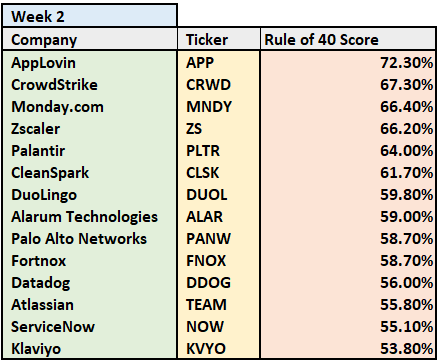

The Best Rule of 40 Stocks

Rule of 40 ABOVE 50%

Hi fellow investors!👋

I’ve recently started releasing a short article every Monday with a few quick screens and the results of those screens. For example, I’ll focus on margin expansion, revenue growth, dividends, international growth stories, small caps, large caps, valuations etc etc. It’s a way for us all to introduce ourselves to some potential new gems. Depending on the screen results I’ll then give a bit of information on 3 or 5 of those stocks.

The narrative on the stocks won’t be in depth because I want to keep these article short and snappy and save the details for my deeper dives. Of course if any of these stocks that come up in my screens really interest me, then I’ll do a deeper dive on them at a latter date.

Here’s the details of my screen this week:

Rule of 40 Score: Greater than 50%

Market Cap: Greater than $500M

Note: I excluded any Biotech and Pharma companies because I don’t know much on these and deem these industries too risky for my liking.

Results:

There’s some very interesting companies in here. Those that I’ve touched on before like PLTR, DUOL, APP, and ALAR, and those that I’ve done very limited research on which I guess is the whole point of doing these screens to introduce us all to new companies with high potential.

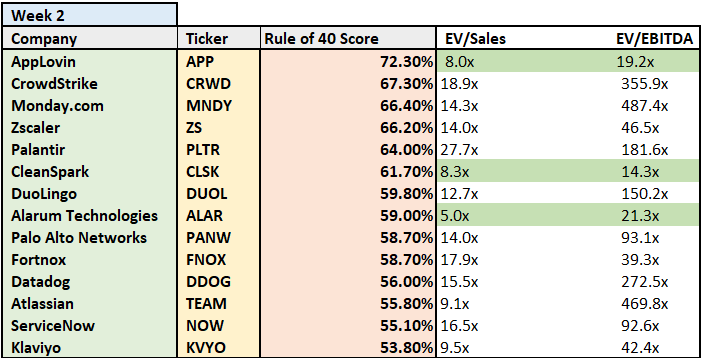

To find the 3 stocks that I want to discuss a bit further, I noted the LTM EV/Sales and LTM EV/EBITDA multiples. See below:

Of course these aren’t like-for-like comparisons, but they do give some insight into valuations. The 3 stocks I’ll focus on in this article are therefore APP, CLSK, and ALAR. I’ve (briefly) touched on ALAR and APP before but never have done in depth research on CleanSpark.

AppLovin (APP)

Company: AppLovin

Ticker: APP

Website: https://www.applovin.com/

Current Stock Price: $86.03

52-Week High: $87.93

52- Week Low: $36.26

Market Cap: $26.86 billion

Headquarters: Palo Alto, California

Number of Employees: 1,731

Introduction

AppLovin is a SaaS company that operates in the mobile ad tech industry, predominantly in the mobile gaming segment. It wasn’t until 2023 that they really made a strategic decision to put full focus on the software industry because the Apps business (in which they own ~150 free mobile game apps) began to stagnate.

The primary reason for the rapid shift towards becoming a SaaS player was due to AXON 2.0, which is APP’s AI-based ad recommendation agency. The platform generated a 75% YoY growth in the recent Q2 earnings and EBITDA growth of 91% YoY.

Primary customers of APP’s software platform are various game developers, as well as the big players such as Meta and Google. It’s an exciting time for the mobile ad business in the midst of a AI/personalization revolution which is a huge tailwind for a stock like APP.

Numbers

Q2 revenue reached $1.08 billion which was a 44% YoY growth from Q2 23.

Gross profit margin and net margin both expanded in Q2 to 73.8% and 28.7% respectively.

The software platform now makes up 65% of total revenue, compared to 49% 15 month ago.

Investment Thesis

There’s one main competitors in the mobile ad tech space and that’s Unity. However, they are going through a very difficult reorganization period which has led to a -16% YoY revenue reduction, compared to APP’s 44% growth. APP have quickly become the clear leader in an industry with lots of tailwinds.

The tailwinds are mainly all a result of technology advancements which adds personalization to ads leading to more converts and more revenue generation. Advanced AI models make the bidding process a lot more effective and this is where AXON 2.0 wins. Client campaign goals are being met with greater speed, efficiency, and on a much larger scale.

