3 Quality Stocks Trading At Their Lowest Multiples

AMZN ABNB & ULTA

Hi fellow investors 👋

I recently started releasing a short article every Monday with a few quick screens and the results of those screens. Last week I focused on the best Rule of 40 stocks and the week before I focused on high growth stocks. The aim isn’t to dive deeply into each stock (although I do provide some information on them), but it’s to introduce ourselves to some potential new gems.

The narrative on the stocks won’t be in depth because I want to keep these article short and snappy and save the details for my deeper dives. Of course if any of these stocks that come up in my screens really interest me, then I’ll do a deeper dive on them at a latter date.

This week I focused on high quality stocks (which are either in my portfolio or on my watchlist) that are trading at or near their lowest valuation multiples.

Note: I do not include any Biotech or Pharma companies because I don’t know much on these industries and deem them too risky for my portfolio.

Here’s the companies for this week:

Amazon (AMZN)

AirBnB (ABNB)

Ulta Beauty (ULTA)

Amazon (AMZN)

Company: Amazon

Ticker: AMZN

Website: https://ir.aboutamazon.com/overview/default.aspx

Current Stock Price: $177.39

52-Week High: $200.00

52- Week Low: $119.57

Market Cap: $1.86 trillion

Headquarters: Arlington, Virginia

Number of Employees: 1,525,000

Commentary

AMZN posted Q2 earnings on the 1st August, where they missed on revenue estimates which led the stock to plummet (despite revenue growth still being double digits). Think of it like this… how many companies that post $150 billion + in quarterly revenue still grow above 10%?

I’m not going to dive into the entire company too much but I’ll provide you with a short, snappy investment case here:

The AWS cloud segment alone could likely justify the $1.8 trillion current market cap basically meaning at current valuations you’re getting the retail and digital ad business almost for free. Cloud computing is arguably the most important sector in tech as it powers all the major trends (AI).

Looking at the AWS numbers we have the following:

$105 billion annual run-rate (compared to MSFT cloud at $40 billion)

Quarterly operating income of $9.3 billion.

Operating margin of 35%.

So the AWS business has $100 billion of recurring revenue (growing at ~20% annually) generating $40 billion of annual income (growing at ~70% annually).

So at the current $1.86 trillion market cap the 2024 multiples for the AWS segment alone are:

EV/Sales - 17.7x

EV/Income - 46.5x

Optimistic? Yes. Completely unrealistic? No. Remember NVDA trades at an EV/Sales of 38x…

Also, let’s compare to NVDA a bit further. NVDA has a $3.16 trillion market cap (1.64x that of AMZN) yet has lower revenues and less cash flow than AWS alone.

