5 Charts For The Week

08/09/2025

Hi all 👋

Continuing my new series which gets released every Sunday/Monday before market open where I look at some potential adds/trims/buys/sells for the week.

The first 3 will be open to all and the last 2 will be for paid subscribers.

1. Harrow | HROW

I spoke about HROW a few weeks ago in my “5 Charts of the Week” series and I’ve spoken a little about it for my paid subs in my spreadsheet. HROW is definitely nearing a price where I’d be interested in it. Here’s why:

HROW management have said that they should have a $1B revenue run rate by 2027 and be debt-free by then too. I’m not too concerned that HROW miss nearer term guidance of $280M in 2025 as they need ~$169M in revenue in 2H 2025 which is a bit of a ramp up but prescriptions from VEVYE seem to be increasing alongside IHEEZO and TREISENCE which are showing strong volumes too.

Looking down the road, I’m quite bullish on HROW and considering initiating a position soon if we can get another small drop into the low $30s. Here’s why the numbers make sense:

If they hit the $1B revenue number in FY27 then revenue would have grown 74% CAGR over the next 2-2.5 years which is very strong considering they’re also expanding margins and eliminating debt. They’re trading at just 4.6x NTM sales currently which is too cheap for that projected growth.

Of course, healthcare is one of the more defensive sectors as well which gives me an added sense of comfort of investing in a healthcare related growth stock in today’s macro situation.

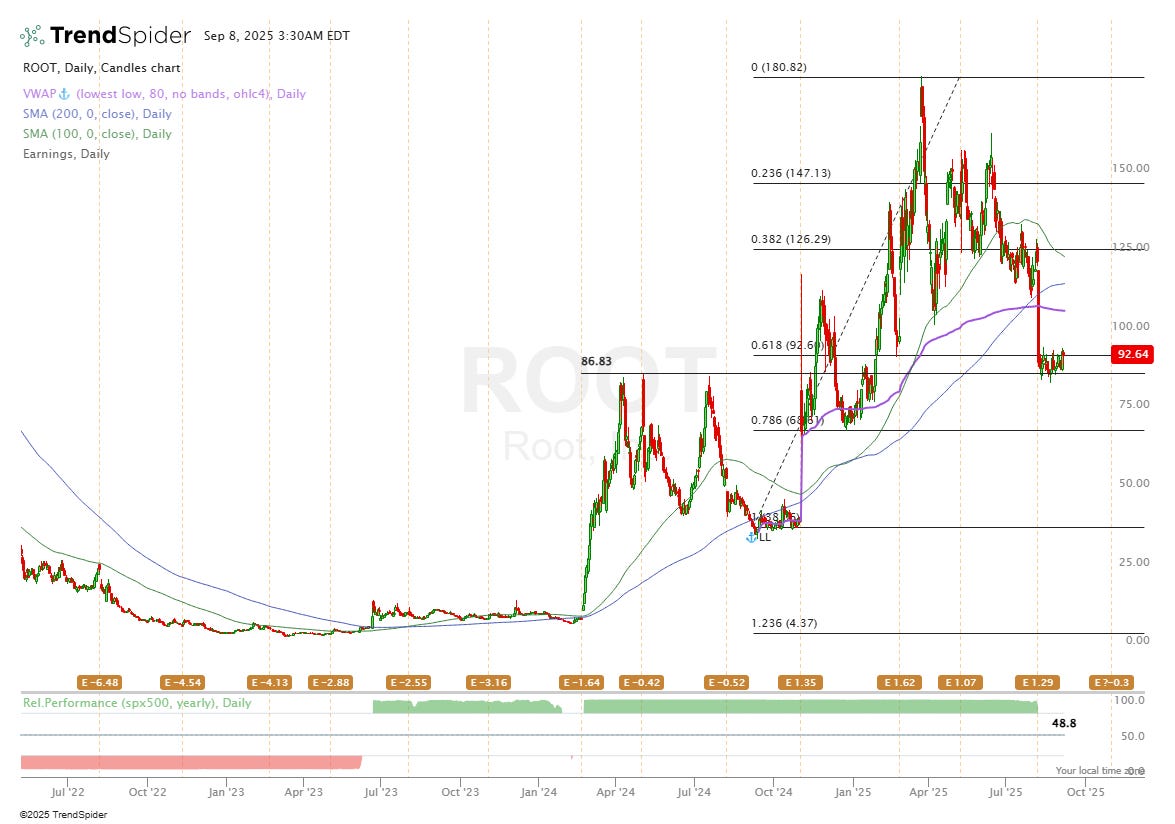

2. Root | ROOT

You should all know that LMND is my largest position, but there’s another InsureTech that I initiated a position in over the last month as paid subs will know.

ROOT are big in embedded insurance and embedded insurance will likely as per forecasts make up ~20% of all insurance sold by 2030 so the growth of ~30% CAGR per year for 0.7x sales makes complete sense at the moment.

The only issue at the moment with ROOT (and LMND for that matter) is that they’re generally quite cyclical markets with rapid changes in competitive pricing so if we do have a recessionary period I’m not sure how well a company like ROOT will perform. With that being said, I am building a position in ROOT today but I am being careful over position sizing as I’m already very exposed to the industry with LMND.

3. TransMedics | TMDX

TMDX is a top 4 position for me, but I’m considering making it a much larger position at this level. This recent drop is another seasonal weakness drop with flight counts down slightly but likely set to ramp up again in Q4.

Long term for me there’s no worry about a finite TAM or slowing growth with international expansion ramping up and the kidney market set to have a very large TAM.

My models hits ~$800M in revenue in FY26 which means they’re trading at 4.4x 2026 sales today which makes no sense when peers like OrganOx for example got sold for 20x LTM revenues. TMDX is not priced like a MedTech with a huge moat and I still see another 100-200% upside for them.