LMND Q2 Update

There's a reason it's my biggest position

Hi all 👋

Consider becoming a paid subscriber to MMMTWealth. You get access to all my deep dives, plus access to my spreadsheet which includes my portfolio, real time notes, news, commentary, buys, sells, adds, trims, charts, and much more - all for just $16 a month.

2025 Q2 Earnings Analysis

As paid subscribers will know, LMND makes up a very large chunk of my portfolio and I’m now up ~61% with an average cost of $35.6 with consistent adds and DCA’s between $29 and $55. It’s one of the rare stocks in today’s market that I feel confident buying heavily, because I believe it’s among the very few — perhaps the only — companies evolving into an autonomous insurance giant in a $7.5 trillion market.

Before we dive into the earnings report, let me just remind you very briefly why I’m so bullish on this company:

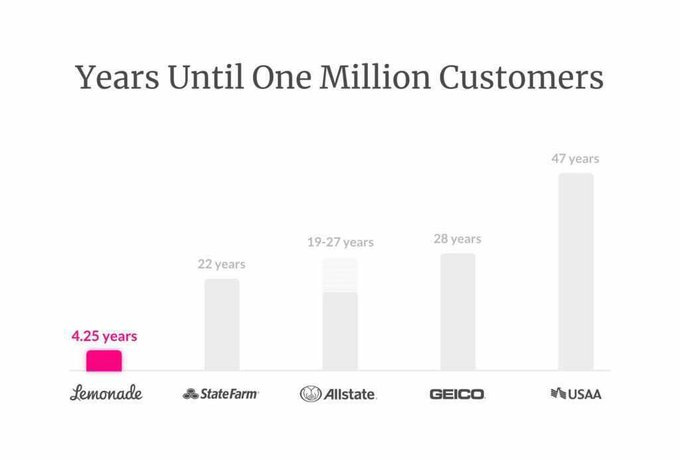

They hit 1 million paying customers at a faster rate than NFLX, SPOT, and AMZN. Their growth is completely underrated.

They’re one of the few high growth small caps with complete control over their costs.

Growth has been accelerating, and management are guiding for continued revenue growth rates above 30%.

Insurance is worth roughly 7-8% of US GDP and no company has disrupted this market in years.

Most companies have strong competition which makes choosing stocks in a certain niche quite difficult, however, LMND is an exception. Of course, they’ve got competition from the traditional incumbents like AL, PGR, State Farm, and Geico, but the real value moving forward over the next decade is in those companies who use AI/LLMs the best to provide real value in the world.

It’s those companies who truly harness AI that will define the next generation of industry leaders.

And if you look at the insurance industry it’s probably the only multi-trillion-dollar industry that has yet to be disrupted by tech.

Healthcare has started to become disrupted - you’ve got telehealth players like HIMS, robotics like ISRG, diagnostics like TEM or ABCL for example.

You’ve got transportation that is being disrupted by AV’s (TSLA, GOOGL, and UBER).

You’ve got the finance industry, which is changing by the minute with HOOD, PYPL, CRCL and the stablecoin rise, and COIN in crypto for example.

You’ve got RKT, Z, and OPEN in real estate.

In insurance, you’ve got ROOT (focused solely on auto), and HIPO (focused solely on home), but LMND stands out as the only AI-native insurer competing across multiple verticals.

And yes, insurance is not the most exciting industry, but you know what is exciting?

PGR doing 53,733% return and LMND aiming to completely disrupt it in a much better way.

In this earnings report, I’ll dive into:

Numbers

Earnings call highlights

Opportunities ahead that we haven’t touched on before

Updated valuation

Numbers

Demand:

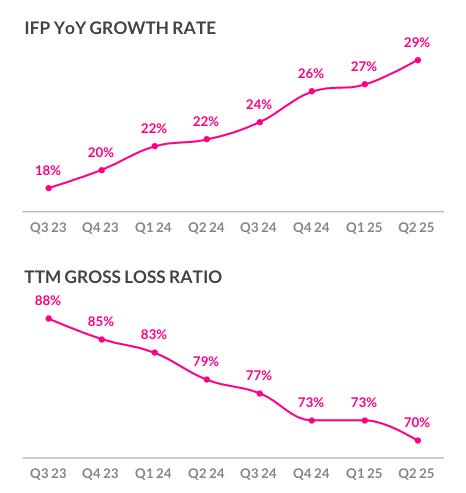

IFP YoY Growth Rate: 29%

IFP: $1.083B (beat top end of guide by $19M) - This has nearly doubled in the last 2 years alone.

