The Entire Robotics Ecosystem

The Backbone & The Frontier

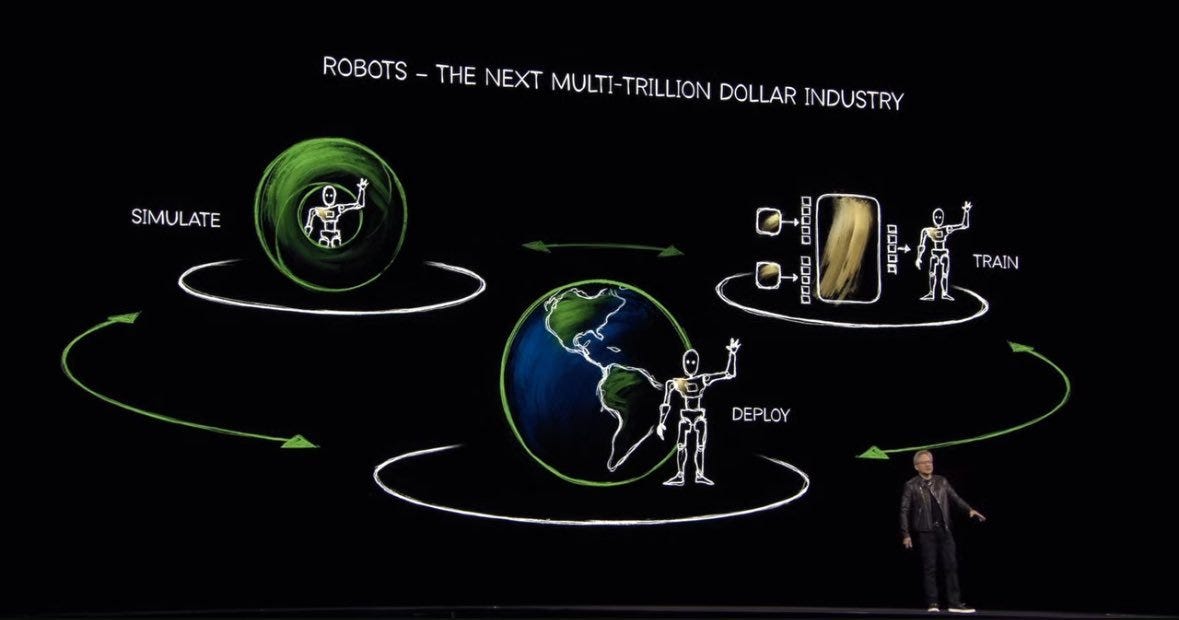

Physical AI has always been the end goal. This is the perfect form of using AI to do actually useful things that increase productivity.

"The era of robotics is here. Billions of robots, hundreds of millions of autonomous vehicles, and hundreds of thousands of robotic factories and warehouses will be developed.”

