5 Growth Themes & 10 Stocks

Some stocks to have on your radar

Hi all 👋

There’s a couple of ways I look at finding stocks to invest in.

From the inside out: I run daily screeners across the market for companies hitting certain growth metrics and dig into the fundamentals that drive those numbers.

From the outside in: I start with the big picture — macro trends and long-term themes I’m bullish on — and then drill down to find the companies best positioned to benefit.

Today, we’re looking into number 2.

Here’s 5 (and a bonus) big picture growth themes that I am very bullish on for the next 3-5 years.

Some of these stocks mentioned are already in my portfolio, and some aren’t.

Remember that I run a paid community on my Google Spreadsheet for just $16 a month. You get access to:

My portfolio (exact $ amounts)

My watchlist

My daily notes

My Investing Universe (+200 stocks analyzed by revenue growth, EBITDA growth, and EPS growth)

You can access my portfolio and spreadsheet here 👇

➡️AI Applications

The first wave of AI was all about infrastructure… NVDA, AMD, TSMC.

The second wave of AI is all about the applications layer where companies start turning AI & automation into real economic value.

Think back a couple of years for example:

The internet boom began with stocks like INTC & DELL crushing it, and then the long term value shifted to GOOGL, META, and AMZN who built the applications on the internet.

The AI revolution will (and already is) following the same pattern.

#1 Lemonade | LMND

There are not many fully autonomous companies out there just yet, but I think LMND is one of the most autonomous companies today.

Although a boring industry, disrupting insurance with AI will reap absolutely huge rewards over the next 20 years, hence why LMND is currently my biggest position by quite a distance.

#2 Zeta Global Holdings | ZETA

ZETA is an AI-driven market technology company using AI and ML to collect customer data from multiple sources, predict consumer behavior, and automate marketing campaigns.

The numbers are very attractive with analyst estimates for EBITDA currently sitting at 25% CAGR for FY26 and FY27 whilst the stock trades at just 15x NTM EBITDA or 12.6x 2026 EBITDA.

These kind of multiple to growth estimates are good value in my opinion.

ZETA also sits in a nice zone technically just above this bigger support area which I will consider adding at.

➡️Engineering, Procurement, & Construction

There’s a lot of structural tailwinds currently behind the EPC theme in the US in particular with a combination of energy demand, AI infrastructure, reshoring, and policy.

With a huge CapEx cycle ongoing, trillions of dollars are pouring into power generation, grid upgrades, semiconductor fabs, data centers, battery manufacturing and much more. All of these ultimately require EPC contractors.

Although companies in the EPC space aren’t the exciting part, or the end product, of these themes, they’re central almost every other growth theme over the next few years, yet nobody is really talking about them as much.

#1 Fluor | FLR

FLR is one of the world’s largest EPC firms building massive projects across energy, chemicals, mining, nuclear and data centers. They’re currently going through a nice transition away from the traditional oil & gas theme towards clean energy, hydrogen, and AI data center construction.

I’ve spoken about FLR a bit on my spreadsheet over the last 2 weeks. In my opinion, I think they’re the most attractively valued in this space at just 0.44x NTM sales and 12.90x NTM EBITDA for 4.1% revenue growth (FY26) and 35.3% EBITDA growth (FY26) estimates.

That’s very attractive given the stability of the theme too.

#2 Quanta Services | PWR

PWR specialize in power transmission, distribution, and grid modernization essentially building (and upgrading) the electric backbone between utilities, renewables, and data centers. As the US electrification theme continues, so does the demand for PWR.

This is the weekly chart which looks quite overextended, but ultimately has only ran 605% in 5 years which, although incredible, relative to their demand and other stocks in the niche, is somewhat underwhelming given their position at the heart of the AI power grid investment cycle.

➡️Lidar

The lidar market has some of the highest forecasts out of all the themes I track.

Most forecasts suggest between 22%-32% CAGR for the next 5 years which is exceptional growth if you can find the best stocks to ride the wave.

