Redefining Insurance - LMND Deep Dive Part 1

Portfolio Company

Hi investors👋

Want to see previous articles that I’ve wrote? Including my other 2025 deep dives?👇

Introduction

This deep dive is on Lemonade ( LMND 0.00%↑ ), a company that I’ve become very interested in lately and one that is quickly heading towards becoming one of my largest positions, particularly on the amount of red days we have seen lately.

All of this post will be free, however Part 2 which will include the financials, opportunities, and valuation will be for paid subscribers. Paid subscribers pay less than $4 per deep dive which I think is pretty good value considering the hours and hours of research I put into these deep dives.

If you do find my work valuable, please do consider becoming a paid subscriber. It’ll allow me to take this full time and therefore create even more value for my followers.

I first bought Lemonade in January 2025

Company: Lemonade Holdings

Ticker: LMND

Stock Price Today: $34.8

Stock Price High: $145.5

Market Cap: $2.54B

Headquarters: New York, NY

Outline

Introduction (Part 1)

Business Overview (Part 1)

Competitive Advantage (Part 1)

Risks (Part 1)

Financials (Part 2)

Opportunities (Part 2)

Valuation (Part 2)

Business Overview⬇️

LMND offers renters, home, auto, pet, life, and car insurance in the US and some parts of Europe (but this is very minimal). As management state, they’re “rebuilding insurance from the ground up” due to their tech driven, and innovative business model.

Their technology enables very low fixed costs and generally very low operating costs relative to traditional insurance companies like GEICO, and Allstate, which have much higher operating costs mainly due to high underwriting costs and agents to deal with claims. LMND is aiming to automate all of this.

LMND has:

AI Maya - LMND’s LLM to get covered with renters, homeowners, pet, car, or life insurance.

AI Jim - LMND’s LLM that pays claims in up to 2 seconds.

The other key part of LMND’s business model to understand is how they manage volatility. More traditional insurance companies “cede” or transfer 20-50% (depending on the product) to reinsurance companies to offload risk and not rely on massive reserves. LMND cede around 55% of their premiums to reinsurers which massively de-risks them making it a slightly safer company relative to other smaller cap, high growth stocks. It gives management comfort in focusing on growth and rapid expansion, with less concerns over volatility and capital reserve requirements which can be disastrous for companies the size of LMND.

LMND are slowly reducing their reliance on reinsurers as they gain more comfort in their LLMs and hopefully add more longer term life insurance products which have a higher LTV and more stability.

The big money with semiconductor companies and AI hardware has been made already. The next big opportunity is with those companies who best use AI to drive huge growth and huge efficiency.

I think LMND is that company in the insurance industry just as I see HIMS as that opportunity in the healthcare market.

Competitive Advantage📊

LMND operates in a competitive environment which makes it very tough to argue that it has a large moat like META, or NVDA. However, they’re a very disruptive company competing directly against the likes of Allstate, Farmers, Liberty Mutual, State Farm, and Geico. These firms have much more capital, a stronger presence, more resources, and easier access to more funding which gives them a competitive advantage over LMND.

But none of them do what LMND is able to do in generating and analyzing data in an extremely streamlined fashion.

Technology Advantage

LMND was built in 2015 as a pure AI and tech insurance company. Everything they have done for the past 10 years has been about developing a streamlined, vertically integrated, tech company all within a single proprietary system (called Blender) that improves with every data point. The data they have is structured purely for ground up AI analysis and it always has been. This is where they have a big advantage over the traditional insurance companies. For example, GEICO, supposedly (as per GEICO owner Ajit Jain) says they have more than 600 legacy systems trying to communicate with one another but this clearly does not work or lacks any efficiency.

You’ve also got insurance agents used to the traditional ways of insurance who are now being asked to modernize and drive efficiency whenever they can. These agents want “normal”, because without the normal they have no job. It becomes an extremely difficult cycle for traditional insurance companies to make any significant changes.

Just look at Allstate (ALL) net income margin over time. They are finding it almost impossible to drive more efficiency, hence margins have actually contracted over time down to 11% today.

I sense LMND will end up with net income margins far superior to this with better gross loss ratios and better gross profit to gross earned premium ratios.

