5 High Growth Stocks With A Market Cap Below $5B

StocksGuide Screen

Hi all 👋

StocksGuide has some of the best screening tools on the market with built in screeners for things like high growth stocks, dividend aristocrats, and fallen angels, as well as customer screening tools.

I often use them to keep my watchlist up to dates, and my list of stocks to follow fresh.

All of the below stocks rank highly on StocksGuide High Growth Investing rankings, and are all below a $5B market cap.

I'm getting a lot more interested in a few small caps right now and I’m building a big investing universe tab on my spreadsheet for paid subs - it’s just $16 a month 👇

P.s. Links throughout this article contain affiliate links for StocksGuide so if you do decide to sign up with StocksGuide, I would benefit a little bit too.

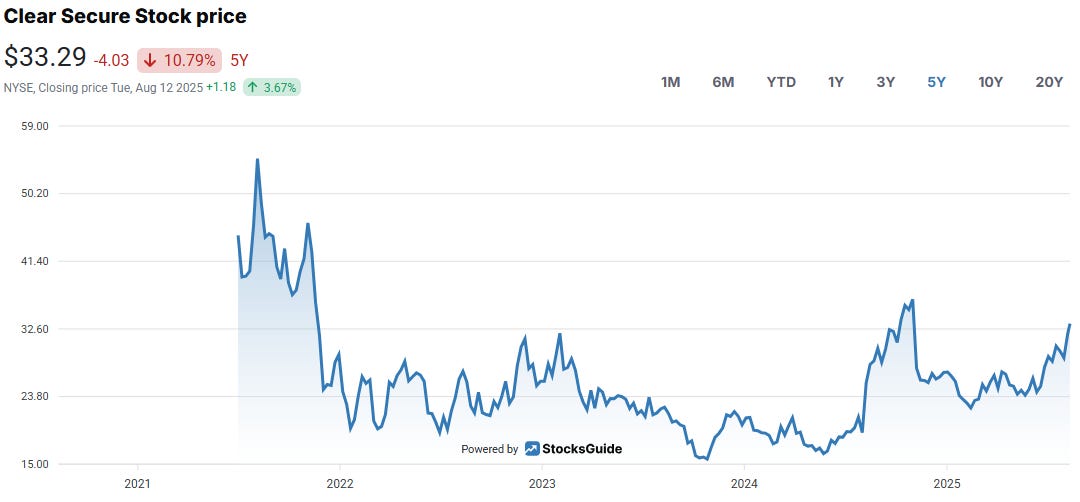

1. Clear Secure | YOU

Introduction:

YOU operates an identity verification platform best known for its CLEAR lanes at airports, where members use biometric data like fingerprints or iris scans to verify identity and skip security lines. They also operate in venues, stadiums, and other businesses.

Numbers:

Revenue up 17.5% YoY.

Total bookings up 13.1% YoY.

Operating margin: 19.4%

Investment Thesis:

Clear+ has scaled to over 30 million members across airports, stadiums, and new venue types, benefitting from significant barriers to entry such as space constraints, brand trust, and its TSA PreCheck partnership.

Huge expansion opportunities beyond airports as well. YOU is expanding into high-margin digital identity and verification solutions with adoption by government agencies, healthcare facilities, and brands like LinkedIn and Uber. This expands the TAM beyond just travel.

YOU is debt free with over $500M in cash and FCF margins above 40%. Estimates suggest ~$427M in FCF by 2027 which would be a CAGR ~15%. With a 15x FCF multiple, YOU has potential to be a $6.4B business, which shows approximately 42% potential from today.

2. MDA Space | MDA

Introduction:

MDA Space is a Canadian leader in satellite and space robotics.

Numbers:

Revenue up 54% YoY.

Adj. EBITDA up 57% YoY.

Adjusted net income up 106% YoY.

$417M in cash at quarter end.

Investment Thesis:

MDA is delivering rapid top-line expansion while generating consistent profits and positive free cash flow, supported by a $4.9B backlog in a very attractive market.

The Aurora digital satellite platform and Skymaker robotics line position MDA to capitalize on surging commercial and defense demand, whilst the SatixFy acquistion adds in-house semiconductor capabilities for vertical integration.

Despite near term margin pressures being likely, they’re growing expected to grow EBITDA at 24% next year and are trading for just 14.5x EBITDA. Not the most attractive in my list, but very solid nonetheless.

StocksGuide are offering 30% off until Sunday 17th. Give it a try through this link!

3. Zeta Global Holdings | ZETA

Introduction:

ZETA is a data-driven marketing technology company that helps enterprises acquire, grow, and retain customers through its AI powered Zeta Marketing Platform.

Numbers:

Revenue up 35% YoY exceeding guidance.

Adj. EBITDA up 52% YoY.

FCF up ~70% YoY.

Investment Thesis:

Sustained and expanding margins - Q2 revenues grew 35% YoY whilst EBITDA grew 52% reflecting very strong operating leverage.

ZETA has delivered sequential growth in scaled customers for 17 straight quarters now with rapid increases in +$1M clients.

ZETA are growing revenues +35% with a 3.3x sales multiple and a FY28 PE below 15x. Not many quality companies fit this criteria.

4. Palomar Holdings | PLMR

Introduction:

PLMR is a speciality property and casualty insurer that designs and underwrites customized insurance products for underserved and niche markets across the US.

Numbers:

Gross written premiums up 28.8% YoY.

$1.68 diluted EPS.

Adjusted net income up 51.8% YoY.

Investment Thesis:

High growth, diversified insurer with an expanding TAM. With revenue growth over 45% YoY and GWP growth ~20% in Q1 2025, there’s still a lot of product and geographic expansion opportunities ahead.