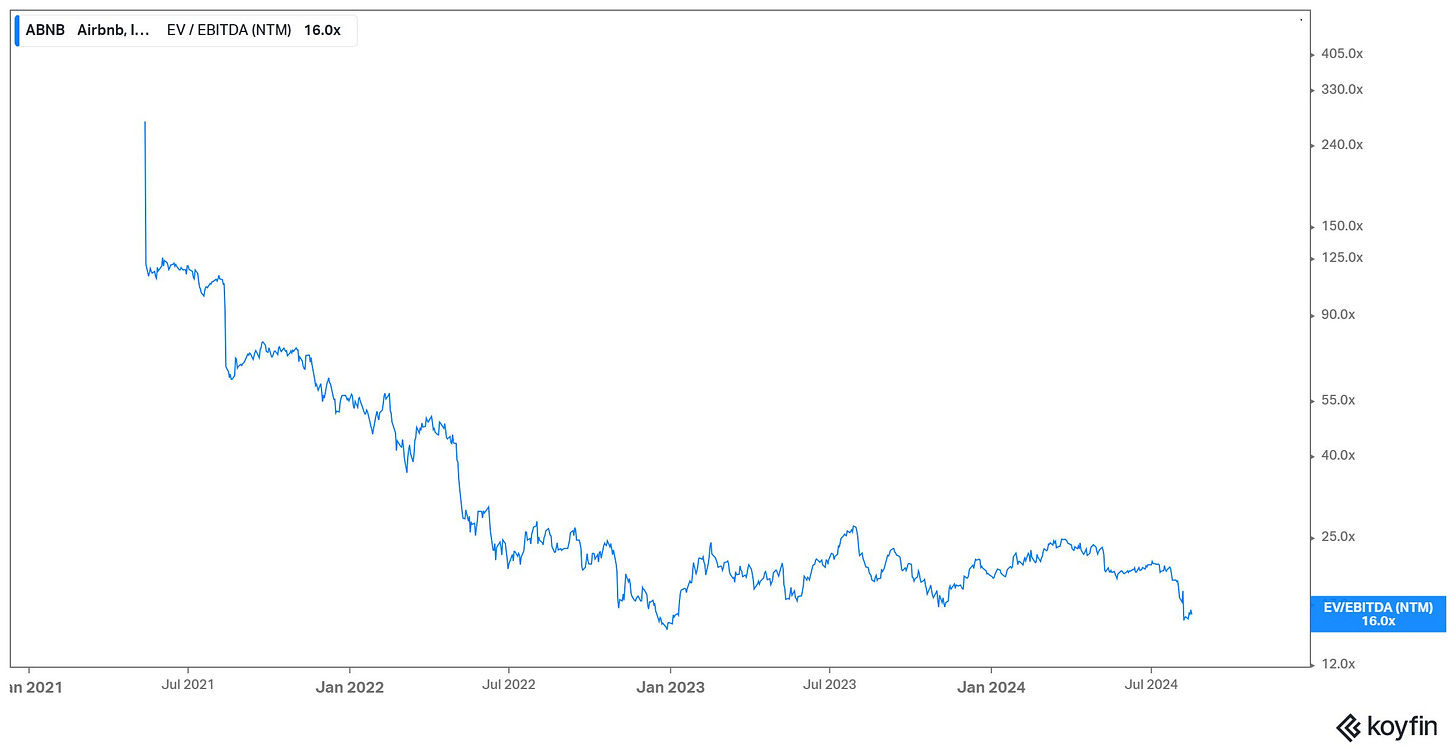

AirBnB (ABNB)

Company: AirBnB

Ticker: ABNB

Website: https://investors.airbnb.com/home/default.aspx

Current Stock Price: $115.71

52-Week High: $114.09

52- Week Low: $167.86

Market Cap: $73.9 billion

Headquarters: San Francisco, California

Number of Employees: 6,907

Commentary

I’m less bullish on ABNB compared to AMZN, but that doesn’t mean I don’t like this company at today’s valuation as I think there’s still a lot to like.

The stock dropped massively after Q2 earnings due to expectations of a pullback in consumer spending and overall slower demand from US guests. As with market cycles in the past, this higher inflationary environment won’t be permanent, and we will see consumers gain confidence in booking longer trips again.

From a fundamental business perspective, ABNB is definitely a quality stock. Here’s some key numbers that depict this:

97% revenue growth over the past 3 years

140% growth in cash from operations over the past 3 years

FCF margin at over 40%

On top of this, ABNB boast a very healthy balance sheet with cash & cash equivalents being almost 6x debt. These healthy fundamentals are allowing the company to buyback shares pretty aggressively.

I will definitely add to my ABNB analysis at a later date, but for now ABNB is a bit of a waiting game I think. The stock is entering a good buy area but I don’t think in the current environment ABNB is a screaming buy (like AMZN) and nor do I think that ABNB is a much better investment than their competitor - Booking Holdings.

Ulta Beauty (ULTA)

Company: Ulta Beauty

Ticker: ULTA

Website: https://www.ulta.com/investor

Current Stock Price: $375.04

52-Week High: $321.13

52- Week Low: $565.44

Market Cap: $18.08 billion

Headquarters: Bolingbrook, Illinois

Number of Employees: 38,000

Commentary

ULTA has been on my watchlist since April when the stock first started selling off, but I never invested even though everything was pointing towards it being a great buy. I didn’t chose to not invest because I was being complacent, I just had more conviction in the likes of PLTR, TSLA, and SOFI which I’ve probably added to the most in the last few months.

Anyway, the stock popped over the last week after 13F filings showed that Buffett also saw the value in ULTA as he added it to Berkshire’s portfolio.

ULTA’s growth has been fair over the last 2 years, not bad but nothing spectacular. However, they do have some nice growth opportunities which when considered make the 10.2 EV/EBITDA multiple look very attractive.

Firstly, they’re rapidly expanding into Mexico where consumer spending in the beauty market has been consistently showing signs of strength. As per my investment into MELI and DLO, I’m very interested in the LatAm market and I think this is a very good opportunity for ULTA to get a dominant share in early.

Secondly, ULTA are going to continue to drive revenue through their in-store service offerings such as hair salons and personalized make-overs. This obviously has nice benefits to customer loyalty, customer experience, and same-store-sales growth.

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

Check out the gold companies. Gold is breaking out and the gold companies are yet to catch up with gold.

I think you got the labels wrong for 52 week low and high..