5 Alerts Triggered This Week

A Quick Read: Opportunities Are Coming

Hi all 👋

Trumps trade wars combined with a forever high budget deficit sent shocks through the market with the NASDAQ erasing all gains from September 2024 in the matter of 2 weeks.

This market wide pullback led to some alerts being triggered on stocks I’d be very interested in at certain prices. There’s one stock in my portfolio in this list that I’ll be making a big purchase of soon at today’s price.

Stocks Covered👇

A strong lithium play

A semiconductor company trading below 0.5x PEG

A next-gen robotics company trading near the 12 month lows

A stock down 30% in a month despite a massive growth in ARPU and MAU.

A portfolio company and my next deep dive company 👀

1. Albermarle | ALB 0.00%↑

ALB has been on my watchlist for a while and it’s finally hit my zone of interest around the $70 range. Considering the risk to reward on lithium over the next 5 years, I think ALB could be an extremely nice addition.

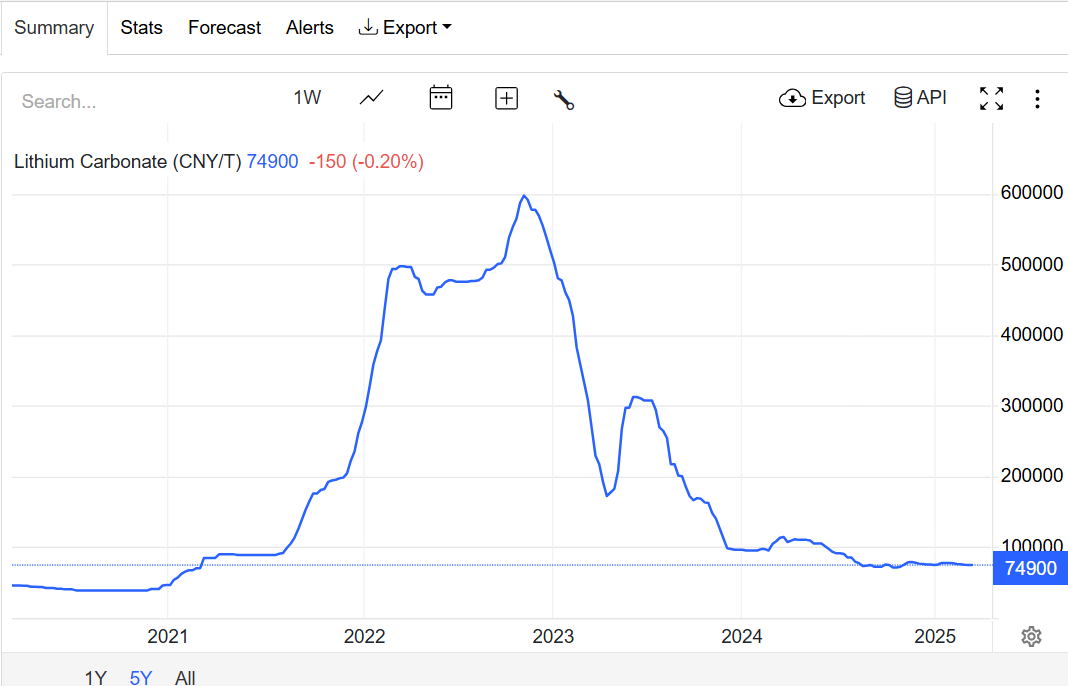

From a technical perspective, there’s evidence that lithium prices are stabilizing and have been for the last 4 months. Currently, lithium is in an oversupply market but the market is expected to grow at 20% YoY which will put the market into undersupply very soon which could be bullish for lithium and ALB. The last time lithium prices rose which was in the second half of 2021 and 2022, ALB’s stock price didn’t exactly follow suit but this time could be different. Here’s some key points👇

Lithium is expected to need 3x more supply over the next 5 years

Secular growth trend in energy storage and EV markets

Expect FCF breakeven in FY25 even at current lithium prices

CapEx has reduced to 2/3rds of 2023 levels

Trump statements are generally supportive of critical minerals

Position: No position yet.

2. Advanced Micro Devices | AMD 0.00%↑

I’ve spoke about my worries with AMD quite a bit on X, especially comparing them to NVDA. However, I set an alert at $99 to dive deeper into the company and here we are:

Fundamentally, we have:

A company in an incredibly bullish industry

A company trading at 0.49x PEG

That alone is worthy of a deeper look but here’s my very brief rundown of where I stand with AMD:

If hyperscalers were actually diversifying away from NVDA, AMD wouldn’t be in the position they’re in today. NVDA still remains the default choice and there’s no debating that. In such a fast paced, innovative market, hyperscalers head to NVDA because they’re the best choice.

AMD’s data center segment is where the potential is but growth slowed down in Q4. It also missed revenue estimates by a lot.

There’s no doubt potential with AMD but potential is meaningless. It’s execution and winning that we care about and so far AMD aren’t delivering in a golden period where they should be. They have won contracts with MSFT, IBM, and Fujitsu though which is of course a sign of momentum.

The main issue is that hyperscalers want more than just GPUs and CPUs. They want the entire stack (software, compatibility etc) and AMD don’t really compete with NVDA here when you consider all this.

I’ve been following AMD for a while and it’s always been a potential and “just wait” story about inference. NVDA is also investing heavily into inference and I’m very unsure how much AMD can realistically compete.

What I will say is that a 0.49x PEG always presents a fairly compelling opportunity.

Position: I think I’m going to put my alert at $90 now and see what happens. I don’t have the conviction just yet and I’d reassess at a lower point.

🔥 TradeUP x Oliver@MMMT: Score FREE NVIDIA Stock! 🔥

TradeUP, the U.S. trading platform powered by Tiger Brokers (NASDAQ: TIGR), is bringing MMMT readers an exclusive stock giveaway!

🚀 Here’s the deal:

1️⃣ Open a TradeUP account through exclusive link or using promo code OLIVER

2️⃣ Deposit or transfer $1,000+ and maintain your balance for 30 days

3️⃣ Get 1 FREE NVIDIA stock

4️⃣ Plus, enter a prize draw for 2 to 5 extra shares, with individual stock values reaching up to $1,800! (Every draw guarantees a winner.)

⏳ Offer ends 03/31/2025. Don’t miss out—secure your free NVDA now!

TradeUP Affiliate Landing Page | Exclusive Welcome Gifts & Bonus Offers

3. Symbiotic | SYM 0.00%↑

SYM has appeared in a few screens of mine, hence why it’s on my watchlist here. I set an alert at $20 and I’m starting to find it interesting. Here’s why👇

SYM is extremely volatile. I thought they were heading to EBITDA profitability post some pretty consistent margin expansions over the last 24 months but Q4 came in at a $17.4m EBITDA loss. However, at 7.5x NTM EV/EBITDA, SYM are offering 27% expected EBITDA growth which is nice.

What is less nice is a 65.7x PE multiple. However, 2025 is profitability inflection point for SYM and if we have a risk on market environment, I think SYM down in the $20 range could be quite nice.

However, it’s a big assumption that we have a risk on market.

Position: I’m interested. SYM is going to go high up in my watchlist.

The next 2 are my higher conviction plays 👇