The AI Power Race: 3 Biggest Winners

Hi all 👋

When people think AI, they picture complex algos, chips, flashy tech. What gets mentioned the least is the fuel that ultimately makes all of this possible: electricity.

AI data centers draw huge amounts of power and as the race to build out data centers intensifies, there’s a select few number of complete necessities to allow this all to happen. Think cybersecurity infrastructure, network connectivity, cooling and above all electricity.

The issue today is that the traditional US grid as some may know it today wasn’t designed for the data center future. This is where the massive opportunity lies today.

I often say the best industries to invest in today are:

Electricity

FinTech

AI Applications

Quantum

Robotics

Today, we’re completely focused on the electricity & AI power industry with my 3 favorite stocks.

The Second Wave of AI

In my spreadsheet for paid subscribers (please see link below), I’m building a huge list of stocks ranked by valuation in the most exciting niches.

Over the next week, I’ll have built my own list of 100+ stocks (including those in my portfolio) ranked my revenue growth to sales multiple and EBITDA growth to EBITDA multiples.

I’ll also find those close to the 200MA to find those with the best potential for a huge breakout.

So far, I’m up 50% on ONDS, 240% on SOFI, and 60% on LMND. The next wave of AI will likely introduce us to even more spectacular gains.

Join us here for $16 a month. Less than the price of 2 coffees.

