Stocks I'm DCA'ing Into (Part 2)

TMDX MELI NU

Hi fellow investor👋

The markets are valued quite high now, especially amongst the more common names like Palantir and Tesla which are trading at some ridiculous valuations. I am owners of both PLTR and TSLA and have done very well from them, but there’s no time to wait around and enjoy the returns.

These are 3 stocks that I have started to slowly DCA into. I am being a bit more hesitant with the market right now as I think there is likely we get some move downwards. That’s why I’m DCA’ing on a bi-weekly or monthly basis into these👇

By the way this is the 2nd part of my article which I recently released. You can see the first part here:

TransMedics Group | TMDX

Introduction

TMDX, headquartered in Massachusetts, is a medtech company who created an innovative way to increase organ transplant success rates through their Organ Care System (OCS) technology.

OCS is a portable, warm perfusion technology that keeps organs as close to a living state as tech has allowed so far. This is much better than cold storage which is currently the traditional method where success rates are far lower.

The stock currently trades at $87 after falling from the $175 highs in August 2024, post a weaker Q3 earnings report. The earnings report wasn’t actually that weak in my opinion, hence why I have taken full advantage of this drop and am now DCA’ing on a monthly basis as long as the stock still trades around the 2023 levels.

Numbers

Revenue Growth: 63.72%

NTM EV/Sales: 6.1x

EBITDA Margin: 8.37%

Commentary

TMDX investors went into Q3 with extremely high expectations as the company have continuously crushed earnings ever for the last 2-3 years. These expectations were essentially what led to a +40% drop post earnings which is completely ridiculous, but excellent for someone like me who was dying to start a position.

Though TMDX management didn’t make it very clear, they did warn investors of a potential seasonal decline in US transplant volume. Hence when there was a 5% decrease in heart transplant volume, and a 3% decrease in lung transplant volume, I wasn’t too concerned like many others. The important part to realize here is that management said:

“We did not see any degradation of our market share or center penetration on all three organs.”

The other important part to note is that management have not changed their full-year guidance of 4,000 transplants at all, and in fact reiterated that they firmly expect to hit this figure. They also expect 10,000 transplants to be fully realistic within the next 3-5 years which would lead to revenues of ~$1 billion based on current fees.

So from a full-year outlook we have seen no evidence that a long term thesis should be damaged. Of course, as investors we need to be a little skeptical and keep close monitoring of these growth rates, but there’s no reason to panic and certainly no reason for a 40% price drop.

The other negative part of the report was increased maintenance costs and increased use of 3rd party logistics companies which put a lot of pressure on margins. Of course this wasn’t ideal but I have 2 main comments here:

It’s likely a one-off issue that won’t reoccur too much.

It’s proof that their business plan of controlling an entire aviation fleet is the right move.

I think it’s important to note that TMDX are still an early stage company and their logistics fleet is quite a new addition to the business model. This will only get better with time, knowledge, and experience.

Looking at multiples and comparisons to other medtechs (there’s no direct competition but I think ISRG and PRCT are worthy comps), TMDX are very undervalued.

Also, TMDX have the largest revenue growth of these companies listed above even despite having an EV/Sales considerably lower.

MercadoLibre | MELI

Introduction

MELI has seen a slight drop since Q3 earnings that prompted me to deeply dive into the company and initiate a position. The more I learn about MELI the more I see it as one of my favorite companies in the portfolio. I’ll give a very brief investment thesis in the commentary section.

As a note, these articles are not meant to act as deep dives and instead are purely to introduce my readers to new stocks with a bit of information about them. I’ll definitely start planning a deep dive into MELI soon. I have a lot to say on it.

Numbers

Revenue Growth: 35.27%

NTM EV/Sales: 4.2x

EBITDA Margin: 13.44%

Commentary

I think there’s a huge parallel between MELI and AMZN. MELI are obviously don’t have the scale in terms of width of portfolio, but I think they definitely have the potential to be the AMZN of LatAm.

