Here's 10 High Growth Stocks You Likely Haven't Heard Of

Hi fellow investor 👋

Today I’ve got a quick article for you introducing 10 high quality growth stocks that came up in my weekly screener. This screener was done on StocksGuide which I think has some of the best screening tools in the entire market.

A lot of these stocks are international stocks. I think it’s quite a good idea to be considering some investments internationally with the US market at peaks. I’ll always favor the US but it’s never a bad idea to allocate some of your portfolio elsewhere.

Without further ado, let’s get into the 10 stocks. I’ve ranked them from high to low in terms of valuations (on a multiples basis).

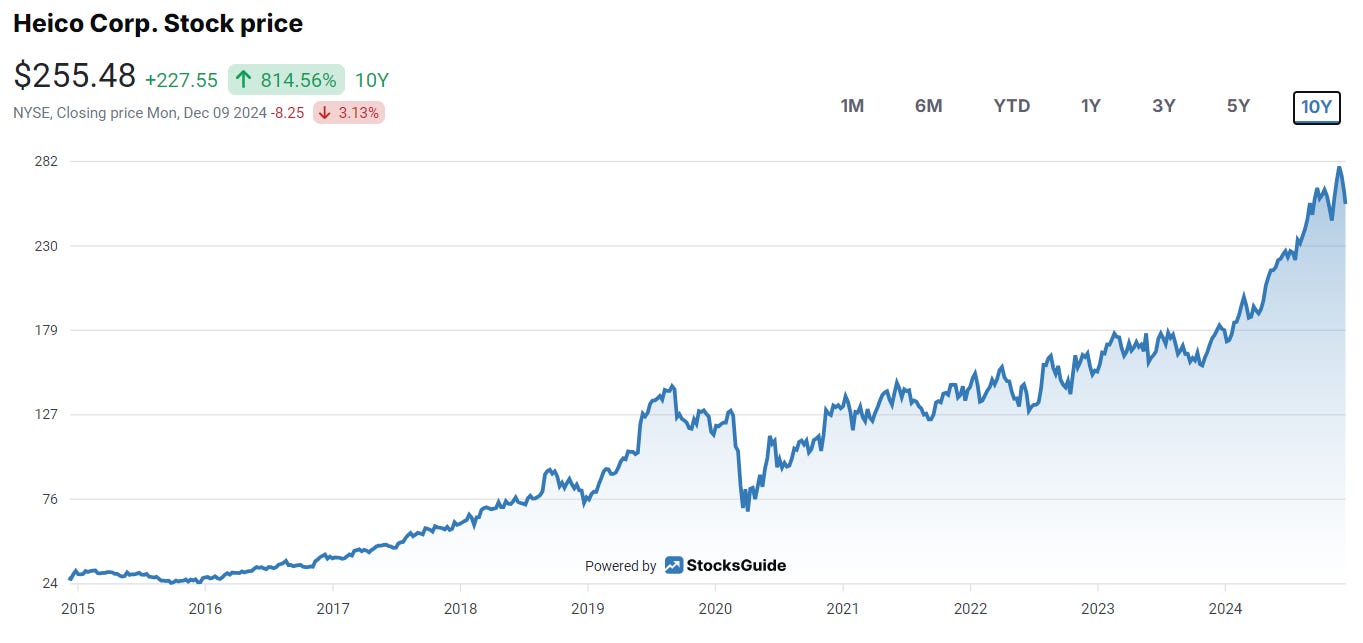

1. Heico | HEI

What does it do?

HEI specializes in design, production, and repair of aircraft and advanced electronic equipment, supporting commercial airlines, defense agencies, and other industrial customers.

Numbers

Revenue growth: 37.26%

Gross profit margin: 39.23%

EV/Sales (NTM): 8.1x

EV/EBITDA (NTM): 30.5x

FCF per share (LTM): $4.02

Brief investment thesis

HEI have become a FCF giant. Just 1 year ago they had FCF per share at $2.83 and now it is $4.02 per share.

Revenue growth is accelerating.

