Tesla: Today's Reality or Believe the Optimism?

Let me know where you stand!

Hi fellow investor👋

If it’s your first time coming across my page then you’ve probably missed these articles from last month:

Introduction

This write up on Tesla (TSLA) wasn’t actually planned but I’ve been finding myself wanting to express my opinion on one of the most talked about stocks on the internet for a while and I thought post Q2 earnings was a great opportunity to do so. I bought TSLA back in early June 2024 at $170 after a lot of deliberation over the past 12 months. You’ll likely understand why I delayed my investment so much as you read this article but I’ll briefly sum it up in a sentence or two here.

For the last month or so, TSLA has been trading between a PE of 90x to 100x which is quite frankly insanity for the current reality of the business. If I showed you YoY highlights of revenue and margins without you knowing the company was TSLA, you’d never in a million years touch the company trading at the current valuation.

However, the exciting thing about investing is that the market is forward looking and there is arguably (lots to unpack) a significant opportunity for investors to get in even at today’s prices.

But the question is…how much can investors believe in the vision of the company, especially when we know that Elon Musk is a genius marketer?

Are the FSD and Optimus numbers that have been thrown around a possible reality? Or are they just hype that is temporarily keeping the stock up?

Currently, the market is pricing TSLA based on the former as a 100x PE can’t be justified for a struggling EV company.

Here’s a snapshot of analyst recommendations compared to the stock price. As you can note, today’s price is slightly ahead of analyst projections. Aside from in 2022 when prices dropped pretty drastically, analyst projections have been fairly accurate.

Anyway, let’s dive in. I’ll try to cover everything important in this article but here’s the outline if you want to jump around:

Q2 Earnings

Long Term Trends

EV Business

Energy Business

Optimus

FSD/Robotaxi

Conclusion

Reality: Q2 Earnings

Demand

Total revenue was $25.5B, exceeding analyst expectations of $24.8B.

This was a 2.3% growth YoY, considerably lower than inflation.

Automotive revenue down 6.5% from Q2 2023.

Total deliveries declined 5% to 444k, however we did see “other” model deliveries (including Cybertruck) rise 12%.

Energy revenue soared 99.7% from Q2 2023 now making up 11.9% of total revenue.

Profitability

EPS came in at $0.52 which missed expectations by $0.04.

However, excluding the one-time charge associated with Q2 severance costs for TSLA’s 10% layoff, non-GAAP EPS would have beat expectations by $0.04.

Gross and net margins improved 600bps and 500bps respectively, but margins YoY are down.

EV Business

The exciting parts to discuss about TSLA are of course Optimus and FSD, however, today’s reality is that we know so little about the future of those operations that it’d be naive to base our analysis completely on those segments. And the big players in the markets know this. The main driver of the stock right now will be the EV business which accounts for ~80% of profits. If you’re a TSLA bull and basing your entire investment case on the future unknowns then you’re purely gambling.

Here’s the reality of the core TSLA EV business right now:

The auto business is not performing well and management aren’t addressing it. In Q2 earnings call they spent just 30 seconds on the auto business. My guess is because they know anything more will take focus away from the future unknown potential of Optimus and FSD and refocus investors on the struggling auto segment.

Auto gross margins excluding regulatory credits are down at a 36 month low. (Regulatory credits are credits TSLA receive for free because they only sell EVs that they sell for profit to other automakers).

Auto revenue is down 6.5% YoY.

Competition is intensifying. TSLA had the first mover advantage but they’re not selling the most vehicles today.

With these pretty disastrous numbers there’s been no discussion on how management plan to stabilize margins or how management plans to convince more consumers to buy EVs. Sentiment around fully electric vehicles isn’t great right now due to lack of infrastructure, cost, and just all round hassle compared to traditional ICE (Internal Combustion Engine) users.

Although there’s clear growth of EV’s in the US, demand is quite evidently far behind the likes of China and even Europe. In many circumstances I’d be quite positive here because all this should mean is that TSLA has a huge opportunity in China to ride the EV wave that is happening now. With 1 in 5 new vehicle registrations in China being EV’s in 2023, this should be a huge opportunity for perhaps the most respected EV brand in the world.

However, there’s no guarantee that TSLA is going to dominate the China market. Here’s why:

There’s many China-based EV companies already operating there. BYD, XPeng, Nio, Geely just to name a few.

China is an ongoing geopolitical risk. There’s some doubts in there whether the CCP will even allow TSLA to successfully operate in China and outperform their own local EV companies.

