My 2025 Playbook👇

Here's exactly what I'm doing to start 2025

Hi fellow investor👋📈

In this article I’m going to give you the exact playbook that I’ll be following at the beginning of 2025 (unless anything crazy happens in the markets between now and then).

I’ll be DCA’ing a lot, trimming a little, and trying to find some new stocks that I’ll of course update you with.

DCA Strategy

I think the outlook for the wider market is a bit unknown at the moment. Valuations are very high, but yet I think there’s some nice opportunities around. However, I think lump summing into some stocks is a bit too risky at the moment.

We’ve had a great year in the US stock market. Quite rarely will the next year live up to these expectations so I’m predicting a slightly more subdued 2025. I think this will provide investors will extremely nice opportunities to gradually build positions over time, especially if we do see some market drops.

Here’s the stocks I’ll be DCA’ing into.

NuBank | NU

ASML Holdings | ASML

TransMedics | TMDX

MercadoLibre | MELI

Starbucks | SBUX

DraftKings | DKNG

Occidental Petroleum | OXY

Amazon | AMZN

1. NuBank | NU

NU has enormous geographic growth expansion and enormous cross-selling opportunities when the geographies become more saturated. In Brazil (their most saturated market), they now have an ARPAC of $11 which rises to $25 for more mature customers.

This shows the stickiness of the platform over time. In Mexico and Colombia, the runway ahead is huge as they have only acquired less than 5% of adults in both countries.

On a macro basis, NU are struggling and this is exactly why they are selling off over the last few weeks. I do think this will put pressure on the stock price over the next couple of years but the optimist in me thinks this is an incredible opportunity to load up on an incredible stock.

I personally think NU will become a top 3 position for me over the next 12 months if the stock prices stays below $12.

I’ll be DCA’ing into NU on a weekly basis if the price remains below $12.50. I’ll also add aggressively on any larger drops.

2. ASML Holdings | ASML

ASML is now trading at 25.1x NTM EV/EBITDA which appears on the higher side for a company that has only grown revenues at 12% annually. However, let me explain why it’s not.

Demand is still very high (and will remain very high) for ASML’s key customers like TSM, Samsung, and Intel. Just in the last month:

The US Commerce Department offered TSM a $6.6 billion subsidy for TSM Arizona facility.

Samsung has been given $6.4 billion to expand facilities in Texas.

Micron has finalized a subsidy from US Department of Commerce for $6.1 billion.

Demand is sky high and these companies know it. If their demand is high, ASML’s is just as high, particularly for their next-gen machines which will be selling for upwards of $300 million.

Management also expect an $60 billion in revenue by 2030 and 800 bps of margin expansion. If this materializes, I expect ~$24 billion in EBITDA by 2030, 2.7x from today.

I’m adding into ASML on a bi-weekly basis. This will be a long term hold for me.

3. TransMedics Group | TMDX

I’ve not seen a sentiment shift this strong before. 3 months ago TMDX was a revolutionary medtech…and now they’re a revolutionary medtech that has fallen 64% in 3 months due to seasonal declines and fleet maintenance.

The Investor Day last week stated:

They’re aiming for 20,000-30,000 transplants a year (far ahead of the 10,000 publicly stated goal).

The vast majority of the donor pool is untapped.

Most competitors of TMDX are not solving the key issue of Ischmeic damage. If they are, they are nowhere near to owning a full scale logistics business like TMDX.

Data shows TMDX have reduced primary graft dysfunction by 50% in lung and 65% in heart and liver.

International expansion shows how large the TAM is for TMDX.

Kidneys will add 50,000 transplants a year to the TAM by 2029.

TMDX trades at 4.5x NTM EV/Sales with +40% revenue growth next year expected. That’s way too cheap to not invest in.

I’ll be buying TMDX on a bi-weekly basis until it recovers past $85.