LMND have built a tech company from the ground up that is:

Precise

Automated

And you can see this in the numbers too. As LMND grows, margins improve because operating costs for a tech platform like this don’t grow too much with scale. And this is exactly why LMND’s biggest increase in costs over the last 12 months was sales and marketing because growth is essentially the bottleneck for the company. With growth comes automation comes margin expansion comes an incredibly profitable business with huge network effects in motion.

FWIW, a nice stat in the 10-K is that LMND’s customers per employee is 2,000+ whilst traditional insurance businesses struggle to get above 450, with most in the 250 range per employee range.

Alternatively, with companies like GEICO, or Allstate, more business doesn’t mean more margins. More business means more operations and more employees to handle claims so you get to the point where the marginal increases in the business aren’t actually too much better for the general business.

To sum up this section, back in 2015 and the early days of the business, LMND front-loaded all of their fixed costs to set themselves up for the decades of success. The market is now starting to realize that these years of losses are quickly turning into a nice vision for a very profitable future.

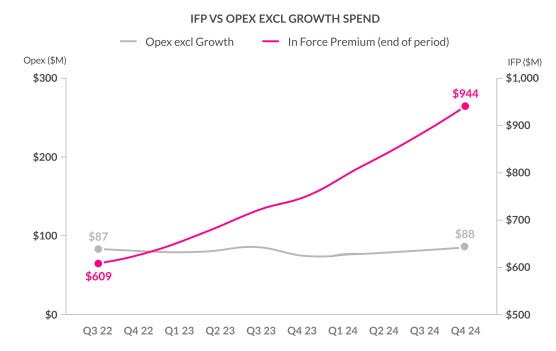

This graph below essentially sums up exactly what I’ve said above 👇

Data Advantage

The most interesting part of this competitive advantage comes down to where LMND derive a lot of their data vs peers. For reference, firms like GEICO rely on:

Credit scores

Historical claims data

Motor vehicle records

Comprehensive Loss Underwriting Exchange (CLUE)

Lemonade use:

Real-time behavioral data (language used, response time, hesitations)

More questions from AI Maya

Location tracking

Third party data

Weather data

Geospatial risk analysis

Etc

Simply they gather much more data, and much more quality data. Hence the reason for more precision and lower loss ratios. However, the overlooked part of this data is that it provides a huge growth lever. This data guides LMND into realizing the locations, and the types of insurance needed for a specific demographic allowing them to be very accurate in their marketing. It also allows for much better cross-selling and product expansion ideas.

Young Consumer

LMND’s customer base is predominantly all younger than 35. Although this means that the TAM is quite small today since the customers are only those that aren’t used to to traditional insurance as we know it.

However, this does give a great indicator of where the market is heading over the next few years. That 35 year range will soon become 45 and then 55 and we’ll get to the stage where this new tech insurance is the norm as almost all consumers will expect simplicity in locating insurance and filing claims. The days of traditional underwriting, and complex claims will be in the past and LMND will have had a huge first-mover advantage.

Quality Products Talk

Excuse the simplicity of how I titled this section, but it’s true. LMND’s marketing spend is about 5% of what the traditional tech companies are spending yet:

They now are the 4th largest insurance company in pet.

They are now the 2nd largest insurance company in renters.

People are starting to realize how strong the LMND brand is and the benefit of this is then high marketing costs are not as necessary.

Founder Led

LMND are still founder led and both founders, Daniel Schreiber (CEO) and Shai Wininger (Director) have substantial skin in the game. Daniel owns ~18.8% of the company whilst Shai owns 21.1% of the company bringing founder led ownership to 39.9%. As an investor, this gives a lot of confidence that founders still retain a high portion of equity.

TradeUp

TradeUP x Oliver: Score FREE NVDA stock!

TradeUP, the U.S. trading platform powered by Tiger Brokers (NASDAQ:TIGR), is bringing MMMT readers an exclusive stock giveaway!

Here’s the deal:

Open up a TradeUP account through exclusive link or using promo code OLIVER

Deposit or transfer $1,000+ and maintain your balance for 30 days.

Get 1 FREE NVDA stock.

Plus, enter a prize draw for 2 to 5 extra shares, with individual stock values reaching up to $1,800! (Every draw guarantees a winner).

Offer ends 03/31/2025. Don’t miss out.

https://www.tradeup.com/gift?invite=OLIVER&group_id=CG9000000534&f=BCS®ion=USA&lang=en_US

Risks

I decided to bullet point this section. I hope it makes it more reader friendly with some more concise points. Let me know if you prefer it this way or not.

