Harrow (HROW): High Growth Outside Tech

Deep Dive

Hi all 👋

Contents:

Introduction

Business

Financials

Risks

Valuation

Introduction

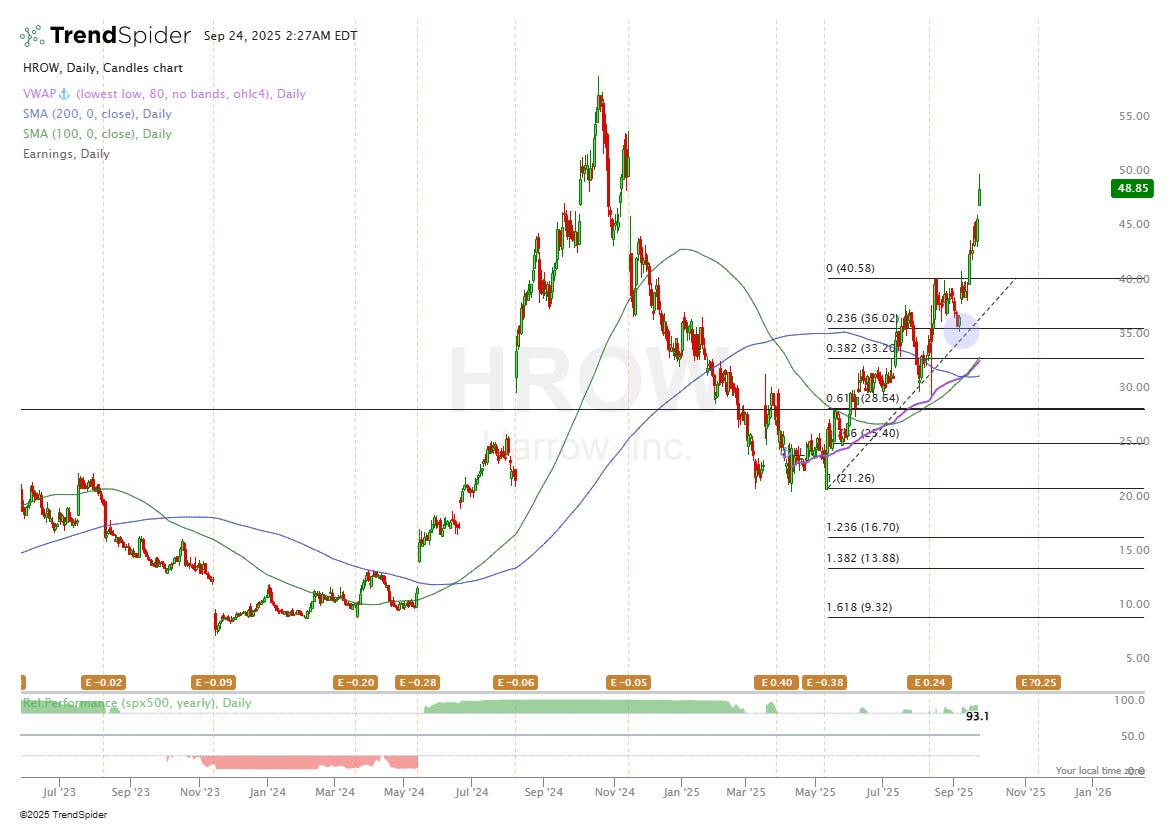

On 8th September I initiated a position in HROW as paid subs will know at a cost of $36.70. Since then, I’m up 33% on the position but would like to increase my position size when the time is right.

The blue circle on my chart above shows where I bought. Technically, the stock is due a little pullback maybe back to the $40 level which is where I’d probably buy in some more if we get there. Ultimately, I decided to buy in after hearing about management’s 2027 goals of $250M per quarter which when you run the numbers (valuation section), it becomes very hard not to be bullish, even if HROW miss their own goals.

HROW appeared in a lot of my high revenue growth, and high EBITDA growth screens for the entirety of 2025, and even back in 2024 but I never decided to give them much of a look because I didn’t love the pharma industry, nor did I know anything about ophthalmology (eye care). I saw a few people who I like a lot on X talk about it a bit back in the summer and then it started to catch my attention more and basically forced me into diving deeper into the company.

HROW have an Investor Day on the 26th September which I believe may spark a lot of interest. I wanted to get this article out before then, and perhaps offer an update after the Investor Day if there’s a lot more to add, or if the valuation becomes more attractive.

