5 Stocks To Ride The Robotics Wave

Hi all👋

“Robotics” to most people is humanoid machines, futuristic factories, and sci-fi automation. What rarely gets talked about is the much more practical, less flashy reality of the market:

Logistics

Healthcare

Agriculture

Offshore energy

And the scale of this transformation into the above niches is happening very fast. We now currently have ~5 million industrial robots operating worldwide growing ~12% CAGR YoY through to 2028. Some niches within robotics like collaborative robots (Cobots) are expected to grow at +20% CAGR as small and midsize companies adopt automation to solve their labour shortages.

Logistics robotics is another booming niche with warehouse automation expected to hit a $70B valuation by 2032, tripling from 2023 levels.

The drivers are fairly self-explanatory:

Labor scarcity and rising wages in developed markets.

Reshoring and supply chain reconfiguration that demand cost-efficient, high tech factories.

The constant need for efficiency and precision in almost every industry.

Unlike AI which lives predominantly in AI and chips, robotics is the next wave…the physical layer of automation. Without it, the productivity gains that AI is driving are mainly stuck on a screen.

That’s why robotics is one of the most exciting niches to start researching and investing in.

You’ll notice in this article I don’t talk about some of the more obvious robotics names out there (TSLA, AMZN, SYM, ISRG for example). That’s for 2 reasons:

Many people already know some of these names and I want to talk about different stocks and introduce you elsewhere.

Some of the big winners will be those that quietly dominate niches.

The Second Wave of AI

In my spreadsheet for paid subscribers (please see link below), I’m building a huge list of stocks ranked by valuation in the most exciting niches.

I currently have ~150 stocks in robotics, drones, space, nuclear, quantum, and data centers all ranked by revenue growth to multiple, EBITDA growth to multiple, and EPS growth to multiple to gauge if they’re worthy of diving into them more.

All of the stocks I talk about here are currently appearing as attractive from a revenue growth point of view as per my spreadsheet.

So far, I’m up 50% on ONDS, 240% on SOFI, and 60% on LMND. The next wave of AI will likely introduce us to even more spectacular gains.

Join us here for $16 a month. Less than the price of 2 coffees.

You get:

Access to my portfolio (core and swing trade)

Access to my daily notes

Access to my watchlist

Access to my Investing Universe

1. Teradyne | TER

Business

TER’s main legacy business is automatic test equipment (ATE) and industrial automation solutions. They originally built their business by supplying semiconductor test systems to chipmakers, but they’ve managed to strategically diversify their business into robotics and industrial automation over the last decade meaning they’re now extremely well positioned to benefit from:

The ongoing semiconductor cycle.

The structural shift towards automation.

The automation segment of TER only contributes ~20% of revenue today, but this is ultimately where a huge amount of the future growth is focused. This segment was established post an acquisition of Universal Robots (UR), and later their acquisition of Mobile Industrial Robots (MiR).

This means today TER’s robotics business is made up of:

Universal Robots: Builds robotic arms designed to safely work alongside humans without cages or heavy safe barriers. Handy for assembly tasks, machine tending, and packaging.

Mobile Industrial Robots: Develops self-driving robots that move goods around factories, warehouses and hospitals.

Energid: Provides advanced motion control and path-planning software to essentially allow robots to perform more complex tasks with more precision.

AutoGuide: Builds AMR’s designed to carry heavy loads such as pallets and large components mostly used in automotive, aerospace, and large-scale manufacturing.