There’s been rumors that TSLA are cutting back production in their Shanghai facility.

Beijing has doubled subsidies to consumers who purchase EV’s.

Despite the above negatives in China, TSLA sales in China are off to their best start in the last 5 quarters thanks to 0% financing promotions. They’re also offering 0%-2% financing promotion in the US which is positive. I’d prefer they do this rather than offer further price cuts as this doesn’t affect residual value.

The other positive I see for the EV business is TSLA’s entry into the more affordable $25k-$30k range which should begin by June 2025. This expands the TAM massively for TSLA and whilst there’s no data yet to support anything positive here, projections from management (have to take with a pinch of salt) are 2,770k units which is 50% above 2023 of production of 1,846k.

This 2,770k production projection does include the more affordable $25k-$30k range which will be able to be produced on the same manufacturing line as the current vehicle lineup. Current Wall Street estimates predict 2025 production of 2,073k and deliveries of 2,070k which is well below management expectations. I sense the figure we end up with will be somewhere between this range which will be a huge positive.

EV Business Recap

Of course over the long term, as an investor I do hope that the positives of the robotaxis will far outweigh all of the above negatives I discussed. However, we must focus much of our thesis on the above today as this is today’s reality.

Over the next two years or so unless we see any data come out about FSD efficacy or FSD take rates, the EV business will be the core driver of the stock. If trends continue like they are today, then I don’t see the stock being a huge winner up until 2025/2026. Only then I believe we will know more information on FSD and Optimus.

Energy Business

The TSLA energy business includes a variety of business such as solar panels, solar roofs, and consumer batteries. Over the last decade, investors have mostly ignored all “non-core” segments just because they are so minimal.