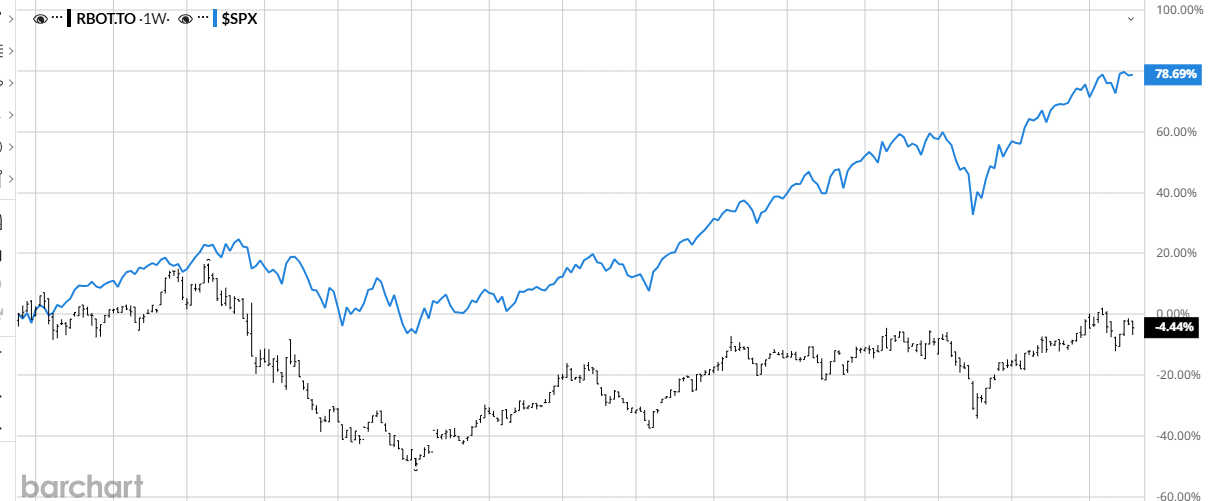

It hasn’t been the easiest theme to invest into over the last year or so outside of the compute layer (i.e. NVDA for example). For example, here’s the Gx Robotics & AI Index ETF. This holds stocks like SYM and ISRG though it does also hold stocks that I wouldn’t include in a pure play robotics ETF so it’s not as accurate as I’d like it to be…but the idea is there.

Anyhow:

RBOT ETF -4.4% over the last 5 years.

SPY 78.7% over the last 5 years.

Content

The Backbone Of The Robotics Ecosystem

Actuation / Bearings

Stocks To Invest In

Sensory / Perception

Stocks To Invest In

Software / AI Integration

Stocks To Invest In

Compute

Stocks To Invest In

Motion Control

Stocks To Invest In

Manipulation / End Effectors

Stocks To Invest In

Communication

Stocks To Invest In

The Frontier Of Robotics

Medical Robotics

Stocks To Invest In

Defense Robotics

Stocks To Invest In

Logistics Robotics

Stocks To Invest In

Humanoid Robotics

Stocks To Invest In

Industrial Robots

Stocks To Invest In

Other

Stocks To Invest In

Maybe investing in robotics 5 years ago was too early, but it’s always been a question of “when” and not “if”. I think finally we are getting to a period where the companies we want to invest in are hitting a key inflection point, whilst being at fairly depressed multiples, in a period where Trump wants to start pushing robotics forward far more.

There remains a huge amount of evidence suggesting the next 2-3 years are going to be key for Physical AI. We think this “tipping point” is coming and when that point arrives stocks like OUST won’t trade at 6x sales, nor will SYM at 2.3x sales. This is why I think it’s important to have this deep research now.

The Backbone of the Ecosystem

These are the boring “picks and shovels” plays that nobody talks about, yet there are huge rewards to be gained here. I spent days going through the entire robotics supply chain and the main takeaway was…China and Japan currently dominate.

However, as paid subscribers will know I focus mainly on the US market, with potentially some European exposure as well. I don’t want to focus too much on the Chinese markets for a couple reasons:

Many of my readers are based in the US and cannot invest in China or Japan.

China and Japan present a lot more risks than I can fathom.

Note I do invest in Alibaba (BABA) and at the time of writing this am currently up quite substantially…though I fully appreciate the risks of investing in China at the moment and don’t want to overexpose myself.

On January 1st 2026, I’ll be releasing my new spreadsheet for the year. Just like with the 2025 spreadsheet, it includes my exact portfolio, watchlist, and valuation models all for $16 a month.

The main difference is my Investing Universe tab which I have broken down by theme. If you want to see all the robotics stocks for example, then head to the robotics tab and you’ll see clear breakdowns ranked by valuations.

I will be upping the price in mid-Jan so if you’re considering becoming a paid sub, now is the time.

Note: There’s likely a lot of crossover in the stocks listed below in “The Backbone Of The Ecosystem” section. A lot of these plays are not pure play robotics but instead are positioning themselves very well for the wave. A few stocks in the “actuator” section may also be key players in the “motion control” section as well.

Actuation & Bearings

These are the robots’ muscles. Without them robots are essentially just a very intelligent statue. Together, actuators and bearings essentially form the foundational mechanics that convert electrical energy into motion.