The AI Power Race: 3 Biggest Winner👇

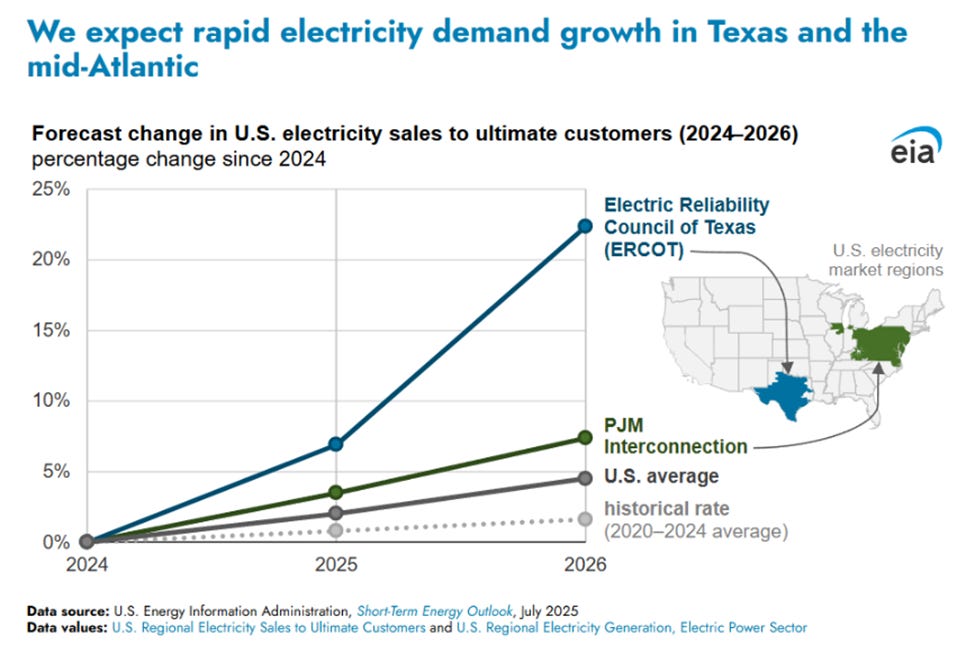

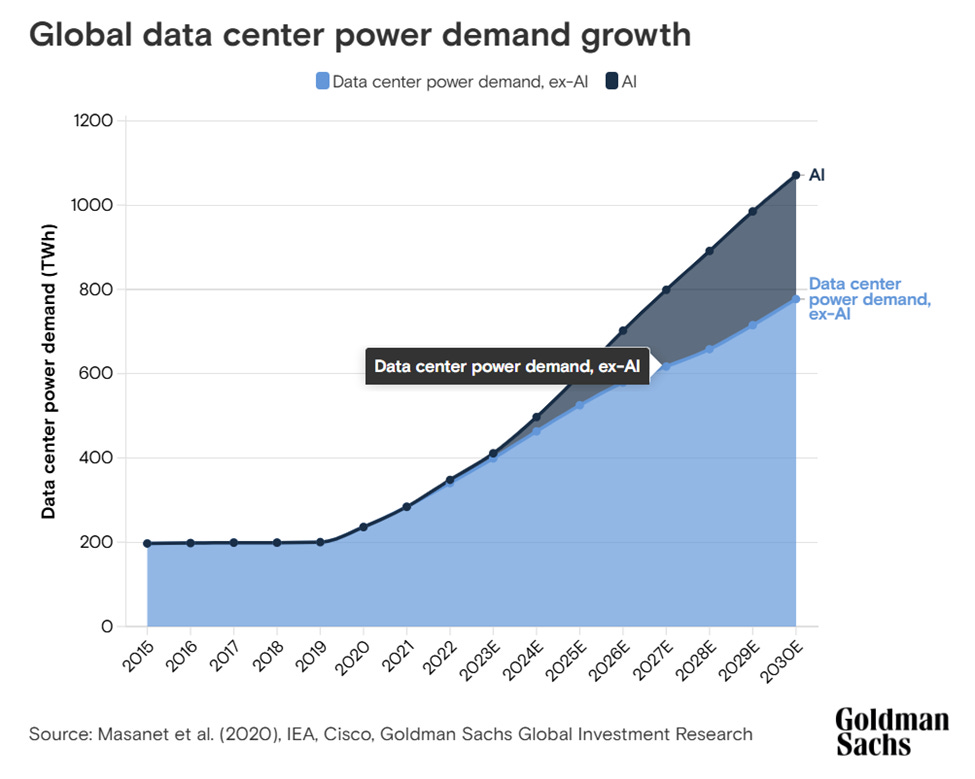

In 2023, data centers consumed ~4.4% of total US electricity but that figure is set to be upwards of 11-12% of total US electricity consumption by 2028.

Globally, the International Energy Agency (IEA) projects electricity usage from data centers will double by 2030.

It’s clear data center demand is massive. It’s why we’ve seen NBIS up 223% YTD and CRWV up 204% YTD. The big opportunity though sits in power.

Here 3 of my favorite AI power plays 👇

#1 Solaris Energy Infrastructure | SEI

Introduction:

SEI provides mobile and scalable solutions for:

Distributed power generation.

Logistics and fluid management.

Their service lines include:

Power as a Service: Rapid and portable mobile generation.

Logistics solutions: Last-mile delivery, proppant management, fluid handling systems.

Industry applications: Data centers, industrial facilities, oil & gas, microgrids.

The key difference between SEI and other power generation firms is that SEI is not a utility or large-scale company. Instead, they’re an equipment, service & logistics provider. Since many data centers need reliable backup power, fluid handling, or logistics operations, there’s a very strong demand for SEI’s offerings.

Ultimately, data centers aim for 99.999% uptime so SEI PaaS model is a critical backup requirement for many operators.

Numbers & Q2 Updates:

In Q2:

Revenue was up 102% YoY to $149M. This was also a 18% increase from Q1.

EPS came in at $0.34 which was a 161.5% increase on Q2 2024.

Q2 saw very strong top-line growth, particularly in their PaaS segment.

Growth Drivers:

SEI targets 1,400 MW of operated capacity by 2027, with the majority of that tied to data centers. Analysts forecast US data center demand to double over the next 5 years as the AI wave continues to unfold. As part of this 1,400 MW target, SEI have signed a 900 MW JV with xAI.

As I mentioned above, for data centers uptime is the most important metric and SEI allows uptime to be as close to 100% as possible. Any single outage essentially can corrupt workloads and lead to millions of dollars lost in compute cycles.

Currently, traditional grids are 99.9% reliable (in terms of hours of downtime per year), but hyperscalers at the scale they are operating require 99.999% (less than 5 minutes of downtime per year). This is where SEI comes into play by essentially selling layers of insurance against downtime/failure through hardware redundancy, hybrid microgrid design, and modular scaling.

As hyperscalers continue to invest in CapEx and the MW increases, so will the requirement for 99.999% uptime.

Valuation:

SEI currently trades ~3.3x NTM sales, and 7.6x NTM EBITDA which appears very cheap considering the growth. Analysts expect 78.1% growth in FY25 and 25% in FY26 (revenue) and 122% growth in EBITDA in FY25 and 56% in FY26.

These growth rates to multiples appear very attractive making SEI potentially quite an undervalued and under the radar play relative to some of the bigger names in the power space such as OKLO for example which trade for very premium multiples.

Technicals:

Given the fundamentals, I don’t feel the need to look into the technicals too much here. SEI is definitely very high on my watchlist and I think a buy around the blue circle will serve well over the coming years.