Outside of the SaaS platform, AI is being used creatively to generate better quality games as well as better monetization within those games.

Further, this quarter APP has expanded outside of the mobile gaming industry into e-commerce where merchants with a website can purchase APP’s in-app inventory. This won’t really make an impact to the numbers in 2024, but management have so far suggested that data is strong and TAM should be vastly improved with this strategic move.

On a valuation front, the stock is trading at 8.0s LTM EV/Sales which seems extremely cheap considering growth rates are currently in the 40% range and expected to be maintained in the 30% range. The market clearly doesn’t believe this is possible otherwise APP wouldn’t be trading at such a compressed valuation. This must clearly be because there’s a risk that ad spend comes under pressure as macro conditions weaken. However, management’s revised upwards guidance and comments around Q3 trends so far suggest this isn’t the case. I’d imagine that if market wide conditions remain stable, a beat in Q3 of the revised management guidance should get rid of this risk and we could see a good surge in the stock price.

CleanSpark (CLSK)

Company: CleanSpark

Ticker: CLSK

Website: https://www.cleanspark.com/

Current Stock Price: $11.95

52-Week High: $23.4

52- Week Low: $3.47

Market Cap: $2.94 billion

Headquarters: Henderson, Nevada

Number of Employees: 131

Introduction

CleanSpark is a Bitcoin mining company that operates by utilizing renewable energy sources like solar and wind to power the mining operations. The aim is to reduce the carbon footprint that is notoriously associated with bitcoin mining activities.

It’s been a challenging period for bitcoin miners post the April halving event as essentially the same amount of work needs to be done for half the reward…though the BTC price appreciation post halving obviously counteracts this to a certain degree. CLSK now hold 6,154 BTC which would have a market value of ~$363.6 million today.

For mining companies, it’s all about increasing the hashrate and CLSK are doing this by acquiring mining facilities. In June 2024, they announced the acquisition of 5 new BTC mining facilities in Georgia which adds ~60 MW of infrastructure.

Numbers

CLSK reported a $119 million fair value gain on BTC in Q2.

Revenue increased 128.7% YoY

Investment Thesis

Let me start this brief section by saying I likely will never own a mining company like CLSK. Whilst I see the benefits of owning miners because they generate bitcoins at a significant discount to the spot price and ultimately then profit substantially more. As an investor in miners, you are essentially buying exposure to their holdings of BTC at a discount which is great. However, miners are essentially a riskier investment than BTC which is a risky investment in itself. I own BTC and if BTC appreciates in price the way I hope it will, then I’ll make a lot of money. It’d likely be less than what I’d make owning a company like CLSK, but the risk of BTC going down in price combined with BTC halvings makes CLSK just too risky…even for me.

I do believe CLSK has a strong future as they’re one of the few miners that are performing well post halving. This should provide investors with belief that they’ll continue to perform very well. But just look at a competitor like MARA which has gone down almost 30% YTD, despite BTC’s surge. It’s too risky of an industry for me.

I like BTC and I’m a happy holder of BTC. There’s no need for me to dive into miners.

Alarum Technologies (ALAR)

