HIMS: We're Just Getting Started

Q1 Earnings Report

Hi all 👋

HIMS reported earnings after hours yesterday and they crushed it. It’s very tough to look at these numbers and be bearish (though the stock did drop and is now recovering today).

HIMS Q1 Earnings Report: https://s27.q4cdn.com/787306631/files/doc_financials/2025/q1/Hims-and-Hers_Q1-2025-Shareholder-Letter_Final.pdf

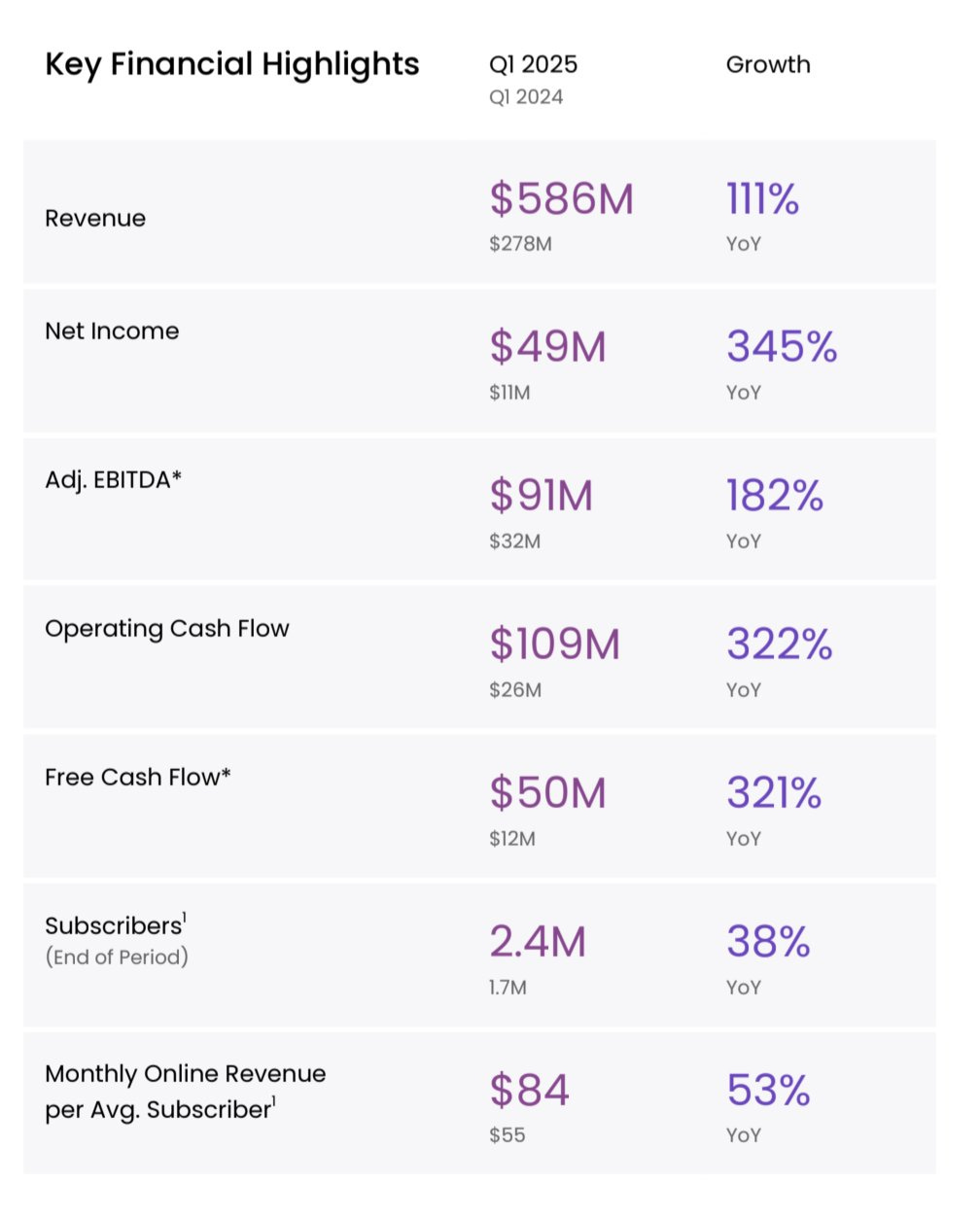

Here’s a snapshot👇

+111% revenue growth (highest YoY revenue growth rate since going public)

+345% net income growth

+182% Adj EBITDA growth

+322% operating cash flow growth

+321% free cash flow growth

+53% growth in monthly revenue per subscriber

These are numbers that remind me of NVDA growth rates back in 2022/2023. I quite simply can’t name another company with this level of disruption, growing at these speeds, let alone trading at 3.7x NTM sales multiples.

