A Look At What The Best Investors In The World Own

Here's 50 stocks held by the best

A Look at the Superinvestors

Thanks to the Internet, we can learn bundles from the best investors in the world.

Are you looking for some investment inspiration?

If so, here’s where 10 of the world’s most accomplished investors have their money right now in 2024.

Warren Buffett

Where else would we start?

Since 1965, Warren Buffett has compounded Berkshire Hathaway at about 20% per year.

$10,000 —> $800 million today…!

Top 5 positions of Berkshire Hathaway:

Apple (50.0%)

Bank of America (9.0%)

American Express (7.2%)

Coca-Cola (7.2%)

Chevron (5.9%)

Li Lu

Li Lu is often considered as the Chinese Warren Buffett.

He has a very simple strategy: find undervalued stocks and invest heavily. Simple.

Since 1998, Li Lu has returned ~30% annually to shareholders with Himalaya Capital Management.

Top 5 positions of Li Lu:

Bank of America (27.2%)

Alphabet (22.0%)

Google (18.3%)

Berkshire Hathaway (17.3%)

East West Bancorp (8.0%)

Mohnish Pabrai

The founder of Pabrai Investment Funds, and one of the most successful value investors of all time, Mohnish Pabrai is a huge fan of Buffett.

In fact, he once spent $650,000 to sit down with Buffett for lunch, and called it a “bargain.”

Pabrai has averaged an annualized return of 25%, and in 2009 had a 120% year.

Top 3 positions of Mohnish Pabrai:

Alpha Metallurgical Resources (67.6%)

Consol Energy Inc (24.5%)

Arch Resources (7.9%)

Chuck Akre

Chuck Akre focuses on 3 areas of analysis they he calls his “three-legged stool.”

Quality businesses

Exceptional management

Disciplined reinvestment

Since the start of Chuck’s fund in 2010, he has returned 13.8% annually to shareholders.

Top 5 positions of Chuck Acre:

Mastercard (21.5%)

Moodys Corp (14.9%)

American Tower Corp (10.4%)

Visa (10.3%)

Kkr & Co L P Del (9.7%)

Howard Marks

The founder of Oaktree Capital Management, Howard is the best investor of distressed companies in the world.

Warren Buffett always says that he always reads Howard Marks Memo’s as soon as they are released.

Top 5 positions of Howard Marks:

Torm Plc (21.2%)

Chesapeake Energy Corp (8.8%)

Garrett Motion (5.0%)

Sitio Royalties Corp (4.5%)

Star Bulk Carriers (4.5%)

Clifford Sosin

Clifford is the founder and investment manager of CAS Investment Partners.

As you can see from the percentages below, Sosin has a very concentrated portfolio which have returned ~30% per year.

Top 5 positions of Clifford Sosin:

Hilton Grand Vacations (46.8%)

Carvana (26.9%)

World Accep Corp (15.2%)

Capital One Finl Corp (5.8%)

Cardlytics (5.2%)

Bill Ackman

Ackman has a net worth of approximately $3.4B. He’s gathered this immense wealth through activist investing.

He looks for large, but distressed companies, with great potential that he tries to solve himself.

Ackman has returned 17.1% annually for 19 years.

Top 5 positions of Bill Ackman:

Chipotle Mexican Grill (16.4%)

Restaurant Brands Intl (15.4%)

Lowes Cos (14.5%)

Hilton Worldwide Holdings (14.5%)

Howard Hughes Corp (11.6%)

