Here's 5 Higher Risk/Higher Reward Stocks

They all fit a very specific criteria

Hi fellow investors 👋

The big gains came in 2024 showing the life changing potential of investing in stocks that end up doing 300-400% in 1 year.

Of course this isn’t realistic which is why I’d suggest building a core portfolio of more secure, but still high growth stocks like the following 👇

5 Core Stocks For 2025

Hi all👋 And a HAPPY NEW YEAR!Make Money, Make Time is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

It’s also nice to allocate your portfolio to some very high growth, high potential stocks that are a little more unknown and risky…especially if you’re more risk seeking naturally.

Here’s 5 high risk, high reward plays that all fit this following criteria:

Revenue growth > 40%

EV/Sales < 8x

Gross margin > 65%

PEG < 1x

Debt/Equity < 1x

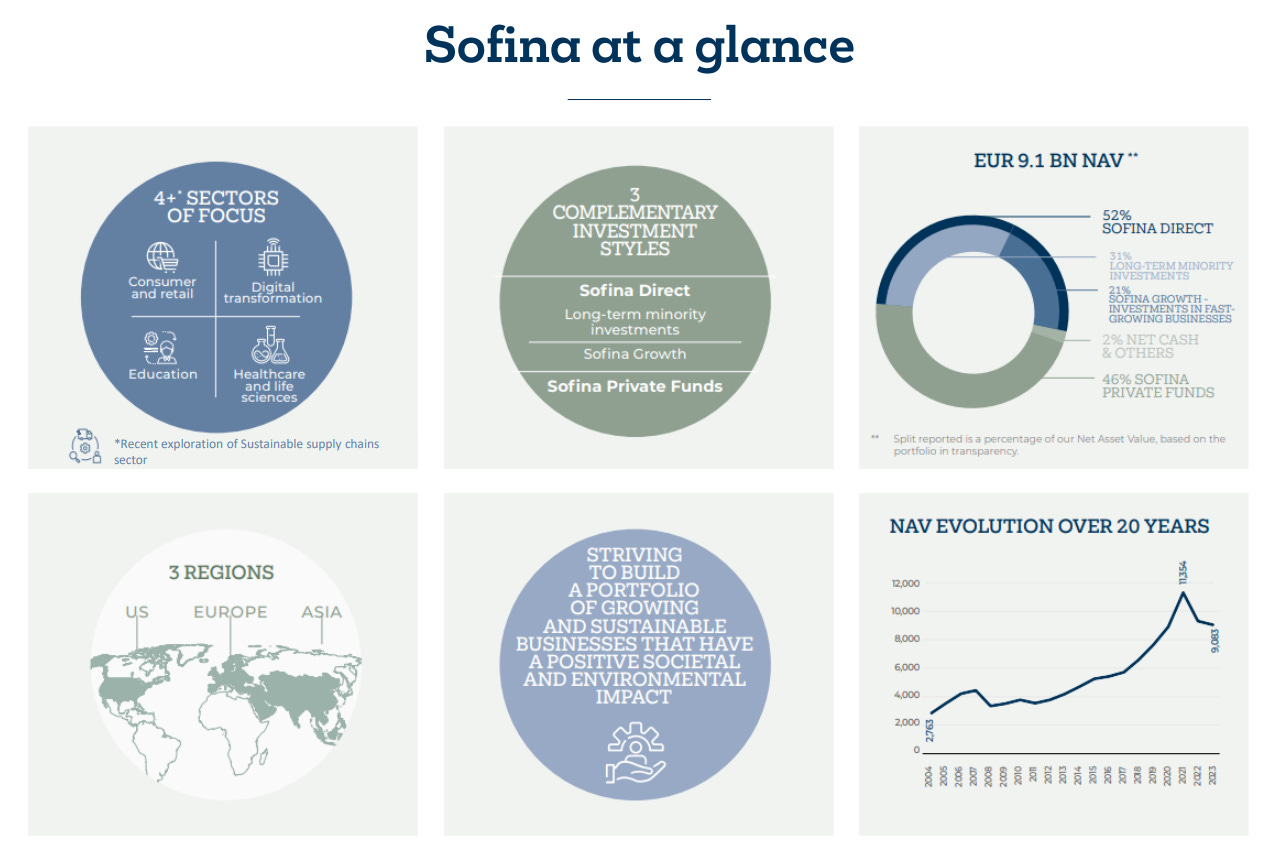

1. Sofnia | SOF

Introduction

Sofnia is an evergreen (no termination date) fund that makes investment into owner-led and innovative growing businesses in Europe, Asia, and the US.

