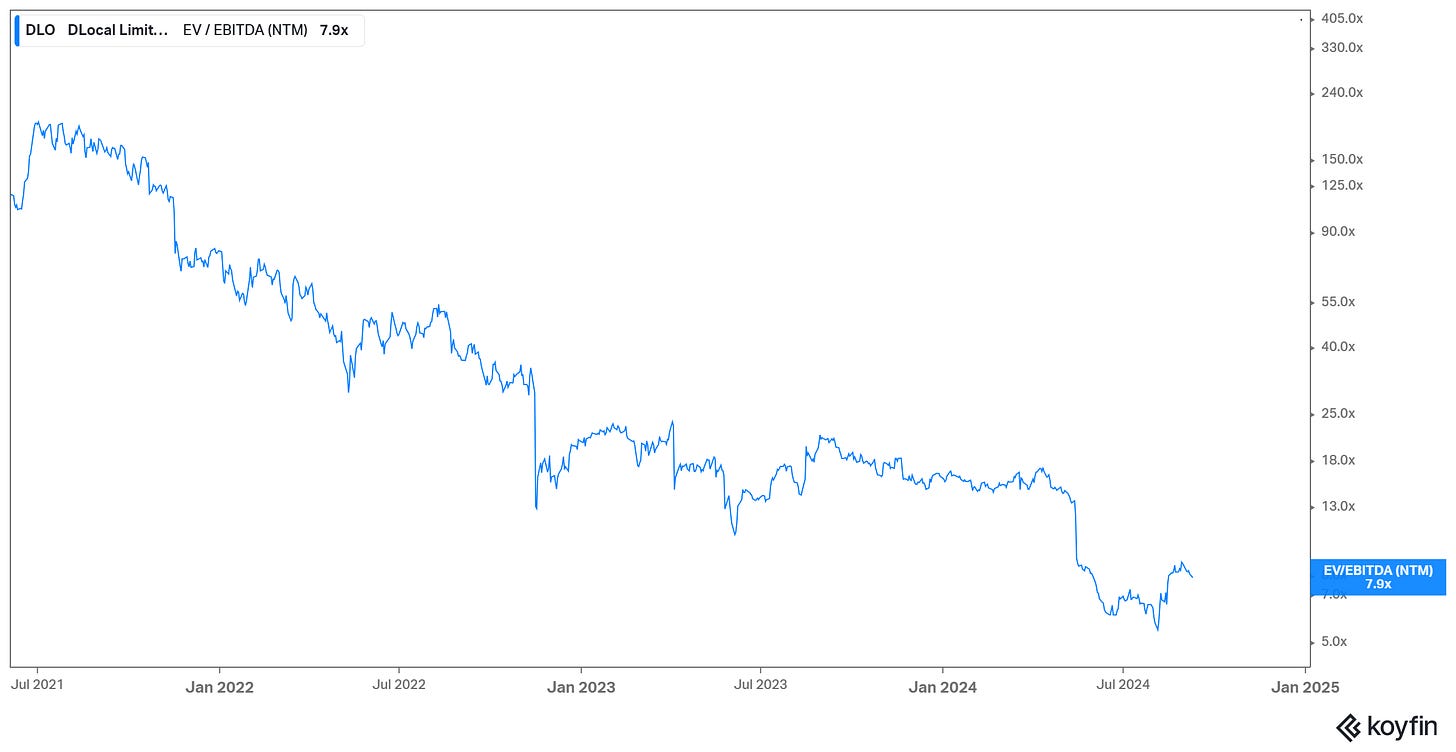

As you may know if you’ve been a reader of my newsletter for a while, I have been an owner of DLO for quite some time, and…well it’s not performed great. I chose DLO over NU and it’s safe to say NU has performed a lot better than DLO so far. But, my investment thesis still remains intact and I have never considered selling the stock. Here’s why I bought DLO and why I continue to like it:

One of the main reasons I bought this payment processor was because I have a macro bullishness on emerging markets (LatAm, Asia, and Africa) and felt that DLO would be one of the key beneficiaries of this growth. I still think this investment plays out long term but I’m less confident that it has some good growth over the next 12 months or so. I think this is a 5+ year play.

From a fundamental perspective, for a company in the growth stage that DLO is in, it’s financially healthy with $1.1 billion in total assets vs just $753 million in liabilities. Yes growth has slowed a bit…but we have a company with a market cap of $2.4 billion that is financially healthy, profitable, and growing revenues YoY in the emerging markets. I think this is a good play at today’s prices.

Paycom Software (PAYC)

Company: Paycom Software

Ticker: PAYC

Website: https://investors.paycom.com/overview/

Current Stock Price: $163.75

52-Week High: $285.95

52- Week Low: $150.69

Market Cap: $8.66 billion

Headquarters: Oklahoma City, Oklahoma

Number of Employees: 7,308

Numbers

Revenue growth: 23.4%

Gross profit margin: 52%

Net profit margin: -9.9%

Commentary

I don’t own PAYC, and to be honest I haven’t really been that close to owning it at any point over this year which has seen a 43% drop so far YTD. However, I know lots of people on X that are interested in this stock so I wanted to give my take as it came up in this screen.

