GXO Logistics (GXO): Deep Dive

Hi all 👋

Contents

Introduction

Business Model

Numbers

Growth Opportunities

Risks

Valuation

Conclusion

Introduction

I’ve been looking to lower the beta of my portfolio a bit over the last couple of months and thought this was a good article to release now just as the S&P 500 hits an ATH again and valuations again get lofty.

Of course, there’s major bull and bear cases both ways and I’m ultimately more of an optimist for the future, though I appreciate the risks of today’s hefty valuations across certain industries.

At the end of the day though I am a high growth investor, and I always want to invest in the biggest trends and themes that I see over the next few years. I like to stay aggressive even when valuations are high. I just get a bit more pickier with my buys, adds, and a bit more open to trimming positions. For example, paid subs will know that I’ve been trimming (~30%) my HIMS position since August as I thought the multiples they were trading at don’t warrant the current growth rates.

With that being said, I wanted to increase my robotics exposure but didn’t want to invest in companies like RR (Richtech Robotics), or SERV (Serve Robotics), which in my opinion trade at quite ridiculous multiples (111x and 66x NTM sales respectively) even given my bullishness on the robotics niche.

That’s how I came across GXO. A company that combines robotics (high growth) with warehouse automation and logistics (much slower growth and more defensive). I tend to brush off a lot of these slower growth companies because ultimately my aim is to always believe there is at least a 100% move possible and most of the time with these slower growth plays, that isn’t possible. But I think there is substantial re-rating potential ahead for GXO and I’m going to try explain exactly why today.

The Business Model

GXO is a pure-play contract logistics company meaning it partners with large enterprises to design, operate, and optimize their warehouse and supply chain operations. Their customers include some of the most recognizable, blue-chip companies in the world like NKE, AMZN, AAPL, Adidas, and H&M. These companies not only rely on GXO to operate their warehouses, but they help them to modernize, automate, and scale them in an ever more complex logistical environment.

End-to-end supply chain execution that GXO takes ownership over for a client could include:

Design and operating distribution centers from the ground up.

Managing inventory flows and optimizing stock placement.

Implementing storage and throughput optimization.

Building reverse logistics operations to process and refurbish returns.

Handling resale preparation, repairs, or repackaging.

Managing cold chain and temperature-controlled supply chains.

Ultimately, GXO become the operations backbone for these blue-chip customers. But central to this outsourced logistics work for GXO is automation, and that’s core to my investment thesis for them. GXO work with seven major industrial robotics partners, deploying technologies like AMRs (autonomous mobile robots), automated storage and retrieval systems, robotic picking arms, and ML based workforce planning tools.

For clients of GXO, automation leads to:

Higher throughput

Lower error rates

More scalability

Reduced unit labour cost

For GXO, automation leads to:

Higher contract stickiness

Process standardization

Margin expansion as labour becomes more productive

One of the first questions I had when I first started researching GXO was why do these huge multi-billion dollar (even trillion dollar) companies outsource their logistics operations to a small $6B company in GXO?

There’s a reason why the global contract logistics market is expected to grow to nearly $400B by 2028 ($334B today).

The answer is as follows:

The main reason is it gives companies the ability to focus on their core competencies. Ultimately, NKE wins because they have the ability to differentiate through product and brand power. AAPL have a different core edge. AMZN have a different core edge. But none of them have the ability to differentiate themselves in logistics.

The second fundamental reason is it improves efficiency and productivity. These huge enterprises have an edge in their field, but they don’t have an edge in logistics. GXO are a pure play logistics company with huge expertise there.

GXO’s contracts are typically 3-7 years contract, and typically they span much longer than this as clients see the value add. These contracts are rarely transactional; instead they’re structured as ongoing partnerships in which GXO designs, staffs, manages, and optimizes the clients logistics ecosystem over time.

More importantly, and probably just as important as the automation part of my investment thesis, switching costs in this business are extremely high making the GXO moat much stronger than people understand. If a customer wants to drop GXO as a client, it’s far more complex than just swapping vendors. They’d need to re-engineer facilities, migrate data, change already customized workflows, reacquire hardware etc. And when you combine this with keeping millions of units flowing through the supply chain every week, it becomes far too disruptive, and risky.

“On average, our top 20 customers have been with us for 15 years, and each year we grow and renew more than 95% of our revenue.”