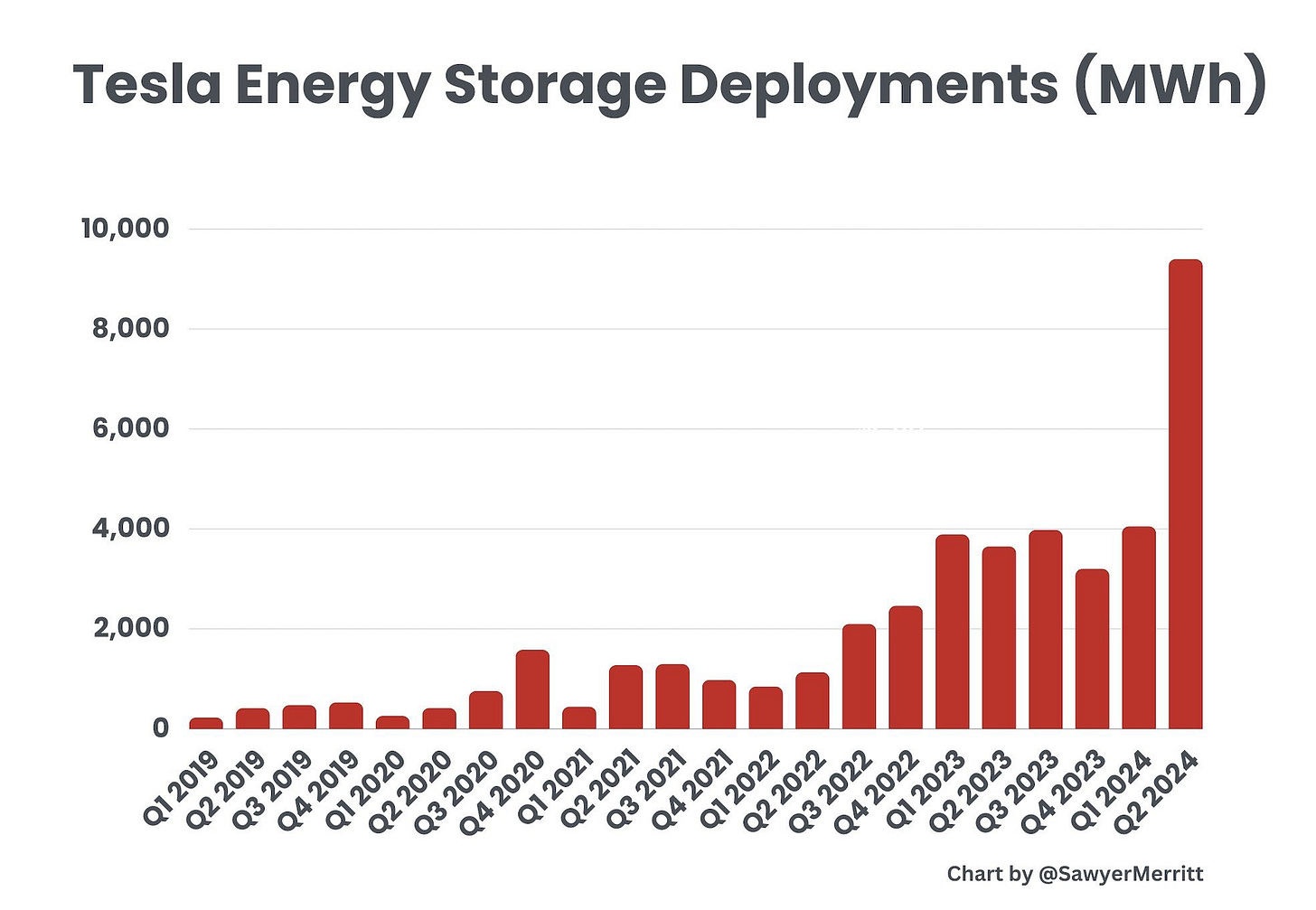

However, here’s the growth in terms of deployments QoQ from Q2:

Despite a 6.5% decline in auto revenue, total revenue ended up 2% due to the energy segment which grew 99.7% YoY which still has a very strong backlog of open orders:

“Energy storage deployments more than doubled with contributions not just from Megapack but also Powerwall, resulting in record revenues and profit for the energy business.

Energy storage backlog is strong. As discussed before, deployments will fluctuate from period to period with some quarters seeing large increases and others seeing a decline.” - Vaibhav Taneja (CFO)

This is the first quarter where I believe investors have really taken the energy business seriously and it’s one of the reasons why the stock is up 6% today (29th July). The only worry I have is that now investors will have high expectations for the energy business which management have openly said will be highly fluctuating.

Opportunities

Right. The exciting parts…!

It is becoming increasingly unlikely that TSLA will ever reach its previous growth rates (+70%) or margins with the EV business alone due to the headwinds we discussed above. This is why the below AI related projects are extremely important for investors to understand.

“Although the numbers sound crazy, I think Tesla producing at volume with unsupervised FSD essentially enabling the fleet to operate like a giant autonomous fleet. And it takes the valuation, I think, to some pretty crazy number. ARK Invest thinks, on the order of $5 trillion, I think they are probably not wrong. And long-term Optimus, I think, it achieves a valuation several times that number.” - Elon Musk

Optimus

Optimus really interests me. A few months ago I thought the idea of Optimus was never going to catch on but today I see the potential, though obviously remain cautious.

It’s really interesting to see a company who outsiders commonly label an auto company, that is actually an AI company, where the CEO says the biggest part of their valuation over the next decade will be humanoid robots…

“Optimus is already performing tasks in our factory…in 2026 we’ll be providing Optimus robots to outside customers…as I’ve said a few times, I think the long-term value of Optimus will exceed that of everything else that Tesla does combined.” - Elon Musk

Here’s why I started to see the vision for Optimus:

There’s tons of insight suggesting that the future labor market will be nothing like it is today. As Musk has spoke about a lot, he sees the skilled labor shortage being a much bigger issue to Earth than global warming. COVID led to 1.4 million manufacturing job losses, but the industry was already facing crisis with predictions that they’ll be at least 2.1 million unfulfilled jobs by 2030.

Further:

A study by Deloitte said 75% of manufacturing executives said their current biggest challenge is hiring and retaining skilled staff.

The ILO (International Labor Organization) estimates ~60 million new agricultural jobs are needed.

Korn Ferry reports by 2030 more than 85 million jobs could go unfulfilled because there’s not enough skilled people to take them leading to a $8.5 trillion revenue shortfall.

More than 50% of US workers will likely participate in the gig economy by 2027 rather than employed work.

What’s the solution to all this? Optimus/Robotics

The most likely scenario is that TSLA lease Optimus in the future when they become commercialized as they’ll aim for a recurring revenue. Robotics will allow businesses to increase productivity for a much lower total cost humans. I’m anticipating a hourly cost of ~$17.00 per hour which is far below the “all in” costs of hiring an employee when you consider taxes and insurance.

I don’t believe we’ll see Optimus commercially available anytime before 2031, though by that time they may be in full use within TSLA factories. Currently, there’s plans to have Optimus used internally in 2025.

Anyway, here’s some rough calculations to show the TAM and the potential.

1M Optimus bots in circulation (I think this is on the low end, especially considering Elon’s comments. But I want to be conservative).