Valuation

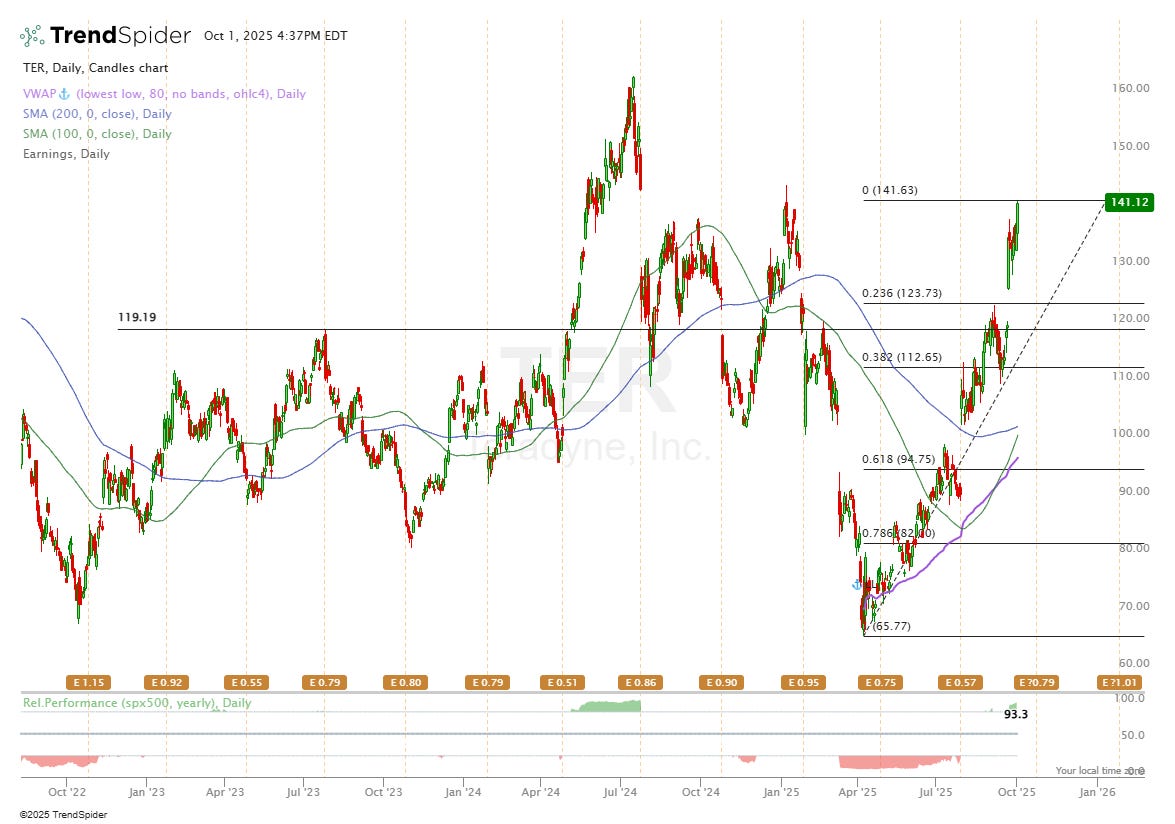

TER currently trades for 6.7x NTM sales and 25.2x NTM EBITDA whilst set to grow revenue at 2.6% in FY25 and 19.4% in FY26 and EBITDA at 36% in FY26. Given those multiples, I don’t think TER is overly attractive today, but it’s definitely got potential.

Aligning with my technical analysis below, I’d prefer a pullback into the $120s or so or where the NTM EBITDA multiple sits around 18-20x. That would make it far more attractive for me.

Technicals

Technically, TER looks a bit over extended currently and I’d be waiting for a little pullback if I were being picky which I think is advised given the current environment.

2. Omnicell | OMCL

Business

OMCL’s business is built around medication management and adherence automation solutions for healthcare systems and pharmacies. They started by providing automated dispensing cabinets that help hospitals safely store and dispense medications, but over the years they’ve expanded into cloud-based software and analytics to optimize pharmacy operations.

Today, they’re extremely well positioned to benefit from:

The ongoing push for efficiency and cost savings in healthcare.

The structural shift towards automation in hospitals and pharmacies.

Automation is central to their current strategy. Their portfolio now includes automated dispensing systems, robotic pharmacy solutions, and workflow software that reduces human error in medication management. Ultimately, many healthcare services are looking to automate processes, but it’s not easy to automate a process that has historically been very manually driven. OMCL have built their automotive process from the ground up meaning it’s a core part of their business and culture unlike many peers.

Valuation

We’re currently trading at the same price as ~2016 levels so historically speaking OMCL is quite cheap today.

If you look at analyst estimates for 2025, 2026, and 2027, there’s very limited growth but if you look ahead to 2028, analysts are expecting a huge jump in EBITDA. This one completely comes down to execution from management.

Ultimately, the multiples today seem quite cheap at 10x EBITDA for example, but they’re cheap for a reason given current growth prospects. It’s definitely worth a deeper look whether or not you believe there’s strong growth ahead for them.

Technicals

Technically, we’re sitting well below all the main MA’s and at a multi-year support level. Looking at price action today, I see a fairly strong base, but also very little momentum.

