5 Charts For The Week

18/08/2025

Hi All 👋

Continuing my new series which gets released every Sunday/Monday before market open where I look at some potential adds/trims/buys/sells for the week.

The first 3 will be open to all and the last 2 will be for paid subscribers.

Last week we looked at 👇

Eos Energy | EOSE: I said I’d consider EOSE at the $5 region and last week we fell 8% heading closer to my buying zone. Not there yet, but definitely a company I’m interested in.

Cognex Corporation | CGNX: Not much movement last week. As I mentioned, it’s important to see if we can switch this resistance zone into a support zone. Until then, we wait. Fundamentally, a good play, but just have to be picky with the valuation and technicals in this market, and CGNX doesn’t pass my criteria just yet.

Upstart | UPST: UPST stabilized at the 200 SMA last week at $64. A very nice zone and one that I may add to this week. I’ll update paid subs if I do of course.

Oscar Health | OSCR: OSCR is now above the 100 and 200 daily SMA’s and just above the $15.50 support/resistance zone I drew out. Definitely some downside still but any time OSCR retreats and bounces of the $13 zone, I’m interested in adds.

PayPal | PYPL: PYPL is one where I look at the technicals less than others. Management are doing all the right things to turn the business around. They’re hanging on to this $67 support and anything above there I feel fairly good about the stock moving forward.

5 Stocks I’m Watching This Week👇

1. Harrow | HROW

HROW has been popping up in the retail community a little more lately. They’re a US based ophthalmic pharmaceutical company. I decided to look into the numbers a bit more and I really like what I’m seeing.

They guided for $280M in revenue in FY25 meaning they’ve got to hit ~$170M in 2H 2025 which is the risk because that’s a jump on 1H. However, if they do execute like they expect to they’ll have grown revenues at 42% YoY whilst trading at 5.7x 2025 sales. That’s quite a rare multiple to growth metric.

The issue here is that liquidity is a bit of a risk, and a good amount of share dilution is likely to continue to occur, but purely from a valuation perspective I think HROW is deserving of a re-rating.

They’re sitting at quite an interesting level about 36% of 52-week highs, and still above the 100 and 200 SMA’s. If they come down to the $32 level I think that is a screaming buy. Until then, I’d be quite happy to initiate a smaller position which I may do this week.