Ultimately, as a result GXO has very high contract renewal rate in the mid to high 90% range, very longstanding and stable customer relationships, and a very stable and recurring revenue stream. This is ultimately what separates GXO from peers in the wider logistics industry.

Financials

Demand

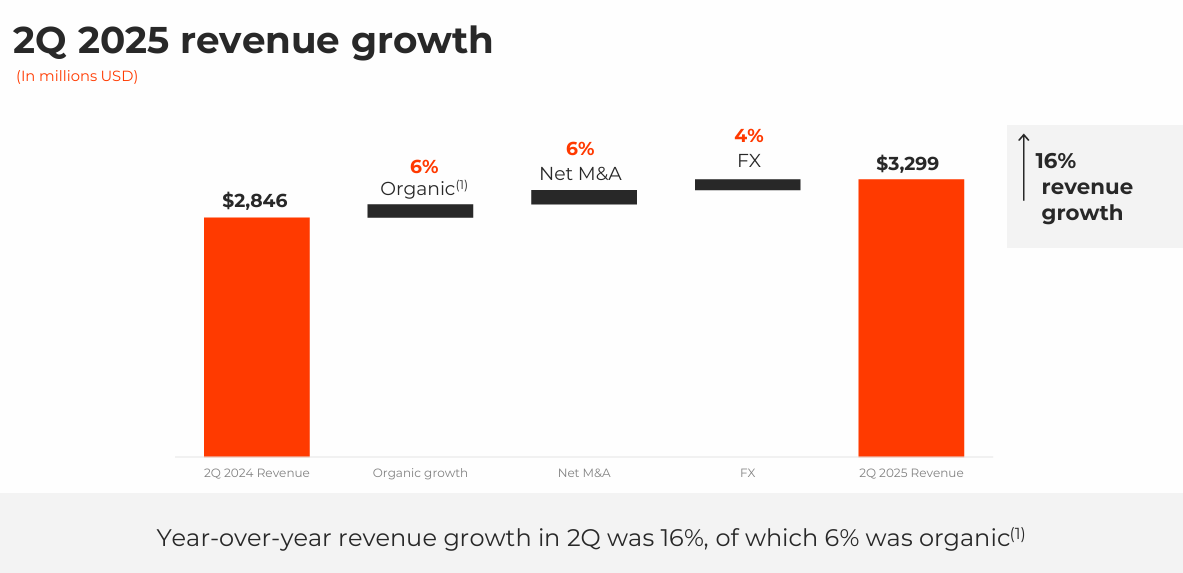

Revenues have currently hit $12.7B over the LTM which was a 16% total revenue growth. As part of this growth, 6% was organic, 6% was inorganic through M&A, and 4% was FX driven. As part of this organic growth ~26% was won from new competitors, and 23% was won from customers who previously did not outsource. Big brand wins include LVMH, L’oreal, ThermoFisher, M&S, Boeing, Bridgestone, and Harrods.

The rest of the new wins for GXO (51%) came from existing customers new activity which ultimately led to a grand total of $513M in expected incremental revenue increase for 2026 which was won purely over the last quarter.

