5 Charts For The Week

Hi all 👋

Last week was crazy. Paid subs will know I was quite active in my buys and sells, especially on Thursday where I made 3 different adds to existing positions post the huge intraday swing in the market.

I remain quite bullish on the market for the rest of the year but I am letting price action guide my decisions. Every stock in my portfolio and watchlist has gone through hours of due diligence, so it’s just a case of making buys, adds, trims, and sells now at the right time when the market agrees with me.

A friendly reminder here that I run a paid community on my Google Spreadsheet for just $16 a month. The price will be increasing in 2026.

You get access to:

My portfolio (exact $ amounts)

My watchlist

My daily notes

My Investing Universe (+200 stocks analyzed by revenue growth, EBITDA growth, and EPS growth).

Here’s 5 charts for the week.

The first 3 will be open to all and the last 2 will be for paid subscribers.

1. AST SpaceMobile | ASTS

We missed the first big wave of ASTS from around $36 to $100, but I always considered if far too expensive once it got above the $60 range to jump in. Fortunately, patience pays and now we are back at the $50 range where I will take advantage.

From a technical point of view, I think anything in this zone (between the two channels) is a good buy for now. The bottom white line is right at the 200MA so as long as we remain above that I’ll be bullish. If we go below there, I’ll have to reconsider.

Fundamentally, I love ASTS. They’re not an innovative company chasing a niche part of the value chain. They’re targeting a multi-hundred billion dollar global coverage market making it a global requirement.

It’s one of the reasons LMND is my largest position. They’re chasing an almost trillion-dollar TAM ultimately. It’s the same case with HIMS & PATH (2 other very large positions). They’re all chasing massive, structurally important TAM that can reshape industries rather than fight for corners of the value chain. This the same case with ASTS.

The other reason I’m very bullish on ASTS is they’re operating a fundamentally different approach to peers like Starlink and Apple. They’re operating the only true 3GPP-native broadband, direct-to-phone satellite network globally. They combine low-band, L-band, and S-band as well as deeper integration into carrier networks making the moat and the switching costs far stronger. Ultimately, if ASTS executes, this can become the default layer of global connectivity which would make them far more than a $18B company.

