March Gave Us These Opportunities 👇

Some notes on 5 good buys in March

Hi all 👋

March was a bad month for investors, with the S&P down ~9.5%. For long term investors, this is great news.

What I know will happen will be ~50% investors flee from the stock market in fear, and 50% double down on their research, become more aggressive, and ultimately over the next 3-5 years will do very well.

Which camp are you in?

Here’s some notes on 5 stocks that have presented some nice opportunities in March 👇

The Trade Desk | TTD

Introduction

I’ve never followed TTD too closely because I just always thought it was very overvalued. I think that narrative is starting to change slightly after a 58% drop YTD and a 26% drop over the last month alone.

TTD basically serves ads on the internet through auctions and subsequently tracks the data to improve future performance. It’s a high quality company, though one that will be prone to recessions.

Valuation

Despite being on the high side at 27.4x, TTD is trading near its lowest Fwd PE multiple since 2016 after it’s huge drawdown in February and March.

However, looking purely at historical valuations is risky as it doesn’t consider if the stock was overvalued or undervalued before. At 50-60x EV/EBITDA and a PEG quite often about 8x, it’s tough to argue that TTD was ever a good valuation. I think today we’re starting to approach that though and I’d definitely have TTD on my watchlist, but I’m not quite there yet to say it’s undervalued because a 20x EV/EBITDA and 1.19x PEG still don’t suggest an undervalued company to me.

A bit more downside would be very welcome…but high on the watchlist for a value play.

Hims & Hers | HIMS

Introduction

HIMS is in my portfolio. They had an incredible start to the year before dropping 31.2% over the last month.

They’ve been in the headlines the last couple of days post news that they are going to sell LLY’s Zepbound in what was thought to be a partnership, but what is just in fact glorified reselling. I sent some notes to my paid subscribers about this the other day. Ultimately, from a long term perspective, the GLP-1 narrative has never been a bullish catalyst for me and it’s more of a distraction than anything.

People can argue one way or another and the truth is nobody really knows what’s going to happen with GLP-1 law suits, demand etc. IP and patent law is very complex. My initial thoughts are that not much is going to change and this big news was completely overblown.

Valuation

I keep running the numbers on HIMS and slightly change my assumptions and ultimately I keep coming up with it being a very good investment. In my HIMS deep dive I’ll offer a bullish, base, and bear case but for the sake of argument today let me offer you the most bearish case I personally see:

HIMS lose their right to sell semaglutide

HIMS go through a lawsuit

This would likely result in ~$1.7 billion in revenue in 2025 ($700 million less than the $2.4 billion guide). At $1.7 billion and and a sales multiple of 4x you’re looking at a $6.8 billion market cap which is 10% higher than today in the next 8 months of 2025. This doesn’t even consider the 5-10 year time frame I invest in with HIMS and is the worst case scenario. HIMS has never missed guidance before so the chances of this bear case I outlined materializing are low.

I’m excited to share my bull and base case investment models with my paid subs.