Business

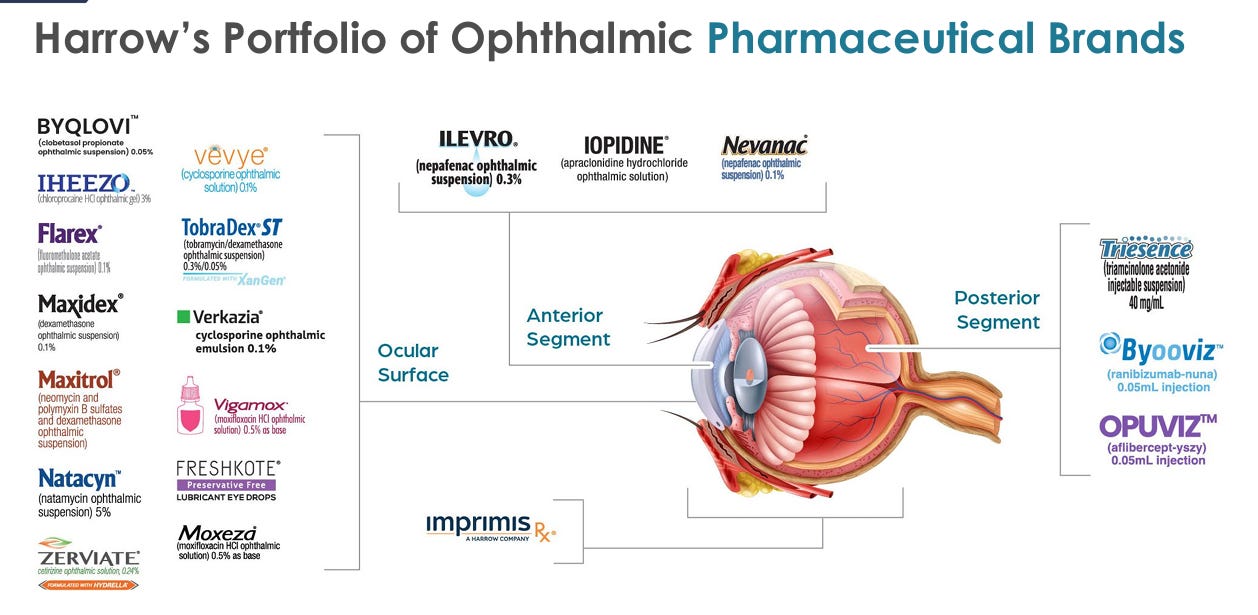

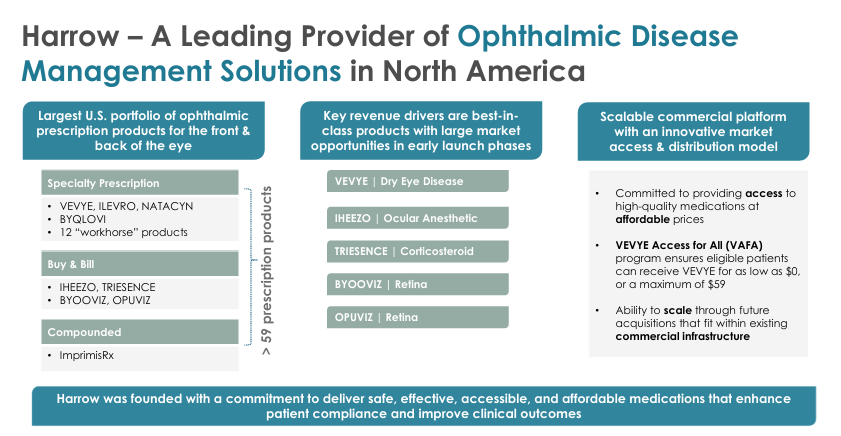

HROW is a US based (Nashville HQ) pharmaceutical company in the ophthalmology niche dedicated to the discovery, development, production, and commercialization of innovative ophthalmic therapies. For example, their portfolio covers dry eye disease, glaucoma, ocular inflammation, and post-surgical recovery (and much more).

Today, the business model is essentially split between 3 pillars:

FDA-approved pharmaceuticals.

Compounded formulations.

Equity stakes in emerging innovators.

The first two (FDA approved and compounded formulations) allows HROW to serve the specialized needs in clinical practice as well as the broader commercial markers. This is essentially one of HROW’s main advantages. Almost no competitors match the HROW breadth across both FDA-approved ophthalmic drugs and large-scale ophthalmic compounding.