Company: Alarum Technologies

Ticker: ALAR

Website: https://alarum.io/

Current Stock Price: $21.50

52-Week High: $45.66

52- Week Low: $2.48

Market Cap: $160.9 million

Headquarters: Tel Aviv, Israel

Number of Employees: 52

Introduction

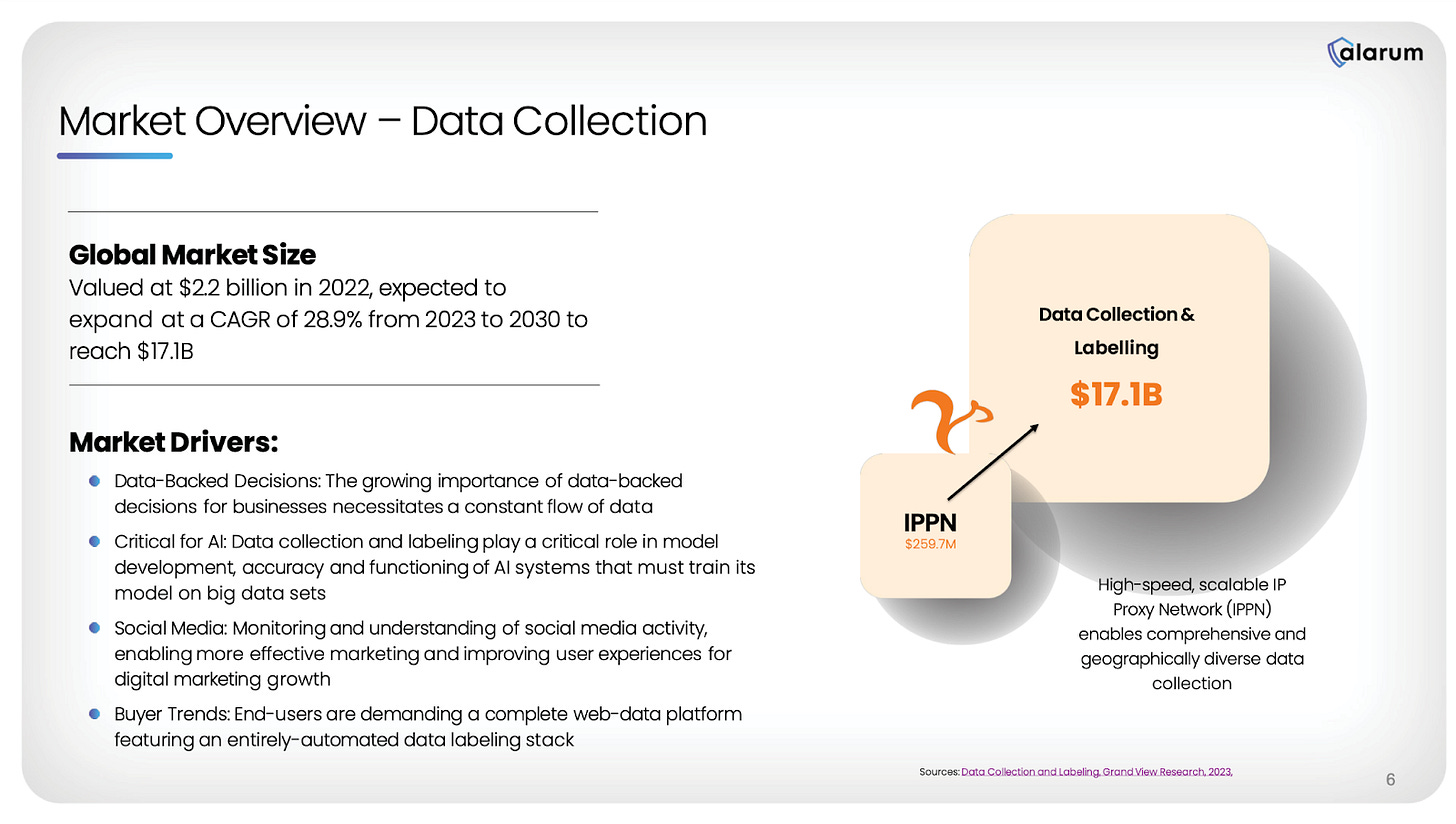

ALAR is a global SaaS company operating in the Enterprise Web Data Collection market, providing services for complex data collection. With AI advancements, there’s becoming a high demand for rapid and accurate real time data collection to allow for data-driven decision.

ALAR own NetNut which now makes up +95% of all ALAR revenue. The problem with data collection is that data is never all in the same place/ Some may lie in corporate databases, and some may lie in faraway files or websites. This is where NetNut comes in. NetNut allows users to collect data from public web sources whilst maintaining anonymity, privacy, and high-speed access.

However, it’s not just a passive web browsing data collection tool. It’s a very clearly defined, instruction-driven product that accesses the specific data needed to train models, and turns that unstructured data into a structured format.

Numbers

Revenue for Q1 2024 was $8.4m, up 47% YoY from Q1 23.

Gross profit increased to $6.5m which is 75% up from Q1 2023 of $3.7m.

ALAR stopped their cybersecurity loss making segment which increased gross margin to 78% from 66% 12 months ago.

Net retention rate of 166%

Investment Thesis

After a 1,500% price increase over the last year many investors think they’ve missed the boat but if we dig in to the numbers, I’d have to disagree. ALAR is a SaaS company trading at ~16.6x Fwd P/E with revenues estimated to grow at 90% next year. Compare this multiple to companies like Snowflake (SNOW) which trades at 13x P/S (not P/E) with ~25% predicted revenue growth and you’re all of a sudden thinking ALAR is massively undervalued.

Driven by AI, the data collection market is growing at incredible rates expected to hit $17 billion in 2030 ($2.2 billion today) meaning an annual CAGR of 29%. I don’t have any specific numbers on market share just yet, though I will add to this investment case at some point in the near future. But simply looking at gross margin expansion (139% YoY), it’s pretty evident that ALAR has some nice pricing power in the market. There’s certainly no issue with the demand.

On top of this, ALAR have recently launched new products including their first data collection product called SERP Scraper API, their first Website Unblocker, and a new AI data collector product line. Although these are all in early stages, it’s evident that management are still “playing to win” as I like to see. I don’t think we will see much revenue impact over the course of 2024, but certainly in 2025 these products will continue to keep revenue growth extremely high I believe.

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

I look forward to SentinelOne being on this list! 😅