Here’s my 2 favorites currently 👇

#1 Ouster | OUST

OUST basically is a liDAR play that gives us indirect exposure to the following themes as well:

AV’s

Industrial automation

Robotics

Defense

Smart infrastructure

OUST has moved 350% in the last 6 months so understanding the valuation today is very important. Of course the valuation back in May was very attractive with the stock trading below $10 but today we still have 35% growth YoY estimates (quite in line with the wider LiDAR market) and a stock trading for just 11x NTM sales.

I think that’s quite attractive. I’d personally wait for a pullback to the $25 level just to increase the risk to reward slightly.

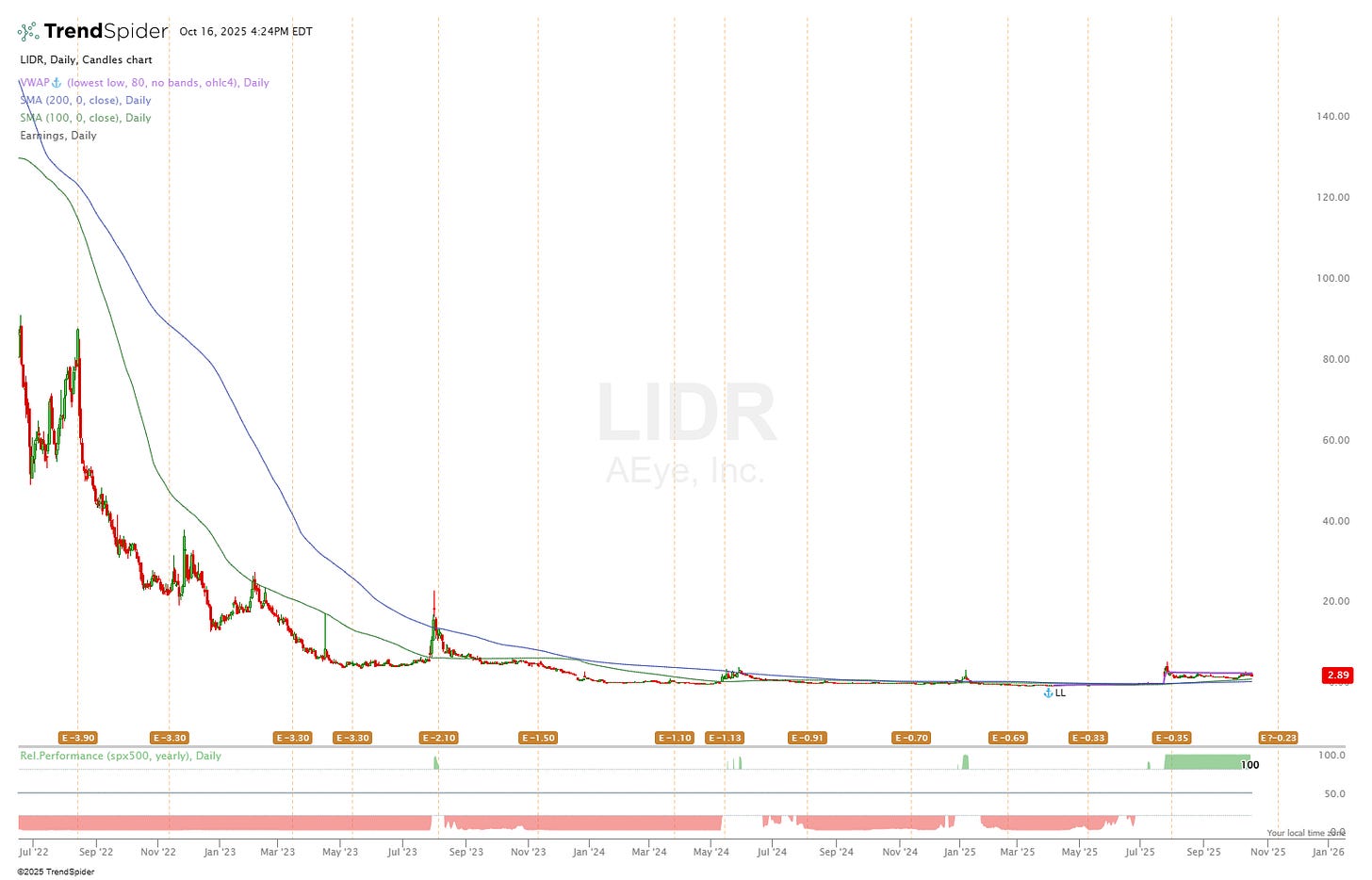

#2 AEye | LIDR

LIDR is a much higher risk play as they’re still pre-revenue and have a market cap ~$100M so this one will be a very catalyst driven stock for the next 18-24 months until they start commercializing (assuming they do).

LIDR management said they currently see a runway into mid-2026 so there’s a chance LIDR liquidate, but it’ll be an interesting one to keep an eye on.

OUST would be my play though today.

➡️eVTOL

The eVTOL market has an even better CAGR forecast than the LiDAR market at ~35% per annum through to 2030, hence why I am very focused on making one of these stocks below a position very soon.