It’s a very barbelled market. On one side you have the big ophthalmic pharma companies:

Alcon

Bausch & Lomb

Santen

Novartis

And on the other side you have dedicated compounders/503B outsourcing facilities:

Fagron Sterile Services

Edge Pharma

Leiters

HROW are one of the very few “full spectrum” players in the ophthalmic market in the US.

Here’s HROW’s portfolio:

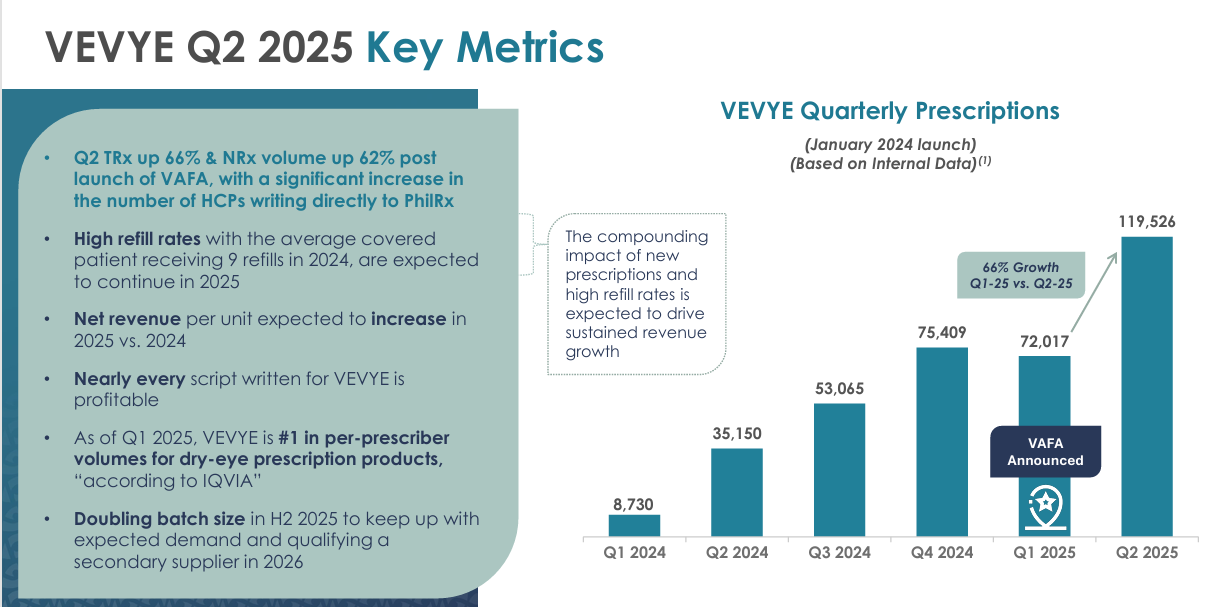

VEVYE | Dry Eye Disease: Expected to generate $100M+ in revenue in FY25. VEVYE is the:

“First and only water-free cyclosporine to treat the signs and symptoms of dry eye disease.”

They’re the most effective, longest lasting, fastest working, and most well-tolerated on the market. They also have a patent until 2039.

Dry eye prevalence is definitely on the top with an aging population in the US, increasing screen time, and poor diets. Currently, ~37.1M patients globally suffer from dry eye disease. The price of VEVYE is $59 depending on insurance but HROW likely receive ~$300-$400 per bottle based on a wholesale acquisition cost (WAC) of $760 and a 40-50% of WAC as net revenue being the average.

Therefore, if HROW are receiving $300 (lower end) per bottle and FY25 revenue for VEVYE is $100M, they’re likely selling ~300,000 to 400,000 bottles per annum which is below 1% of the total TAM (assuming we take the 37.1M figure globally). Domestically, the current market share is just below 8%.

Let me make it clear that $300 figure is purely a guess on my end. The average selling price is very difficult to gauge, and very difficult for HROW to get right to make it attractive for HROW shareholders whilst also keeping it sustainable for commercial demand.

One area to note here is that HROW have recently announced a strategic alliance with Apollo Care, a service provider for patient access and commercial solutions across the entire US market, essentially massively increasing the distribution network for HROW. The existing network includes 500 pharmacies and is mostly contracted with major and smaller Medicare and TRICARE plans. This should stabilize the ASP (average selling price) for VEVYE.

One other keynote; HROW are not yet sustainably profitable but VEVYE is a profitable segment for them consistently now.

Quite a large market for them to still win.