#2 Constellation Energy Corporation | CEG

Introduction:

CEG is the largest producer of carbon-free electricity in the US and is headquartered in Baltimore. Approximately 70% of the 32 GW generation capacity comes from nuclear and the rest comes from natural gas, hyrdo, wind, solar, and energy storage. The nuclear fleet alone powers ~20% of all US nuclear generation making them the single largest source of carbon-free electricity in the country.

Current clients include the large hyperscalers such as MSFT, AMZN, and GOOGL.

CEG is the only stock out of the 3 here that I currently own in my portfolio.

Numbers & Q2 Numbers:

In Q2:

Revenue was up 11.3% to $6.1B.

GAAP EPS reached $2.67 which was a 3.5% increase on Q2 2024.

Nuclear generation was slightly down in Q2 to 45,170 GWh due to unplanned outages.

On the more positive side CEG announced:

20 year deal with META beginning in 2027.

Acquisition of Calpine is expected to close in Q4 2025.

$400M share repurchase program.

Growth Drivers:

CEG are the go-to company for many of the hyperscalers with contracts with META, MSFT, and AMZN allowing them to reap the rewards of the huge CapEx seen by these trillion dollar companies. Combining this with policy tailwinds under the Inflation Reduction Act, and reshoring, AI, & electrification trends, the demand for US’s largest nuclear power generator will remain very strong.

From an investor point of view, CEG currently have a 94% capacity factor (this essentially measures how efficient they are). CEG have invested heavily into digital optimization through digital twin modelling and AI dispatch systems to optimize plant operation under varying loads and market conditions. This in turn should lead to improved margins.

Valuation:

From a sales perspective, CEG trade very cheaply but from an EBITDA and PE perspective they’re slightly more expensive relative to peers like NEE, SO, and DUK. However, they are the largest player and deserve to trade at a premium.

In FY25, CEG are set to grow EPS by 9.1% and in FY26 analysts expect 18% growth. This makes the 33.8x 2025 EPS figure seem on the pricier side but if you compare to peers you have:

NEE trading at 19x EPS for 7.3% growth.

DUK trading at 19x EPS for 6.1% growth.

NRG trading at 20.1x EPS for 20.7% growth.

NRG is probably the only one that appears to be a better valuation than CEG, though CEG has a steadier growth and is much more anchored in the carbon-free power generation niche which deserves a premium.