Car is accelerating in IFP with 22% YoY growth which is slower than the overall IFP growth rate, but we should see some more acceleration here now the loss ratio is down to a better level than it was. Remember the current LMND goal is to 10x the book of business

2.69M customers (148,000 customer growth QoQ) which was a very significant amount and likely due to European expansion which they’re growing aggressively (more on that in opportunities section). IFP in Europe was $43M but it was only $12M in Q1 24 so still very small numbers as a percentage of overall IFP but large growth.

In Europe, most customers are renters with modest premiums (~$168), but it’s a smart entry point into a sticky product that can drive strong cross-sell over time.

Premium per customer: $402 - This will be one to track very closely over the next 2-3 years to ensure that cross-selling to higher value products like car and home does happen. So far, we’ve seen just a 5.6% CAGR in premium per customer, but we have barely touched the surface with car yet. Most customers are being acquired and using LMND for low value products like renters or pet insurance, so the LTV to CAC multiples, although strong, are not anywhere near what they’ll be in the future. FWIW, the US average for premium per customer is ~$4,000 and LMND are still below $402.

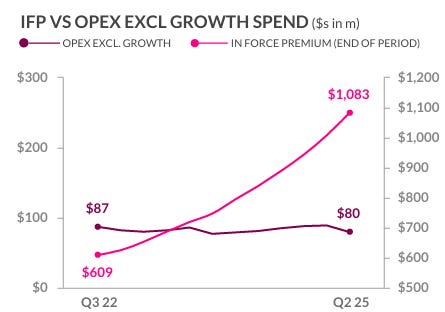

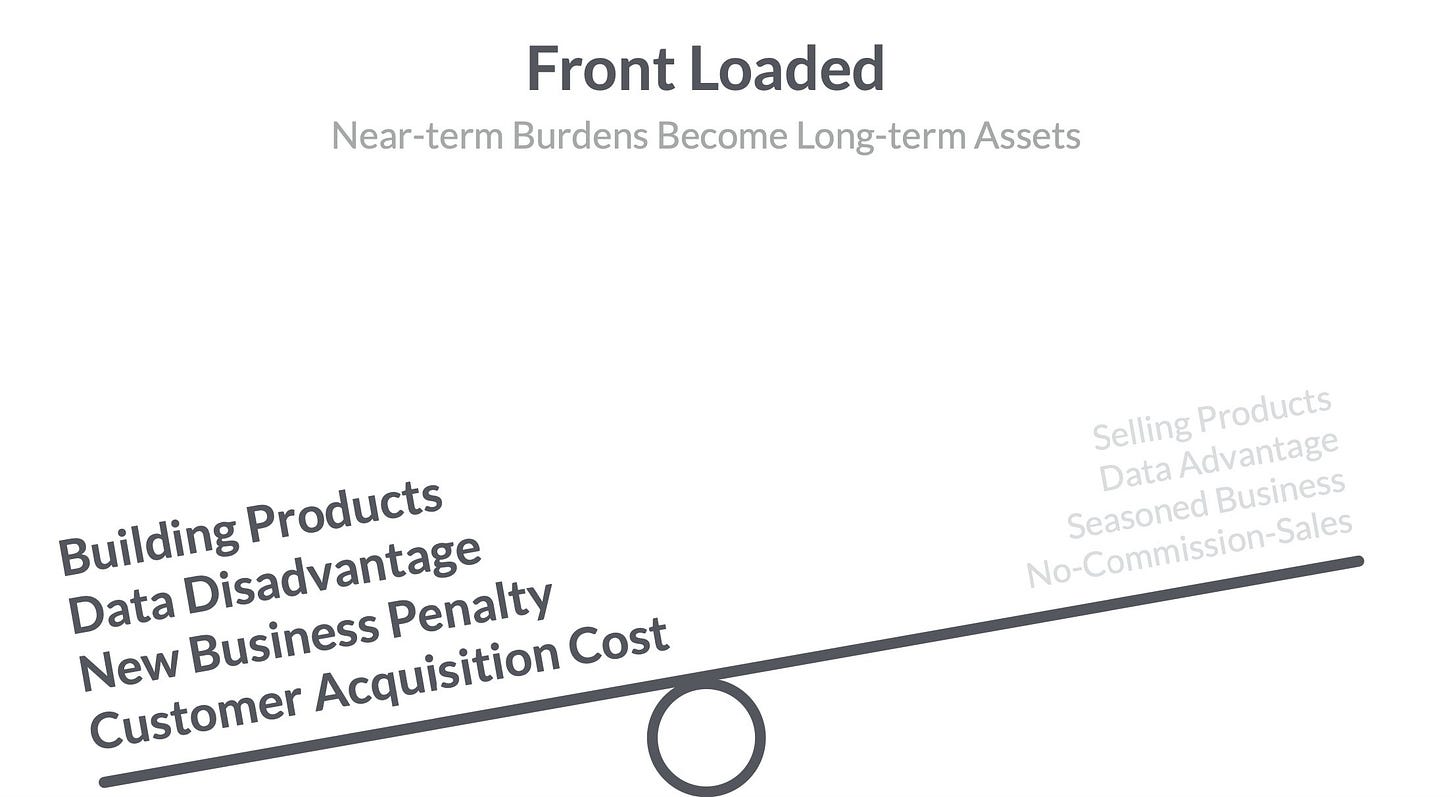

This growth was extremely good, but it also came with the highest growth spend we have seen to date. This is a bear case that I see many people make because they mistake poor (unprofitable) financials today for a weak company.

