How Joel Greenblatt Outperformed The Market💸

"Concepts will make you great"

It’s #SundaySpecial!

Through his hedge fund, Gotham Capital, Joel Greenblatt averaged 40% per year for 20 years. That means a $1,000 investment would be worth $836,683.

I spent the entire week studying Joel Greenblatt’s class notes and interviews to provide a summary right here for you in just 4 minutes reading time.

Magic Formula Investing

Joel Greenblatt published a book in 2006 called “The Little Book That Beats The Market.”

The book explained Greenblatt’s investment investment philosophy. In the book, he wrote about The Magic Formula which is a simple strategy that returned 33.8% between 1998-2004.

The formula is a rules-based, methodical, investing strategy that is designed to beat the index.

How does The Magic Formula work?

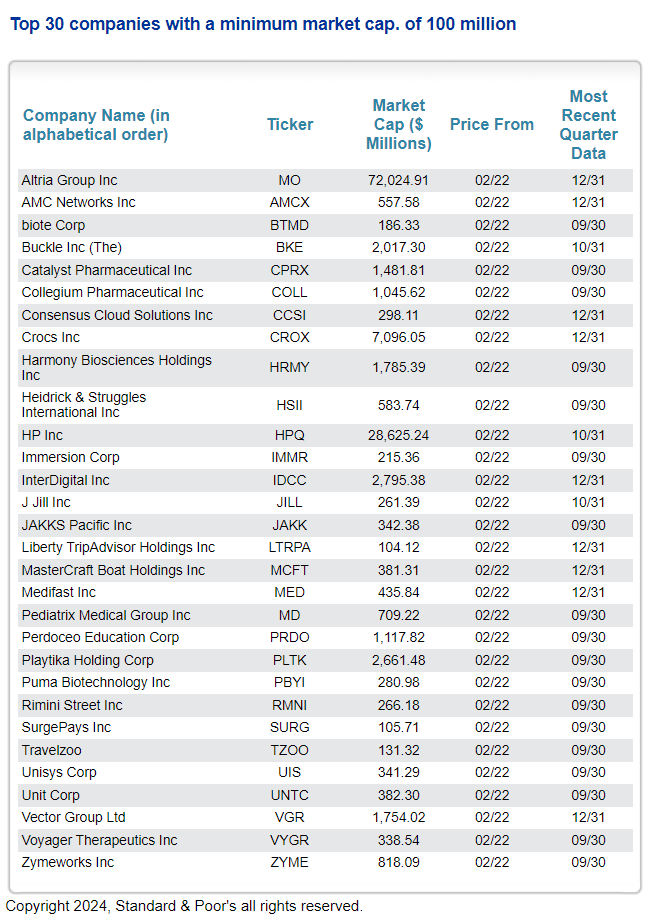

Set a minimum market cap. Typically this should be higher than $100 million.

Exclude financial and utility stocks.

Exclude American Depository Receipts (foreign companies).

Calculate the company’s earnings yield (EBIT / Enterprise Value).

Calculate returns on capital (EBIT / (Net Fixed Assets + Working Capital).

Rank all companies by highest earnings yield and highest return on capital.

Buy companies with highest earnings yield in combination with highest return on capital.

Re-balance portfolio every year.

Repeat the process for at least 5 years.

If you don’t want to do the calculations yourself, Greenblatt does it on his website for you. Here's the link.

But is it just that easy?

No, it’s not easy at all purely because of behavioral biases.

Greenblatt tells a couple of stories to illustrate this.

Have you ever heard about this well-known book “What Works on Wall Street” by James P O’Shaughnessy in 1997?

James was a “quality” value investor who started a fund in 1996. His fund underperformed the market by 25%(!) and after three years he decided to sell the fund to Hennessy Funds.

James P O’Shaughnessy in his book wrote about:

Why value investing works.

And how investors need to have the discipline to see the strategy through despite years of underperformance.

The guy who wrote the book who back tested 40 formulas WHO KNEW THE STRATEGY WORKED quit his own system!

Seven years after publication of the book, an investor would be much wealthier if they had followed the strategy instead of just investing in the index.

Now, do you understand why value investing isn’t easy?

