Palantir Q2 Earnings - The Best Company In The World?

A Proud PLTR Owner

Hi fellow investor👋

I don’t add any advertisements or any paywall to my newsletter so any like, comment, or share is so important for me to get my newsletter out to many more people!

Company: Palantir

Ticker: PLTR

Website: https://www.palantir.com/

Current Stock Price: $30.21

52-Week High: $30.21

52- Week Low: $13.96

Market Cap: $65.67 billion

Headquarters: Denver, Colorado

Number of Employees: 3,661

Introduction

As you may know, PLTR has been a pretty recent purchase of mine. It’s been a top watchlist stock of mine for many years, but I never managed to convince myself that the premium multiple was worth it until I really learnt about the company and just how good it was.

Firstly, PLTR is not a data analytics business like many believe it to be. It’s a software company that helps entities integrate data to improve their operations. They’re currently split into 3 different sectors:

Gotham (Government Operations)

Foundry (Commercial Operations)

AIP (Artificial Intelligence Platform)

All 3 sectors are performing brilliantly, but the game-changing product that is arguably revolutionary is AIP which is how I managed to convince myself that this was a stock worth owning. Through AIP, PLTR aims to provide organizations with a platform to harness the full potential of AI, allowing organizations to really use data in all their important decision makings.

Currently, AIP is one of the few products that allows organizations to create really specialized LLMs easily by training models on their specific in house data. Use cases are everywhere from service engines to accounts payable automation to inventory balancing to supply chain efficiencies to warranty claims resolution to pricing. Get the gist?

Before AIP became such a successful product so quickly I was hesitant to own PLTR at the prices the market was offering. But as soon as I saw stability in the $26 range as well as a drop last week down to $23 I was pretty quick to load up on PLTR. After the results I believe PLTR is very fairly valued, despite some metrics probably not signaling that at all, but PLTR isn’t just an ordinary company and therefore metrics shouldn’t be compared to other “similar” companies.

Here’s a breakdown of Q2 earnings, my updated valuation model, and my take going forward:

Q2 2024 Earnings

Demand

$678M in revenue which beat estimates by $25M.

Government revenues grew 23 YoY

Commercial revenues grew 33% YoY, and 55% in the U.S. This came in thanks to the US Commercial Customer Count increasing from 61 in June ‘23 to 295 in June ‘24, a 83% YoY increase.

Closed 96 deals with at least $1 million and signed a 7-year expansion deal with Tampa General Hospital.

Discussion

Sequoia, a US based research firm noted that there was a $200B opportunity in AI. Just 9 months later that figure has been revised to a $600B opportunity.

The AI roadmap is constantly growing and there’s no doubt PLTR are leading the revolution in the data analytics niche. This is backed up because there’s no company near the size of PLTR that has growing revenue rates like PLTR. Arguably the two closest competitors are SNOW and DDOG. Here’s the revenue growth rates for those compared to PLTR:

As Karp said (PLTR CEO), many companies have managed to ride the AI wave with product prototypes but actually fairly poor execution and no focus on top quality technology. It’s difficult to say exactly how this true is, but the data doesn’t lie.

After just introducing AIP in mid 2023, PLTR have held over 1,000 bootcamps worldwide to showcase the software and there’s no arguing that it appears to be game changing. 7 figure deals have been signed just 16 days post bootcamp with a large insurance brokerage, and another large corporation had a 25 day period post bootcamp to contract.

Perhaps more of a sign of a winning product is expansion deals that are being signed by existing customers. Management noted that they’ve seen a huge uptick in the volume of customers who are signing expansion deals as a result of AIP. For example, over the quarter, huge brands such as United Airlines, Stellantis, Tampa General Hospital, Eaton, Kinder Morgan, Panasonic Energy, and Wendy’s also initiated expanded partnerships with PLTR. A quick note here to focus on the variety of clients that PLTR are winning across almost every sector.

And then you combine these partnership expansions with PLTR’s ability to simply just win new clients which was up 83% YoY and you have a pretty indestructible company at the moment.

Profitability

Seventh consecutive quarter of GAAP profitability with $134 million in net income.

Adjusted gross margin (excluding SBC) to 83% and FCF margin to 21%. Free cash flow is expected to increase through 2H with timings of government and commercial year-end collections.

Adjusted expenses rose 4% with expectations of further increases to expenses.

GAAP EPS came in at $0.06

Rule of 40 Score of 64%.