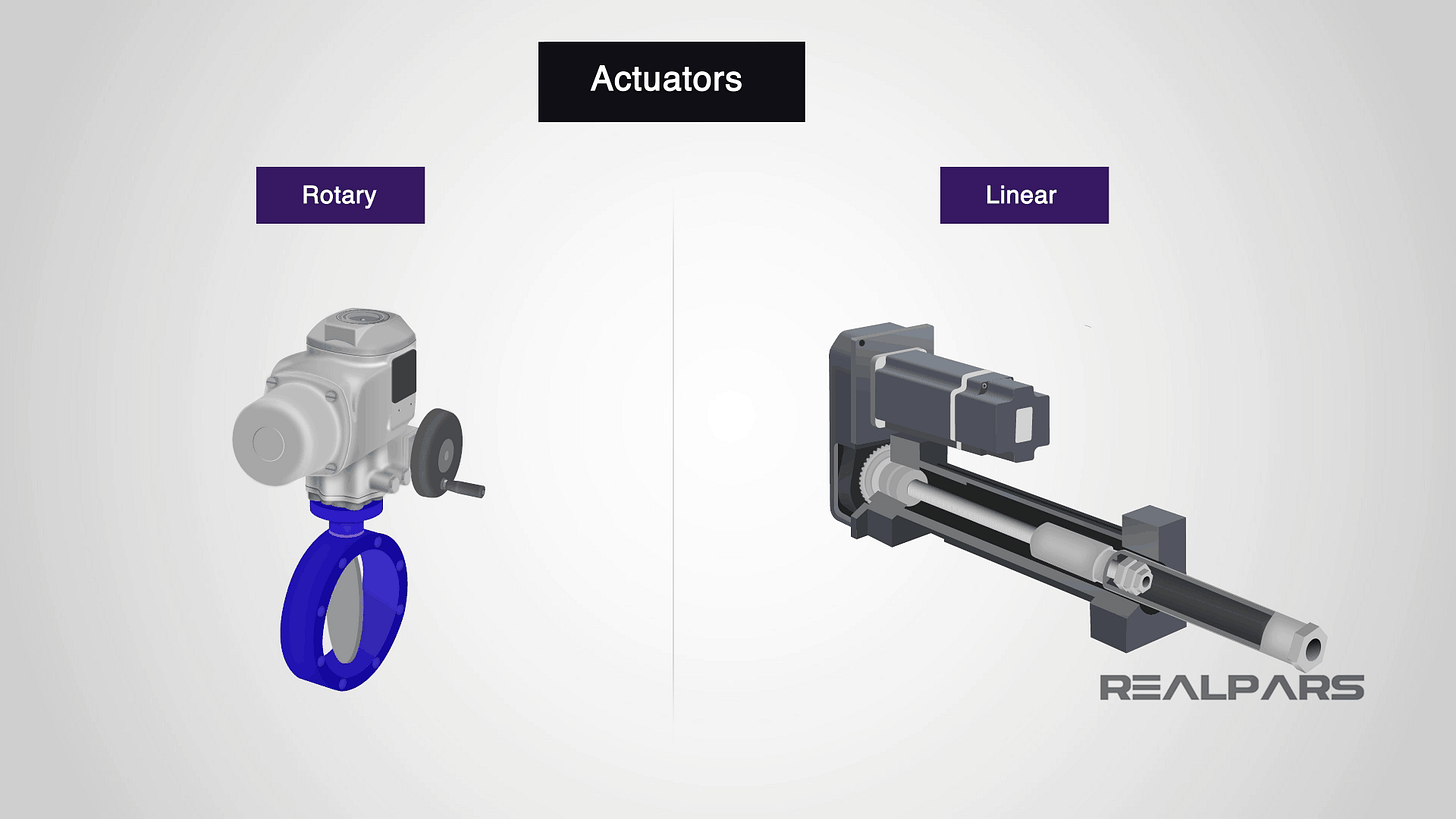

Actuators

You’ve got rotary actuators which spin, and linear actuators which move forwards and backwards. They take the actual electrical energy and turn it into physical motion.

Rotary Actuators: Great for a “swinging” motion (shoulder or an elbow). Generally, they’re much cheaper and simpler.