They invest across in 5 sectors which are consumer & retail, digital, education, healthcare & life sciences, and supply chains.

Sofnia invest in 3 ways:

Long-term minority interests in companies with sustainable growth potential.

Fast growing businesses that are less mature and have a higher risk profile.

Invests with managers of venture capital funds.

Numbers

1,381% revenue (TTM) growth and 1,395% increase in gross profit with 183% net profit growth to $433 million.

263% increase in free cash flow to $385 million.

Investment Thesis

Sofnia invest in companies that are dedicated to the environment and sustainable supply chains. These investments haven’t performed great recently, but long term government initiatives will focus on these companies.

Sofnia is on the Belgian stock exchange. History has shown weak performance here growing just 24% over the last 6 years, but it’s a nice way to diversify away from the US.

Invests in a basket of high growth companies without you having to choose one specific company.

Visual

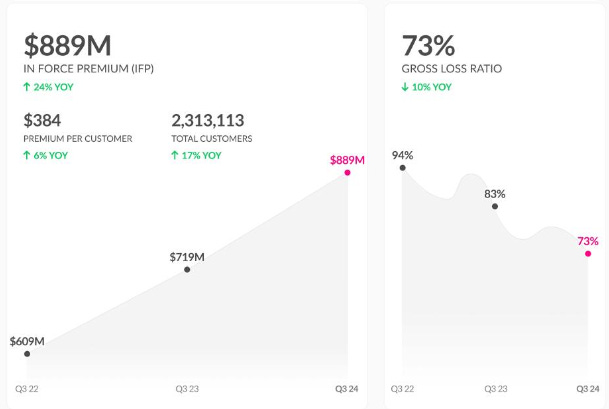

2. Lemonade | LMND

Introduction

LMND are an insurance technology company that can offer insurance in a matter of seconds using AI on their digital platform.

They offer renters, homeowners, pet, & life insurance with their current big bet being on making auto insurance ~40% of their premiums (revenue).

They compete directly against other insurance tech firms like ROOT, hoping to disrupt traditional insurance firms like State Farm.

Numbers

19% revenue growth and 43% gross profit margin.

Loss ratio down to 73%, compared to 79% a year ago.

Investment Thesis

I don’t like to base an investment case on a natural disaster, but LMND will likely see some big drops over the next few months as California is the largest state in LMND’s business even though this shouldn’t be too much of a hit on the business as they stopped selling home insurance in California in 2022.

At an inflection point by becoming net cash flow positive in 2024.

Over 70% of customers are under the age of 35, so this is the insurance company of the future with a huge TAM, particularly if they can carve out some market share in auto insurance.