Despite increased expenses, we’ve seen some nice margin expansion in Q2 with net margin up 320 bps. For me, a great visual to show off PLTR’s huge success is this:

Here’s a graph showing total revenue vs R&D vs selling and admin costs. Clearly, these costs are remaining fairly steady whilst revenue continues to sky rocket. R&D has risen 15% since September ‘21 whilst revenue has jumped 78%. This is a sign of a quality business where marketing costs and R&D costs don’t jump proportionally with revenue. Of course, we’re going to see smaller incremental increases in R&D costs likely as PLTR continue to introduce new products (more on this later) but the important part to realize is that R&D as a percentage of revenue is decreasing rapidly YoY.

Just a quick note on stock based compensation as this is often a bear case that I hear come up quite regularly on PLTR. Back in 2021, SBC as a percentage of revenue was extremely high (62%). Today, it’s around the 22% range which I’m very happy about as a shareholder. When everyone in the company is incentivized to make the company more valuable combined by the fact that PLTR don’t have to borrow money to pay SBC, you’ve got a very solidly working company. SBC shouldn’t be a bear case anymore for PLTR.

Financial Health

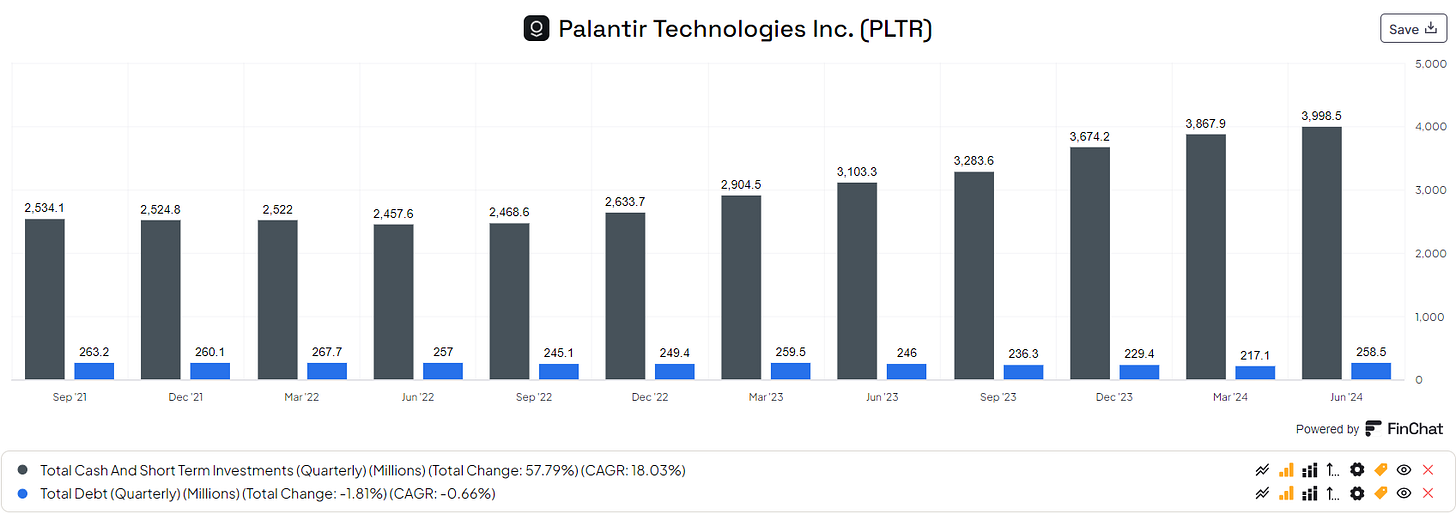

Cash & cash equivalents reached nearly $4 billion in the quarter, whilst debt increased slightly up to $258 million (see chart below).

PLTR now boast a current ratio of 5.9, and a gearing ratio of just 0.1.

There’s not many companies out there who can sustain the organic growth that PLTR has managed without M&A and without debt. This has allowed them to boast a pretty much flawless balance sheet which gives them the opportunity to bring new products like AIP to market without taking much risk.

Other Notes

Warp Speed

Currently management are adding new products on average every 18 months. Their latest product offering was announced on the Q2 earnings call and is named Warp Speed, which has been formed to power the American reindustrialization by providing a modern industrial operating system.

The platform includes ERP (Enterprise Resource Planning), MES (Manufacturing Execution System), PLM (Product Lifecycle Management), and PLC (Programmable Logic Controller). Essentially, Warp Speed’s goal is to modernize and streamline to American manufacturing process. We don’t know a whole lot on this product yet, but here’s some thoughts that come to mind about the potential for this product for PLTR:

Warp Speed could have some integration with Oracle’s current ERP solution given the two firms already have some partnerships. There is some potential for big cross-selling here.