Linear Actuators: They extend and retract (bicep or quad muscle).

Linear actuators are where the bigger money is. These are the high end mechanisms that allow a robot to squat, jump, or lift for example. These command significantly higher margins than standard motors because very few companies manufacture them at scale.

Bearings

All of this movement creates massive amounts of friction. If metal rubs against metal, the robot destroys itself in minutes. This is where bearings come in. They act like the lubricant in a door hinge for example, making sure everything glides smoothly without loss of energy.

I’m no engineer so I’m not going to pretend to understand everything here. But the important message I want to get across to you is that as robots become more complex, i.e. more nimble with higher degrees of freedom (how many different ways the robot can move), the necessity for:

More actuators and bearings

More linear actuators (more expensive with higher margins)

Importantly, you must understand the hardware deflation cycle. Over time these will all become commodities over time just like GPUs will. When something becomes a commodity, it becomes standardized and it essentially becomes a competition on who can sell it the cheapest. Prices drop and it becomes much harder for companies to stand out through unique engineering or charge a premium price.

As an investor, it’s therefore important to understand:

Massive demand is coming as the robotics megatheme plays out. Revenue growth rates will increase and in the short term margins will likely increase with simple economies of scale.

Commoditization will eventually kick in. I suspect this will be ~2-3 years after we see a demand surge which definitely opens up some opportunities for investment. Prices could fall 50% or more over time. In fact, rotary actuator prices have already fallen ~50% but the main bottleneck is in linear actuators today.

The playbook therefore is to invest in the specialist component makers (listed below) now whilst they still have pricing power. Over time, the big money will be made in the software/integration players though as the hardware becomes cheap and abundant.

Actuator & Bearings Stocks to Invest In

Here’s a full list of stocks to invest in:

RBC Bearings | RBC

Timken Company | TKR

Ducommunn | DCO

Allient | ALNT

Regal Rexnord | RRX

Curtiss-Wright | CW

Woodward | WWD

Parker Hannifin | PH

Flowserve | FLS

ITT | ITT

Ametek | AME

Rockwell Automation | ROK

Emerson Electric | EMR

And here’s those I think are the purest plays with the best valuations:

RBC Bearings | RBC

Description: RBC manufactures highly precise bearings and actuators in the robotics, aerospace, and industrial machinery niche. It’s best known for it’s bearings but has more recently expanded into the actuator space post-acquisition of Sargent Aerospace & Defense.

The differentiator for RBC here is that they’re currently winning in the high-precision bearings market. With so much Chinese competition that can likely win on price, RBC are currently still winning in terms of manufacturing precision.

Valuation:

EV/Sales: 7.8x

P/E: 35.7x

P/FCF: 35.2x

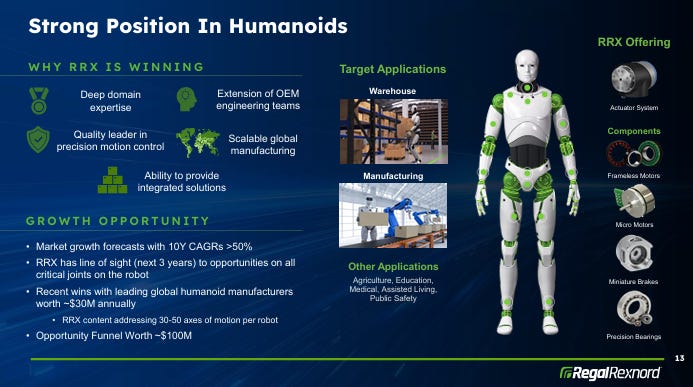

Regal Rexnord | RRX

Here’s a quote from the RRX CEO Louis Pinkham:

“We have secured contracts worth over $20 million annually and are pursuing a funnel of opportunities totalling approximately $100 million.”

Description: RRX operate broadly in the motion systems niche including linear actuators, bearings, gearboxes, and couplings for aerospace and robotics. It has partnerships with ABB cobot integration giving them direct exposure to the humanoid and surgical robot space.