4. MercadoLibre | MELI

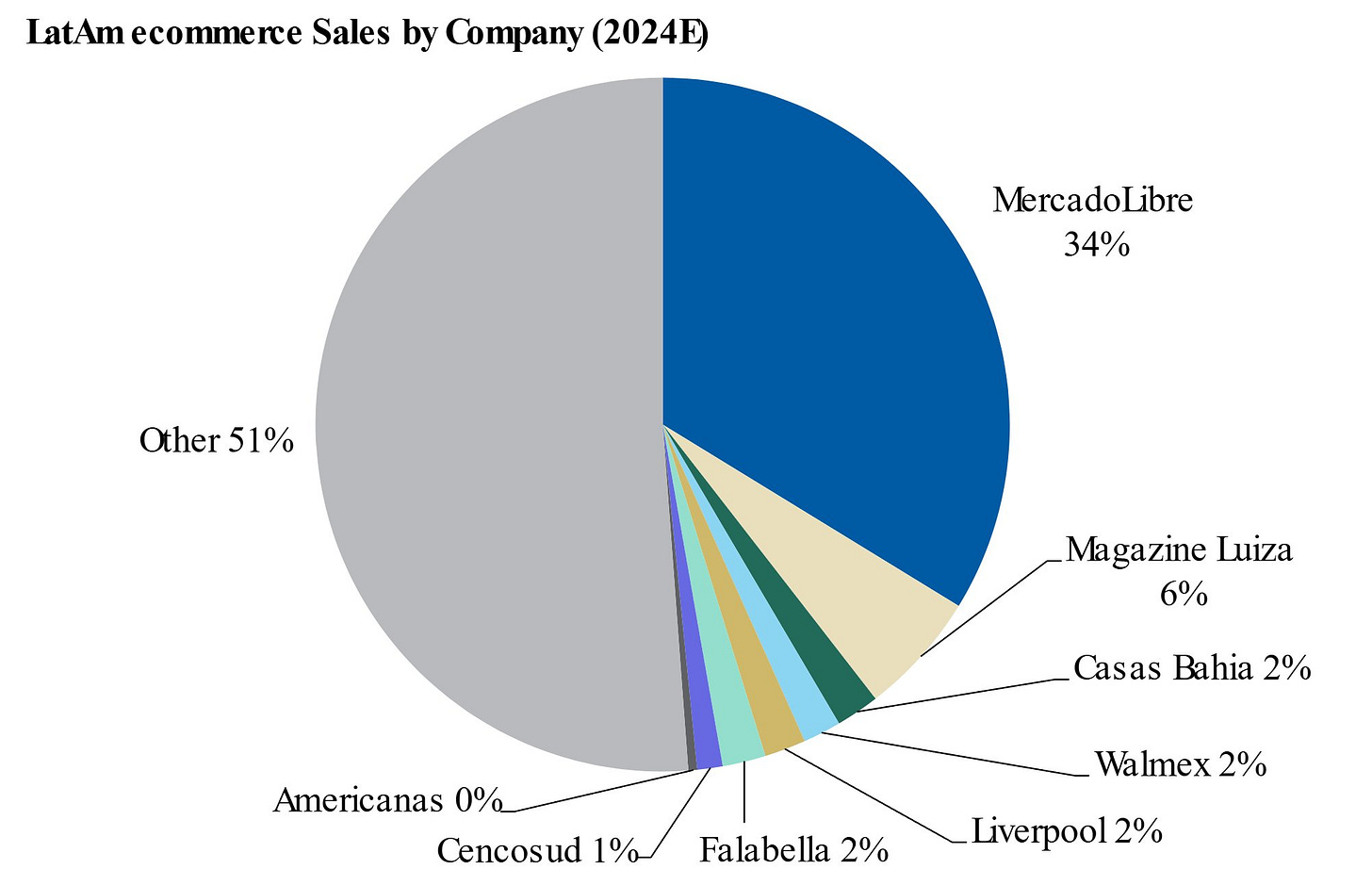

Morgan Stanley estimate that MELI has a 34% e-commerce share, far more dominant than any competitor. The fintech division is also seeing growth of 35% YoY for active customers, and AUM (assets under management) is growing 93% YoY.

There is no fundamental flaw in the business that I see and therefore the only reason for 11% drop in the last month is the macroeconomic concerns that are also troubling Nu. But, MELI aren’t playing it safe and waiting for the macro concerns to pass. They’re continuing to invest into innovation, growth, and efficiency to become the Amazon of LatAm.

I’ll be investing monthly into MELI for as long as the stock price struggles with the macro issues in LatAm.