Why Does Value Investing Work?📈

This is why value investing works:

“Investors tend to mistakenly project a continuation of abnormal profit levels for long periods into the future. Because of this, successful firms become overvalued. Unsuccessful become undervalued. Then as the process of competitive entry and exit drives performance to the mean faster than expected, investors in the formerly expensive stocks become disappointed with reported earnings and investors in the formerly cheap stocks are pleasantly surprised.” - Robert Haughen

If you can see the numbers yourself, you should be able to gain more conviction that value investing can be very lucrative if done well.

There hasn’t been a single 2-year period of buying the lowest deciles P/E, P/S, or P/B stocks where you wouldn’t outperform the index!

You will underperform the market over some periods, but over the long term value investing works.

10 Core Principles ✔

Now we know about The Magic Formula, why value investing works, and why value investing is so difficult, let’s dive a bit deeper into Greenblatt’s investing principles.

Here’s 8 of Joel Greenblatt’s core investing principles.

1. Small Caps

The market for small caps are more inefficient. There is less analyst coverage and less information flow, so you have the chance to find prices more above or below value.

When Greenblatt removed the smallest 2,500 stocks from his 3,500 “sample universe” The Magic Formula only returned 22.9% vs 30.8%.

It’s important to understand that when value investing you’ll naturally be buying smaller cap stocks because the stocks are out of favor, and therefore naturally have depressed/smaller market caps.

2. Valuation

Greenblatt emphasizes that if you can do good valuation work, you’ll make good investments.

Different valuation methodologies:

Discounted Cash Flow

Relative Value

Break-up Value

Acquisition Value

“If you don’t look at price, I don’t call that investing.” - Joel Greenblatt

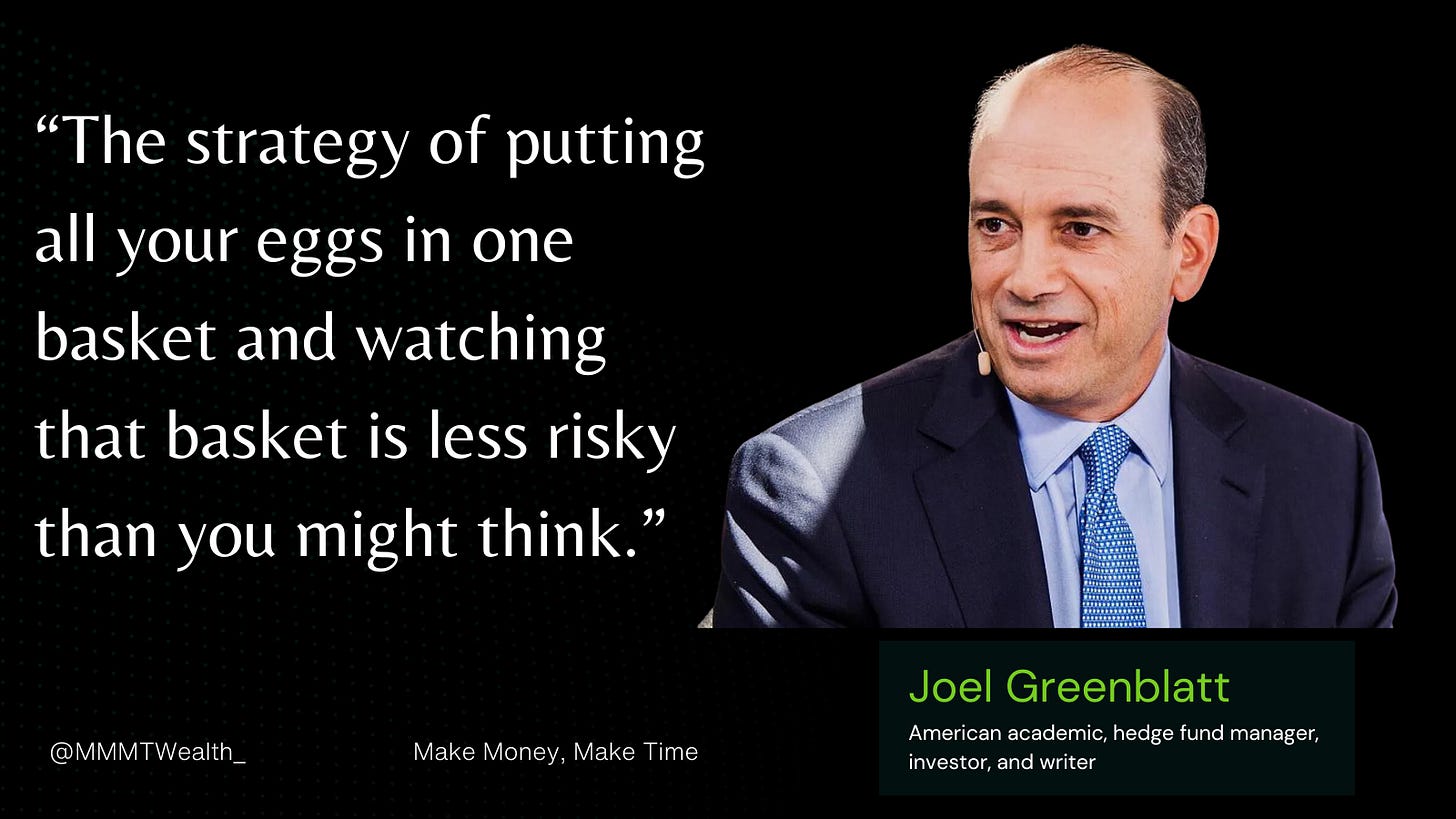

3. Concentration

Greenblatt doesn’t believe in diversifying across 20+ securities. He advises for a portfolio of 6-9 investments that you know extremely well.

Greenblatt said he would be more than happy to put 20% into 1 stock. The only reason he is happy to take on that weighting is because he puts a lot of work into valuing each business he buys to ensure there is a good margin of safety.

“I am on the extreme scale of concentration. When I see an opportunity this good- buy for $5 and have the potential to make $30 to $50 - I load up.” - Joel Greenblatt

4. Earnings Yield

There’s 2 metrics that Greenblatt mentions a lot: Earnings yield & ROIC.

According to Greenblatt, cheap stocks have high earnings yield

Here’s the formula for earnings yield:

Earnings Yield = Earnings per Share / Share Price

So let’s say a company earns $1 per share and its share price is $10, its earning yield is 10%. Since the 10-Yr Treasury is currently 4.26%, a 10% yield could be considered attractive.

The higher the earnings yield the better.

5. ROIC

Earnings yield helps you determine if a company is cheap, ROIC helps you determine if a business is good.

ROIC allows investors to determine if management are investing their capital wisely to improve earnings power.

For instance, if a company spends $1 million on a new factory to create an additional $500,000 in profits next year, that’s a 50% ROIC (which is outstanding).

6. Other Characteristics of a Good Business

Aside from the 2 main metrics above, Greenblatt has 4 main characteristics of a good business.

High Barriers to Entry

High Margins

Good Management

Pricing Power

Want 5 Quality Companies with a Wide Moat? Look no further:

7. Management Incentives

“Show me the incentive, and I’ll show you the outcome.” - Charlie Munger

This is the art of investing. There’s no rules-based strategy for evaluating management.

The question you need to ask yourself is:

Will this director act in his own best interests or the best interests of the Company?

How is this director incentivized?

If this director is not incentivized, how will this affect his role?

“There are some people in the world that will do the right thing regardless of incentives but on average human nature prevails. You must expect people will act in their best interests.” - Richard Pzena

8. Be a Business Owner (Not a Portfolio Manager)

Greenblatt advises thinking of owning a business rather than investing in a stock.

This helps investors focus on the underlying business rather than the stock price movement.

9. Be Ok With Underperforming

If your investment case was correct, you will be rewarded.

Not necessarily over the first or second year, but Mr. Market will eventually pay you back.

The market is always right…over the long term.

“Though not easy to do, even maintaining a three-five year horizon for your stock market investments should give you a large advantage over most investors. It is also the minimum time frame for any meaningful comparison of the risks and results of alternative investment strategies.” -Joel Greenblatt

10. Limiting Yourself

Arguably one of the main reasons investors regularly underperform the market is because they’re unable to say no.

There’s a lot of stock research online today, and so many “opportunities”, it’s very tempting to continuously fall for all of them.

But what stocks do you truly understand?

Greenblatt says this is one of the hardest parts of investing.

A Graphic Summary

Here’s a One-Page graphic to summarize these 10 principles:

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also me follow me on X.

Interesting thoughts, Oliver. Having your own independent opinion about what's happening in the market is a big positive for your ROI.