Valuation:

EV/Sales: 2.5x

P/E: 14.1x

P/FCF: 12.5x

Curtiss-Wright | CW

Description: CW produces advanced actuation systems. Their Exlar division manufactures the Inverted Roller Screw Actuators - complex components vital for high-force, precise robotic movements.

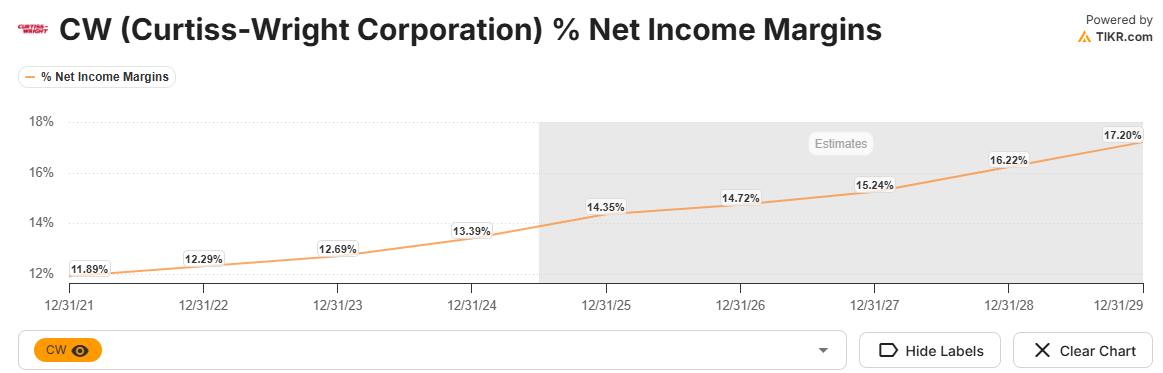

CW has one of the most stable financial profiles out of this segment of stocks. Here’s the net income margin trend over the last 4 years.

Valuation:

EV/Sales: 5.6x

P/E: 37.9x

P/FCF: 36.1x

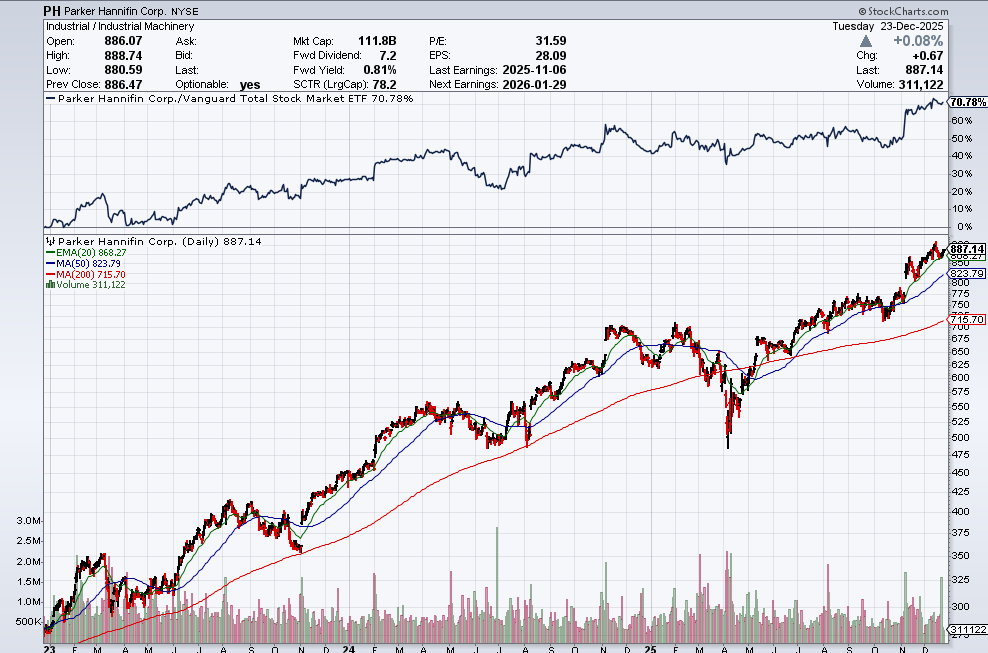

Parker Hannifin | PH

Description: PH dominate the electro-mechanical actuator market. These are explicitly focused on the robotics, factory automation, packaging, and material handling markets enabling smooth movement but under a lot of force. Whilst not exclusively robotics focused (like every stock in this list), actuators are a core part of their $20B revenue in motion and control technologies positioning themselves nicely in the automation trend.