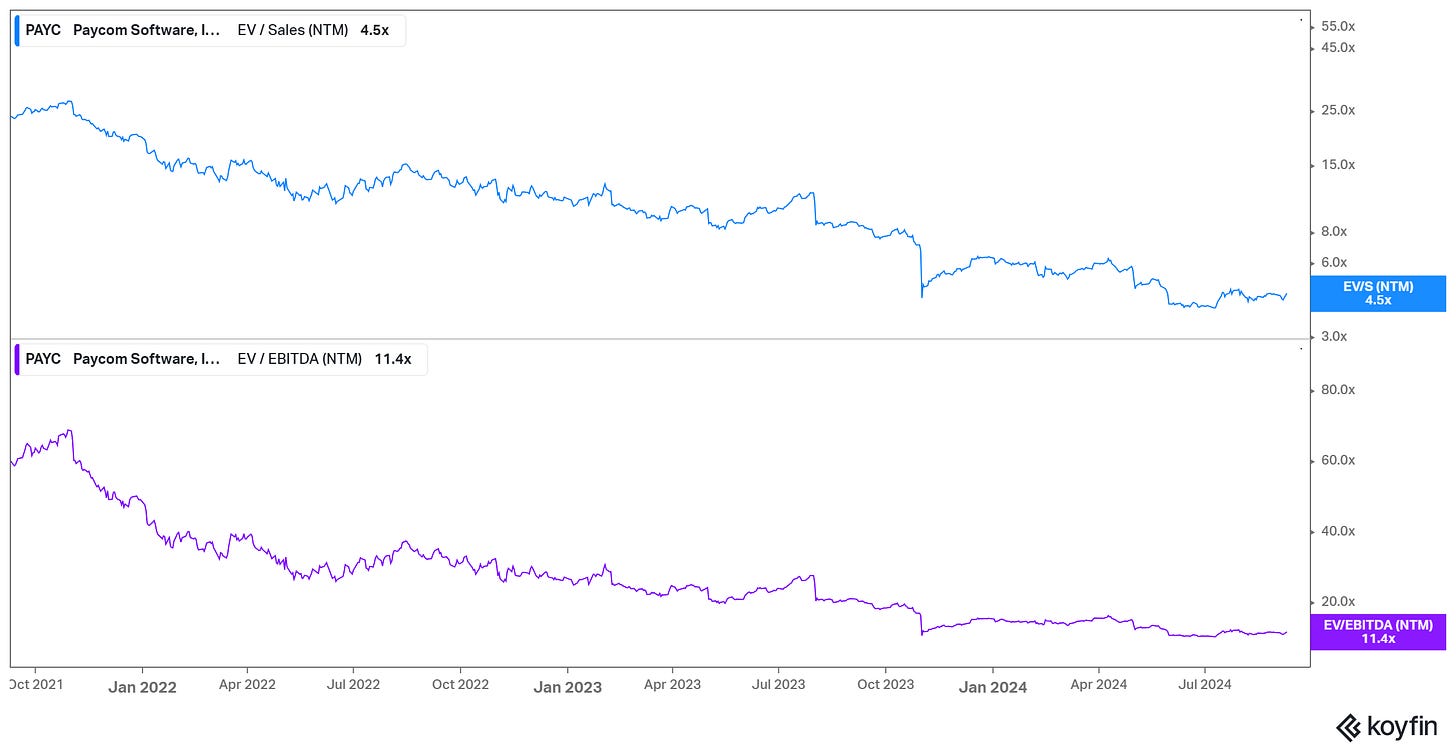

To me, PAYC is one of those “leap of faith” stocks where you need to see the vision that management have because the actual numbers currently aren’t amazing to me. They’re not too bad as we see solid revenue growth, nice EPS growth, share buybacks, and low debt, but for some reason I just don’t love the stock.

There’s no denying there is potential though:

As per management, they have only penetrated 5% of the TAM. For some industries I’d say this is fairly high actually but I do think in this landscape PAYC can reach much higher.

BETI is a strong product. It’s just not really being appreciated by clients yet (or the market). If we begin to see sales of BETI grow over the next year or so, especially in new regions then I think the market will reward PAYC with a significantly higher multiple.

There’s international expansion opportunities which should maintain revenue growth, or even accelerate it.

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

Disclaimer

Disclaimer: The Accuracy of Information and Investment Opinion

The content provided on this page by the publisher is not guaranteed to be accurate or comprehensive. All opinions and statements expressed herein are solely those of the author.

Publisher's Role and Limitations

Make Money, Make Time serves as a publisher of financial information and does not function as an investment advisor. Personalized or tailored investment advice is not offered. The information presented on this website does not cater to individual recipient needs.

Not Investment Advice

As customer of $PAYC, I can tell you the product is good, not great. BETI works fine, but it’s not a standout feature. Paycom also does not have a lot of APIs allowing it to play with other software like competitors do. We’d probably use Gusto if we were allowed. None of that means it’s a good or bad investment, but it’s not nothing. We’ve been a customer for 5 years and have 200+ employees for reference.