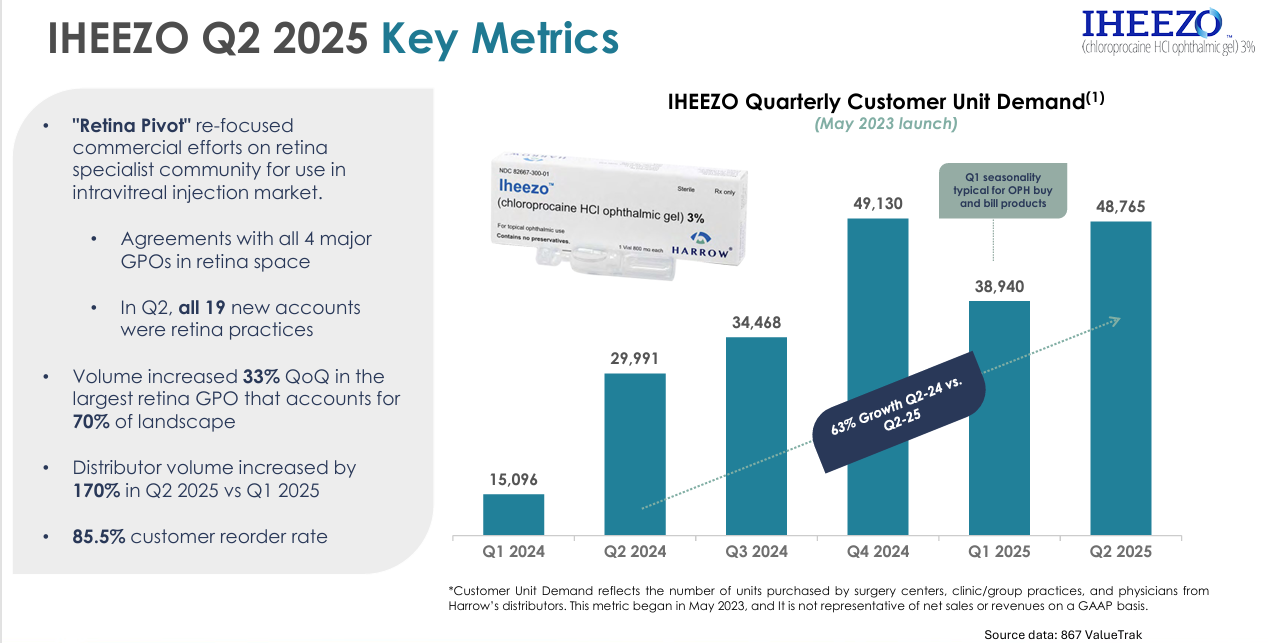

IHEEZO | Ocular Anesthetic: Expected to generate $50M+ in FY25.

“First branded ocular anesthetic approved for the US market in nearly 14 years.”

With 12 million annual US ocular procedures requiring ocular surface anesthesia, and a patent until 2039, there’s no wonder IHEEZO is seeing 63% growth YoY.

In fact, in just the first month of Q3, we’ve already eclipsed the total number of new IHEEZO accounts we added in all of Q2. The momentum is real, and we’re very bullish on IHEEZO going forward.”

The numbers for IHEEZO are pretty incredible too with Q2 revenue up over 251% vs Q1 and 62% over Q2 2024. It’s their fastest growing segment, and something management are continuously very bullish on.

TRIESENCE | Corticosteroid: Expected to generate $50M+ in FY25. Patents are lasting until 2029 but the next generation of TRIESENCE is already in development and expected in the market prior to patent expiration.

“The only FDA-approved preservative-free synthetic corticosteroid with separate reimbursement in all traditional setting of care.”

TRIESENCE currently isn’t performing as strongly as IHEEZO and VEVYE in terms of growth and numbers, but management do expect 2026 and beyond to be strong for them here with 84% coverage Management believe IHEEZO will be a big contributor to their 2027 goals (which I’ll get to later).