LMND are investing massively into growth now in exchange for huge profits that will come for many, many years. They’re investing in building a completely autonomous organisation whilst also controlling costs far better than many people realize and this is what people are missing.

Autonomy costs most. Engineering costs money. Growth costs money. New geographies cost money. New products costs money.

But it’s important in this instance to be forward looking rather than backwards looking. If you look at the trends (and ignore the actual numbers), there’s really not many better companies in the entire market.

And even more importantly, they have an LTV to CAC (lifetime value per customer-to-customer acquisition cost) above 3x so every dollar they’re currently investing in growth yields $3, hence why ramping up growth spend today is hugely beneficial. When car becomes more common, I see this LTV to CAC multiple being over 5x.

Profitability:

Loss ratio: 70% (TTM) - Think of this as the inverse of LMND’s gross margin so a contraction here is positive. Q2 24 was 79% for reference.

Car loss ratio was 82%, the lowest it’s ever been.

Operating expense (excluding growth spend) was down, granted this was because of a one-time $11.7M benefit but without that it would be more or less flat. This is central to the LMND bull case. When you have (so far) exponential revenue growth, and flat OpEx because they’re so heavily invested in AI, you have a company that is set to compound earnings for many years to come. This proves they’re building a highly automated insurance company.

Adj. EBITDA was negative $40.9M, which was made worse by the one-time benefit. Without that, Adj. EBITDA would be ~ negative $29M.

Balance Sheet

Total cash and investment rose 1.032B.

Long term debt totalled $123.5M.

Guidance

IFP guidance raised for FY25 from $1.208B to $1.218B.

Revenue guidance raised from $663M to $715M (mainly due to reinsurance changes. They lowered the rate of ceded premiums in July which directly increases revenue whilst of course increasing risk).

Reiterated annual EBITDA guide.

Reiterated positive EBITDA by 2026 but hinted this could be sooner.

Earnings Call Highlights

Reinsurance Change:

As touched on above, LMND reduced their reinsurance reliance in July from 55% to 20% which has zero effect on the balance sheet. There were rumours that this was a forced decision because the new reinsurance terms were not as favourable as the prior year, but management assured investors that this was a decision made completely on their terms. Why is this bullish?

They clearly believe they (their models) have made huge strides in underwriting as seen in the reduced loss ratios. They also clearly believe that existing reserves are sufficient enough to handle expected claims.

As the business becomes more and more profitable, they won’t need to set aside reserves as quickly meaning growth has less of a strain on liquidity. In practice, this means LMND can keep scaling without the balance sheet getting stretched.

“The confidence to make such a move directly stems from a multiyear track record of improving loss ratios as key products and geographies have become more mature and predictable.” - Daniel Schreiber

Note: This is a gradual change. It should reach 20% by Q2 2026. Therefore, at some point in the next 4 quarters we should see a very large quarter (or few consistent quarters) of huge growth. Many people may miss this so if we see +40% revenue growth, it does not actually mean they’re growing revenue at +40% exactly.

Opportunities

Profitability

2026 has always been the year that management have said they’ll reach EBITDA profitability (with GAAP income profitability in 2027), but in Q2 they mentioned they may reach this milestone slightly earlier. Ultimately, this changes nothing to do with the bull case for me at all if they hit it in Q2, Q3, or Q4 2026.

For me, it’s all about continued excellent unit economics, continued reduction in loss ratios, continued customer growth, and continued AI-driven cost advantages. I think it’s pretty clear we are heading quite steadily towards EBITDA profitability. Currently, analysts are estimating only $45M in EBITDA profitability by FY27, which I think appears too low. Real LMND investors care about LTV/CAC growth, gross loss ratios, and scalability rather than which quarter LMND hits profitability.

Compare it to TSLA for example. They spent decades burning cash before achieving sustained profitability and bears argued endlessly about when they’d actually make money, rather than seeing the trends and the operating leverage unfolding before them. The exact quarter they hit profitability does not matter if you’re an investor with a 5+ year time frame - what matters is that there’s further evidence of the business model working.