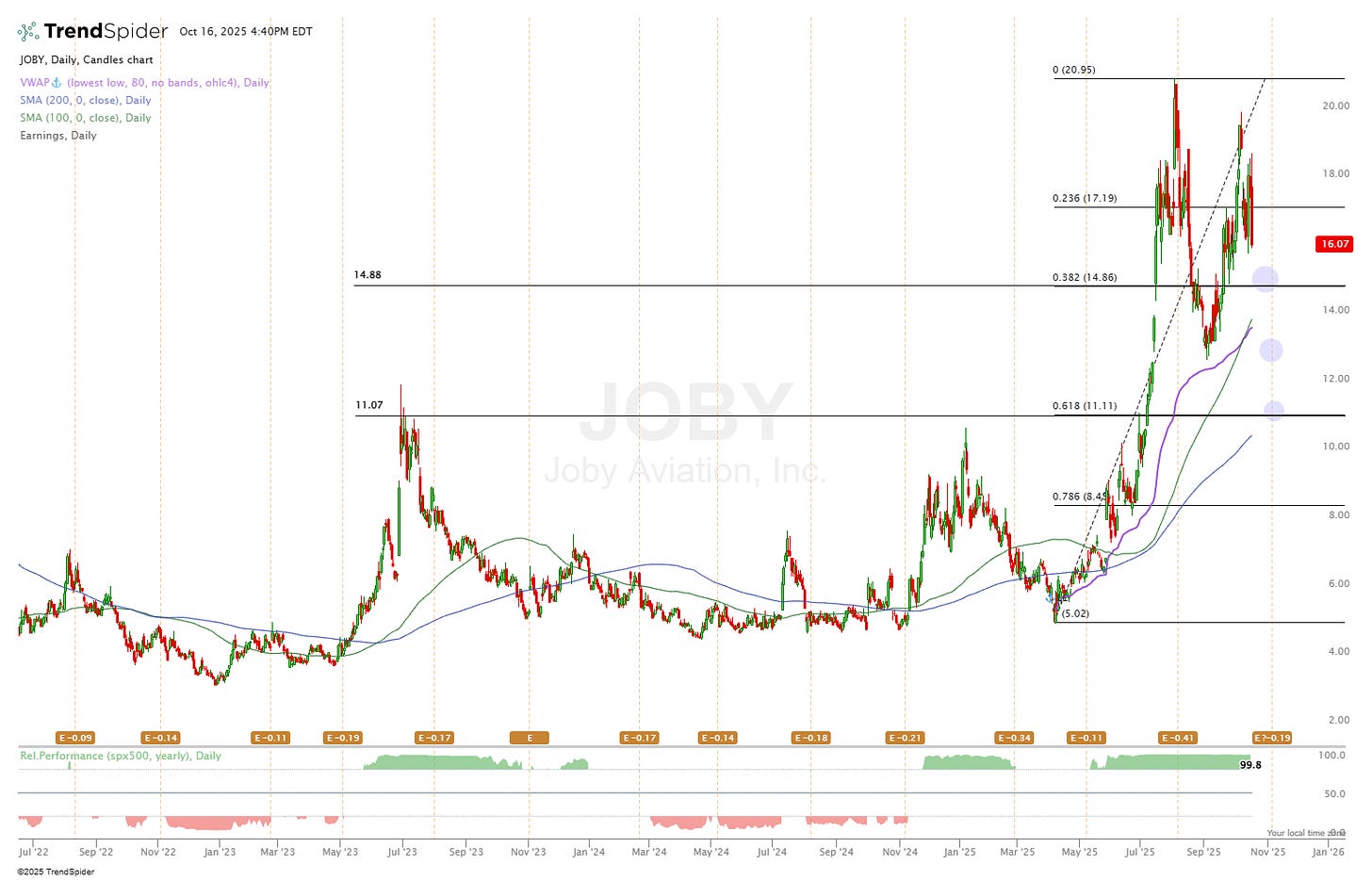

#1 Joby Aviation | JOBY

Paid subs will know that I talk about JOBY almost daily. I’ve been very patient and picky about my entry but I am very bullish on JOBY long term. I suspect if the price hits $14.50 I will initiate a small position, and increase my position size if we do go further down.

Of course, I’ll update paid subs the second I do anything.

#2 Archer Aviation | ACHR

Personally, I am currently a lot more bullish on JOBY just given their current commercialization roadmap and valuation, but ACHR has so far performed slightly better over the last year.

To be honest, I think both have a bright future and if you can invest in either at a nice valuation, I think over a 5-year period you’ll do well.

➡️Warehouse Automation

Warehouse automation is probably the first huge market that will get completely disrupted by robotics. With rising wage pressure, labour shortage, explosive e-commerce growth, and supply chain pressure, warehouse automation is an absolute necessity for many large retailers today.

The warehouse automation theme combines AI, robotics, and logistics, making it a high growth theme mixed with the more recession proof logistics theme.

#1 GXO Logistics | GXO

GXO trades below 0.5x NTM P/S with growth estimates in the low double digit, high single digit range for the next 2-3 years.

They work with big players like Apple, Boeing, and Nestle and are a great addition to a growth oriented portfolio that is looking to slowly diversify away from high multiple US tech plays.