Valuation:

EV/Sales: 5.7x

P/E: 28.8x

P/FCF: 31.4x

Sensory & Perception

There’s a ton to talk about here… so I’ll try keep it as concise as I can. But to cover this properly we need to cover LiDAR, IMU, tactile and force sensing, and analog and semiconductor sensor components. I’ll combine this all into my breakdown below which I’ve done by biological equivalents (eyes, touch, and inner ear).

The Eyes (Vision & Depth Perception)

The robots “eyes” come from cameras and depth sensors like LiDAR allowing it to see colours, shapes, objects, and also to build 3D maps of the world for navigation and recognition. Basic cameras handle the simple stuff, whilst LiDAR adds precise distance judgement to avoid objects or grab items accurately.

I’ll talk more specifically on my favorites below but you’ve got:

Ouster | OUST

Innoviz Technologies | INVZ

Luminar Technologies | LAZR

Aeva Technologies | AEVA

Cognex | CGNX

Teledyne | TDY

Faro Technologies | FARO

Teledyne | TDY

On Semi | ON

Hesai Group | HSAI

Sony Group | SONY

Keyence | 6861

The Touch (Tactile & Force Sensing)

Touch essentially gives robots the “skin” and sensitivity through tactile arrays and force-torque sensors allowing them to detect pressure and texture. The finer the manipulation needed in humanoids, the more demand for innovation here.

Here’s a list of stocks:

Sensata Technologies | ST

Vishay Precision Group | VPG

TE Connectivity | TEL

Amphenol | APH

Novanta | NOVT

Spectris | SXS

The Inner Ear (Balance and Internal Awareness)

Just like humans vestibular system gives us balance and proprioception, a robots IMU’s, gyroscopes, and encoders do the same thing. These allows robots to remain upright during walks, turns, or jumps for example without relying on vision.

Here’s a list of stocks:

Analog Devices | ADI

Honeywell International | HON

STMicroelectronics | STM

Bosch | BOS

Novanta | NOVT

Teledyne | TDY

TDK Corp | 6792

Sensory Stocks to Invest In

I gave you a list of stocks above but here I’ll give you my five favorites based on moat and valuation.