The only companies above $5B market cap growing revenues by more than 100% are HIMS, COIN, ALAB, RKLB, CRWV and then a couple of pharma/biotech companies which I don’t really count. And then if you add on FCF growth above 100% (remember HIMS is doing 321% growth), my screener doesn’t return anything aside from HIMS so in terms of the pure numbers there’s really nothing like HIMS in the market today. We’ll look a bit more at the numbers here though 👇

Growth💰

The growth numbers are proving the business model works. We’ve yet to see growth slow down materially and in fact it’s still increasing with 111% YoY growth compared 95% revenue growth last quarter and 51% the quarter before that which has led to a total CAGR of 76% since Q1 2022. 76% CAGR rates for 3 years are not seen often.

In fact, I looked up NVDA’s growth rates from Q1 22 and the CAGR is exactly the same at 76%. Obviously NVDA was doing this growth at considerably higher numbers which makes their growth rates far more spectacular than HIMS, but it’s still very special what HIMS are doing. It’s also noteworthy that NVDA did it during an AI boom and they completely rode the wave of that. HIMS are disrupting an industry so it’s slightly different.

The key reasons for such good growth were:

Monthly revenue per average subscriber grew considerably: This is key for me because it completely solidifies the bull case that the platform is sticky and that cross-selling is happening and that personalized subscriptions are increasing. As this continues to increase (as long as churn doesn’t increase but we don’t know this currently), then CAC will slow down and the LTV per customer will increase. Monthly revenue per subscriber increased 53% YoY which is testament to the platform, the personalization, and HIMS rapid progress to add more products to fit the needs of each customer. As blood testing (Trybe acquisition) becomes more commonplace, personalization will only increase further and that’s what will help further boost this monthly revenue figure. Management did say that this figure will drop a bit in Q2 but that’s expected. This jump in this quarter was huge.

Oral weight loss: Oral weight loss grew at 300% YoY which shows HIMS is far more than just a GLP-1 story (in fact it was never a GLP-1 story). With ~100 million Americans suffering from obesity, the TAM here is huge for a weight loss product that is 2/3rds the cost of branded GLP-1 medications.

1.4 million of 2.4 million subscribers are now using personalized solutions: This was always a huge part of the bull case and it’s nice to see this % of subscribers using personalized solutions ticking up quarter on quarter. We now have 58.3% of all subscribers on the personalized plans with 80% of dermatology users on the personalized plan. Two years ago the % of personalized subscribers was just 21.9%.

Retention is improving: Retention is improving in line with personalized product subscriptions as discussed above.

Management also gave some 2030 guidance which was nice. I never actually love guidance that far out but it shows management’s confidence in the business moving forward. Of course it gives investors an insight into the minds of management and the roadmap they see, but it also comes across a bit unnecessary and a way to perhaps pump the stock a little bit. Anyway, they’ve guided for $6.5B in revenue in 2023 and $1.3B in adj. EBITDA which gives a 20% EBITDA margin.

So given revenue for the quarter this year was $586 million which annualized gives $2.34B though I suspect FY25 revenues will be closer to the +$2.5B mark. This means they’re guiding for 21% CAGR through to 2030.

More importantly they’re guiding for $1.3B in adj. EBITDA by 2030 which means we’re looking at ~28% CAGR in EBITDA from today. At 28% CAGR for 5 years, we should be looking at minimum 40x EV/EBITDA multiples which means a $1.3B EBITDA could lead to a $52B market cap which would be a $230 stock price. Even at 30x multiple, you’re looking at a $39B market which is a +$170 stock price,

FWIW, my models for revenue forecasted larger revenue numbers than management did so I wouldn’t be surprised if this guidance is on the lower end. My assumptions baked in 10M subscribers paying $103 per month. I think the $103 per month is very realistic and perhaps low considering we are already at $84 per month.