Profitability

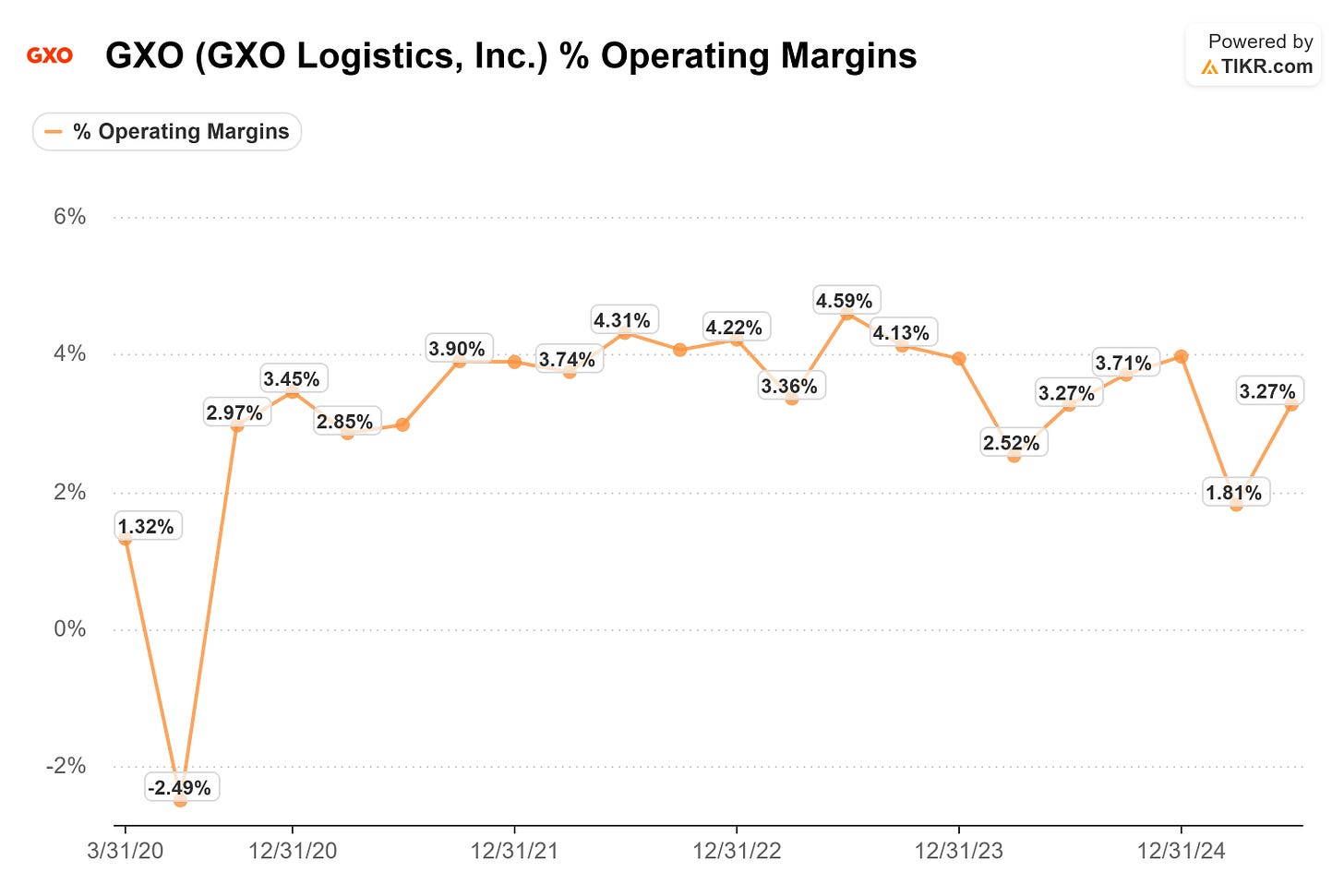

Operating margins are razor thin for GXO, hovering between 2.0%-4.0% QoQ meaning of the $3.3B in revenue generated in Q2 25, only $108M of that passed down to operating income with a 3.3% margin. Net income was only $26M

This profitability picture likely is quite off-putting for many investors, but this is ultimately the nature of this business. These margins stem because a large portion of GXO’s revenue is essentially a pass-through of costs (labour, utilities, technology) under contracts which are structured as a cost-plus or fixed-fee. Therefore, even with scale GXO’s bottom line will always remain fairly narrow.

It’s important to understand that this is the nature of the business model though, and not an inherent weakness in GXO vs peers. GAAP margins will always look thin, even though the underlying return on invested capital is perhaps a bit stronger.