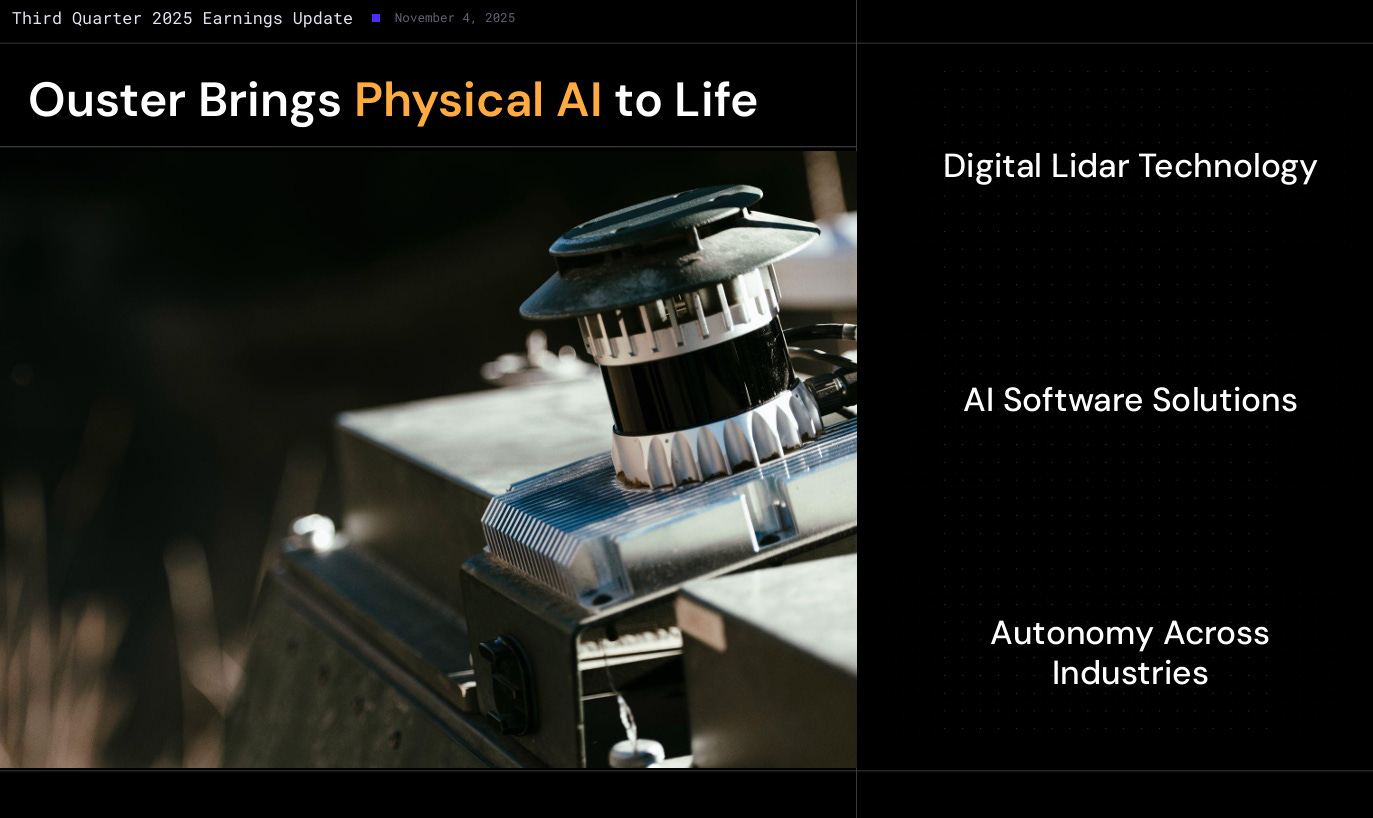

Ouster | OUST

Description: OUST specializes in digital LiDAR sensors that provide high resolution 3D mapping and perception for robotics and autonomy. Revenues have been growing very well, up 41% YoY. OUST is a very good robotics pure play with ~50% of revenue coming from robotics with thousands of customers in warehouses, smart infrastructure, and defense.

LiDAR is currently mainly in the automotive sector, but I see the ultimate opportunity being outside of automotive. Management currently see a LiDAR TAM ~$70B so with current revenues just under $150M, the greenspace ahead for OUST to win is substantial.

Valuation:

EV/Sales: 6.1x

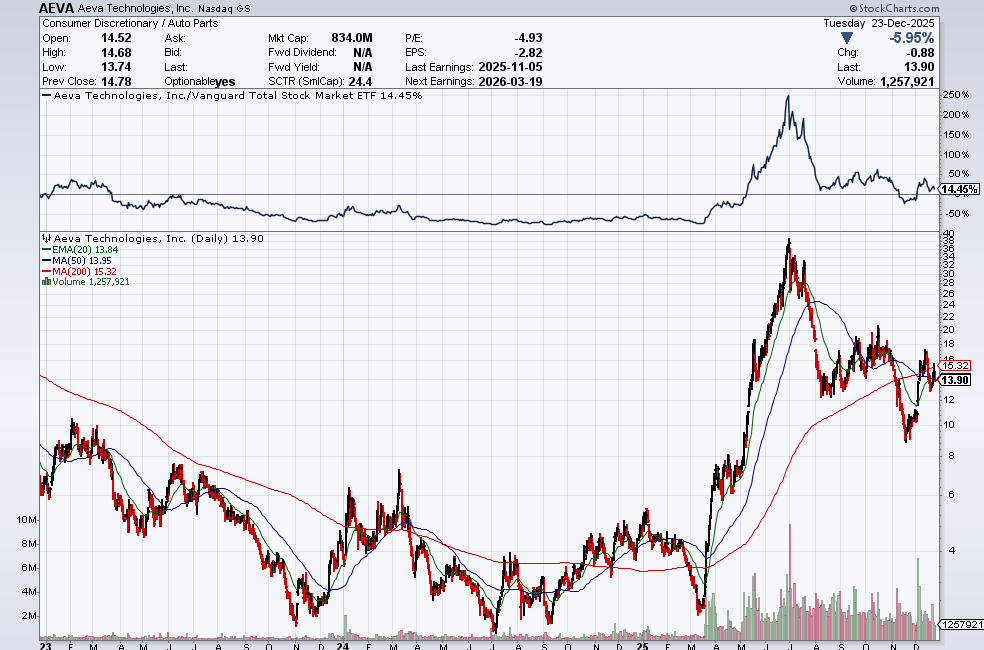

Aeva Technologies | AEVA

Description: AEVA is also a LiDAR company but they specialize in 4D LiDAR which is slightly more advanced. It essentially measures not only distance but also instantaneous velocity of objects. It’s better but much harder to scale at reasonable costs making AEVA a slightly riskier play. Looking at revenue growth estimates, AEVA is quite exciting with triple digit growth likely for the next 3-4 years. As mentioned, the issue is profitability. AEVA aren’t expected to hit EBITDA profitability before 2029.

They’re currently doing very well in the automotive niche with wins with major OEMs such as Daimler Truck.

Valuation:

EV/Sales: 31.9x

Novanta | NOVT

Description: NOVT, through its 2021 acquisition of ATI Industrial Automation, has emerged as a leader in multi-axis force sensors allowing for tacticle feedback and precise manipulation in surgical robots, cobots, warehouse automation, and humanoids. They enable good control and manipulation in applications like surgical robots and collaborative arms and are a key partner for Intuitive Surgical (ISRG).

Valuation:

EV/Sales: 4.5x

P/E: 33.6x

P/FCF: 32.7x

Cognex | CGNX

Description: CGNX is a leading pure play in machine vision for robotics systems through advanced cameras, sensors, and software. In robotics applications, CGNX tech supports robotic arm alignment, pick and place in cobots, quality control on high-speed lines, and navigation in warehouse automation for example.

Financially, revenue growth is fairly slow ~8-10% CAGR, but they’re very profitable with net margins heading towards 20%.

Valuation:

EV/Sales: 5.8x

P/E: 34.3x

P/FCF: 38.2x

TE Connectivity | TEL

Description: TEL manufacture the connects, sensors, and cables that serve as the “nervous system” for robots. TE is a massive industrial conglomerate so their overall exposure to robotics as a % of total revenue is quite slim only around 10%.

Just like CGNX, TEL revenue growth estimates are fairly slim below 10% CAGR but their profitability of ~18% net margins gives them huge earnings on ~$20B in revenue.

Valuation:

EV/Sales: 3.8x

P/E: 21.6x

P/FCF: 21.9x

Software / AI Integration

This layer serves as the “mind” and orchestration center of the entire robotic ecosystem allowing the raw hardware (actuators, sensors etc) to transform into intelligent adaptable machines capable of real world tasks.

This layer encompasses foundational frameworks like ROS (Robot Operating System) for basic coordination and control, advanced simulation tools for virtual training (digital twins), cutting edge AI models for perception fusion, decision making, and learning from experience.

Robot Operating Systems provides standards tools, libraries, and conventions to handle common tasks like sensor data processing, navigation, and motion planning.

Digital twins are virtual replicas of physical robots that run in simulation environments using live sensor data to enable “sim-to-real” training. This ultimately reduces costly trial and error on real robots and also accelerates development cycles substantially.

Examples of cutting edge AI robotic software today includes NVDA’s GROOT or GOOGL’s RT-X.

Importantly, unlike hardware which faces commoditization pressures, software/AI offers high margins with recurring revenues and stronger moats. As humanoids scale, this integration layer is likely going to be a key differentiator in unlocking huge value.