How To Screen For Excellent Stocks

Want to own the best companies in the world? Here's how.

Everyone wants to own the best companies in the world.

But few people know how to screen for the best companies in the world.

In this article, we’ll take a look at how you can find quality stocks quickly.

The best stocks destroy the S&P 500. The best stocks can change your life.

Screening for Excellence

You can fiddle with this framework a bit, but this is a great start to finding the best companies in the world:

Revenue growth >6%

Earnings growth >8%

Inside ownership >10%

ROIC >10%

Gearing <0.75

FCF margin >10%

If you screened for the above 10 years ago, you would have been an early investor into the best companies in the world such as Alphabet, Monster Beverage, Meta, Microsoft, Apple, and Visa.

P.s. make sure you read to the bottom to see my screen of quality companies today.

But why are these criteria so important?

Revenue Growth > 6%

In the long term, revenue growth is the main driver for stock market returns.

With no revenue, there’s no earnings, and subsequently it’s impossible to drive free cash flow.

Earnings Growth > 8%

Revenue needs to be translated to earnings, otherwise the company is unprofitable.

Earnings ultimately show the underlying performance of a company. And stock prices follow the underlying performance of a company.

Inside Ownership > 10%

Inside ownership is important for several reasons:

Alignment of interests: When insiders own a significant portion of a company, their interests are aligned with those of shareholders. This often leads to better decision making and a focus on long-term value creation.

Confidence and commitment: When insiders invest their own money in the company, it sends a positive signal to the market suggesting they believe in the company’s future.

Information: Insiders have access to non-public information about the company. Buying shares can signal to outside investors that they believe the stock is undervalued.

Risk management: Insiders with a significant stake may be more risk averse. This could lead to more prudent decision-making.

After all, if those who know the company best aren’t invested, then why should you?

Gearing < 0.75

Too much debt is rarely good.

Despite this, what may be considered as an “acceptable” level of debt can vary across industries. For example, utilities may naturally have higher levels of debt due to the capital-intensive nature of their operations.

So make sure you compare debt levels to those in the same industry.

ROIC > 10%

ROIC is one of the most important financial metrics.

It shows how efficiently management allocate capital. It also a sign that a company has an economic moat.

"Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you're not going to make much different than a 6% return—even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you'll end up with a fine result." - Charlie Munger

To take this to the next level…if a company has a robust ROIC that is higher than their WACC…then that’s a further sign of a competitive advantage.

Free Cash Flow Margin > 10%

The FCF Margin is a profitability ratio to understand the proportion of revenue that becomes free cash flow.

Earnings can be manipulated. Free cash flow is a fact.

Companies with more free cash flow operate much more efficiently, whilst also having more cash to reinvest into their operations.

If you want a deeper dive into Free Cash Flow then check out a previous article of mine here!

Time to Screen!

There’s many tools that you can use to screen the best stocks.

I’ll be using ChartMill today. It’s one of the easiest, and quickest ways to screen stocks in my opinion.

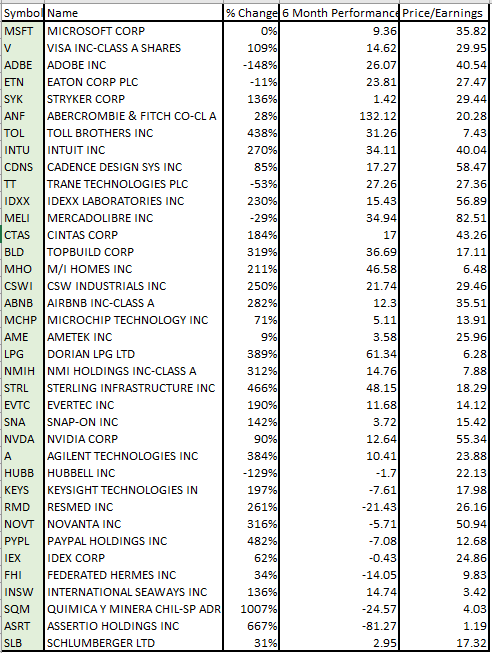

See below the 37 exported quality stocks based on the screening above.

Of course some of these stocks will not fit other criteria that you or I may have. But this took about 5 minutes. It’s given me a great starting point to now go on and perform a deeper dive into some of them.

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also me follow me on X.

About the author

Make Money, Make Time is written by Oliver, a qualified CA, and investor who has read over 300 investment books, and spends more than 50 hours per week researching stocks so that you don’t have to. Let’s level-up together!