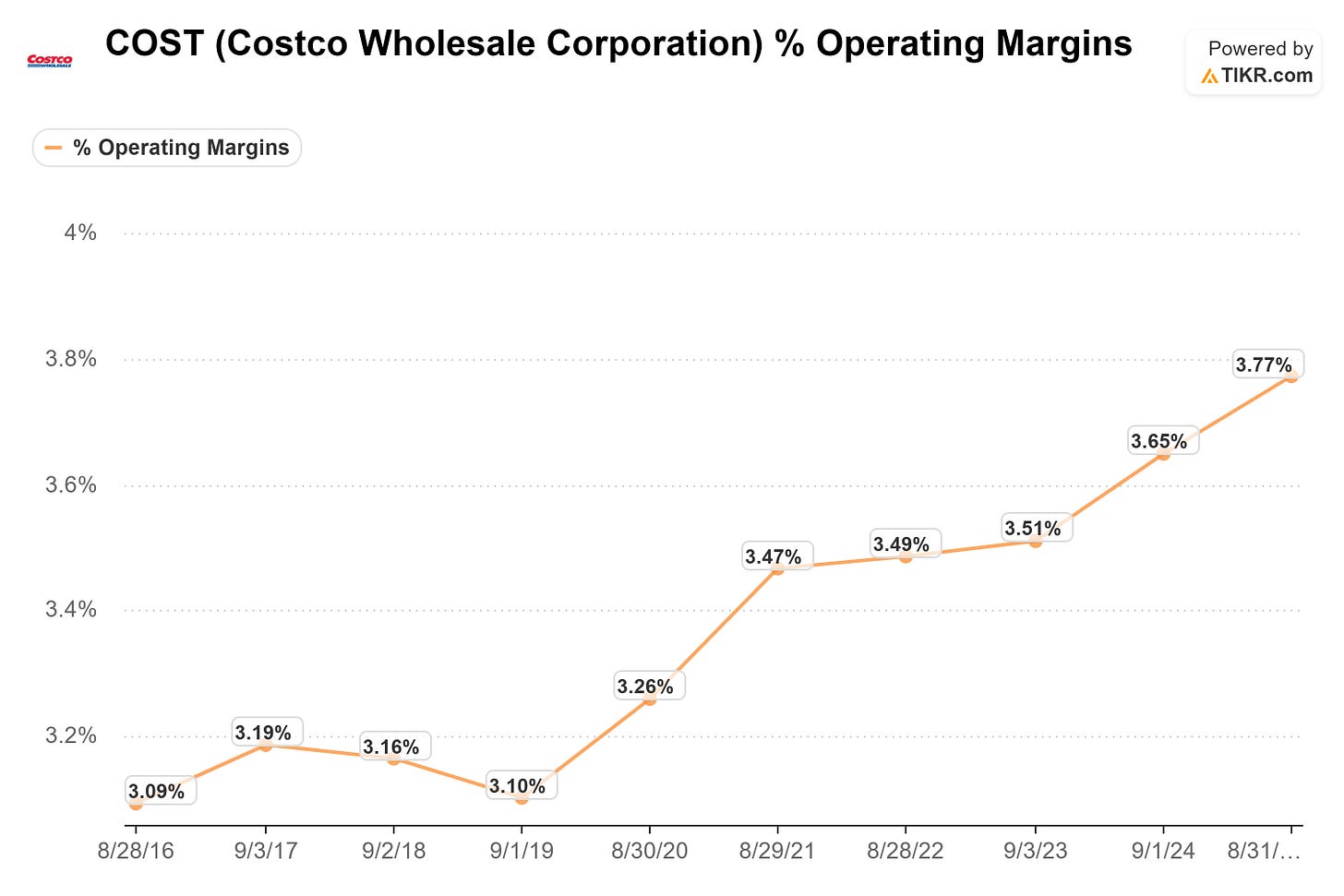

It’s also important to realize that as standardization increases, automation increases, and tech investment decreases, we will start to steadily see adj. EBITDA margins head slowly in the right direction. And as long as revenue streams stay stable (GXO probably has some of the most stable revenue streams in the market with contract lengths of ~5 years), a thin margin business can still operate extremely well.

COST is a great example; thin margins but very steadily increasing operating margins. FWIW COST is up 150% over the last 5 years.

Balance Sheet

Net debt is currently ~$2.5B and this is often a big bear case for GXO, but it is misunderstood. Some sources say net debt is much higher than this at +$5B but this is because they include operating liabilities of ~$2.8B. If you understand how GXO operates, they would never take on debt unless a contract with a client has been secured. Instead, they sign a contract, take on the debt, and then ultimately lease out the warehouse at the end to their customer.

Opportunities

Wider Market Big Picture Growth

Whenever I look for opportunities, I generally start with a top-down approach. I look for themes that I’m very bullish on and then filter down to find the best stocks within those themes.

Most data suggests the global outsourcing logistics market will be worth ~$2.2T by 2033 (around 25% of the global logistics market) which offers a market growing by 9% per year. Relative to most themes that I invest in 9% is on the lower end, but it’s by far the most defensive and the safest and still offers nearly double-digit growth.