There’s currently a big push for reindustrialization in the US, so the product release is timed to perfection. Given the enhanced efficiencies that’ll come from this, and reduced reliance on foreign manufacturing, Warp Speed should attract a good amount of government revenue and contribute to the increasing revenue growth rate we mentioned earlier.

Palantir already have big success in manufacturing, but with this product they’re clearly looking to dominate the market completely. The manufacturing sectors are still traditionally underserved by advanced AI-driven software and are currently run by financial executives, rather than those on the factory floor itself. There’s clearly a substantial opportunity for PLTR to expand it’s TAM here.

Microsoft Partnership

The reason I left this article to be released today instead of yesterday is because of the recent news of a partnership between two heavy-hitters, Palantir and Microsoft. They’re teaming up to deliver secure Cloud, AI, and analytics to the U.S. defense and intelligence community.

I’m not surprised at all by this news, but the one comment that I really wanted to make here is that over the last 12 months these huge organizations are choosing to team up with PLTR, rather than to compete directly with them.

For example, just in April 2024, Oracle teamed up with PLTR and now we have the MSFT news. Whilst bears will continue to be bears, it can’t be argued that the largest governments, the largest organizations, and the largest hospitals are becoming more and more engrained in the PLTR software.

Valuation

The main topic here. From my point of view, owning PLTR is a no brainer. The company is firing on all cylinders and there’s barely anything to dislike about the numbers. The issue here is the valuation.

PLTR is currently trading at a 2024 EV/Sales multiple of 22.4x which is high and there’s no denying it’s high. They’re also trading at 80.8x 2024 estimated earnings and 50.4x 2026 estimated earnings, though I think estimated earnings are currently off and not incorporating AIP success as much as they should.

However, as I have been proven wrong in the past most particularly with NVDA, high-performing companies deserve high premiums. The interesting part of this for me is that I still believe there is a lot of multiple expansion to come for PLTR.

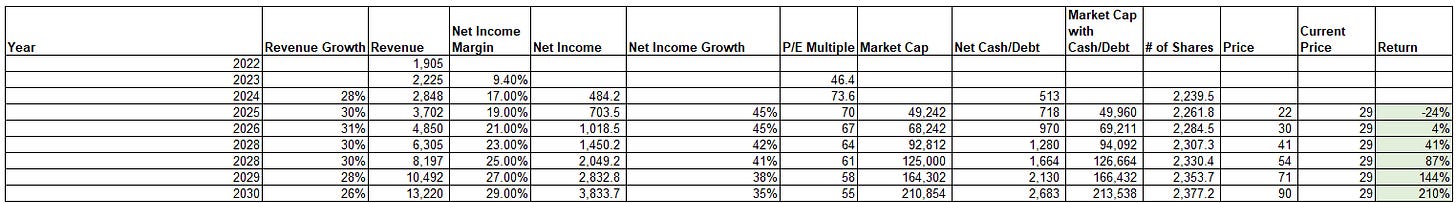

Here’s my investment model through to 2030:

This was quite a difficult model to make because most models I make normally have contracting revenue growth rates and expanding margins, but PLTR currently has expansion of both. I topped out revenue growth at 31% in 2026, though I do believe there’s every likelihood that this could reach mid to high 30s because of AIP. Also, with new products coming out on average every 18 months there’s every chance that revenue growth rates could continue to remain very high for very long, especially when you consider the international opportunities still available for PLTR to exploit.

I did keep the PE multiple fairly high because PLTR fully deserves a high premium with long-term growth trajectory and value opportunity across pretty much every industry.

This model therefore gives a value of $90 per share by 2030 which is 210% from today’s prices of $29.

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

Lot of good noise regarding Palantir. Good momentum and sentiment. But truly need to grow faster top and bottom lines to even be remotely valued reasonably. I believe most see the potential and climbing aboard and moving this above FV. That said, I am one of them as I bought in low $27’s (600 shrs) recently and thus up about 10% already. Given the immense valuation I am torn between a trade (valuation) and long term investment (potential). My intuition is to sell covered calls on half the position. If there is another leg up on Monday (hopefully a good day) then I probably do cc on half the position.

Good write up!

Not sure about the "best", Oliver, but Palantir is finally showing what it's capable of. The (consistent) positive earnings make the stock price respond favorably. Now Palantir is on the rise.