Earning Reviews (NFLX ASML TSMC)

News for the week (14.10-18.10) / ASML NFLX S SOFI TSMC HOOD UPST AFRM HIMS

Happy Saturday 👋

We’re just getting into Q3 earnings season. That means lots of analysis is coming your way (completely for free). This week we had some earnings from big players like Netflix, TSMC & ASML. We also had some nice news from one of my favorite companies in the portfolio - SoFi which jumped over 10% this week, briefly topping the $10 range and a little review of SentinelOne’s investor day.

I’ll dive into all this in this article.

Finally, I’ll touch on some nice analyst upgrades that we’ve had this week.

Taiwan Semiconductor Earnings (TSMC)

TSMC manufactures and sells semiconductor devices (such as IC’s) internationally to the big players like NVDA, AMD, INTC and many others. They have one of the biggest moats in the market due to the complexity (and price) of their manufacturing process.

Here’s a rundown of the Q3 earnings.

“The demand is real. And I believe it’s just the beginning of this demand. So one of my key customers said, the demand right now is insane. That it’s just the beginning, it’s a form of scientific to be engineering. And it will continue for many years.” - CEO

Note: Revenue numbers above are in TWD currency.

Numbers Overview

There’s no denying demand for TSMC isn’t high and trending very nicely upwards. Revenue beat estimates by 1% and grew 13% QoQ.

TSM also saw some nice margin expansion during the quarter beating all estimates and guidance.

GAAP EPS came in at $0.39 ($0.03 above estimates).

Cash & cash equivalents reach $68 million, $5 million above Q2.

Commentary

TSM is continuing to see revenue growth across all products. Advanced technology (high performance computing & IoT) were the main reasons for this growing at 11% and 35% QoQ respectively.

Management said that they see AI-related demand to be “extremely robust” until 2025 at least forecasting revenue contribution from server AI processors to more than triple this year. This shows TSM’s position in the market, brand, & network are all perfectly positioned to capture a huge part of the wider AI markets growth.

One of the big risks for TSM amongst investors has always been their dependency on Taiwan for pretty much all business operations. When you consider current geopolitical tensions between China and Taiwan you start to realize that this is quite a risk. This is why I’ve been very happy to see the CEO discuss good progress surrounding their fabs (factories) in Arizona, supported by the federal, state, and city governments. Not only does this decrease geopolitical risks and add to flexibility for TSM customers, but it also should create some nice economies of scale over the next decade when all 3 factories hopefully begin production. The amount of cost efficiency potential over the next 10 years or so is very impressive.

Management also briefly touched on fabs in Japan and Germany which both have volume production goals for 2027. Margins may be slightly pressured due to these expansions, but this is a decade long plan for TSM which likely will create one of the most cost-efficient manufacturers across the globe. For shareholders today, this shows some nice evidence of the sustainable competitive advantage that TSM is building.

Conclusion

NVDA’s growth is TSM’s growth. AMD’s growth is TSM’s growth.

Fundamentally, this quarter showed that. We’ve seen demand stay very high and management seem convinced that this is just the beginning of that trend. TSM are wonderfully positioned to continue to capture all the benefits from this secular trend.

Shareholders should be ok with a bit of margin decline over the next 2-3 years with CapEx increases, and investments into their international fabs in Arizona, Japan, and Germany. These investments should reap huge rewards over the next decade.

If demand stays high, TSM is one of the best plays to ride this AI/semiconductor secular trend.

Netflix Earnings (NFLX)

I’ve not wrote on NFLX before or really delved into the company ever, but Q3 was very strong for the company and I thought it was time to really look into the company more.

I’m not sure I’m too close to making an investment in the company as I think I’m a tad late to the party but that’s fine.

Numbers Overview

Revenue beat estimates by $57 million which was a 2.8% QoQ growth and 15% YoY growth.

GAAP EPS came in at $5.40 which beat estimates.

Subscriber count reached 282.7 million, 4 million ahead of estimates.

Net income margin reached 24.1% which is 450 bps ahead of Q3 2023.

Commentary

One of the reasons I’ve always been slightly reluctant about NFLX is because of the intense competition with rivals like Disney (DIS) and Amazon Prime (AMZN). Competition obviously puts pressure on revenue growth but also on margins which hasn’t expanded massively since 2022. Nevertheless, Q3 earnings from NFLX really gave shareholders confidence that they are leading the competition.

NFLX have done a very good job at expanding their offering (into live events, gaming, ads, & international) which is one of the main reasons they’re winning. For example, they won the live streaming of the Mike Tyson and Jake Paul boxing match, as well as NFL games over Christmas. This helps NFLX not only expand their TAM but also cater to a much higher portion of their 600M+.

To further cater for NFLX’s huge audience, management are looking to be a bit more flexible with their plans and pricing to meet the varying needs. In some regions such as Japan, Spain, Italy, US, and France prices are being increased. Whilst in some areas, NFLX have introduced lower price points which include ads. These are now accounting for over 50% of sign-ups.

Obviously this is positive because NFLX are managing to monetize from the consumers who are less willing to spend more on an ad-free subscription, but it also suggests some signs of consumer weakness.

The ad platform is still very young so there’s limited data for us to really dive into yet but management are insistent that expanding the offering for advertisers over the next few years is a priority. We’ve seen a lot of success over the last 2-3 years for those companies which have opted to build an advertising segment (UBER is the name that jumps out most to me) but the issue is a lot more companies are doing this now. Competition in the ad space is becoming a lot more intense.