I won’t dive into the structural drivers for this growth too much but I’ll just touch on them here:

E-commerce and more omnichannel fulfilments means more order volumes, more returns, and more need for sophisticated, data-driven warehousing.

Increased D2C means more smaller shipments rather than traditional orders through B2B. It also means more returns, and far more complexity.

Cost pressures and supply chain complexity are forcing companies to outsource their logistics functions rather than attempt to build in-house. 3rd party logistics companies are able to invest in their core tech and offer far more value which makes the proposition to outsource far better. These larger blue-chip companies want to invest in tech that will give them the edge in their core area, most of the time of which is not logistics.

I could break this down far more and perhaps I will at some point, but for now I think it’s important to understand that a 9% growth rate for a more stable, defensive market like logistics is a very good growth rate. Management stated in 2021 that their market share is ~5% so if we can conservatively assume that this number doesn’t go over 7.5% by 2033, then the ultimate opportunity in a ~$2T market is quite substantial.

The other area that I love is that this is an indirect play on a higher multiple niche of robotics/automation and GXO offers that without having to pay huge multiples for players like RR, and SERV which likely offer a lot more downside from here in the short term.

Newer Growth Verticals

Aerospace

GXO are rapidly growing their presence in the A&D (Aerospace & Defense) space with huge deals with RTX for example, and now their recent Wincanton deal gives them exposure in the UK & Europe as well.

They’ll likely continue to grow this segment of the business because the services they offer are full-life cycle which not many peers offer. Global MRO spend is set to rise roughly to $150B in 2030 as fleets age, and aircraft backlogs continue to increase. Of this $150B, we can conservatively assume ~10-15% is likely made up in logistics support whilst the other 85% is made up with maintenance and parts management. So we’re looking at ~$15B-$20B opportunity here of which GXO tend to have ~5% market share in the general wider outsourced logistics market.

If they can grow their aerospace segment to a 5% share, then I think we can conservatively say there’s another $300-500M that GXO could win here if I’m making a base case.

Obviously, these kinds of deals are a lot rarer, but the values are way higher in some cases (such as with RTX for example). More importantly, these are much more mission critical services and would likely carry higher margins.

Healthcare

Healthcare is another rapidly growing market for GXO, especially post their recent win with the NHS in England which was GXO’s largest contract win of all time. Management estimate that the healthcare logistics market to win is valued ~$34B today, but I suspect this will be one of the higher growth rate markets based on:

Stringent compliance

Expanding cold supply chain for biologics

If you look at some of the big trends in healthcare today it’s biologics, more personalized medicine, and home care delivery. McKinsey for example estimates ~25% of care could shift to home settings by 2030. GXO currently don’t operate here as they basically sit one layer upstream in the core warehousing and regional distribution centers running the entire logistical operation from there, but I think this is something GXO could potentially dive into down the road as they increase their exposure to the healthcare niche.

Further as healthcare essentially gets more decentralized, insurers and hospitals will require more end-to-end visibility basically from production all the way through to doorstep. It seems like the next big obvious move for GXO given they do try and become an end-to-end player in other niches. I assume this will be a gradual step maybe starting by supporting clinical trial logistics and then building out smaller fulfilment sites near major cities.

If you look at the numbers, healthcare is arguably the biggest risk to reward ahead for GXO if they can become fully vertically integrated here and capture even a small part of the global 3rd party logistics market. Management did state $34B currently but if you start to include last-mile logistics and everything else, the market becomes very big very quickly.

Reverse Logistics

The global reverse logistics market is worth ~$823B and projected to reach ~$3.2T by 2032 suggesting GXO are operating here in a market growing ~18% CAGR. Currently ~25% of returns end up in landfill and 50% end up never being sold again mainly because the cost and inefficiency of handling returns is not worth it for brands.

This problem is only getting larger as the share of commerce that is online continues to increase and customers are now choosing who to shop with based on their returns process and the ease of it. This means instant refunds, no-box drop offs, and clear tracking all are very important, and expected, for a customer shopping online.