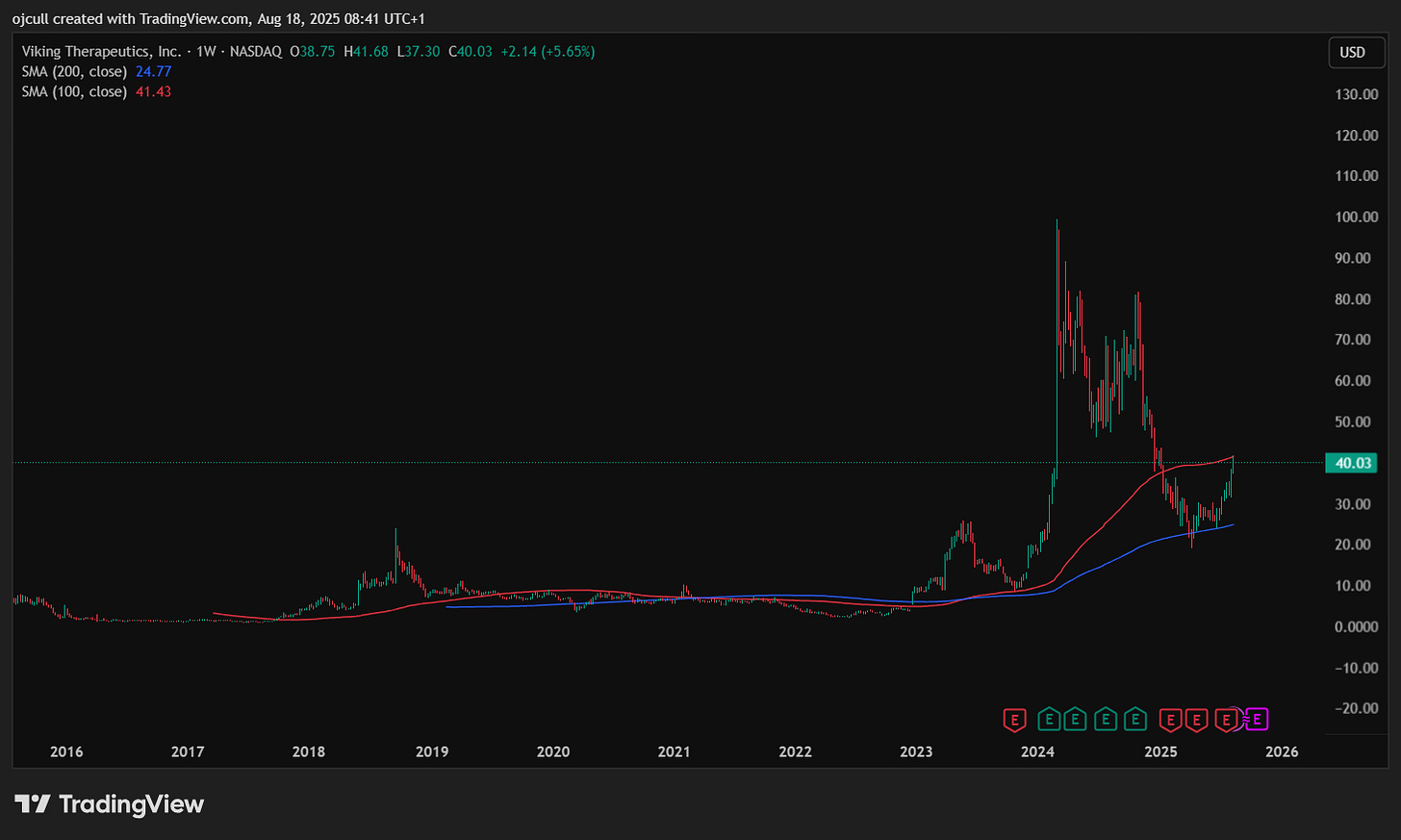

2. Viking Therapeutics | VKTX

I’m not a huge fan of biopharma companies, but VKTX is one I had to look into after Stanley Druckenmiller bought it and after his stellar track record in the pharma niche.

VKTX is a clinical-stage biopharma company developing therapies for metabolic and endocrine disorders in the obesity and liver niche. They have VK2375, a dual GLP-1/GIP receptor agonist which has so far led to nearly 15% weight loss in a Phase 2 trial over 13 weeks. The other major program they have is VK2809, an oral thyroid hormone receptor beta agonist also in Phase 2 trials which have so far been successful. Beyond this, they’re also in a few Phase 1 trials.

Valuation is difficult with these biopharma companies, hence why I don’t invest in them much but I’m definitely intrigued in this after Druckenmiller’s buy. These stocks move completely on catalyst driven events and VKTX has a couple going up. Perhaps worth a small investment if you’re a risk taker.

3. Lululemon Athletica | LULU

LULU report in a couple weeks, and quite recently the numbers haven’t been great with revenue and net income down QoQ.

Whatever happens I think LULU at the level in the chart below is a good opportunity with 200% upside back to ATH’s.

If you want to invest before earnings then note this:

Fwd PE of 13.5x

Gross profit margin of 58%

Historically high FCF margins.

The expectations are that LULU hits $1.44B in FCF in 2027 meaning they’re trading at 16.5x 2027 FCF which relative to peers like ONON and NKE is quite an attractive multiple. LULU has historically traded up in the 30x FCF multiple range so if LULU does hit $1.44B (as analysts expect) then with a 30x multiple we have a $43.2B which is ~82% from today.

Definitely undervalued if LULU can slowly turn things around.