Visual

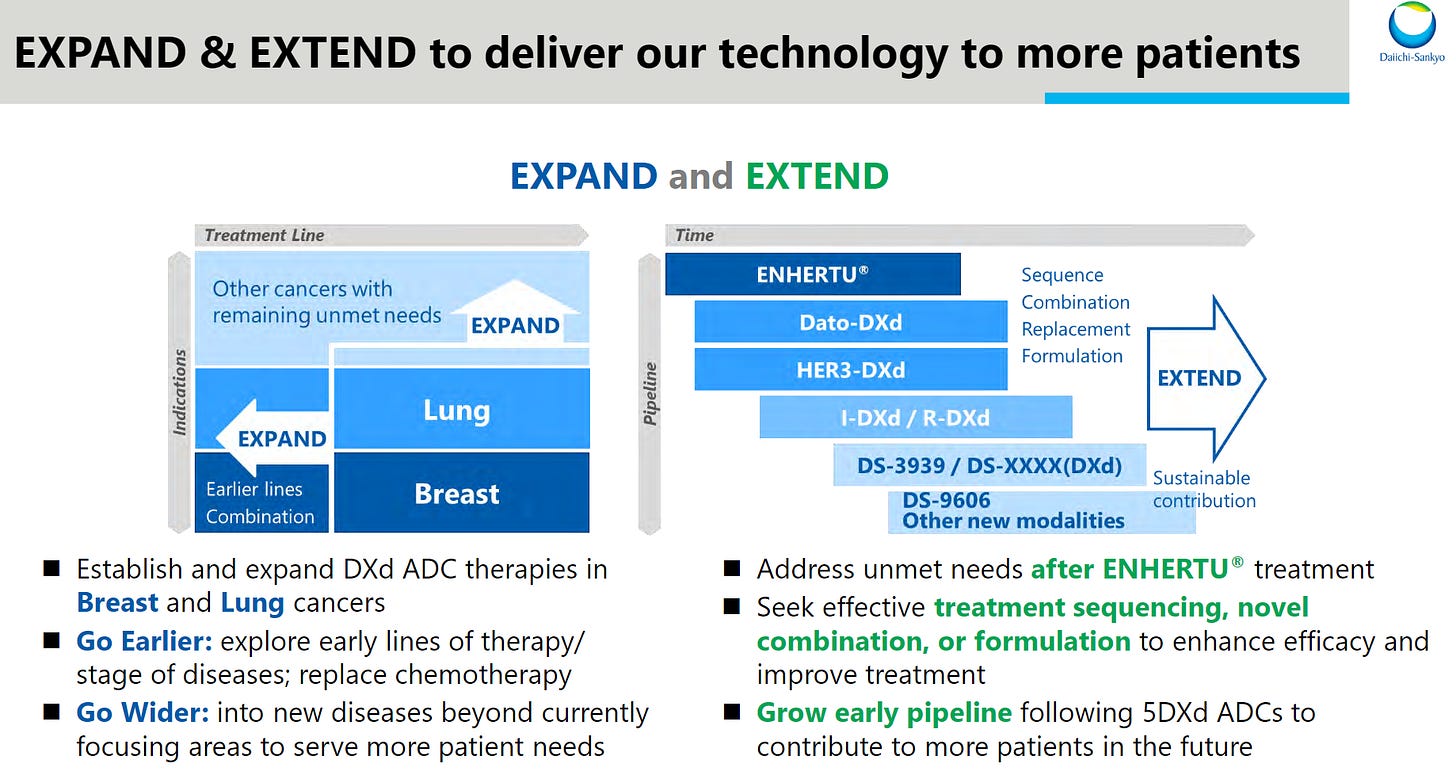

3. Daiichi Sankyo | DSNKY

Introduction

Daiichi Sankyo is a Japanese brand that operates in the research, development, manufacture, and sale of pharmaceuticals.

They mainly develop oncology drugs, but also are involved in cardiovascular, and rare diseases. They have partnered with AstraZeneca which massively increases their R&D and global market expansion goals.

Numbers

25.8% revenue growth and 33.2% gross profit growth which has been as a result of a 76.1% gross profit margin, nearly 1000bps higher than 12 months prior.

Trades at just 4.1x LTM EV/Sales, compared to 6.8x in July 2024.

EV/EBITDA has also dropped from 60x in April 2023, down to 19.4x today.

Investment Thesis

Daiichi Sankyo are focused on ADCs which is an innovative class of cancer therapies that combine the specificity of an antibody with the potency of cyotoxic drugs (chemotherapy).

Very strong pipeline of drugs and therapies compared to other pharmaceutical companies. I don’t think we will see a substantial slowdown in revenue in the coming years.

Visual

Do consider signing up to be a paid subscriber where you’ll get access to my weekly deep dives and full archive of articles over the last 12 months 👇

4. Grab Holdings | GRAB

Introduction

GRAB are building the “superapp” in Southeast Asia. They’re building the UBER of the region combined with the fintech of the region to create a very exciting flywheel.

In fact, they competed so well against UBER in Southeast Asia that UBER bought a stake in their company and didn’t compete any more.

GRAB is a company on my deep dive list. I’ll get around to this one shortly.

Numbers

16.4% revenue growth for 4.7x EV/Sales multiple.

They trade at 42.8% gross profit margin which is actually about 900bps higher than UBER are currently achieving showing the profitability that GRAB have.

Delivery is their biggest segment in terms of revenue, with mobility being a close second, and financial services being by far the smallest (but also the fastest growing at 32%).

Investment Thesis

GRAB are 4x larger than their closest competitors in Southeast Asia in the mobility market which has historically (looking at UBER) been more a winner takes all market.

Just with examples like UBER and MELI, there’s a fantastic “flywheel” that is being created at GRAB meaning the fintech division is growing extremely well thanks to the continued mobility and delivery growth.

GRAB possesses an extremely vast amount of data, all of which feeds into their systems to acquire customers, and improve products more.

Southeast Asia also has a 5.1% forecast growth over the next decade with Vietnam growing at 7.4%.

