SoFi Reported Q2 Earnings. Bullish?

The most confident I've been

Hi fellow investor👋

If it’s your first time coming across my page then you’ve probably missed these articles from last month:

SoFi Technologies

Introduction

SoFi is building the one-stop-shop for all financial needs and it’s building it well. The aim is to build a financial services platform that is so well-rounded that there’s no need for consumers to go anywhere else for any financial needs. SOFI also own their own tech stack and possess a bank charter. One-stop-shop in the making.

If you’ve been a long term subscriber you know I’ve been a SOFI investor for almost all of 2024. My average buy has been in the low $7s and it’s now around a 4.5% position in my portfolio.

SOFI’s been one of those stocks that people love to hate, and CEO Anthony Noto made this quite well known on the earnings call (30/07/2024) which I loved. He made a real effort to change the sentiment around the stock and that’s what’s needed from the CEO of a company with improving fundamentals but a stagnant stock price.

Here’s a rundown of Q1 earnings for SOFI.

Demand

“The quarter was exceptional, as we continue to demonstrate a record of strong diversified growth even in uncertain times…I can’t wait to see what we can achieve in a better environment.” - Anthony Noto (CEO)

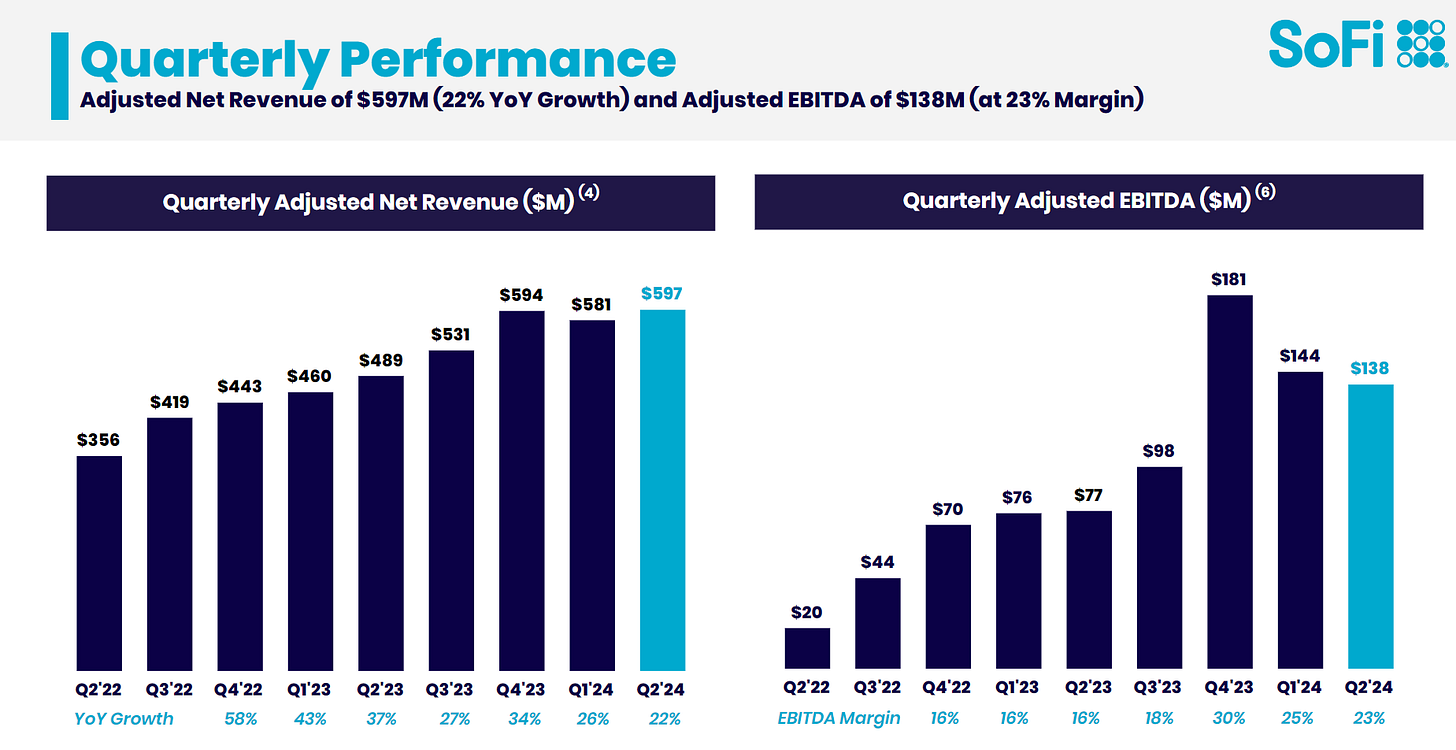

High level, SOFI beat revenue estimates by 5.3% and beat their own guidance by 6.6% (though they are known for sandbagging a little). Net interest income rose 42% YoY to a total of $412.6 million. 3 years ago this figure was just $72 million.

For a more detailed breakdown, we’ll look at the results to the following:

We’ve got:

Members

Originations

Deposits

Lending Revenue

Financial Services Revenue

Tech Platform Revenue

Members

Members growth is one of the key drivers for the SOFI business and likely will be for a few years to come. I expected ~635k-640k new members based on the tailwinds of the NBA playoffs which was a huge catalyst for further brand awareness.

SOFI crushed this and added 643k new members (highest ever in 1 quarter) in the quarter bringing the total to 8.8M members which is 41% YoY growth. This is fueled by consistently quality product innovation, product growth, and marketing expertise.

We did see a rise in selling & marketing costs as a percentage of revenue in this quarter, however, this declined by 6 points relative to Q2 23 which is a strong sign considering this quarter added the most members SOFI has ever added in a single quarter.