5. Starbucks | SBUX

SBUX is not in a good position at the moment.

Net revenues declined 3%

Operating margin contracted 380 bps.

EPS declined 25% YoY.

It’s become a turnaround story but I quite like investing in turnaround stories (such as PYPL). The below graph shows what Brian Niccol (the new CEO) did with Chipotle and I believe he can do exactly the same at SBUX.

This will be another small position until I start to see data show that the company are heading in the right direction.

I’ll be investing a small amount in SBUX over the next 2-3 years.

6. DraftKings | DKNG

DKNG isn’t a big position for me and I don’t think it ever will be…but it’s a position nonetheless and one that I wouldn’t invest into if I didn’t like. I first decided to invest into DKNG mainly because the wider sports gambling market in the US has a huge amount of room to grow as the regulatory environment eases one state at a time.

The pressure on the stock price today is:

Competition from the likes of FanDuel and Flutter

The regulatory environment (such as higher taxes) which are all out of DKNG’s control.

Despite this, I believe having some exposure to this industry will pay off. Flutter (FLUT) trades at 3.4x NTM EV/Sales whilst DKNG trades at 3.3x but DKNG is growing revenues at 36% YoY vs 27% for FLUT. To me, this suggests DKNG is at a fair valuation compared to peers.

I’ll be investing a small amount monthly into DKNG for the next 12 months.

7. Occidental Petroleum | OXY

OXY has now hit a FCF Yield of 10%.

The oil markets are uncertain to say the least but most of the driver of price currently is supply, rather than the diminishing demand. We are seeing supply disruption, and geopolitical tension under a new administration which should lead to higher volatility in the commodity markets.

For OXY specifically, of course they have no control over the price of oil. But they are one of the best oil companies at controlling costs and generating FCF as we can see from a record cash flow quarter, and a decline in lease operating expenses of 20%.

I’ll be investing monthly into OXY for the next 12 months.

8. Amazon | AMZN

AMZN is one of those must own stocks for the next decade I believe. Here’s why:

They’re the biggest cloud player and their growth is reaccelerating.

They’ll expand margins in e-commerce through robotics.

They’ll win more market share in digital ads.

They can hit $1 trillion in revenue in the next 5 years which would mean they’d have $250B in EBITDA annually at a 25% EBITDA margin (just 100 bps increase per year).

At an EV/EBITDA of 15x (lower than today), you have a $3.7T company.

I’ll be investing bi-weekly into AMZN.

Waiting

Here’s the companies in my portfolio I won’t add to unless there’s some big declines in share price (and what price I’d consider adding)👇

PayPal | PYPL - $65

Silvercorp Metals | SVM - $2.80

SoFi Technologies | SOFI - $8.50

Hims & Hers | HIMS - $19

SentinelOne | S - $20

DLocal | DLO - $9.50

Coinbase | COIN - $200

Uber Technologies | UBER - $55

Tesla | TSLA - $210

Alibaba | BABA - $70

Celsius | CELH - Will not add

I own all of the above stocks and the majority of them have performed well aside from DLO, UBER (recent drop), BABA, and CELH.

Other Additions

Of course I’ll be continuing to perform weekly screens (that I’ll share with you) for any interesting companies that I deem worthy of adding to. I think I need to get a bit careful because I am holding a lot of companies at the moment (20+) which I’m not overly happy about. But then again, there’s none that I really wanted to sell out of just yet.

The two stocks that I am most interested in at the moment are Grab (GRAB) and Enphase Energy (ENPH). I am very bullish on GRAB and can see myself initiating a position in the next couple of months.

I’m going to release an article just after Christmas which will highlight exactly how this newsletter is going to work in 2025.

There’s some bigger and better things coming. Trust me.

Until then, see you later 👋

That’s it for today

I hope you enjoyed this rundown which I’ll be sticking to in the early parts of 2025. I’ll be updating you with every change to my portfolio and as I mentioned I have some very big plans with this newsletter in 2025.

I’ll be sending an article out just after Christmas explaining it.

For now, I wish you and your loved ones a Merry Christmas. Also a huge thank you to everyone for all your support this year. I hope you have enjoyed reading my work just as much as I have enjoyed writing it.

Oliver,