Unprofitable: LMND isn’t profitable. However, if you look at the net income margin over the last 3 years I’m not too worried about LMND becoming profitable. Nor am I worried because if you understand the low operational costs of a tech insurance company compared to traditional industry peers, I think LMND’s profitability isn’t too big of a risk. The only worry I have is how the company will fare during macro wide weakness like we saw in 2021 when margins for LMND fell off a cliff. If this happens in 2025, I think LMND could delay their profitability journey quite a lot, but long term I don’t worry too much about this.

Low revenue growth: Most small caps that are “disrupting” industries have much higher revenue growth than 29.6% especially for a company with a market cap of just $2.5B. I’d expect a tech driven AI company to be growing revenues in the 40-50% range. LMND could get there again, though this is very unlikely but it’s been nice to see revenue growth rates increasing for the last 2 quarters.

Geographic concentration: Nearly half of all gross premiums for LMND are written in just 3 states: California, New York, and Texas. LMND currently do a very good job of de-risking through reinsurance so significant catastrophic events like the Californian wildfires aren’t too disruptive to the overall business currently. The positive to take is that this concentration is heading in the right direction as revenue from California has reduced from 25.6% (of total revenue) in 2022 to 24.3% in 2024 and Texas has reduced from 16.4% to 14.4%. Europe and the UK now makes up 2.2% of revenue compared to just 0.8% 2 years ago. So it’s trending in the right direction, but LMND is still extremely concentrated in these 3 states.

Low value products: LMND’s main products are renters which for insurance are very low value customers. A big opportunity for LMND is cross-selling these customers to higher value products like home ownership, life insurance, or car insurance but currently this isn’t happening much. Part of the reason is maybe some economic uncertainty around home ownership today and the average age of LMND’s consumer base being the younger demographic that aren’t homeowners. Ultimately, we’ve seen customer numbers grow 19.8% on a YoY basis whilst revenue grew 22.5% implying cross-selling to higher premium/value products has not been too successful yet. Most of the growth today is from acquiring customers and not from up selling current customers. If you compare this to SOFI for example, the growth in customers is far less correlated to revenue growth meaning cross-selling is in full effect. I know LMND vs SOFI is not a valid comparison, but it details the point I make.

Competition: Although LMND don’t have much direct competition in terms of tech driven insurance companies, they have a lot of competition from traditional peers like State Farm, GEICO, Progressive, Allstate etc. This puts a lot of pressure on LMND’s automated pricing model and strategy to price competitively and win share, but also to drive margins and profitability.

Data and regulators: LMND’s core business model essentially relies on their ability to analyze vast amounts of data. There’s always some regulatory risks over data usage and implementation and any material changes here could lead to significant disruption to the business.

Data and international expansion: With international expansion which is a key opportunity for LMND (Part 2) comes compliance with GDPR and various other data protection regulations. I don’t see this as a material risk in any way for LMND but it’s a key part for LMND to tackle as they expand internationally.

Slow product expansion: A big risk I see for LMDN is that the market assigns it a low multiple because geographic and product expansion is slow…hence one of the reasons why revenue growth isn’t what I’d hoped it be. New product launches require a lot of rigorous testing and regulatory approval meaning development cycles are very long and complex. LMND cannot easily lean into certain insurance products more or release a new product if demand is high because that’s just not how insurance works. It takes time.

Macro climate: The insurance industry is historically quite cyclical and moves with general economic conditions. I worry that if we hit a macro period of weakness, a smaller, disruptive, high growth company like LMND will not fare against the high resources, and brand power of the bigger players like GEICO.

That’s all for today

I do hope you enjoyed this LMND Deep Dive Part 1. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

Part 2 out soon!

Disclaimer

Disclaimer: The Accuracy of Information and Investment Opinion

The content provided on this page by the publisher is not guaranteed to be accurate or comprehensive. All opinions and statements expressed herein are solely those of the author.

Publisher's Role and Limitations

Make Money, Make Time serves as a publisher of financial information and does not function as an investment advisor. Personalized or tailored investment advice is not offered. The information presented on this website does not cater to individual recipient needs.

Not Investment Advice

Any chance to pay per deep dive instead of a monthly subscription?. I know you prefer subscription but I follow many key people and I cannot pay many subscriptions.