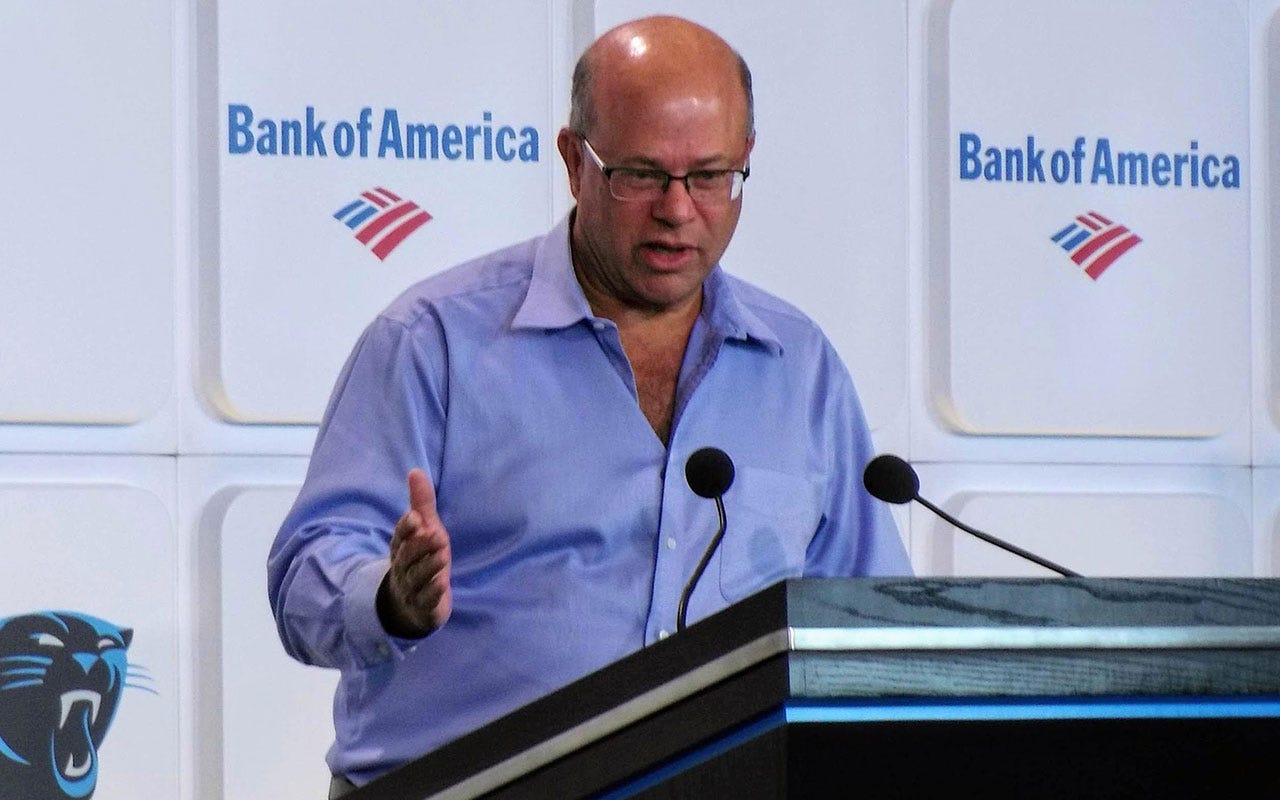

David Tepper

David Tepper is more well known for his sporting investments, such as owning the Carolina Panthers NFL team.

However, he’s a quality investor and runs Appaloosa Management which has made $32.3 billion since its inception.

Top 5 positions of David Tepper:

Meta Platforms (11.6%)

Microsoft Corp (10.2%)

Amazon (9.4%)

Nvidia Corp (8.8%)

Alphabet (7.2%)

Michael Burry

Michael Burry, perhaps most well known for his huge profit shorting the market during the financial crisis, is a hedge fund billionaire.

Though he is down quite a large amount currently since he shorted the market in the middle of 2023.

Top 5 positions of Michael Burry:

Ishare Tr (47.9%)

Bookings Holdings (7.8%)

Stellantis (7.7%)

Nexstar Media Group (7.1%)

Star Bulk Carriers (4.9%)

Guy Spier

Guy is perhaps the least well-known on this list, but he’s an incredible investor.

Guy is based in Zurich and runs the Aquamarine Fund. He’s also the author of “The Education of a Value Investor” which teaches you his exact strategy.

As you can see he runs a very concentrated portfolio of large, quality companies.

Top 5 positions of Guy Spier:

Berkshire Hathaway (22.6%)

American Express (17.1%)

Bank of America (14.0%)

Mastercard Incorporated (12.2%)

Ferrari N V (8.6%)

A Focus on Quality…Always

All of these investors are quality investors, but that doesn’t mean you should follow every stock they buy.

The aim of this article was simply to give you inspiration for ideas to look further into.

Alternatively, you can also screen for stocks using this below framework.

That’s All For Today

I hope you enjoyed this article where we dove into the top 5 holdings of 10 super investors.

If you’d like me to write more (or less) on a specific topic, then please do let me know in the comments!

Also, please do share, comment, and like this article. It will massively help get my free content out to more people!

They tend to invest in large established companies with a solid track record. Thanks for the insights, Oliver!