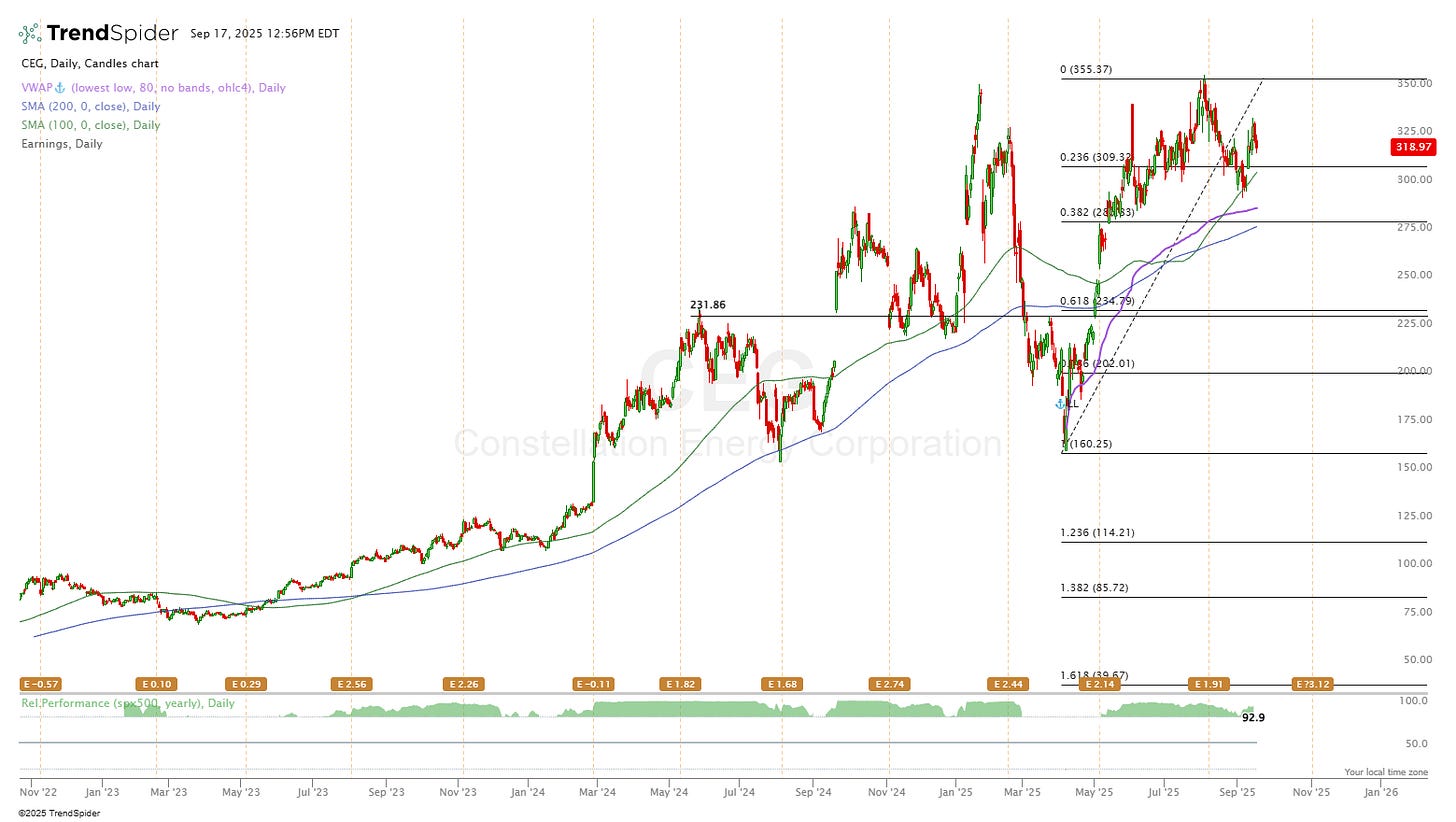

Technicals:

Technically, CEG looks like it’ll continue to the downside a little bit perhaps to the 0.382 fib level. I already have a nice position in CEG so am not rushing to invest at any point just yet but if CEG pulls back to $275 I may consider a position.

#3 Ormat Technologies | ORA

Introduction:

ORA is a vertically integrated global renewable energy company with a focus on geothermals and waste-heat recovery with an expanding energy storage division to giving them nice exposure to the lithium-ion battery niche too.

Traditional grid power takes year to connect, but ORA delivers carbon-free electricity at source making it extremely attractive for fast data center production.

Numbers & Q2 Updates:

In Q2:

Revenue jumped 9.9% to $234M. Estimates from Tikr suggest revenue growth should remain in the double digits until the year end.

EPS was $0.48 (vs $0.40 in Q2 2024) marking a 20% increase.

Maintained guidance at

Product revenue increased 58% and energy storage revenue increased 63% whilst electricity revenue (makes up most of the company) fell 4% (mainly due to maintenance). The backlog remains robust at $263M and $300M in development funding has been secured.

ORA recently bought a Nevada based plant to expand their geothermal footprint adding 3.5MW of capacity which is expected to add ~$4M in EBITDA in 2H 2025. This is a small % of the $293M in EBITDA expected in 2H 2025.

Geothermal Power:

Geothermal power taps heat from the earth to make electricity. This makes it firm, 24.7 power, low-carbon “baseload”, and a high utilization vs wind and solar. For these reasons, it’s expected that the geothermal market will grow ~5% CAGR through to 2030 to reach approximately $15B.

Peers in the space are Boralex (CA), Calpine (US), Enel Green Power (Mexico), KenGen (Kenya), and Pertamina (Indonesia). The installed global capacity today sits ~16.9 GW and ORA is currently generating 1.6 GW (1.27 GW in geothermal & solar) making them one of the largest geothermal operators globally.

Valuation:

BLX definitely isn’t cheap at the moment trading at 8.09x Q3 2025 sales, 13.6x EBITDA, and 40.2x PE whilst set to grow revenue at 2.5%, EBITDA at 4.8%, and net income at 58%. If you look at this purely from a revenue and EBITDA picture, it’s likely far too expensive, but from an EPS perspective we have +45% growth expectations in 2026 for a 74x 2026 PE multiple which isn’t as bad.

Personally, I’d consider an investment at ~$70. At that level, the market cap would be $4.25B which means they’d be trading at 56x 2026 EPS which seems a lot more feasible given the 46% expected growth in EPS over the next 18 months.

Technicals:

Because of the current valuation, I wouldn’t consider making a small purchase until we see that blue circle, but even at that level I would likely only make a small purchase. I’d much prefer to see the price come down to the MA convergence, or even the lower support ~$60.

That’s it for today!

I do hope you enjoyed this article. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

👏👏👏

I prefer Bloom Energy.