5 Core Stocks For 2025

Let these be your core holdings

Hi all👋 And a HAPPY NEW YEAR!

The top 10 stocks in the S&P 500 now make up over 40% of the entire market.

I don’t think owning the S&P 500 alone is as safe as it once was.

But I do believe these 5 stocks can make up the core of everyone’s portfolio.

5. ASML | ASML

Numbers

Revenue growth: 11.90%

FCF per share: $7.30

NTM EV/EBITDA: 23.6x

NTM EV/Sales: 8.3x

Net income margin: 27.8%

Investment Thesis

This first part is not directly the investment thesis but did you know this 👇

Firstly, the semiconductor manufacturing market is expected to grow at ~9% CAGR through to 2030, and ASML is a company that more or less has a monopoly in a very key part of this manufacturing process.

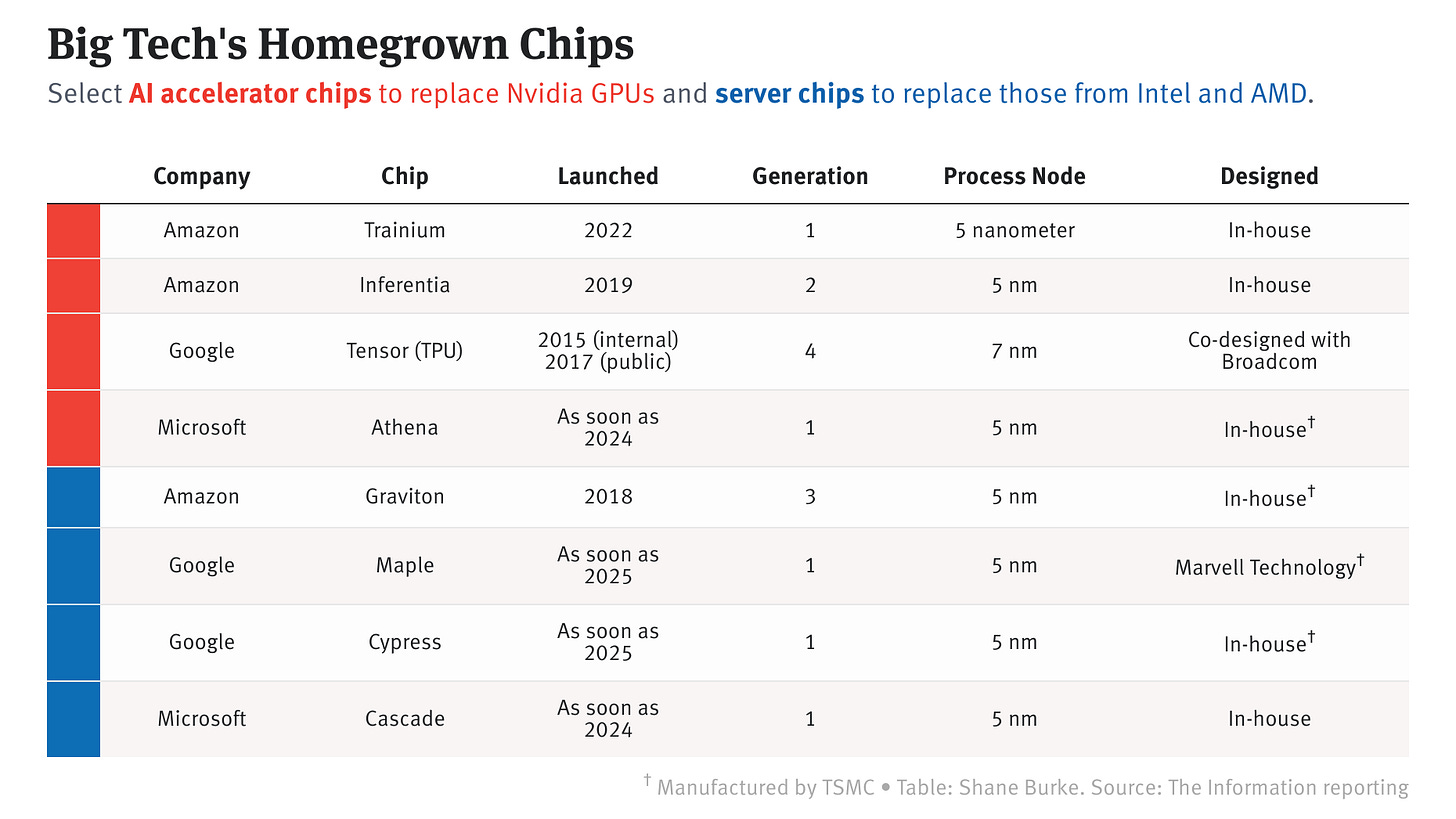

TSMC, Intel, and Samsung currently account for the majority of ASML’s revenue, however the likes of AMZN, MSFT, and GOOG will gradually reduce their reliance on key foundry companies such as TSM. They’ll soon manufacture more in-house to improve margins. As this plays out, ASML’s revenue mix will be a lot more diversified and many other companies will also become very reliant on ASML’s technology.

The other key part to understand is that ASML’s current revenue leading countries (Taiwan and South Korea) will be replaced by the US by 2030 onwards. Samsung has $17 billion fab in Texas, whilst Intel has a $20 billion fab in Ohio.

I won’t discuss the moat in detail here (as I’ll save that for the upcoming deep dive) but investors must realize that within EUV lithography, there’s no company in the world that competes with ASML.

Visual

I saw this post on X by Aldin and thought it was a great share.

4. Amazon | AMZN

Numbers

Revenue growth: 11%

Net income margin: 9.6%

EV/EBIT: 32.3x

EV/Sales: 4.0x

PEG: 1.74x

Investment Thesis

The main bullish factor supporting my bull thesis for AMZN is the potential for Cloud which has a 31% market share currently, and accelerating revenue growth much more than the closest competitors (GOOG and MSFT).

By 2032, the cloud market is expected to hit $2.3 trillion. Currently they have 37% operating margins but there’s no reason this can’t hit +45% by 2030 with custom, in-house built chips and less reliance on NVIDIA. At 45% margin, a 15x EV/EBIT, and a 25% market share, AMZN AWS alone could be worth $3.9 trillion.