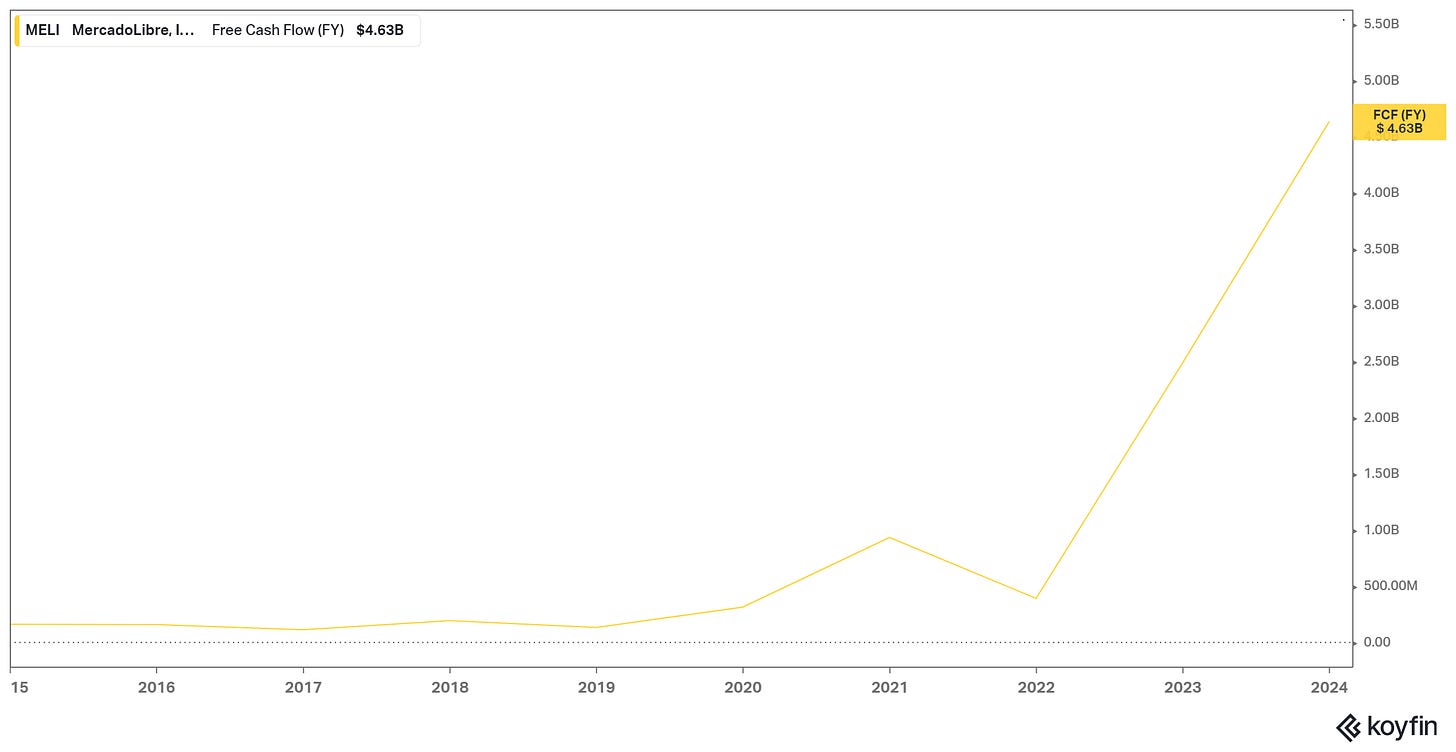

When you have such a large business that expands across as many verticals as MELI does, you have the potential to continue to expand pretty aggressively if free cash flow is high.

Geographic expansion, new products, portfolio additions, and efficiency gains are all very feasible when you’re generating ~$5B in FCF per year.

Currently, MELI’s portfolio consists of a leading marketplace and a very strong fintech division which gives them the ability to cross-sell very well. MELI are generating the data to know exactly what their fintech users are purchasing so they can target those consumer preferences with their marketplace, and alternatively, purchases on the marketplace can easily use Mercado Pago.

I do have a little worry that NU is so dominant in LatAm currently, but competition for NU and Mercado Pago is good. I think that’ll be something to watch closely as they both compete for market share in Mexico.

From a more macro point of view, Brazil are on the road to becoming the 8th largest economy in the world by 2050, up from 11th today. Of course there are risks with the LatAm political uncertainty, and various regulations, but I think the upside potential outweighs those risks and it’s well worth having a portion of your portfolio geared towards LatAm. My conviction in LatAm has increased the last few weeks particularly as I think the US market is valued so highly.

NuBank | NU

Introduction

Out of all the stocks I’m currently DCA’ing into (ASML, OXY, DKNG, TMDX, MELI, SBUX, & NU), NU is my highest conviction which is why this will be a deep dive before the 2024 year is over.

Subscribe here to make sure you don’t miss the best deep dive on NU yet.

Numbers

Revenue Growth: 56.56%

NTM P/Sales: 4.2x

Commentary

NU crossed 100 million customers in Brazil this year, meaning they’ve essentially got 78% of the adult population between 19-65 which is complete dominance. In Mexico, they added 1.2 million customers this quarter which means they added 13.4% of their entire Mexico customer base in just one quarter. Finally, in Colombia they’ve currently only acquired less than 4% of the population so the runway there is huge.

These are the only 3 companies that NU has started investing into but I’m sure in the near future they’ll be operating in Argentina, Peru, Venezuela, & Chile. This should show you the sheer size of customer acquisition opportunities they have ahead of themselves.

That’s the obvious expansion opportunity. The less clear one is the incredible cross-selling capabilities that NU possess, evidenced by ARPAC (average revenue per active customer) increasing 67% YoY in Brazil. ARPAC currently is $11, but the average amongst more mature accounts is $25 which does show managements ability to keep customers and essentially more than double their revenue through new products and increased engagement. This ARPAC figure will only increase over time.

All this growth potential for for just a TTM PEG GAAP of 0.10x. Very very good value.

If you can find me a fintech, growing at 56% YoY, with a market cap of $50B, with the expansion opportunities that NU offer, for a PEG of 0.10x, then please do let me know ASAP.

That’s it for today!

I hope you loved this article. Please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market. You can also follow me on X where I post 3-4x a day.