Visual

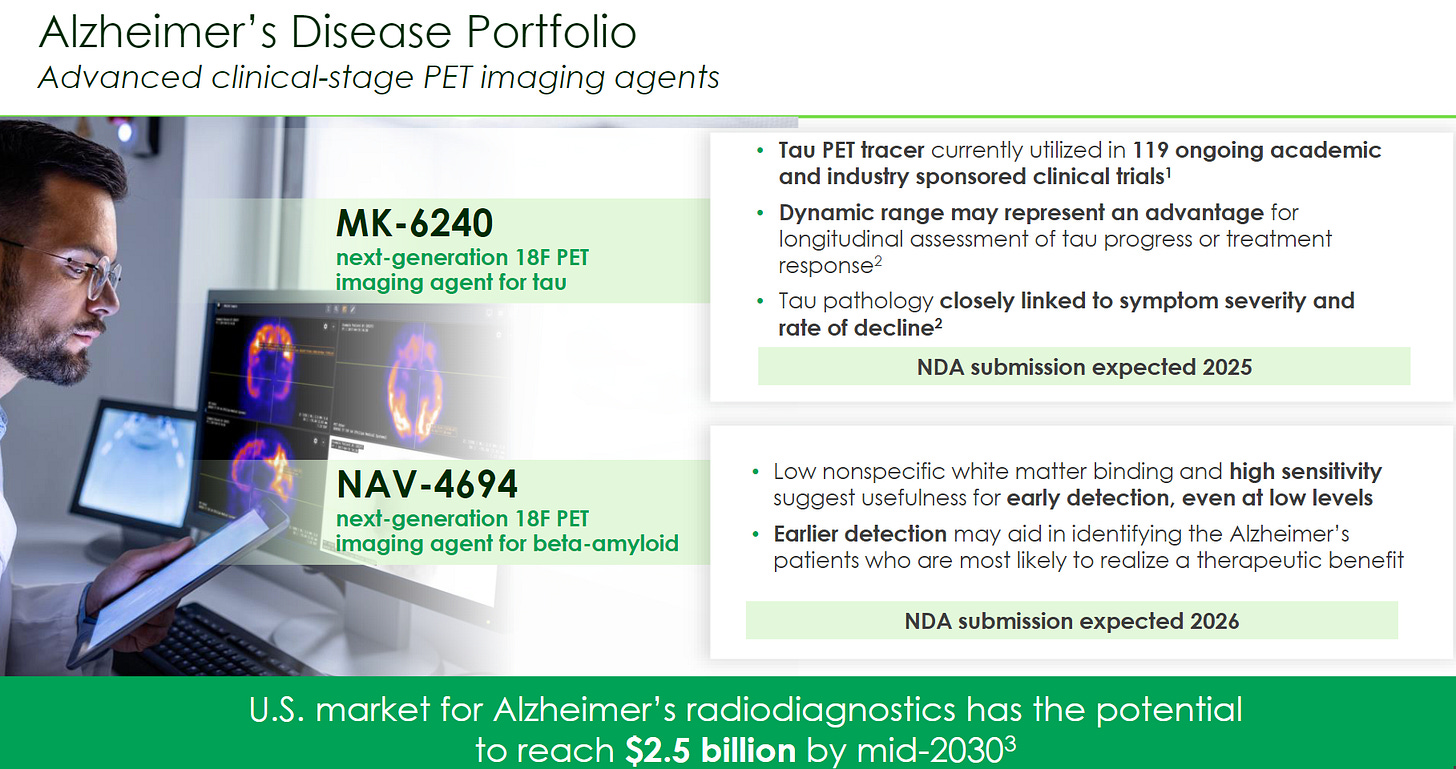

5. Lantheus Holdings | LNTH

Introduction

LNTH is another stock in the pharma industry, but this time it’s a radiopharmaceutical company with 3 main products:

PLYARIFY - Generates 70% of revenue and is an oncology treatment that uses PSMA PET imaging to detect prostate cancer.

DEFINITY

TechneLite

Numbers

The recent quarter saw $260M in net sales which was a 20.6% growth YoY for 4.2x EV/Sales.

This was the first year they have crossed $1B in sales.

Investment Thesis

The PSMA PET imaging market has some strong tailwinds being one of the most precise imaging techniques on the market. The main downsides are cost, infrastructure, and insurance coverage but these are all improving as data is continuing to show they are one of the best products.

The other key investment case is a strong bet on the huge ($2.5 billion) Alzheimer’s market which LNTH are investing heavily into today with their MK-6240 and NAV 4696 products which are in 100s of clinical trials.

Serial acquirer. Just today they announced the acquisition of Life Molecular Imaging which will allow them to accelerate their entry into the Alzheimer’s market.

Visual

That’s all for today

I do hope you enjoyed this screener with 5 high growth stocks. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

Next deep dive is already being prepared…any guesses on what it will be?

GRAB is my favourite, and yes I hold a small parcel. I live in Malaysia and honestly it would be very hard to live here without GRAB. They provide my transport, my food, and arrange my finances. First rate service in all divisions. Go GRAB. Have a look!

It's Sofina not Sofnia!