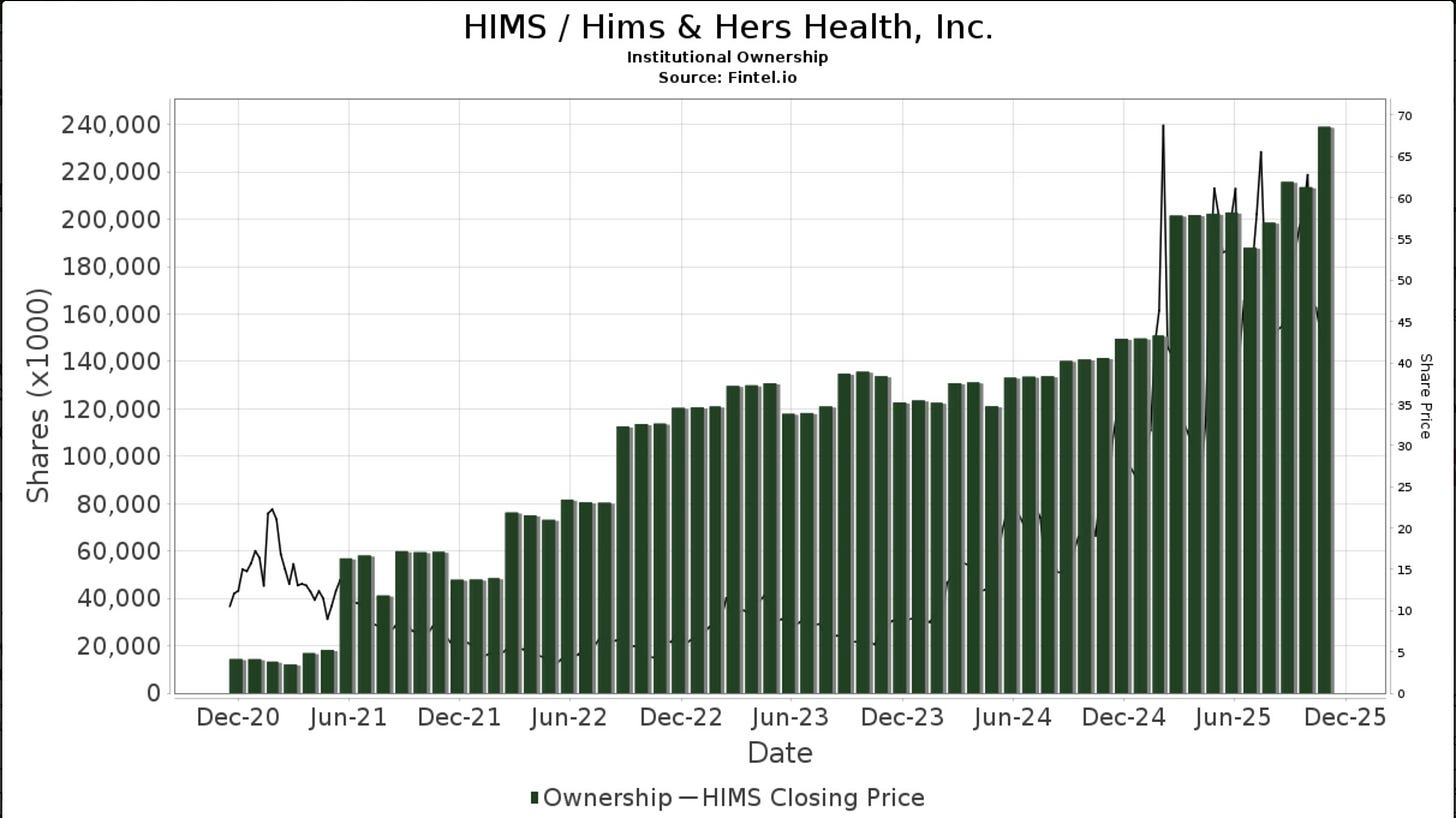

2. Hims & Hers | HIMS

Paid subs know that I began trimming my HIMS position in early August and October when HIMS was over $55. I remained extremely bullish long term but the valuation had gotten ridiculous in the short term with an EBITDA growth estimate of 22% and an EBITDA multiple far above 40x.

As expected, HIMS came back down to below $40 and now it’s sitting at $34. I told paid subs I am once again interested in adding my position back up but not until we start to see some proof that this is a near-term bottom. I’m not sure we’ve got that yet, but perhaps if we see some nice consolidation this week or even a little bounce of this support level, I’d be keen to begin adding again.

Secondly, institutional ownership has been increasing massively over the last 2-3 weeks. That’s a nice confirmation to my thesis. We’ve also seen new labs offerings, new testosterone offerings, and new menopause offerings. The touchpoints are expanding and I’m starting to feel bullish again.