Many people don’t know this but GXO essentially have the capability to run the end to end returns process, including receipts, inspection, and test/repair etc which if run efficiently can basically turn a returns process from a pure cost into an actually valuable part of the business. But as ever with logistics, this is an extremely complex, data-rich, and technologically advanced process that many retailers don’t have to expertise to turn into a valued part of the business, hence the necessity to outsource.

On top of this, retailers and OEM’s are facing huge ESG pressures. Reducing waste and increasing recycling is tracked heavily and GXO are likely one of the few that directly can address this mandate.

Wincanton Deal - EBITDA Growth

The Wincanton deal is very bullish for GXO. I’ll take a look at the numbers for how this affects GXO shortly, but it essentially shows how good GXO are M&A. There’s many regional 3rd party logistics companies out there who are falling behind and unable to fund the automation/robotics that they need to stay competitive.

That’s why I think GXO will continue to buy these ~500M-$1B logistics companies and automate them to heavily lift margins but also give them exposure into some key areas that GXO haven’t currently won. The M&A market is huge in this niche. Obviously, the downside here is that these processes take a long time to materialize into the books for GXO. Management stated the Clipper acquisition they did took ~18 months to realize the revenue synergies from that acquisition but this acquisition was the main reason GXO won the NHS deal.

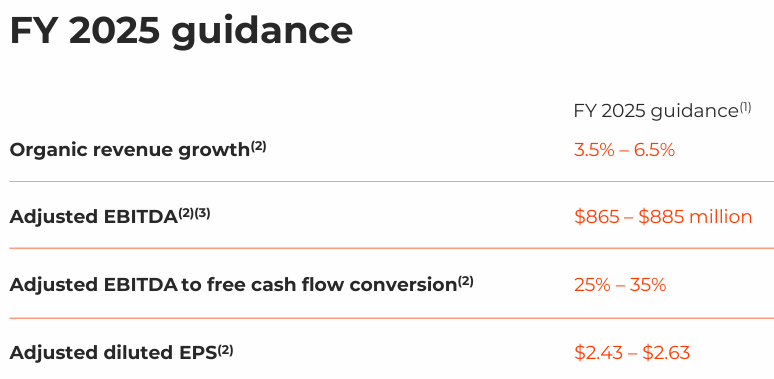

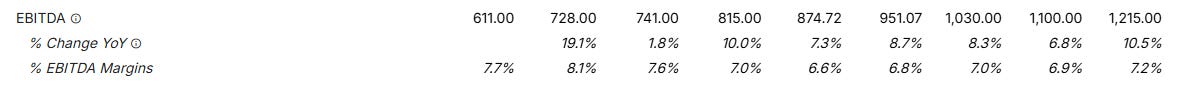

Looking more specifically at the Wincanton deal, there’s ~$60M of cost synergies baked into that deal of which most will be realized in FY26. FWIW, there’s a lot of tailwinds for the numbers in FY26 (including NHS and some big aerospace wins so I suspect by the end of next year the numbers for GXO may shock a few people). In terms of the $60M in EBITDA, FY25 Adj. EBITDA guidance is ~$870M so a $60M uplift here is approximately a 7% jump in EBITDA over the next 18 months-36 months.

As touched on, more importantly than the 7% uplift in EBITDA over the next 2-3 years is the fact that GXO have some very good expertise in M&A, and that will be a key driver for growth (albeit inorganic) as smaller firms struggle to keep up with the high tech needed in today’s complex supply chains.

Risks

By far the main risk for GXO is the macro environment seeing a general slow down in international trade, but that will only happen if we have a recession in which case I think the entire stock market will be in trouble and not just GXO. In fact, if that does happen I think GXO will be one of the stocks that holds up the best relative to a lot of the market.

Other risks include:

Customer concentration risk: GXO has many customers (nearly 1,000), but some of the blue chips mean from a revenue perspective ~40% of revenue is gained from their top 10 biggest positions. Losing or downsizing one of these major customers will obviously have a material impact on GXO’s numbers.

M&A risk: M&A is obviously a risky strategy for growth if synergies or integration doesn’t work as expected. GXO have historically done some very good deals with Clipper in 2022 and Wincanton in 2025. We haven’t seen the full synergies of Wincanton yet, but management sound very positive so far.

CapEx: GXO are automating their business with ~50% of warehouses now being automated. This is essentially their big edge right now but there’s an obvious risk of implementation delays, cost overruns, or simply underutilization.