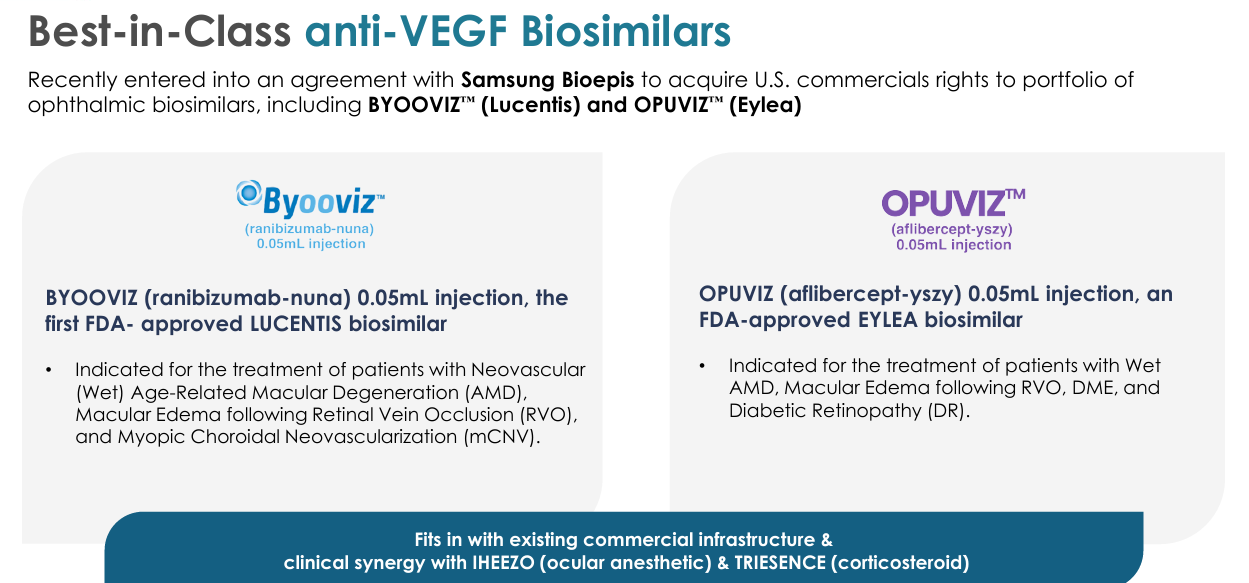

BYOOVIZ | Retina: For the treatment of patients with Neovascular Age-Related Macular Degeneration/retina diseases.

HROW has a commercialization agreement with Samsung Bioepis in the US meaning HROW will take over the marketing, sales, and distribution of BYOOVIZ in the US once the transfer of commercialization rights is completed expected to be by the end of 2025.

It’s difficult to quantify the potential for BYOOVIZ on the information that I have currently, but BYOOVIZ does give HROW a nice entry into the retina category which a higher value area. It also enhances their position as a full-spectrum pharma company.

OPUVIZ | Retina: More or less the same commentary as above for BYOOVIZ. However, OPUVIZ in my opinion has slightly more commercial potential just because of the TAM being a lot broader. The downside of this of course though is that OPUVIZ will face some more intense competition, putting more pressure on price and more pressure for rebates.

Unrelated to OPUVIZ directly here, but I think it’s quite clear so far that HROW’s portfolio and product roadmap is extremely diverse. They’ve got newer products (OPUVIZ and BYOOVIZ) with commercialization rights. They’ve got patents in 2039 with a ginormous TAM (VEVYE), and they’ve got a lot more too that I won’t talk about here.

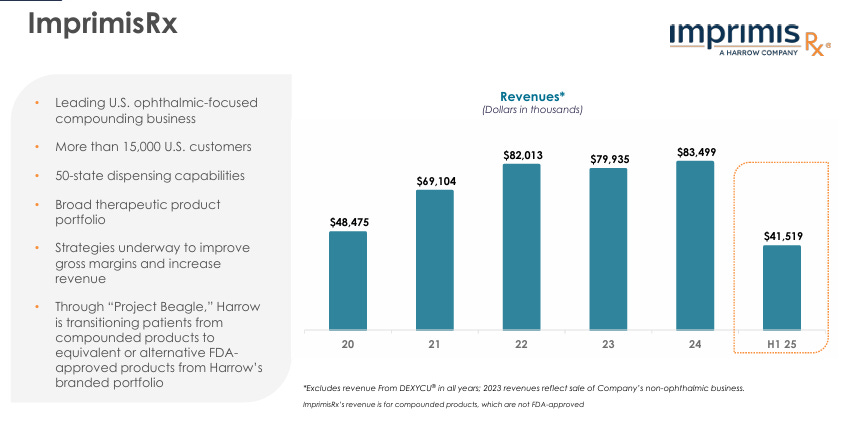

ImprimisRx | Compounded: Expected to generate $80M+ in FY25.

