Running The Numbers on HIMS & NEW POSITIONS

A Quick Article Showing You Why I Own HIMS

Hi all 👋

Here’s a look into HIMS and also my new buys 👀

I wanted to get this out yesterday which would have actually been perfect (and lucky) timing before the huge HIMS news today about their partnership with NVO. However, I hope that all my subscribers know I’ve been in HIMS for a while already so today was a great day for the portfolio since HIMS is one of my bigger positions.

Anyway, here’s some info on HIMS for you to explain why I own it (just looking at the numbers).

Peer Valuation

EV/Sales

I think the main peers to HIMS are Teladoc (TDOC), GoodRx (GDRX), and LifeStance (LSFT). We could also put CVS in there because they have a telehealth division but it’s tough to do this as well.

Here’s a quick rundown:

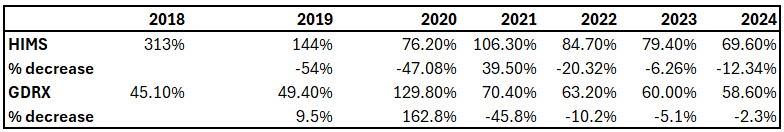

As you can see, HIMS is by far the best company here based on revenue growth and profitability metrics, and yet I don’t think the valuation really reflects that based solely on EV/Sales multiple. The HIMS multiple is only 12% higher than the GDRX multiple, yet HIMS are more profitable and revenue growth isn’t even a competition.

On a gross margin basis, GDRX is the most profitable as they’re operating at 93.8% margins, but net income is low because of SGA expenses (58% of revenue) and also high interest expenses which HIMS doesn’t have. However, HIMS SGA expenses are 70% of revenue which if you take out the interest expense makes GDRX more profitable. Ultimately, here I’m trying to make a case for HIMS trading at a multiple just 12% higher than GDRX and I don’t think that’s a valid argument because with HIMS there’s a clear downtrend in SGA as a % of revenue so to me the road to better profitability is very clear. With GDRX, I think it’s less clear:

HIMS is decreasing SGA as a % of revenue at a much quicker rate than GDRX whilst also growing far quicker and being more profitable on a net income basis.

The argument above is based solely on numbers and why HIMS numbers are better, but it completely ignores why HIMS TAM is far larger than GDRX and TDOC.

TDOC offers telehealth services

GDRX sells prescription products online (although they are starting to grow their telehealth division but it’s early days).

HIMS does telehealth services, prescription products online, & non-prescription products.

They package everything together far better than TDOC and GDRX, just like a company called Roman does but Roman isn’t public at the moment so we don’t know specifics on this yet, although we do know that:

Roman is far more focused on males whilst HIMS is far more diversified

Roman’s revenue is about 1/3rd of HIMS

HIMS is growing considerably faster

EV/Gross Profit

I think EV/GP is a nice way to look at HIMS since they’re still a high growth company. Earnings growth rates should start to materially grow over the next 3-4 years in which case PE will be a more reliable metric but I don’t think we’re quite there yet.

From an EV/GP, HIMS valuation makes a bit more sense because they trade at 5.1x which is far above:

GDRX at 2.5x

TDOC at 0.9x

CVS at 3.1x

However, they trade below LSFT at 7.1x but HIMS are growing gross profit at 64% per year whilst LSFT are growing it at 33% per year so once again, compared to peers (who aren’t as good as HIMS), HIMS is undervalued.

Market Share Calculation

There’s many different estimates out there for the market that HIMS can operate in. I’ll take you from most bullish to most bearish and run the numbers briefly on each:

Andrew Dudum (CEO) said “80% of the $4 trillion healthcare market will move towards a delivery service that looks like Hims & Hers in the next 5-10 years.”

Ok. So he’s saying that the TAM could be ~$3.2 trillion in the next decade. There’s clearly going to be more innovations, more businesses, and more ways of creating this delivery service. This is clearly above the forecasted size of the telehealth market as we know it but HIMS today proved that they are looking to become the NFLX of healthcare with the NVO partnership and this will of course make the market much larger.

So I’m going to be conservative on Andrew’s bullish note here and cut this by 50%. We now have a $1.6 trillion TAM. HIMS currently have a 47% market share in telehealth, but let’s say this drops down to 30% over time with new entrants which is totally reasonable.

You’re then looking at a $480 billion opportunity of which HIMS may take 15% of the revenue which offers $72 billion in revenue which is essentially 63.1% CAGR through to 2032. This seems overly ambitious but it’s a potentially very bullish case.

With $72 billion in revenue and an overly simplistic calculation using a 4x sales multiple, you then have a $288 billion market cap which is a 3,493% increase from today’s price.

Straits Research estimates that the telehealth market will reach $770 billion by 2032 which is ~50% of the above market size that Andrew estimated above.

So if we take this as the basis of our calculation and the fact that HIMS has a 47% telehealth market share, you’re looking at a $361 billion TAM assuming they keep market share. If they take 15% of this as revenue, then you have a $54.2 billion revenue opportunity which is a 3,670% increase in revenue from today which equates to 57.4% CAGR. Again, very ambitious I think.

Again taking a 4x Sales multiple, you end up with $216 billion market cap.

The final estimates we have are with Grand View Research who estimate $450 billion market size in 2032.

Following the same calculation as above, you have $31.7 billion in revenue which would lead to a 47.1% CAGR.

Investment Model

Here’s my investment model for HIMS which gives 300% upside potential whilst also being very conservative based on what I’ve spoken about above with the potential market size. This is far more realistic than the simplistic calculations I’ve done above, however, I do also think I’m being very conservative here with the multiples especially post the news that HIMS are partnering with Novo Nordisk.

One of the biggest risk factors with HIMS has always been legal and regulatory risk surrounding HIMS suing NVO. That risk was almost completely eliminated today post the NVO news.

But the NVO news is far bigger than simply eliminating risk. It shows that HIMS now have a much more solidified position in the obesity market meaning GLP-1 could in fact be a bigger part of the HIMS bull case long term. However, let me remind you that GLP-1 was never a big part of me HIMS bull case at all. This is just an extra added benefit.

If HIMS can bring in customers from the $100B obesity market and bundle products together with other industries, then you’ve got some very sticky revenue. A much more bullish investment model looks like this which gives HIMS a 5x opportunity from today’s price (after the jump today):

Of course if you got into HIMS much earlier on in the $20s then congratulations.

I think ultimately the market isn’t valuing telehealth providers just yet, but HIMS is aiming to be much more than a telehealth platform as we know it. They’re looking to become a tech focused, chronic care platform and that should deserve much higher multiples than the 3.2x NTM Sales they trade at today. I think with the platform they are trying to turn into, and looking at other platforms like NFLX, HIMS should be trading at +7x NTM Sales at least, but I’m glad it’s not just yet.

New Position 🚨

As paid subscribers will already know post my message this morning, I initiated 2 new positions. I’m going to give a very brief analysis of them both here 👇