The only downside is that they are trading at a pretty high valuation. I would suggest adding this one to a watchlist and hoping for a big drop to take advantage of.

2. Workday | WDAY

What does it do?

WDAY provides cloud-based enterprise software solutions for financial management, human capital management, and analytics enabling organizations to streamline workflows and improve decision making through data. They serve across all industries and across all parts of a business from payroll to budgeting to talent.

Numbers

Revenue growth: 15.76%

Gross profit margin: 75.46%

EV/Sales (NTM): 7.5x

EV/EBITDA (NTM): 24.7xx

FCF per share (LTM): $7.99

Brief investment thesis

WDAY is another FCF giant that has almost doubled their FCF per share in the space of a year. Unfortunately, FCF growth like this leads to expensive valuations. Here’s where you need to think about PYPL which is becoming a FCF giant but the stock price hasn’t reflected that yet.

Back to WDAY, their AI solutions are showing some very strong demand with 30% of customer expansion being as a result of an AI solution.

They’re also making good strides on expanding margins as their AI solutions streamline operations and add big efficiency to the company.

3. Docebo | DCBO

What does it do?

DCBO is a cloud-based learning management system that helps organizations deliver corporate training programs. It’s automated AI powered platform allows businesses to efficiently streamline employee learning and development whilst tracking performance and compliance.

Numbers

Revenue growth: 19.20%

Gross profit margin: 80.96%

EV/Sales (NTM): 6.0x

EV/EBITDA (NTM): 33.6x

FCF per share (LTM): $0.82

Brief investment thesis

DCBO are increasing their focus on acquiring larger customers meaning they’ve attained a 4x growth in average contract volume since 2017.

They’re also in the process of gaining US Federal certification in 2025 that will ensure cloud-based services to the government include standardized security, authorization, and monitoring.

I think DCBO have a nice runway ahead if they can successfully continue to win larger clients, but I don’t think it’s an opportunity I’d fully focus on.

4. Kruk Spolka Akcynjna | KRU

What does it do?

KRU are a leading Polish debt management and recovery company that operates across Central and Eastern Europe. They purchase and manage non-performing loan portfolios for banks, financial institutions, and utility companies as well as offering debt restructuring solutions.

Numbers

Revenue growth: 20.67%

Gross profit margin: 114.23%

EV/Sales (NTM): 4.3x

EV/EBITDA (NTM): 8.1x

FCF per share (LTM): $(20.95)

Brief investment thesis

KRUK is a very niche company but I think if you’re looking for opportunities in Poland, it’s a very solid compounder.

Poland has some nice tailwinds with an influx of EU funds, a good employment market and GDP growth around 4.4%. This puts Poland in a great position when looking at equity risk premium vs total market cap to GDP (a metric Buffett looks at a lot).

Looking at KRUK specifically, they have a good portion of revenue that is recurring due to their contracts with banks and other institutions. They also operate with a strong and consistent gross margin upwards of 72%. The main question you need to ask if if you think the economy moving forward will increase the chances of defaults on loans. In Central and Eastern Europe, I’m no expert at all.

5. Comfort Systems | FIX

What does it do?

FIX designs, installs, and maintains mechanical systems (HVAC, plumbing, electrics etc) for commercial and industrial buildings.

Numbers

Revenue growth: 39.64%

Gross profit margin: 20.08%

EV/Sales (NTM): 2.2x

EV/EBITDA (NTM): 18.4x

FCF per share (LTM): $17.4

Brief investment thesis

To be honest, I’m very surprised FIX has rose 137% over the last year in a high interest rate environment like we are in. Whether this means, there’s a lot more upside to be had when the macro environment starts to favor them I’m not sure.

There is definitely a strong long term trend towards energy efficient, green, and low carbon footprint architecture and building and this is where FIX will see some nice momentum. Unfortunately, I don’t think Trump has this at the forefront of his priorities just yet.

I think FIX is a stock to like, but err on the side of caution after a big recent run up.

6. Upwork | UPWK

What does it do?

UPWK operates a global freelancing platform that connects businesses with independent professionals for short and long-term projects. They tackle the end-to-end process from hiring to project management to payment.