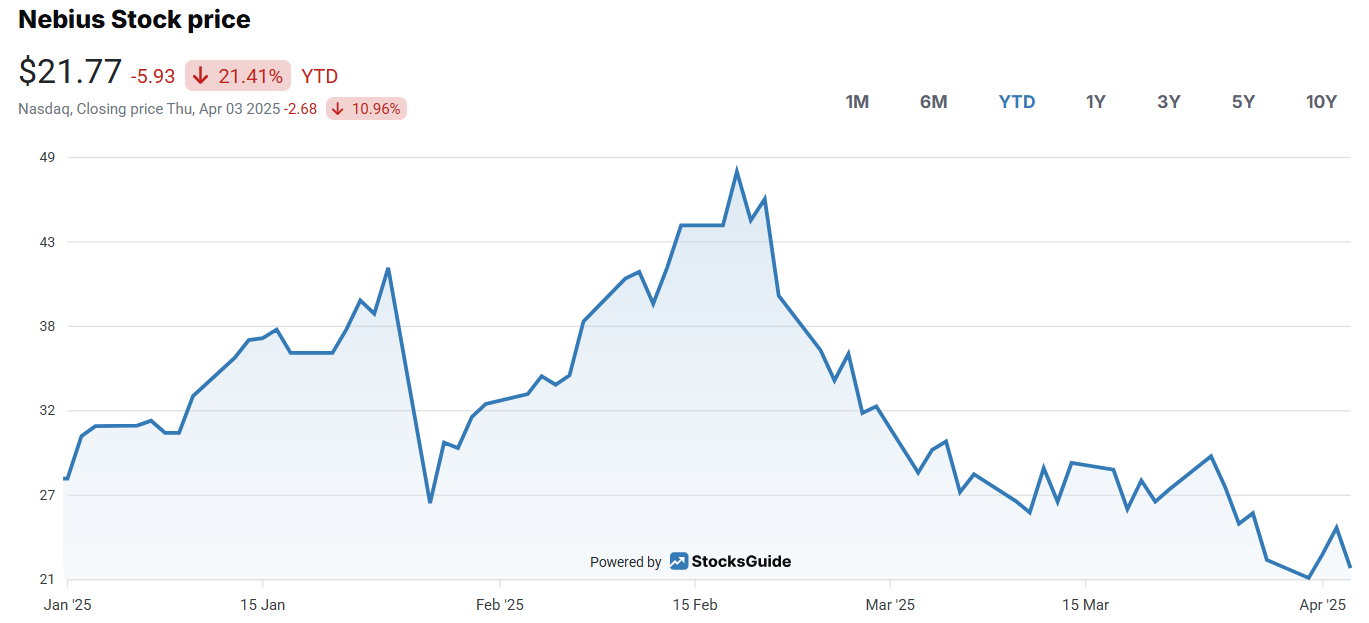

Nebius | NBIS

Introduction

NBIS has become more popular in the retail investing community of late and for good reason. It’s a quality company with some big goals and definitely worth a position on your watchlist.

Valuation

NBIS has an EV of $2.7B and expects to hit $500-700M in revenue in 2025 meaning they’re trading at ~4.9x sales which puts them ahead of competitors like AMZN and GOOG. However, when you really dive into the valuation a bit more, it becomes a different story.

Let me explain here:

At full deployment of all 240k GPUs by 2028, they would likely reach $3.5-4B in ARR which at a 20% EBITDA margin (below comps) puts them at $7B based on a very mere 10x EV/EBITDA multiple (15x is more reasonable for a model but I’m led to be more conservative given the week we’ve had)…

That’s a nice increase in itself, but doesn’t include Avride, Toloka, TripleTen or Clickhouse which should add at least another $2-3B to the valuation.

If NBIS can hit their guidance and analyst expectations, then they’re very undervalued.

TradeUP x Oliver: Score FREE NVDA stock!

TradeUP, the U.S. trading platform powered by Tiger Brokers (NASDAQ:TIGR), is bringing MMMT readers an exclusive stock giveaway!

Here’s the deal:

Open up a TradeUP account through exclusive link or using promo code OLIVER

Deposit or transfer $1,000+ and maintain your balance for 30 days.

Get 1 FREE NVDA stock.

Plus, enter a prize draw for 2 to 5 extra shares, with individual stock values reaching up to $1,800! (Every draw guarantees a winner).

Offer ends 03/31/2025. Don’t miss out.

https://www.tradeup.com/gift?invite=OLIVER&group_id=CG9000000534&f=BCS®ion=USA&lang=en_US

Novo Nordisk | NVO

Introduction

NVO fell 28.5% over March making it one of the single worst months for the stock ever. I’m beginning to follow the stock a bit more closely and there’s areas I like, but there’s also a lot more risks than I originally thought meaning my target buy zone is quite low.

Valuation

Based on historical valuations for NVO, we’ve gone from very overvalued to reasonable. A lot of people are jumping into this stock because it’s cheaper than before but that doesn’t by any means justify it being undervalued today. It’s merely undervalued compared to where it once was.

With that being said, here’s what I think about NVO today. Analysts are estimating ~19% CAGR in EBITDA through to 2026 putting EBITDA at $28.8M, meaning NVO is trading at 10.4x FY26 EBITDA. To me, this is definitely approaching quite a nice zone but I don’t love pharma companies, especially those focused predominantly on GLP-1 and diabetes markets which are currently prone to more political risks.

If this can come down another 15% or so down into the $50s, I’d become very interested.

Tesla | TSLA

General Commentary

Q1 was rough for TSLA. They’ve fallen 30% this year but March was relatively flat.

Here’s my TSLA thoughts which I’ll dive into more in my Q2 Playbook article coming out this weekend:

There’s tons of near-term challenges with TSLA. For one, they reported Q1 deliveries yesterday and they were pretty horrific numbers that you can’t even sugarcoat.

Deliveries were down 13% YoY. That’s not a good look for a company that was once dubbed to dominate the auto industry.

You’ve also got:

Margin contraction (operating margins are at 2020 levels)

Musk doing pretty everything except for TSLA

No FSD revenue and Waymo crushing it

However, the best investments come when you separate the noise from the vision. The TSLA bull case has never been about delivery numbers, and auto revenue.

It’s been about autonomy, AI, energy, robotics, and data.

Today, I think the 107x PE has to come into question a little bit. I’m reluctant to add a lot today just because of the execution vs valuation story which doesn’t really add up too well. Last year it made more sense, but today when you compare the valuation to NVDA or GOOG, TSLA seems hefty especially when they essentially rely on the NVDA hardware.

With that being said, I think the start of this year is going to start to introduce some opportunities for TSLA. If we get down below $200 I think we are looking good at a good long term opportunity. That’s all for today

I do hope you enjoyed this article. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

Thanks for this, appreciated hearing your views on Novo.