3. Allegro MicroSystems | ALGM

Business

ALGM operates in quite a critical but overlooked part of the semiconductor ecosystem which could represent a nice opportunity for us. That niche is motion control and power management IC’s.

ALGM are a big player in the automotive sector where their magnetic senses and high-voltage power semiconductors are being designed into electric drivetrains, advances driver-assistance systems, and battery management platforms. These design wins are very sticky as automakers and suppliers are very reluctant to swap out suppliers mid-cycle, giving ALGM multi-year revenue visibility once a platform ramps.

Outside of their auto segment, ALGM’s products enable energy-efficient power conversion in data centers, industrial automation, and renewable energy systems, aligning the business with secular themes of electrification and energy efficiency.

Peers like Texas Instruments and Infineon are much larger, but ALGM’s niche they have built today given them more exposure to the fastest growing end markets in the semiconductor space.

Valuation

Relative to TXN and ADI, ALGM trades slightly higher on a EBITDA multiple basis (but lower on a revenue basis), but I’d also give them a slight premium over those peers given their growth prospects in the niche they’ve carved out.

EBITDA growth is expected to be 59% in FY26 and 62% in FY27 meaning an EBITDA multiple of 27x today can be regarded as attractive.

Technicals

Technically, I think ALGM is in a nice place in sitting just above a multi-year support level and just around the 100 and 200 MA’s and the VWAP. The 0.618 fib level sits just below the MA’s too.

4. GXO Logistics | GXO

Business

GXO have established themselves as one of the world’s largest pure-play contract logistics companies designing complex supply chain solutions for multinational customers running warehouses and fulfilment centers that are being powered by robotics, AI, and machine vision systems making them a great indirect play on the robotics wave.

GXO’s differentiation currently lies in their ability to integrate automation at scale helping clients reduce costs, increase throughput and build much more resilient supply chains which has ultimately helped them secure multi-year contracts with many blue-chip companies in e-commerce, retail, food & beverage, and aerospace.

Without considering GXO as a play on robotics as well, the outsourced logistics management market has a ton of tailwinds are many companies are shifting away from in-house management to outsourced assistance with very complex supply chains today.

Valuation

I’d put GXO in the same field as UPS for example. Fairly slow growth but fairly cheap at 12x EBITDA (for ~9% growth) but they’re in a very attractive niche. I don’t think a stock like GXO has the high growth characteristics that I tend to look for but I think they’re definitely a company with some nice upside, and especially a nice hold during a period of macro uncertainty.

Technicals

This is the weekly chart for GXO. You’ll see that the price has not moved much since July and they remain stuck in this $50 range just sitting about the weekly 100 and 200 MA’s which is positive. The downside here is that we have been making lower lows and lower highs, but if GXO can break out of this current range, I think we can easily look for a move up to $70ish.

5. Helix Energy Solutions | HLX

Business

HLX occupies a unique niche as well in the offshore energy services market giving them exposure to the oil and gas market, the offshore renewables market, and the automation/robotics trend. The core business revolves around well intervention, decommissioning, and subsea robotics services.

Unlike traditional offshore drillers focused on exploration, HLX specializes in maintaining and extending the life of existing wells. They have a fleet of well intervention vessels and remotely operated vehicles where they support large operators internationally (Gulf of Mexico, North Sea, Brazil, West Africa etc) which ultimately provides a very cost effective alternative to large drilling rigs. This tends to extend the life of producing wells.

Valuation

HLX comes in below many peers like TDW, VAL, and HP from a revenue and EBITDA point of view which is a nice metric to look at. EBITDA estimates in FY26 are 24% so a current EBITDA multiple of just 4.9x is extremely attractive based on that.

Technicals

Technically sitting at a very nice level too right at the monthly 100MA and VWAP.

That’s it for today!

I do hope you enjoyed this article. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

Good breakdown. What I like here is the focus on less obvious robotics plays—logistics, healthcare, offshore energy. That’s where investors miss the forest for the trees. TSLA and AMZN grab headlines, but the real money’s often in the niche operators who quietly own their segment

I suggest looking at Schaeffler AG who are a bearings and mechatronics producer. They are a core supplier for the actuator joints in Tesla's Optimus. Joints are the most complex and highest valued hardware part of the humanoid robot.