However, of all the companies that have built an ads business recently, NFLX offers by far the highest engagement which is exactly what advertisers want. This is where NFLX can offer the most value proposition to advertisers and get the highest CPM. Advertisers want to be in the middle of all the noise, the live events with the most hype, or the series that people are talking about and spending hours watching each evening. NFLX have the potential to be one of the strongest digital advertisers over the next 10 years.

One of the other big opportunities for NFLX is their ability to internationalize.

United States & Canada saw revenue grow 16% YoY.

EMEA also saw 16% growth.

Asia Pacific grew 19%.

LATAM grew 9%.

Growth rates in UCAN and EMEA are somewhat more predictable, whilst APAC and LATAM are a little more volatile but that’s where the huge opportunities are if NFLX can reach that population and price their offering well.

Conclusion

This quarter definitely proved to me that NFLX is still the leading player in their niche. I do think the runway is much bigger than people think for NFLX, particularly because of their ability to build what I think will be a very successful business. The problem I’ll always have with NFLX is the intense competition though…something which will never be an issue for the next company I’m about to talk about ⬇

ASML Earnings (ASML)

A very rough week for ASML saw the stock drop 16.2%. It all started when the earnings were accidentally released a few hours too early and ended when net bookings came in much lower than estimates. I think this weakness does provide a nice opportunity…but I’m not jumping into anything just yet.

Numbers Overview

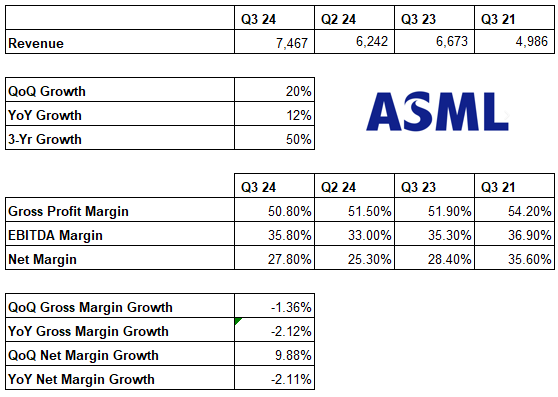

Revenue came in at EUR 7.5 billion, 20% higher than Q2 24 and 12% higher on a YoY basis.

Bookings missed by 51% (!)

EBIT, EPS, and gross margins all beat estimates.

Cash & cash equivalents stayed fairly flat at EUR 5 billion.

Commentary

Firstly, let me say that I’m not worried at all about the future of ASML. People underestimate just how important they are and people don’t realize that they have 100% market share in the EUV lithography market. They’re going nowhere and are definitely a company I’d like to own at some point.

However, the 16% drop this week isn’t tempting me to jump in automatically as I think the stock has a bit more room to drop. Taking out the fact that the company has one of the strongest moats in the market, and purely focusing on numbers, I’d rarely buy a company with 12% YoY growth for 9.8x EV/Sales and 28.2x EV/EBITDA. For me, that’s just too much.

Secondly, a 51% drop in bookings isn’t something that ASML will recover from in just 3 months or so. The end market clearly isn’t where it used to be as customers are very cautious in the current environment. Management expect this caution to remain well until 2025. With that being said, TSM expect very high demand for the rest of 2024 and into 2025 so there’s a bit of contradiction here because TSM’s demand should play into ASML’s hands quite well.

Combining this with the margin pressures that management discussed into Q4, I can’t see ASML’s stock moving upwards too much over the next quarter. If there are further moves downwards, it’s something I’ll take advantage of, but I’m not making any rash decisions following this earnings report.

Conclusion

I think it’s worth being a bit cautious here. I don’t think ASML is a cheap company to own and this 16% drop doesn’t change that.

I believe ASML will be a dominant force for the next decade but I want a cheaper price to invest. I’ll wait and see how this next quarter plays out.

SOFI News (SOFI)

$2 billion loan agreement with Fortress Investment Group

SOFI made a nice move by announcing a $2 billion loan platform agreement with Fortress Investment Group. This partnership allows SOFI to manage loans on behalf of other lenders, instead of using its own capital, hence meaning SOFI can generate income through fees rather than using their own money. This less capital-intensive approach de-risks the company, especially during a time when management don’t want to get too aggressive with loans. Essentially this allows SOFI to expand their personal loan business at a much lower risk than they have been doing.

New credit cards

Nothing too exciting here but it’s evidence that SOFI are continually looking to tailor to many different customers needs. More consumers and more products is what SOFI need to be doing right now.

SentinelOne Investor Day (S)

I won’t spend too much time here because this article is already longer than I hoped but I wanted to quickly touch on SentinelOne’s first investor day which generally had a very positive reaction.

The S CEO filled the conference with product announcements, marketing, Purple AI enhancements, and new LLM releases. As I’ve mentioned before in my discussions on SentinelOne, I think the market has generally massively underestimated S. Their technology is up there with the best in the industry, they just haven’t gone big on their marketing yet.

I think that time is now changing as they have positive FCF and are therefore more willing to spend bigger on marketing. Tomer (CEO) made it clear that S are now going after the bigger customers, instead of just winning the small and medium businesses which is generally what they’ve done for the last 3 years.

I’m excited for the S Q3 earnings report and I’m excited to see whether the CRWD outage actually had any positive effects on S. I’ll be following closely as a shareholder.

Analyst Upgrades

HIMS - Bank of America raised PT to $23. Deutsche Bank, Jeffries, & Needham also raised PT’s.

AFRM - Wedbush raised PT to $45 with expectations of lower interest rates benefitting the company.

UPST - Wedbush raised PT to $45 and Mizuho raised to $48.

HOOD - JP Morgan raised PT to $21.

S - Barclays raised PT to $30 following the Investor Day (outlined above).

That’s it for the day

I hope you loved this article. As I continue to develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.