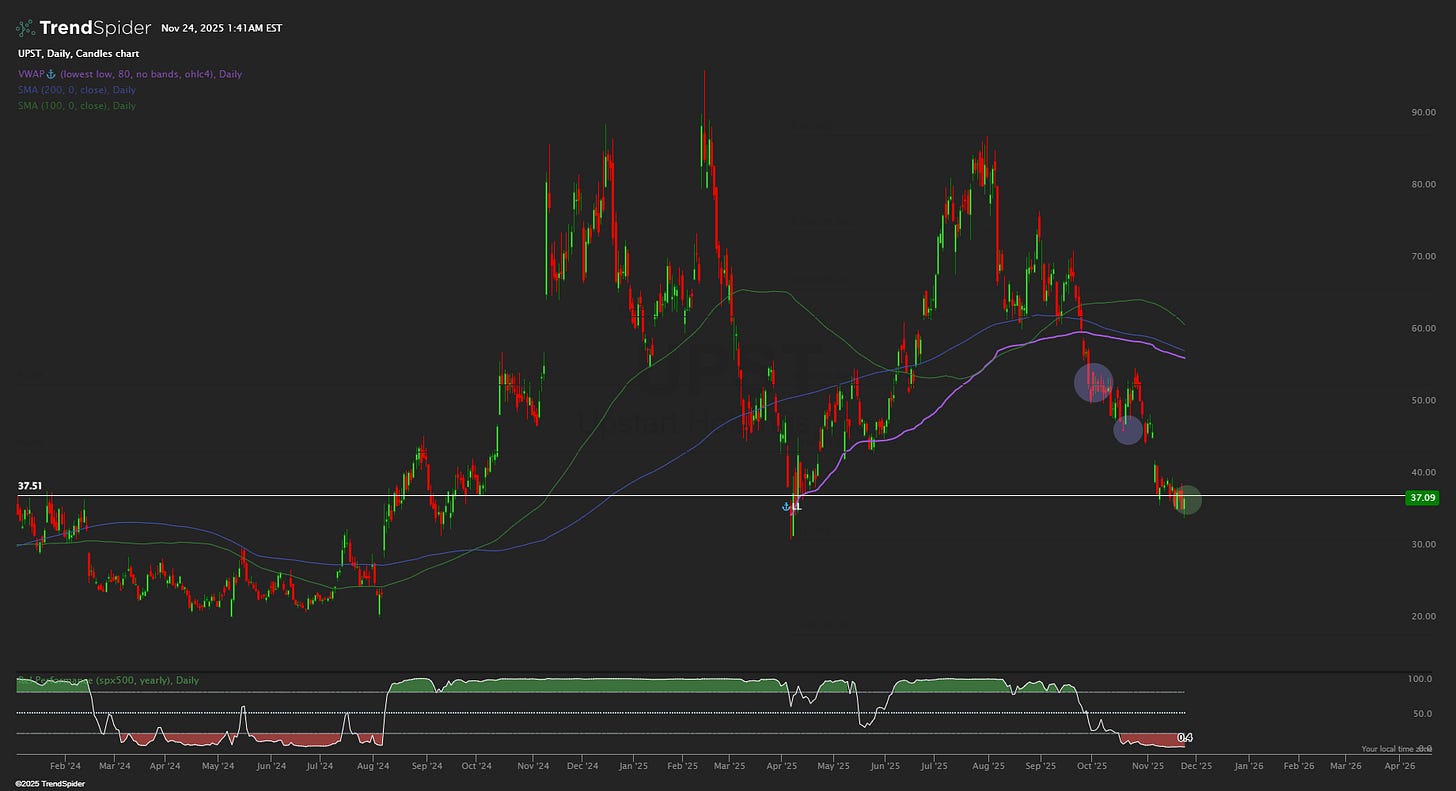

3. Upstart | UPST

UPST has been the worst performing stock in my portfolio but I still remain confident long term especially with the chances of rate cuts increasing in the short term. UPST delivered what the market deemed as a weak Q3 missing on revenue but this was because UPST’s AI lending model went slightly too conservative and lowered loan approvals.

We also had a BTIG analyst incorrectly say delinquency rates were increasing. But this was a “calculation” error that further hurt the UPST sentiment. Q3 and this sentiment shift have ultimately led to a 57% decrease since August peak.

On the other hand, we have a company where the founded recently purchased $3.9M worth of stock. We have a profitable and efficient company growing EBITDA at 41% whilst trading for just 17x EBITDA which is far too cheap in my opinion.

Ultimately, in the short term I think the bull case hinges on UPST being able to deliver consistent, scalable results across a range of produces like HELOCs for example. If we start to see more positive news around this and further growth, I think we see a very fast move back to the $70s because the stock is so undervalued today.