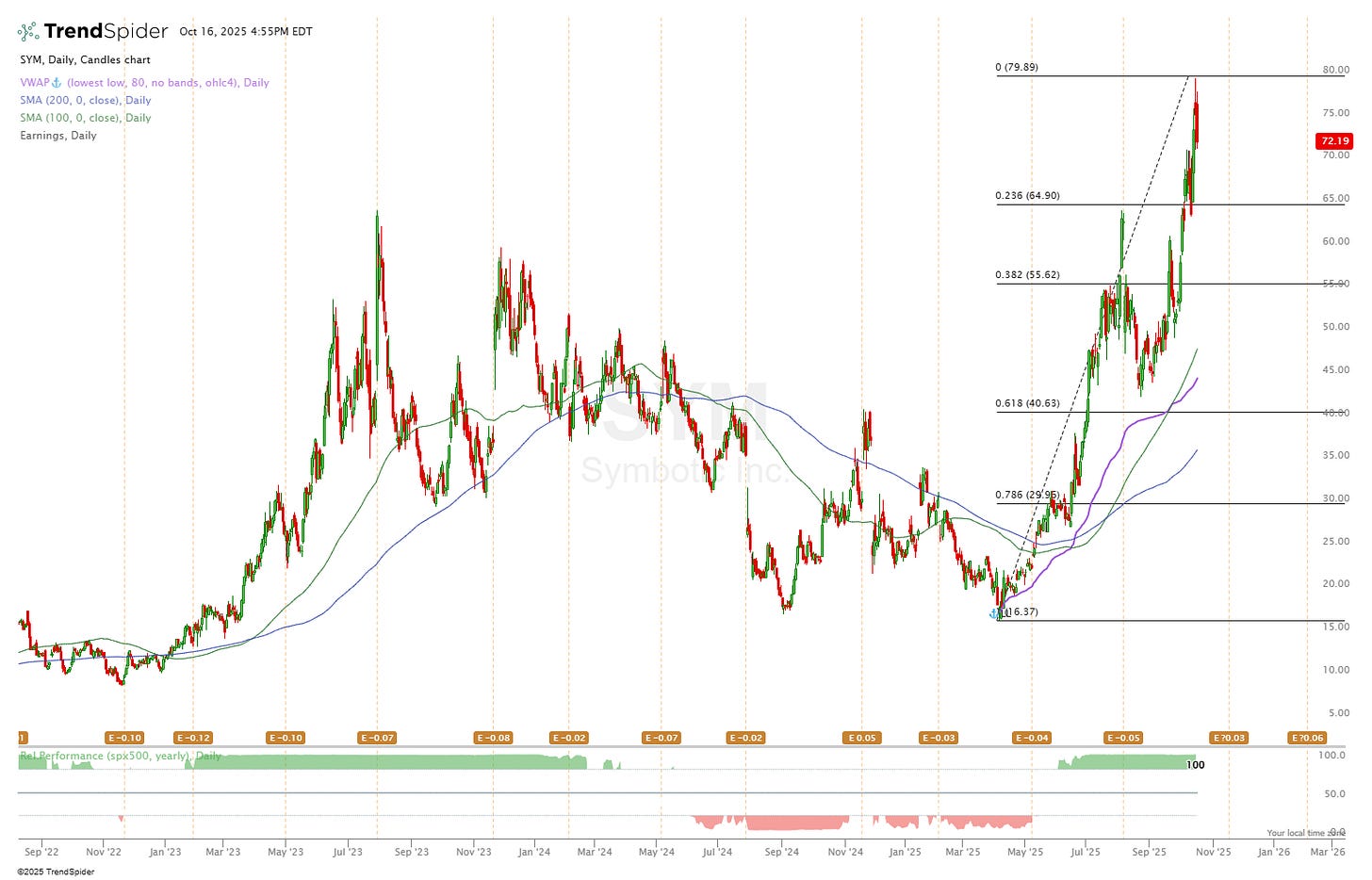

#2 Symbiotic | SYM

SYM is another stock that is quite cheap given very strong growth rates in the mid 20% range for just 3x NTM sales. From an EBITDA point of view, SYM trade at just 32x NTM EBITDA but have EBITDA growth rates estimates of 52% (FY25), 82% (FY26), and 79% (FY27) making this an extremely attractive buying opportunity even today.

If you are more focused on technicals, then a pullback to the $55 range could be nice given the support level there.

➡️Bonus: IVF & Fertility

I won’t go into too much detail here since this is a bonus but given Trump’s words today 👇

“We’re here today to announce a historic victory for American women, mothers, and families. With the actions I will outline this afternoon, we’ll dramatically slash the cost of IVF and many of the most common fertility drugs...” - President Donald J. Trump

I think PGNY and CYRX are both very nice stocks to start considering.

I hope you enjoyed this article. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

Quanta is a great one for the grid modernization, it’s a bit overvalued for my taste but I like it nonetheless. I recommend Itron too, some similar tailwinds with the grid modernization but trading at just 21x earnings, just wrote an article on them

Good morning from Berlin, Germany … Thanks for your time and effort, Oliver. Appreciate!! …. Personally i think OUST is well worth watching as their scanners are used in so many fields. In my view, it could be a good long-term investment. Technically right now the trend continues to point upward and the share price is way above EMA 20, 50 and 200.