The next part I want to touch on is HROW’s compounding division which acts as their steady cash generator. It’s not a high growth segment for them, but it does give HROW the ability to invest heavier (by lowering their risk) into FDA-approved pharma and equity stakes (will touch on this next).

Despite being the “steady” part of the business, ImprimisRx are still in the process of identifying many new strategic opportunities to drive more growth, and drive revenues, and drive operational efficiency.

It’s also a key part of the HROW strategic flywheel selling straight into ophthalmology practices creating daily touch points with surgeons and stuff essentially indirectly lowering CAC and increasing cross-sell/upsell into the higher value items (VEVYE etc).

The other part I love about ImpirisRx is the stability as I touched on earlier. A vast majority of the compounding revenue is cash-pay with much fewer rebates/chargebacks which smooths out the cash flows and decreases PBM risk massively. In turn, creating much more stable margins, and revenues.

All in all, ImpirisRx solidifies the HROW moat more than many realize, whilst also creating a much more resilient cash flow, with fast launches in an unfortunately rapidly growing (cataracts) niche.

Equity Ownership

HROW currently owns:

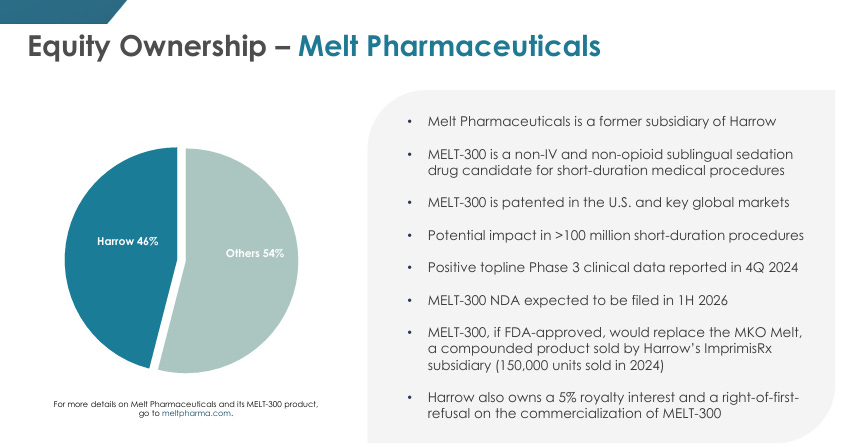

46% stake in Melt Pharmaceuticals - MELT-300 is their flagship product. MELT-300 is a patented sublingual tablet designed as a needle-free alternative to IV sedation in cataract and other short-duration procedures. There’s 4.5M cataracts surgeries in the US alone annually and MELT-300 could complete dominate this space post Phase 3 trials if successful. HROW holds 5% royalty rights if MELT-300 is commercialized.

There’s some channel synergy between Melt Pharma and HROW’s ImpirisRx as they’re both quite embedded in the cataract workflows. If MELT-300 does work post Phase 3 trials, the same surgeons and outpatient centers who are currently buying ImpirisRx will be the target market for MELT-300 too.

20% stake in Surface Ophthalmics - SURF-100, SURF-200, and SURF-201 are the pipeline programs. Surface are focused on ocular surface treatments, positioning themselves as an innovator in the dry eye and ocular inflammation markets.

The important thing to understand here (as with any higher risk equity ownership stake, not least in pharma companies) is that there’s a convex payoff profile. There’s limited downside from today (no extra R&D expenses) and the upside can be material. These are one of the many segments which could be a positive catalyst for a 10-30% move in HROW stock prices for example.

It’s difficult to gauge today, but as programs de-risk as more late-stage data and regulatory milestones are met, the equity value of these stakes becomes a lot clear and that has the potential to lead to substantial re-ratings.

Financials 🔢

Demand

We touched on demand throughout the section above for certain parts of the portfolio but let’s look at it from a whole now.

1H revenue was $116.6M and management reaffirmed a $280M FY25 meaning they expect to hit $163M in 2H based on continued growth and momentum in VEVYE, IHEEZO, and TRIESENCE plus BYOOVIZ and BYQLOVI (later this year).

Margins

Gross profit margin in Q2 2025 was 74% but Q1 was 68% so we saw a little increase, but HROW are still at a stage where this margin profile will be inconsistent. Net income margins are even more volatile.

Branded revenue carries structurally better economics relative to compounding alone but the issue lies in reimbursement and coverage rates which are not completely in HROW’s control. This ultimately changes to average selling price making sustainable profitable quite a difficult task for management. However, over the next 2-3 years, the product mix should skew slightly more to high margin brands such as VEVYE which management have hinted to be consistently very profitable for them.