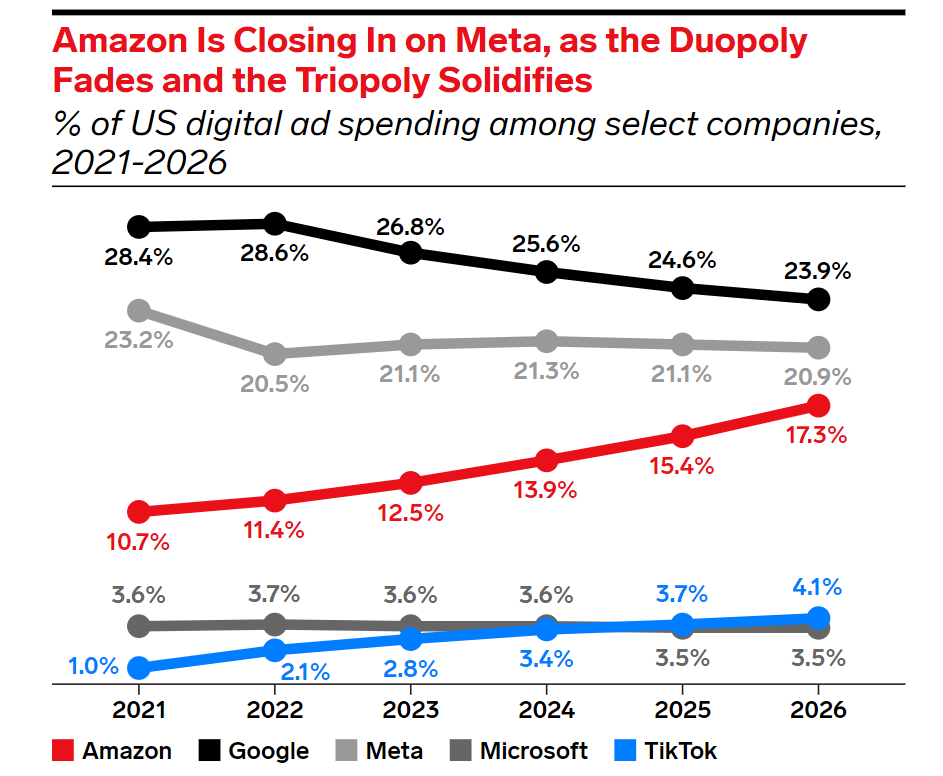

Further, the digital ads business has been consistently taking market share from Meta and Google since 2022 turning the duopoly into a triopoly. As a $1.5 trillion market by 2030, and ~15% global market share, there’s a $223 billion opportunity which would equate to ~$1 trillion at a 4x EV/Sales.

Therefore, I’ve outlined a possible $4.9 trillion AMZN valuation whilst IGNORING THE E-COMMERCE DIVISION which will likely continue to be the biggest value provider as McKinsey predicts GMV to be ~$20 trillion by 2032. With robotics, automation, and logistical improvements, AMZN’s e-commerce sector also has an incredible amount of growth ahead.

Visual

3. MercadoLibre | MELI

Numbers

Revenue growth: 35.3%

Net income margin: 7.5%

PEG (NTM): 1.7x

EV/Sales (NTM): 3.8x

EV/EBIT (NTM): 32.8x

Investment Thesis

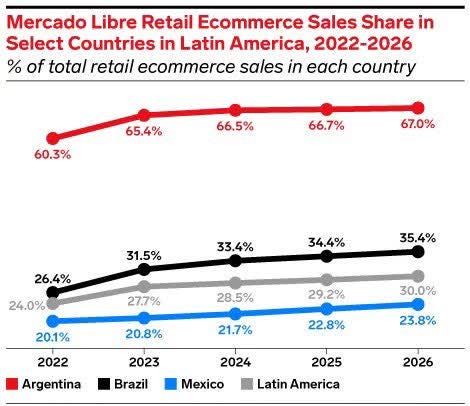

The e-commerce market in LAtAm is estimated to hit $350 billion (Gross Merchandise Volume) by 2027. As per the below visual and research, MELI current have ~29.2% market share which is expected to grow to 30% as weaker competition fades out and MELI continues their hyper investment. At a $350 billion GMV, the revenue potential would be ~$122.5 billion (35% ish) and a 30% market share of this equates to $37 billion in e-commerce revenue. Considering MELI currently trade at a sales multiple (NTM) of 3.8x, this would give them an EV of ~$140 billion by 2027 in e-commerce alone. The current EV of the total MELI business is $90 billion.

MELI’s MercadoPago division is also performing extremely well with 1.5 million new credit cards issued in Q3 24 alone. Most of these individuals are first time credit card users so the room for growth over the next 5-10 years is pretty significant if digital banks can continue to gain momentum and prevail in those areas.