10M subscribers is a long term goal for HIMS, and I’m not quite sure when they hit it but let’s assume they keep growing subscriber count at 20% CAGR (realistic with current marketing spend), they will hit 6 million subscribers by 2030 which at $103 per month gives $7.5 billion in revenue per year. I personally think that’s some pretty conservative assumptions (and don’t forget management did this a few years ago and completely blew those numbers out of the water) and that beats the 2030 guidance figures but let’s see.

SimpleFX

Let me welcome you to SimpleFX here👇If you’re looking for deposit bonuses, a huge range of instruments to trade, and no minimum deposits, SimpleFX is one of the best platforms out there.

You can sign up in the link below!

Profitability

Cash flow from operations came in at $109 million with $50 million in free cash flow of which $59 million was invested into CapEx in the quarter. This means even today in their early stage, hyper growth phase, HIMS are almost covering their entire CapEx spend via FCF. But let’s talk margins:

Gross margin for the quarter came in at 73% (Estimates of 76%) but management suggested they expect this to to increase sequentially in Q2 onwards as economies of scale continues to pay dividends along with growth outside the GLP-1 segment which historically has lower margins that other products (that’s why the margins were lower this quarter). EBITDA margins actually increased by 4 points to 16% so managements estimates of 20% EBITDA margins in 2030 seems (again) quite conservative to me. However, these margins will likely come down a bit as per guidance ~13% mark for FY25.

So to put this into context for you:

I rounded down revenue growth, FCF growth, and EBITDA margins to 100%, 100%, and 10% respectively and then ran a screener. The only non real estate, and non mortgage company, that comes anywhere near to these results is HIMS.

This quarter showed they’re a profitable, high growth, efficient, and sustainable company completely disrupting healthcare.

Opportunities

There were a few areas that I was particularly excited about post the earnings call.

Global expansion: HIMS have just started here in the UK. I don’t know the numbers yet, but with the state of the NHS and high private insurance costs, there’s no reason to believe that an appropriately costed model won’t work extremely well here in UK too. I think here’s it’s important to address one of the bear cases that the marketing spend for HIMS is very high (which it is), although when you’re clearly seeing monthly revenue per subscriber increase, clearly seeing cross-selling happening, and adding more products rapidly, there’s no reason to limit marketing spend for the time being. The business model is profitable today even with a huge marketing spend. HIMS is a disruptive business that people love and they need to get their name out to new geographies around the world.

Testosterone & menopause: HIMS are looking to release their testosterone and menopause support in 2025 which is estimated to target ~50 million Americans. If we assume 0.5% of these American’s sign up for the testosterone and menopause products, then you’re looking at 250,000 potentially new subscribers over time each paying ~$60 per month ($180 million per year).

Trybe Acquisition: I think this is being completely underrated but as soon as HIMS manage to acquire more data on hormones, the amount of personalization they can then begin to offer will be mind boggling. This will also guide their decisions on new product introductions and the marketing spend on each product.

NVO Partnership: The partnership with Novo Nordisk is huge, and there was a mention of discussions with LLY and bringing Zepbound to the HIMS platform. Firstly, the openness of these huge pharma companies to even consider partnering with HIMS is extremely bullish as one of the big bearish cases over recent times was that there would be lawsuits between NVO/LLY and HIMS. Now there’s partnerships.

Valuation

I touched on valuation a bit above surrounding my long term targets and estimates. I’ll update my model and send out to paid subscribers this week. FWIW, as I touched on above, I think HIMS 2030 guidance is very conservative and I personally believe they beat those numbers quite convincingly.

Subscribe here for my model 👇

That’s all for today!

I do hope you found this HIMS article useful. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

Thank you, excellent analysis of yesterday's print. HIMS has already grown to the 2nd largest position in my portfolio (behind RKLB) and you show why a buy is justified even at this level (apparently high valuation on any trailing metric) due to its unique hypergrowth profile. Also instructive re the Feb/March panic over GLP-1: focus on the fundamentals.

Thank you for the head's up on HIMS, quite a performance today but one to stick away for the longer term me thinks.