Valuation

Big picture we have a company trading at 0.46x NTM sales growing at ~13% with $13.2B in revenue expected in FY25. That in itself has to interest most people, especially when you consider that they offer some very good indirect exposure to robotics and automation where most companies in the niche like RR and SERV trade at sales multiples above 50x for example.

Relative to peers in the space like UPS, DHL, or IDL for example, GXO trades far lower on a revenue multiple basis but slightly ahead on an EBITDA basis but that makes sense given GXO are growing EBITDA slightly faster. Fundamentally, I much prefer the revenue GXO earns as well given they are much more asset light and potentially less exposed to economic downturns vs a company like UPS. Remember UPS earn on a per parcel basis whilst GXO have multi-year contracts (typically 3-7 years in length).

GXO’s PE multiple is 19.3x for a 19% growth in FY26. Not incredible but not bad at all given the stability and safeness of this kind of investment.

Generally, I don’t really consider starting positions, no matter how defensive or aggressive they are if I don’t see at least 100% potential upside. So here’s my conservative assumptions for GXO:

EV/EBITDA Basis

GXO are currently expected to hit $1.22B in EBITDA in FY29 but that’s currently based on very slow growth rates (5-7% per annum) and minimal expansion in EBITDA margins.

Based on the opportunities section, we’ve got a 3rd party logistics healthcare market growing at 8% per annum and a reverse logistics market growing at ~14% per annum. Granted these aren’t bigger parts of the business just yet, but I do suspect if we include inorganic growth through the Wincanton deal as well as growth in the aforementioned sectors, I think a CAGR growth ~8% through to FY29 is feasible (and probably more of a bull case).

Give that, we could hit $17.9B in revenue in FY29.

Next, analysts haven’t baked in much EBITDA margin expansion with expectations ranging ~7.2% in FY29.

Given an aim to shift their revenue mix towards higher unit economic niches like reverse logistics and healthcare, as well as their autonomous business and pricing power given the natural demand surge for 3rd party logistics providers, I suspect we could comfortably hit the 9% range by FY29 given these tailwinds. I understand logistics businesses run operations at razor thin margins so a 200bps expansion could be challenging, but it appears feasible.

$17.9B revenue and a 9% EBITDA margin gets you $1.61B in EBITDA in FY29 which basically offers a 16.4% CAGR for the next 4 years. In this niche, and looking at GXO’s historical multiples pre-autonomous shift, I think a multiple in the range of 14x-16x seems entirely feasible.

$1.6B in EBITDA * 14x multiple gets us a $22.4B EV which is ~100% higher than the $11.4B EV that we have today.

This $11.4B EV today also includes the total debt of ~$5.5B but net debt should be ~$2.5B given this $5.5B in debt isn’t actually a liability. It’s basically GXO’s funding method as soon as a contract is signed with a client. They use debt to fund a warehouse and then ultimately lease it out to the client so that operating debt shouldn’t be considered as true long-term debt. In that case, the EV should be closed to $9B in which case we’re looking more at a 130% run from here over a 4-year period.

I think as the market gradually starts to realize that GXO have a deep expertise in robotics and automation, the multiples they trade at will gradually increase. The other big risk that I touched on is tariffs but I think we are heading slowly towards a macro environment where tariff risks aren’t as high as they originally were. That too should lead to multiple expansion.

Technicals

For a company like GXO, I’m far less concerned with technicals… but here are the main levels I would probably consider initiating adds in with GXO.

I am quite close to initiating a small position in GXO shortly, and then hopefully aim to dollar cost average down if GXO does dip to those levels.

Conclusion

The bear case for GXO basically says they’re just a warehouse operator.

My bull case has tried to explain that they’re far more. They’re an automation scaling platform, a systems integrator, and a very data-rich company operating in a very complex, but relatively stable industry.

Whether you’re bullish or bearish on the economy today, I think a company like GXO at today’s valuation offers you with both very good upside, and some safety.

That’s it for today!

I do hope you enjoyed this article. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

I really love the article - thanks for providing it and great research! The only thing i dont really get why you compare gxo to dhl, ups instead of zebra technologies, siemens, fanuc etc? I may be mistaken but based on the reading i would assume these to be more direct competitors?