5 Charts For The Week

15/09/2025

Hi all 👋

Continuing my new series which gets released every Sunday/Monday before market open where I look at some potential adds/trims/buys/sells for the week.

The first 3 will be open to all and the last 2 will be for paid subscribers.

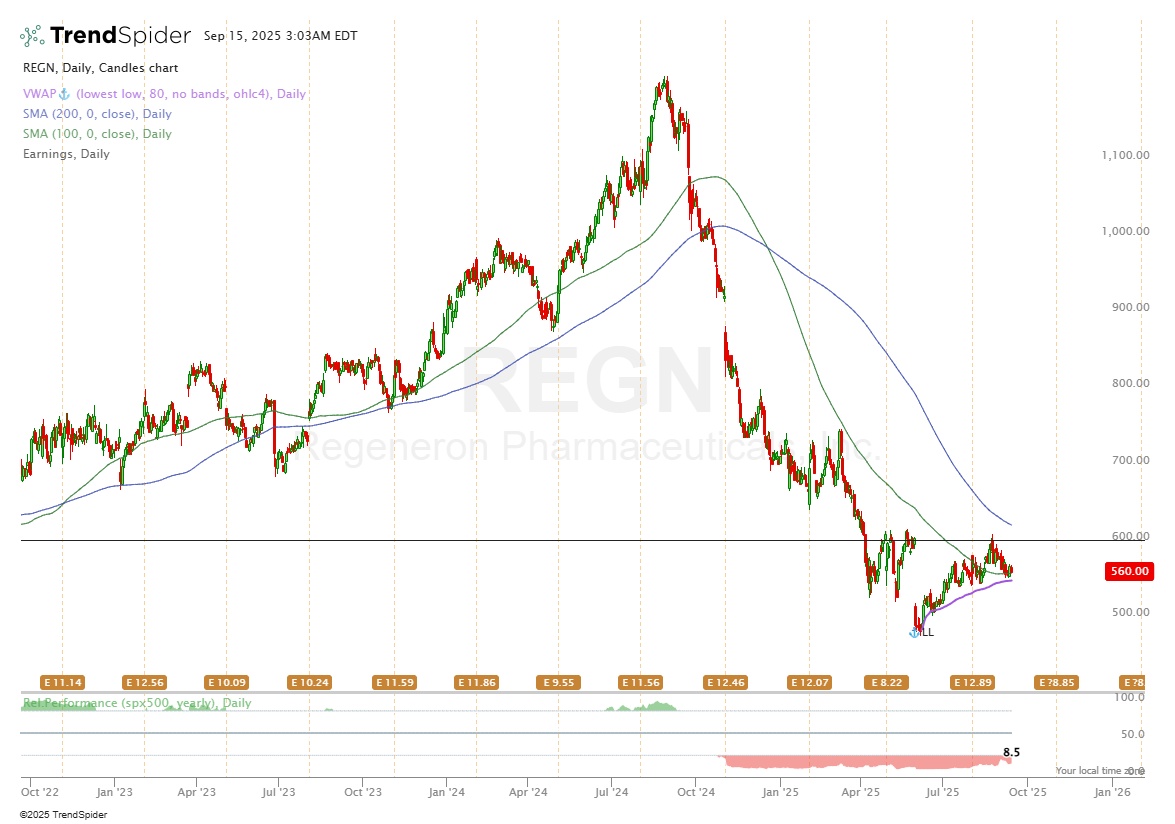

Regeneron Pharmaceuticals | REGN

I’ve spoken about REGN a couple time in this series but made no personal moves yet to invest. If you do want to know when I invest in different companies, you can for just $16 a month 👇

Follow the link in this spreadsheet.

REGN earned $3.7B in revenue in Q2 which puts them ~3.1x sales based on current estimates and trends. However, there’s a lot of positivity in the REGN pipeline at the moment and with Eylea and Dupixent I see revenues almost doubling over the next 4-5 years. In terms of multiples, it’s a lot harder to gauge with pharma companies like REGN but if regulatory headwinds and the pipelines begin to look a lot brighter soon, multiples will rise too.

I do believe there is a 100% move for REGN over the next 3-5 years and I believe it could be a great value play to hold through a difficult time.

Onto Innovation | ONTO

ONTO is another one I’ve spoken a lot about in this series. I’m very on the fence about it (which is why I have not bought in just yet) and here’s why:

If you look at ONTO vs peers like KLAC they trade at a huge discount (ONTO is a 4.6x NTM sales whilst KLAC is at 10x sales). However, there’s a reason for this. In the midst of an AI boom and huge CapEx, ONTO’s growth metrics (and margin expansion) is pretty unclear.

ONTO expects ~7.5% revenue growth in the next year which is not impressive relative to other players like KLAC who are in the mid 20% range. Further, TSM are up in the 26% expected growth range and with double the margins but they also trade at double the valuation.

The reason ONTO remains on my watchlist is because the valuation is because of recent acquisitions (Semilabs), and expected growth in 2026 and beyond. There’s not many other companies in this sector trading at the valuation ONTO trades at and therefore they’re definitely worth keeping an eye on.

The techncials also look very strong today.

Joby | JOBY

JOBY remains no change in the idea to before. If we come down to this 0.618 fib level around the 200 and 100MA then I’ll be a buyer.

Recent bullish news for JOBY has included:

Partnership with UBER

Trump administration launching trial program to fast track eVTOL’s.