European Expansion

“We see rich EU potential: deeper penetration in existing markets, new product launches, and strong cross-sell focus. We believe that Europe will continue to be a key engine of rapid, profitable growth for years to come.”

Europe is a very exciting industry for LMND. Here’s why:

Europe has been quicker than the US top adopt telematic and usage-based pricing in certain lines. People are more used to using telematics, and LMND does this better than most others.

European insurance markets are highly penetrated but less dominated by legacy giants who cross-subsidize aggressively.

Car

Car gross loss ratio reduced to 82%, an increase of 13 bps YoY, which is the best since launch of car. At the same time, car IFP increased 12% IFP YoY showing that:

Cross-selling is working.

Marketing spend is working.

Telematics signals are working to offer lower prices than competitors. This boosted conversion rates by 60%, hence why management are boosting car growth spend by 25%.

Many investors are upset with slower growth in car than LMND may have originally made out at Investor Day last year when they said they’re aiming to 10x the business, mainly through car growth. However, what people are underappreciating is that they can’t spend big on growth here if the underwriting is not ready.

Ultimately, insurance is a commodity, and customers will only switch if the price is compelling. It’s all well that LMND have some of the best UI and UX in the market, but that won’t single handedly mean people make the effort to switch their insurance. That’s why waiting for these models to use telematics best to lead to the best pricing with the lowest risk customers is absolutely vital.

“This strength illustrates a critical pillar of our strategy: broad telematics adoption yields enhanced pricing segmentation that allows us to evaluate risk with precision, driving down both prices for good risks and loss ratios.”

For now, they launched in Colorado in Q1 which led to the highest new business growth conversion out of any state they have previously launched in. Next, they’re growing in Indiana, and after that, I think they’ll be present in a lot of the U.S.

Valuation

Another stellar quarter by LMND. I’m not sure exactly why the market chose to reward LMND investors this time vs the past 2-3 quarters because this quarter wasn’t necessarily any better than previous quarters. It was just further proof that the business model is working, and I think the market, as well as many investors started to realize that.

But let’s look at where the valuation stands today making some conservative assumptions.

Analysts expect a negative EBITDA year in 2026 and $45M in EBITDA in 2027 meaning LMND is trading at 89x 2027 EBITDA today but that’s not the best way to look at it today.

I screened for some high growth names with similar profitability metrics to LMND. Most of these are gross profitable but not net profitable yet. This chart looked quite different in Q1 because the growth rates for UPST, TEM, and RBRK weren’t as strong, and LMND’s EV/GP wasn’t as high. However, all companies aside from NET here are valued very attractively based solely on this metric. Having a growth rate 5x larger than the GP multiple is something is quite an attractive set up.

So based on the above, there’s no argument to be made that LMND is not attractive. If anything, it also shows that companies like UPST (portfolio) and ZETA (portfolio) and TEM (watchlist) are also very well valued.

Assumptions:

If IFP growth continues at 30-31% through to Q4 2026 then we should be at $1.6B in IFP. If we assume the GEP/IFP remains in the 23% range, then we make ~$380 in GEP by Q4 which should give us $304 in revenue (plus investment income, ceding income, and other income which could get us to the $350M range).

This therefore would mean that revenue would have grown 113% in 6 quarters if my assumptions are correct but remember this is artificial because of the reduction in reinsurance ceding.

LMND’s gross loss ratio in Q2 was 67%, so I suspect it’s fairly conservative to suggest we hit ~65-66% by this time next year. If we go with 66%, and a 72% net loss ratio then we are looking at $252 in insurance losses of which $50M will be covered by reinsurance and $202 will be covered by LMND meaning the profit after insurance losses will be ~148M.

Other insurance expenses tend to be in the region of $22M-$25M so if we take the upper end of this to be conservative, we can estimate a gross profit of $123M in Q4 2026 which is a 35% gross margin. This puts gross profit growth rates at 91.3% over 6 quarters or 51% annual growth rate if you calculate it on a CAGR basis.

If gross profit is $123M in Q4 26, then LMND could likely hit $386M in total gross profit in FY 26 if we take into account acceleration by quarter. That means they’re trading at 10.4x 2026 gross profit for 51% growth rates. Far too cheap for now.

Secondly, you can check out my LMND model if you’re a paid subscriber on my spreadsheet. Become a paid subscriber here for just $16 a month.

Overall take:

I have no intention to sell LMND. I’ll continue to DCA for the time being at these prices and if LMND does drop back to a nice level (probably firstly around $45) then I’ll consider making a bigger add.

LMND are completely disrupting one of the biggest industries on the planet, and too few people realize this today. I’m very happy they’re my biggest position by quite some distance.

That’s all for today

I do hope you enjoyed this look into LMND. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

How can I DM YOU

This is really good work Oliver