$30k product cost per bot. That’s $5k annually when you amortize it over a 6 year life span.

$5k maintenance costs annually per bot.

At $17 per hour, 12 hours per day, and 360 days per year each bot could generate $73,440 in revenue.

This would be $63,440 in operating income.

With 1M bots in circulation, this is $63.4B in operating income annually.

Using a PE ratio of 65 (I think fully viable for TSLA), you have a $4.12 trillion valuation for Optimus alone with 1M humanoids in circulation.

I’m fully aware these numbers could all be fluff, but Musk has said multiple times that he eventually envisions more robots than people on Earth. If you consider the above numbers for hundreds of millions, or even billions of Optimus bots in circulation, then the figures get insane.

As with any future quest, there’s tons of challenges. China see themselves as the leading nation in the humanoid robotics space with projections of 2027 for fully commercialized bots. Then there’s the political and regulatory risks to consider as well which likely will be less of a challenge than FSD, but still very present.

The main competitors in this space are:

Apptronik

Agility Robotics

Figure Robots

Boston Dynamics

1x Tech

The Sanctuary AI

Unitree Robotics

Personally, I don’t see any of these being a huge problem for TSLA because of the ability to leverage TSLA manufacturing mastery, AI expertise, and capital raising ability.

Anyway, until we know more regarding the profitability of this project, it’s ignorant to consider Optimus a big part of the TSLA investment thesis today. Until we are provided with a lot more information on the product, the Optimus topic is just speculation to create enthusiasm amongst investors.

FSD / Robotaxi

Elon has been talking about FSD since 2016 now and there’s no doubt that huge progress has been made. They’re now on version 12.5 which has had some tremendous early reviews over the last 2 weeks or so.

TSLA are definitely approaching the 99.99% efficacy FULL-self driving capabilities that are so necessary but it’s still impossible to gauge exactly when this will be. For many years, the FSD project has been stuck in “beta” testing mode but now they’re labelling it “FSD supervised” which essentially means the driver may have to take control of the steering wheel occasionally.

Although this is an exceptional piece of technology, having a supervised FSD at ~95% efficacy will add almost no valuation to the business. An AI aided taxi service with the need for a human driver / “supervisor” would cost just as much as other taxi services out there such as UBER. So the project doesn’t work unless TSLA can achieve a full FSD.

I have full faith in TSLA being able to achieve FSD over the next 5-10 years, however here are my main concerns that I think will delay revenue generation further and perhaps cause some investor worries.

1. Strategy

TSLA’s strategy is very ambitious. They’re aiming to use the huge amounts of data to create vehicles that can be autonomous everywhere, whilst competitors like Waymo train their AI on individual cities with pre-structured mapping. Currently, Waymo is strong in Austin and LA but doesn’t have the ability to operate elsewhere.

TSLA train their models on radars and sensors, but they also cleverly use imitation learning where AI learns from decisions and behaviors made by the 4 million current TSLA owners globally who drive daily.

Chinese EV companies are also following the Waymo approach of being trained rigorously in specific cities where Robotaxi’s will eventually be launched. Although the Waymo strategy seems safer, if TSLA does have success then the financial benefits will be monstrous due to the scale that they’ll boast whilst competitors will be in no position to expand their operations.

This could mean that in many cities in the US and worldwide, TSLA basically has a Robotaxi monopoly. However, this potential success is years away. The reality today is that Waymo is noticeably ahead of TSLA in the race to FSD, though TSLA is playing the long game.

2. Legislation

The second hurdle for TSLA is regulatory approvals which have always been an issue in this industry due to the opposition from more traditional taxi services. My prediction is that Robotaxis will face even more opposition from taxi lobbyists, safety lobbyists, and even Elon Musk lobbyists.

However, because of TSLA’s sole strategy to be able to train robotaxis everywhere, legislation should be much quicker than Waymo. Vehicles are governed by FMVSS which is the same across all 50 states. Therefore, the ability to create a generalized solution should give the best opportunity for deployment across all states.

ARK Valuation

Earlier in the year, ARK came out with a $11 trillion market cap just for the Robotaxi business. It’s tough to back this up, but it does show the potential moving forward for the Robotaxi business. Market projections vary massively between $1 trillion (McKinsey) to $11 trillion which shows just how much of an unknown the future is. Tesla bulls are far too inclined to believe that a market cap of +$5 trillion is almost guaranteed which of course couldn’t be further from the truth.