This should lead to a nice expansion in EBITDA margins from ~26% in FY25 to an expected 38% in FY27. This is one of the key reasons I love HROW today. EBITDA growth is crushing revenue growth (and revenue growth isn’t slow at all).

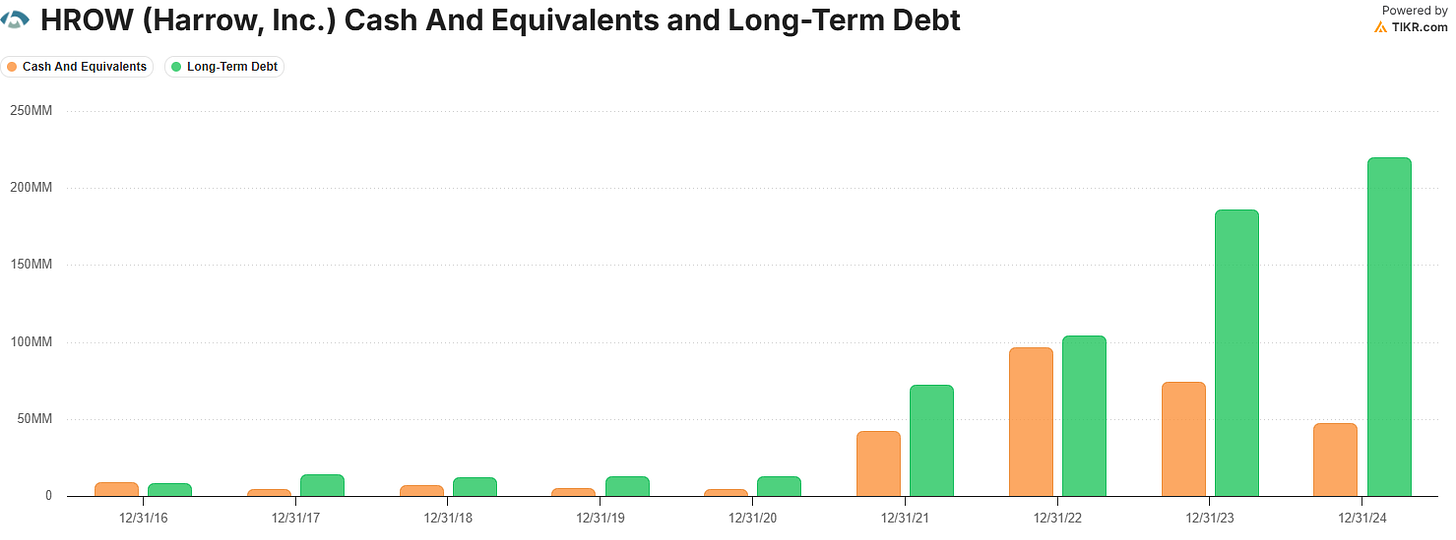

Balance Sheet

HROW currently hold $55M in cash, and $222.75M in debt (prior to current and ongoing refinancing actions). HROW recently offered $250M in senior unsecured notes due 2030 which importantly do not dilute shareholders.

This is all designed to lower HROW’s cost of capital and simplify their debt structure to better align with the expected growth trajectory of their branded portfolio. By refinancing, HROW effectively locks in longer-dated capital at a lower coupon rate of 8.625% and are set to redeem their existing 11.875% senior notes due in 2027.

Risks

One of the big risks for me with HROW is the gross-to-net exposure as the branded portfolio scales. Products like VEVYE, IHEEZO, and TRIESENCE, although the demand is very strong, ultimately rely on broad payer and PBM coverage. Current trends are suggesting the insurance companies and pharmacy benefit managers are taking an increasingly larger slice of the economics from branded drug sales than they used to.

So, for example, with VEVYE being a $760 list price, HROW may net out at only $300 ish after rebates. And this rebate amount is very out of HROW’s hands so although the top line sales look very strong for HROW, the margin profile is becoming increasingly difficult to map out. HROW has tried to mitigate this through their cash pay models (ImprimisRx), but the ultimate big value and higher margin plays lies in these branded drugs where the success ultimately hinges on a select set of insurance companies and PBMs. So it’s very important to track the net economics of these launches over time rather than being impressed solely with demand.

The other risk I see is simply execution due to the complexity and breadth of HROW’s operations. Very few people appreciate the HROW business, but this complexity is what gives them an extremely strong moat but also opens them up to some potential execution issues.

