5 Charts For The Week

Hi all 👋

Continuing my new series which gets released every Sunday/Monday before market open where I look at some potential adds/trims/buys/sells for the week.

The first 3 will be open to all and the last 2 will be for paid subscribers.

1. UiPath | PATH

PATH has gained a lot of traction recently in the retail community and I think for good reason. Although the valuation isn’t something I’m extremely keen about, I think the business model and the future potential especially post partnerships with NVDA and OpenAI, I think PATH has some potential to be one of the go-to businesses in a rapidly developing industry.

Over the last few weeks we’ve seen:

Institutional ownership surge

NVDA & OpenAI partnerships

Investor Days showing their pivot

Valuation wise, PATH revenue and EBITDA estimates aren’t anything special. EBITDA growth estimates are just ~17% CAGR over the next 3 years so the 15x EBITDA multiple probably isn’t too attractive. But the argument for PATH is whether their new AI product will actually lead to low double digit revenue growth rates. I suspect there’s a good chance it could be much higher meaning the 3.3x NTM sales multiple today could be far too low.

Technically, they’ve been trading in this range for ~18 months now but I believe the narrative may start to change soon.

2. Lemonade | LMND

I spoke about LMND a lot previously but since it’s grown to be my biggest position by far, I haven’t spent as much time on it as I want to. I DCA into the stock every 2 weeks and plan to hold for years.

Today, technically the level we are at is fairly nice but I’d like to lump sum ~$40-45 level if we do get there. However, I do believe Q3 numbers will be massive compared to what people are expecting given the huge revenue acceleration we are likely to see with the reinsurance reduction.

Yes, this is an “artificial” revenue growth as IFP won’t necessarily be growing at that rate but we will have a company growing +40% (likely higher) trading for just 4.1x NTM sales.

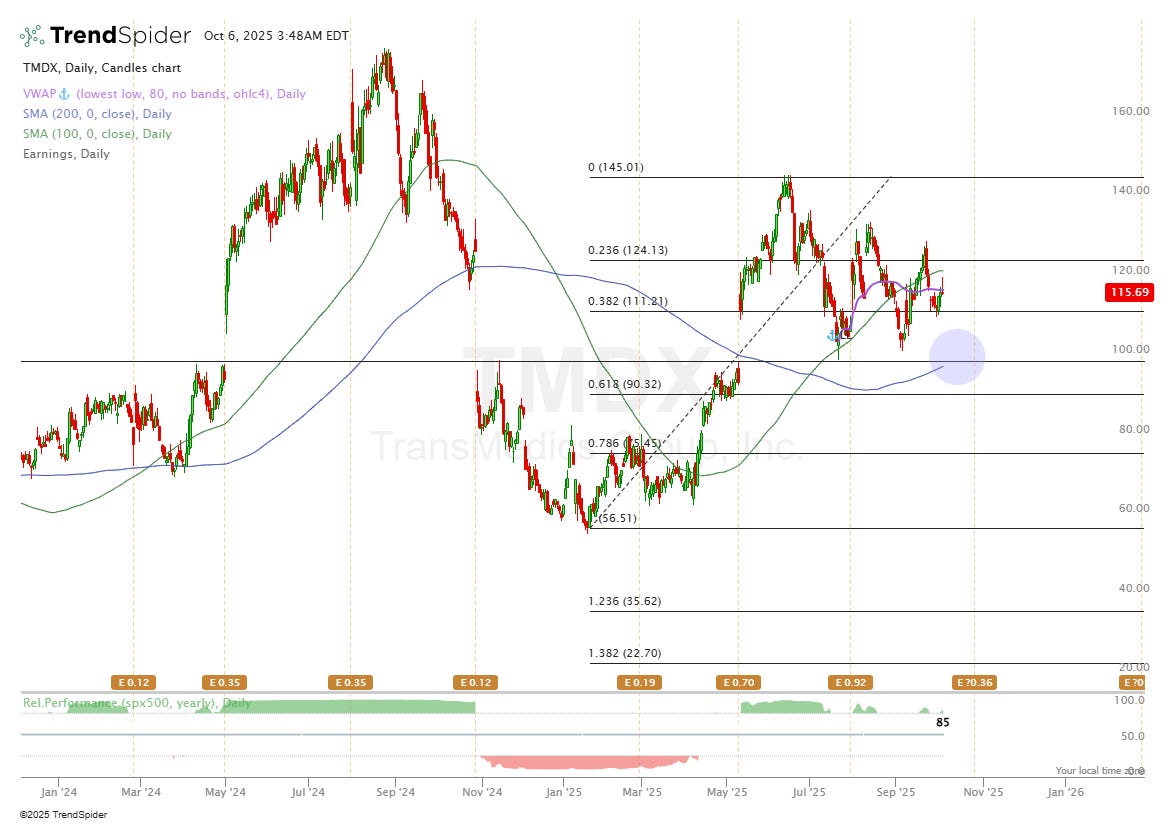

3. TransMedics | TMDX

TMDX is another very big position of mine that I haven’t spoken about as much as I’d like to given it’s my 4th largest position. We’ve seen a Q3 period of weakness again just as we did last year which has presented a nice opportunity to add.

Over the next few years for TMDX, we have:

Kidney (very large TAM)

International expansion (they just expanded to Italy)

And yet we have a company trading for 28x NTM EBITDA growing EBITDA at 39% over the next 3 years in a relatively recession proof industry.

It is becoming increasingly more difficult to track flights and gauge revenue now with TMDX given a lot higher percentage of flights using 3rd party jets or now on the ground with the recent Mercedez Benz partnership.

Nevertheless, I think TMDX is a very high growth stock outside of tech that I think will be a lot more recession proof.