Numbers

Revenue growth: 14.54%

Gross profit margin: 77.29%

EV/Sales (NTM): 2.7x

EV/EBITDA (NTM): 11.6x

FCF per share (LTM): $0.55

Brief investment thesis

A trend towards the gig economy is obviously a positive for a company like UPWK.

Q3 saw record net income, and a 193% rise in FCF thanks to a one-off billing schedule and also cost reduction efforts such as workforce cuts they did last year that are now starting to pay dividends.

UPWK just introduced a Business Plus membership which hopefully will increase the amount of recurring revenue.

7. Envipco | ENVI

What does it do?

ENVI specialize in reverse vending machines and recycling systems designed to collect and process used beverage containers. Its technology supports deposit return systems and contributes to sustainability efforts. They work with governments, retailers, and manufactures.

Numbers

Revenue growth: 8.9%

Gross profit margin: 36.55%

EV/Sales (NTM): 2.0x

EV/EBITDA (NTM): 11.7x

FCF per share (LTM): $0.06

Brief investment thesis

ENVI have become the leading recycling tech company in Europe and now are aiming to secure a 40% market share in North America and globally.

Just recently, economies of scale are beginning to take over which will continue to lead to nice margin expansion and EPS growth over the coming years.

Strong growth pathway as DRS (deposit return scheme) legislation opens up in markets like Portugal, UK, Spain, and France.

8. Nextracker | NXT (My Favorite One Here)

What does it do?

NXT provides solar tracking systems that maximize efficiency of utility-scale solar power plants. The technology adjusts solar panels to follow the suns path, hence increasing energy output and reducing costs. They also offer software solutions for system monitoring and optimization.

Numbers

Revenue growth: 50.13%

Gross profit margin: 32.98%

EV/Sales (NTM): 1.6x

EV/EBITDA (NTM): 7.7x

FCF per share (LTM): $2.20

Brief investment thesis

Looking at those numbers above, for an EV/Sales of 1.6x, I think this company is a bargain and certainly worth researching more.

Compared to competitors like Array, NXT have a much more geographically diversified revenue mix with a bigger portion outside of the US.

I think if you’re bullish on the solar industry, NXT and ENPH are the two best investments you can make here.

9. ACM Research | ACMR

What does it do?

ACMR develops and supplies wet processing equipment used in semiconductor manufacturing to address cleaning challenges that are faced during wafer fabrication, and hence improving the yield of leading chipmakers. Notable clients include TSM, Samsung, Intel, and SK Hynik.

Numbers

Revenue growth: 40.05%

Gross profit margin: 47.80%

EV/Sales (NTM): 1.2x

EV/EBITDA (NTM): 5.4x

FCF per share (LTM): $(1.33)

Brief investment thesis

This is another one that looks incredibly good when you just look at the numbers above.

The big downside here is that more than 50% of their revenue is from China, but management are actively trying to reduce this to below 50% which should provide long term investors with a bit more confidence.

I can’t say here whether they are better than competitors like Lam Research or Screen, but they are most definitely cheaper.

10. GigaCloud Technology | GCT

What does it do?

GCT is a B2B e-commerce platform that specializes in larger items, namely furniture and other appliances. The platform connects manufacturers (mainly in Asia) with resellers worldwide through the GigaCloud Marketplace.

Numbers

Revenue growth: 37.26%

Gross profit margin: 24.59%

EV/Sales (NTM): 0.9x

EV/EBITDA (NTM): 6.1x

FCF per share (LTM): $2.78

Brief investment thesis

There’s no denying GCT is cheap at 37% YoY revenue growth and a 0.9x EV/Sales multiple. However, the B2B furniture market is having some cyclical headwinds as GCT management have pointed out.

Combining the industry headwinds, and the China supply chain which may be made worse under Trump, and I think GCT will struggle to gain much momentum over the next couple of years.

Cheap, but I think cheap for a reason.

I Own the last 3 stocks. Nextracker is also my favourite of the bunch

Been watching FIX for a while, the price just doesn’t drop.