PLMR have a combined ratio of 73.1% (adjusted 68.5%) and a loss ratio of 23.6% which is substantially better than peers like RLI and Kinsale whilst also growing faster.

PLMR also trade significantly below peers like Kinsale (15.9x PE vs 22.1x PE) so there remains a large valuation gap that needs to be reduced.

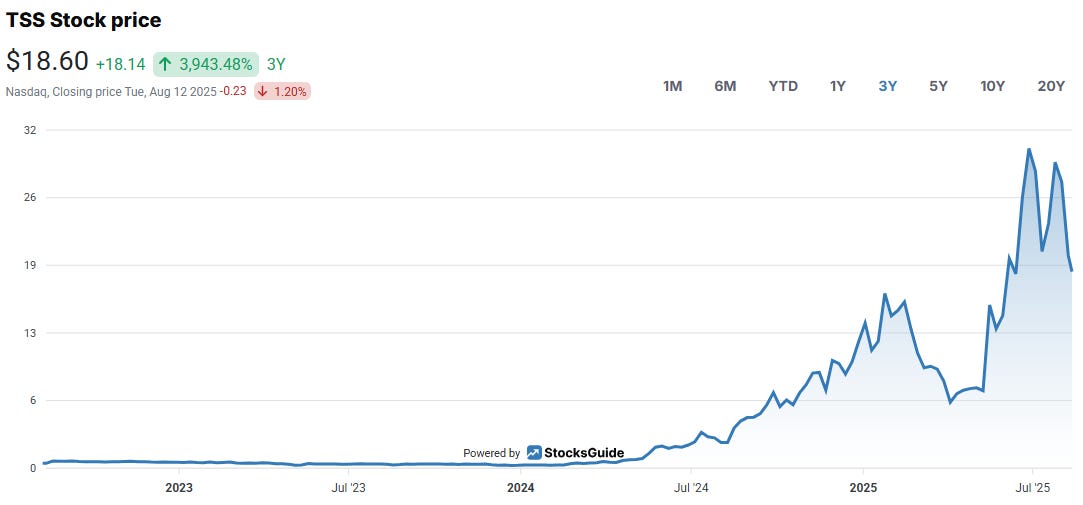

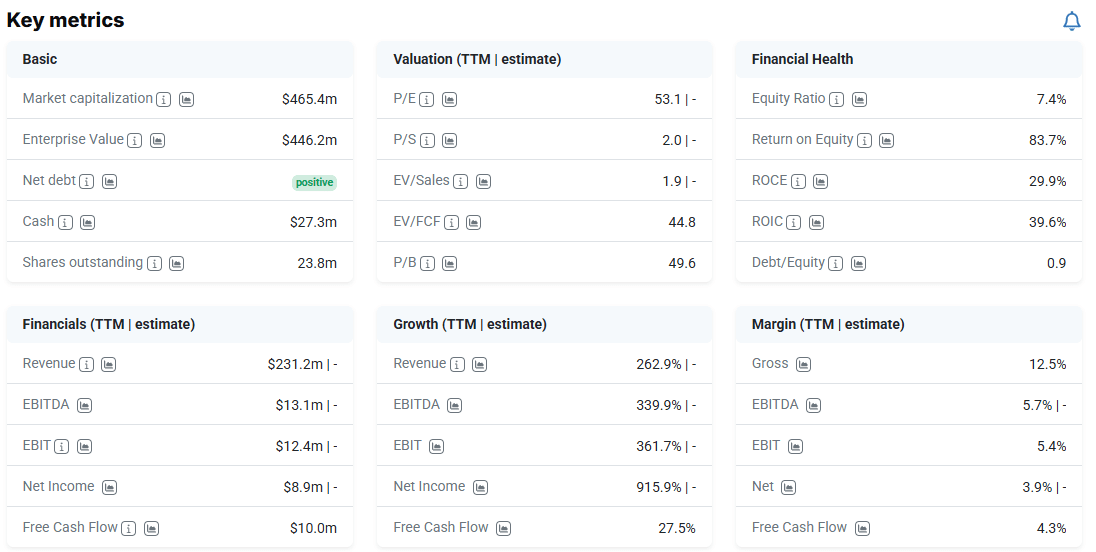

5. TSS | TSSI

Introduction:

TSS is a US based systems integrator that designs, builds, and maintains custom data center and IT infrastructure solutions - specializing in AI rack integration, procurement, and facility services for enterprise and government clients.

Numbers:

Revenue up 262% YoY, specifically up 572% in procurement services division.

Gross profit increased 72% YoY.

Net income up 6% YoY.

Investment Thesis:

TSS has transformed from breakeven in 2023 to $0.24 EPS in 2024 and EBITDA is expected to rise at least 50% in 2025, supported by surging AI rack integration and procurement services.

TSS are partnered with DELL in a multi-year agreement.

Despite a market cap of $465M, TTM revenue numbers were $231M meaning TSS is trading at just ~2.0x sales for 262% growth.

That’s all for today

I do hope you enjoyed this article. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

Great list Oliver! The PLMR writeup caught my eye. That combined ratio of 73.1% is pretty remarkble compared to peers, and the fact they're growing faster than Kinsale while trading at a 28% valuation discount is hard to ignore. What's your take on whether the valuation gap persists because the market is worried about their abilitiy to maintain underwriting discipline as they scale up? I've noticed smaller specialty insurers can sometimes struggle with loss ratios once they move beynd their core niche markets. Curious if you see that as a risk here or if the geographic and product diversification actually reduces it.

A mixture of falling knives and sideway stocks. An example of a growth stock $APH or $EBAY.