Remember HROW are operating across multiple verticals (compounding drugs, branded drugs, retina biosimilars, equity stakes, front of eye products etc etc). But they’re also integrating NDAs, managing sterile manufacturing, coordinating supply chains, aligning sales teams with various call points (surgeons, specialists, optometrists), and distributing efficiently. A single quality issue has the potential to ripple across the entire business and harm cross-selling synergies.

It’s a complex operation to say the least.

Valuation

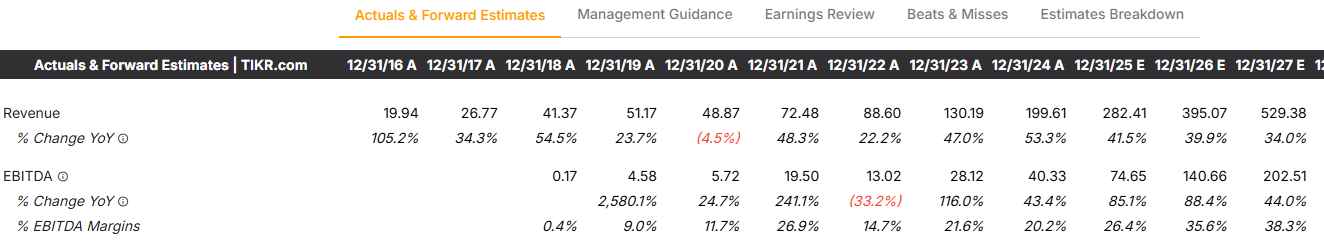

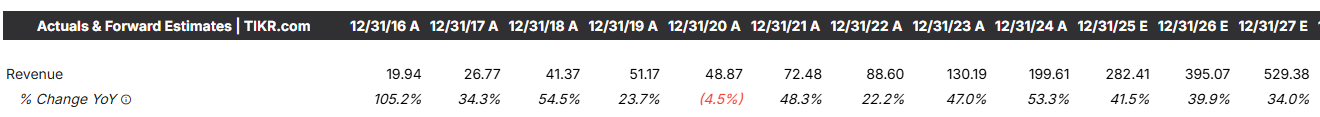

I find the valuation for HROW to be extremely interesting because there’s a huge disconnect between current analyst estimates and management goals. As I said at the start of this article, HROW’s main financial goal is $250M in revenue PER QUARTER by 2027.

Current analyst estimates are as follows:

Analysts expect $529M by 2027, whilst management are aiming for basically double this at $1B.

Let’s make some assumptions here:

#1 HROW meets analyst estimates

If HROW meets analyst estimates of $529M in 2027 then HROW are set to CAGR at 36.9% over the next 2 years which given the current 5.9x NTM sales multiple is very attractive.

If we assume 38% EBITDA margins (in line with analysts) then we should expect $201M in EBITDA in FY 2027 which means they would have grown EBITDA at 64.4% CAGR which again means a 19.9x NTM EBITDA multiple is far too cheap.

Based on a 64% CAGR, I suspect an EBITDA multiple should be in the range of 30-35x so a 30x multiple on $201M in EBITDA means we have an EV of $6.03B (compared to a $1.95B EV today) which suggests ~3x upside from today if HROW meet what appears to be some very conservative analyst estimates.

#2 HROW meet management goals

Following very similar math but just changing the $529M goal to $1B in revenue by 2027 gives us the following:

If HROW reach $1B in revenue, they’ll have grown at a CAGR of 88.3% over the next 2 years which means the current 5.9x NTM sales is arguably one of the cheaper in the entire market when you take into account the margin profile of HROW too.

$1B in revenue at a 38% CAGR gives $380M in EBITDA which means EBITDA would be growing at 125% which again means a 19.9x EBITDA multiple is far too cheap.

I said that if management reach analyst goals there’s a 3x potential here, but if management reach their own goals, I think there’s a 5x goal here over the next 3 years or so. This is a big if, and I’d love to be more confident in management goals of $1B in revenue per year but I suspect we will learn more about this on investor day in 48 hours.

I suspect we will end up somewhere above analyst estimates and perhaps below managements lofty goals, but let’s see.

Either way, these multiples to growth rates are just something I don’t see very often and that’s why I think there’s some very good potential in HROW.

That’s it for today!

I do hope you enjoyed this article. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

Great insight! Where are you looking to buy in? Any optimal target entries?

Great find. What a great investors deck!