Originations

SOFI have historically been quite conservative on their lending despite having a capital ratio ~17% (above the minimum of 10%). I originally thought this was too conservative and essentially was leaving money on the table, however, with rate expectations fluctuating left, right, and center I’m all for prudence here especially since they’re still delivering respectable growth as well. There’s no need for SOFI to add risk here and cause investors any doubts.

Despite the prudence, originations still came in very strong for a total of $5.3 billion.

Personal loan originations reached $4.2 billion.

Home loan originations grew 71% YoY (despite highest interest rates in 10 quarters) to $417 million.

Student loan originations grew 86% YoY to $737 million with Q3 typically being the biggest quarter for student loans as students head back to school.

Just to reiterate…this growth is SOFI being conservative with their lending.

The huge origination platform SOFI boast allows them to fund a much higher APY than competitors that don’t have the origination platform. This is just one example of SOFI’s one-stop-shop which is hugely beneficial to the end consumer but also allows SOFI to have the different business segments work in tandem.

The big takeaway here for me is that this origination growth has come from very limited marketing spend. Management are allocating resources reinvest into the business, but most of it went to diversifying the business to create a much less capital-intensive business. SOFI could have easily increases personal loans even more than they did, but that wouldn’t be diversifying the business which is currently the main goal.

Deposits

SOFI delivered $23 billion in total deposits which is up 80% YoY and $2.2 billion from previous quarter. This is entirely testament to new members, members trusting SOFI as their primary bank, and the higher APY which SOFI can offer compared to competitors.

I see this rising deposits trend continuing because of the above reasons, but also because of the recently introduced Zelle service which is rare amongst fintech competitors. So outside of the higher APY, there’s increasing value proposition for members to have SOFI as their primary bank.

Lending Revenue

I’ve touched on this previously in the Originations section above, but simply put SOFI are being extremely conservative with their lending, yet still achieved some pretty impressive growth.

Here’s some changes to lending over the last quarter:

Members can now apply for small and medium business loans on the SOFI app and be approved from lending partners.

Home loans are now closed internally rather than brokering them out which dramatically increases revenue per loan.

Further growth in lending is in hold until the macro conditions become a lot more clear which is sensible since we are seeing so much growth outside of lending anyway. For reference, 57% of adjusted revenue now comes from lending as opposed to 99% 7 years ago showing just how diversified SOFI is becoming.

There’s absolutely no need for SOFI to be more forceful with their lending segment at the moment. Of course there will be a time (maybe in 2024 or maybe much later) when SOFI push the lending platform further and strive for a 14% capital ratio as opposed to a 17% capital ratio. This would lead to further growth in net interest income and non interest income and I’ll wait patiently for management to decide to tap back into this huge growth engine again.

Financial Services Revenue

The financial services sector had a stellar quarter. Here’s the highlights:

Segment revenue of $176 million which is up 80% YoY.

Contribution profit in the segment was $55 million ($4 million last year).

Debit spend rose 129% reaching $9 billion.

It is true that a lot of this growth is due to net interest income stemming from increased deposits, but we’ve also seen non-interest income rise 58% YoY due to more products and monetization of those products.

Technology Revenue

I’m a bit mixed about the tech platform.

Segment revenue reached $95 million which is 9% YoY.

Strong margin expansion to 33% giving a contribution profit of $31 million.

My worries on the tech platform rise simply because of the lack of discussion around it. It reminds me of TSLA’s focus on Optimus and FSD, but little focus on the core EV business. I don’t know just how successful the tech platform currently is or will be. We consistently get very brief mentions of the tech platform such as:

“Our pipeline of interest remains robust”

“We are pursuing enterprise partnerships with larger existing customer bases for more durable revenue opportunities.”

The issue is the integrations take multiple quarters (which I’m not 100% sure why) and therefore revenue recognition may not be for some time. I guess this one is a bit of a waiting game for the time being but eventually we need management’s confident narrative to translate into numbers. We need details on consumers, cross selling, integration specifics etc

I assumed the 23% growth (highest growth rate in 6 quarters) would lead to some more significant revenue growth but it didn’t. Safe to say I’m confused about the tech platform and am left striving for more in depth information from management.

Profitability

EBITDA rose 80% YoY thanks to a 23% margin.

Beat GAAP EPS estimate ($0.01 vs $0.00 estimated).

Tech platform recorded margin of 33% (4th consecutive quarter of +30% margin).

The highlight (as with last quarter) of the profitability discussion is all around the financial services segment that shows again it’s a very fixed cost business with low variables. For a $25.5 million revenue increase we saw $18 million of that go directly to contribution profit which is pretty remarkable. On a percentage basis we saw a 48.4% QoQ contribution profit increase compared to a 16.9% QoQ growth in revenue.

Financial Health

$2.33 billion in case (decrease of $800 million)

$3.1 billion in debt

Guidance

SOFI raised annual revenue guidance by 1.4% (beating estimates by 1.0%).

SOFI raised annual EBITDA guidance by 2.5% (beating estimates by 3.6%).

Projects 80% financial services revenue growth (vs 75% previously) and 17% YoY tech platform growth (vs 20% previously).

Conclusion

Although the stock didn’t react as well as I expected, this was a very strong quarter for SOFI with revenue beats, EPS beats, credit health confidence, member growth, product momentum, and margin expansion. I was a little meh about the Galileo and the revised downward guidance there, but overall it’s difficult to argue that SOFI aren’t executing well, especially in the challenging macro environment they’re currently in. If rates are cut in September which is predicted, we’ll likely see further acceleration in lending which will of course be huge for growth.

SOFI are building a company over the next decade, and I’m likely holding the stock over the next decade unless anything drastic changes. That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

Could you explain why the net income is so negative despite rising and positive Net interest income?

Thanks