Visual

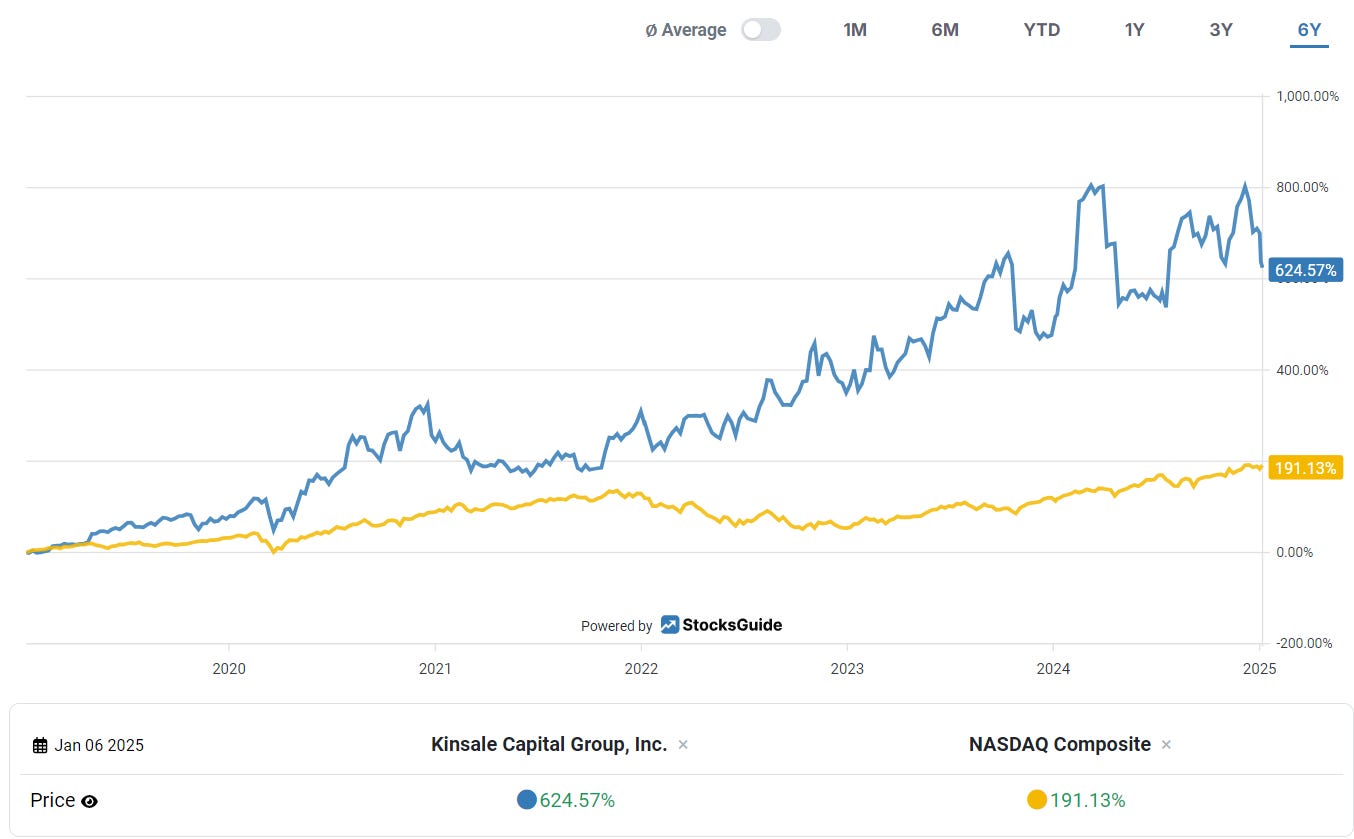

2. Kinsale Capital | KNSL

Numbers

Revenue growth: 32.9%

Net income margin: 27.3%

EV/Sales (NTM): 5.6x

EV/EBIT (NTM): 18.0x

Investment Thesis

I don’t own Kinsale Capital, but this doesn’t mean I don’t think it’s an incredibly strong company that will likely compound for years to come.

They were founded by Michael Kehoe in 2009, and he is the current CEO still and has some significant skin in the game which is always nice to see from an investors point of view.

Q3 saw a bit of revenue growth decline which investors didn’t love but they’ve been performing very profitably with a combined ratio of 75.7% and an expense ratio of 19.2% which is down on the previous year of 20.9% which has ultimately all led to a 46% increase in net income since Q3 23.

Visual

1. Google | GOOG

Numbers

Revenue growth: 15.1%

Free cash flow per share: $1.44

EV/Sales (NTM): 6.2x

Investment Thesis

Although GOOG do not currently have the most dominant Cloud sector (behind Microsoft and Amazon), they’re accelerating revenues at the fastest rate on a QoQ basis. As I explained above with AMZN, the Cloud market is expected to hit $2.3 trillion by 2032, so a 18% (up from 12% today) market share would create an opportunity for $414 billion in Cloud revenue. This is around $75 billion more than Google’s total revenues today.

Despite what people think, GOOG are also leading in AI chip manufacturing as they first developed their leading TPUs in 2015. GOOG still use NVIDIA for custom GPU’s but this lower reliance allows them to have margins in Cloud that are way ahead of Amazon and Microsoft currently.

They have +90% market share in search and are extremely well positioned with Gemini to win a huge part of the AI search market too.

Visual

That’s it for today!

I hope you loved this article. Please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market. You can also follow me on X where I post 3-4x a day.

Thanks, a great list!

Good that I own them all :)