ARK predicts robotaxi commercialization will begin by 2025 or 2026 latest. To me, that is absurd. To commercialize a product like robotaxis in 18 months is extremely unrealistic when we aren’t even close to 99.99% FSD efficacy. Although there’s a small possibility that technology may be ready by then, you’ve then got to consider a 12 month pilot program, plus another 12 month regulatory approval process if everything runs smoothly.

McKinsey (https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/spotlight-on-mobility-trends) predicts commercialization in 2028 which seems far more appropriate.

The Vision

Though at least 4-5 years away in my opinion, I do clearly see a vision for the Robotaxi segment and that’s one of the key reasons why I invested in TSLA.

To me, the vision surrounds a shift from private car ownership to mobility-as-a-service (MaaS). McKinsey see this vision too and estimate that the total cost of transportation will decline by 30%-50% compared to private vehicle ownership and about 70% compared to today’s traditional ride-hailing services like UBER.

I see TSLA being the key player in the autonomous revolution for transportation that makes private transportation accessible to many classes of consumers who have always only been able to afford public transportation.

Conclusion

The main message that I wanted to get across in this article is that the current TSLA business is not good. It’s nowhere near deserving of a 90x Fwd PE and if you don’t see the visions in Optimus and FSD that I outlined above then you need to sell ASAP and take your profits now.

If you do see the Optimus and FSD vision, my advice is to hold TSLA for at least a decade but be very prepared to accept if you are wrong and withdraw your funds quickly. We’ve seen many times over the last 5-7 years that Elon has consistently hyped up projects only to delay them over and over again.

Currently, we have absolutely no data to suggest that the Robotaxi or Optimus projects will be any success at all. It’s a gamble, but to me to the risk to reward is enormous even if one of those projects become half the success that they are expected to be.

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

Disclaimer

Disclaimer: The Accuracy of Information and Investment Opinion

The content provided on this page by the publisher is not guaranteed to be accurate or comprehensive. All opinions and statements expressed herein are solely those of the author.

Publisher's Role and Limitations

Make Money, Make Time serves as a publisher of financial information and does not function as an investment advisor. Personalized or tailored investment advice is not offered. The information presented on this website does not cater to individual recipient needs.

Not Investment Advice

The information found on this website should not be interpreted as investment advice, nor does it express any viewpoint on the future trading prices of any company's securities. The opinions and information shared here should not be taken as specific guidance for making investment decisions. Investors are encouraged to conduct their own research and evaluations based on publicly available information, rather than relying on the content herein.

No Offer or Solicitation

The content, including opinions and expressions, present on this website, is not a direct or indirect offer or solicitation to buy or sell securities or financial instruments mentioned.

Forward-Looking Statements and Uncertainties

Any forward-looking statements, projections, or market forecasts contained in this content are inherently uncertain and speculative. They are based on certain assumptions and may not accurately reflect actual future events. Unforeseen events might impact the performance of discussed securities significantly. The provided information is current as of the preparation date and might not apply to future circumstances. The publisher is not obligated to correct, update, or revise the content beyond its initial publication date.

Position Disclosures

The publisher, its affiliates, and clients may hold long or short positions in the securities of companies mentioned. Such positions are subject to change without guarantee.

Liability Disclaimer

Neither the publisher nor its affiliates assume liability for any direct or consequential losses arising directly or indirectly from the use of the information provided in this content.

Consent and Agreement

By accessing the site or affiliated social media accounts, you signify your agreement to this disclaimer and the terms of use. Unauthorized reproduction of the content, whether through photocopying or other means, is unlawful and subject to legal consequences.

Website Ownership and Terms

Make Money, Make TIme is operated by Substack. By accessing the site, you agree to adhere to the current Terms of Use and Privacy Policy. These terms are subject to potential amendments. The content on this site does not constitute an offer to buy, sell, or subscribe to securities where prohibited by law.

Regulation and Investment Guidance

Make Money, Make Time is not an underwriter, broker-dealer, Title III crowdfunding portal, or valuation service. The site does not provide investment advice or transaction structuring.

Make Money, Make Time does not validate the adequacy, accuracy, or completeness of information provided. Neither the publisher nor any associated parties make any warranties, explicit or implied, regarding the information's accuracy or the use of the site.

Investing in securities carries substantial risk, and investors should be prepared for potential loss. Each individual should independently assess whether to invest based on their own analysis.

I like your conclusion, Oliver. I've never owned Tesla except through QQQ and am not going to buy the stock any time soon.

Tough to bet against TSLA, or anything that Elon touches for that matter.