The Peter Lynch Framework To Picking Winning Stocks 👑

A Set Criteria To Screen For Quality

It’s #WednesdayWisdom No.12! (and Valentines Day!💌)

In today’s article we’re taking a look at the strategy of someone who:

Compounded at 29.2% for years in a row.

Took AUM at Magellan Fund from $18 million to $14 billion.

Consistently doubled the S&P return

If you haven’t subscribed yet, then give it a go 👇

1 Investing Concept - Peter Lynch Framework

Peter Lynch is one of my favorite investing teachers as he’s always been very open to educating fellow investors through interviews and his 3 books.

The biggest lesson I’ve learnt from Lynch is from the following quote:

“If you spend 13 minutes a year on economics, you’ve wasted 10 minutes.”

As a beginner investor, I constantly worried about interest rates, market cycles, housing prices, inflation, disinflation, deflation, policies etc etc.

Instead of simply buying quality stocks that are undervalued.

Here’s how Lynch finds quality:

Small Caps

Although Peter Lynch invested in a variety of market cap sizes, his favorite were those with a market cap less than $5B.

These small cap stocks would tend to be those that are overlooked and mispriced, and therefore those that offer the most opportunities for investors.

Ownership

Lynch believes that bargains are found in those stocks neglected by Wall Street.

The lower the percentage of shares held by institutions the better.

Why?

Institutions bid up the stock price so they’ll be more likely to be overvalued.

Institutional buying leads to more extensive coverage by analysts, which attracts other buyers.

Lynch recommends buying companies where institutional ownership is less than the median of all U.S. stocks.

Inside Activity

Just like many investors, Lynch liked to see executives with a strong personal incentive to do well for shareholders.

More than 20% inside ownership is always a positive sign.

If you’re not sure why inside ownership is so bullish, then have a read of this article:

#WisdomWednesday No.4 and The Best Stocks With Large Insider Buying

It’s #WisdomWednesday here at Make Money, Make Time! In this article we’ll take a deep dive into why skin in the game is such a simple, yet effective way to outperform the market. I’ll also provide you with a quality stock that has had a lot of recent insider buying…

Growth Rates

Generally speaking, earnings growth suggests the company is increasing it’s value. However, earnings need to be taken with a pinch in salt as they are easily manipulated, especially when compared to metrics like cash flows.

Nevertheless, earnings growth is a great filter for screening stocks initially.

Lynch likes stocks with earning growths within quite a tight range of 20-25%.

Too low growth obviously signals no strength and high competitive risk.

However, too high growth rates are rarely sustainable and will also attract a lot of attention from investors who will ultimately bid up the stock price.

Further earning metrics for screening:

A PE ratio lower than the median for its respective industry.

A PEG ratio less than or equal to 0.5.

Strong Balance Sheet

Lynch is very wary of bank debt, especially amongst small caps who often turn to banks for additional capital (rather than the bond market).

Lynch looks for:

A gearing ratio below 0.35.

The total-liabilities-to-assets ratio below industry norm.

Cash Position

"The cash position is the floor for the stock”

The net cash of a company represents the lowest a stock should drop. This can provide you with a good sense of the margin of safety involved in an investment.

13 stocks that fit the Lynch criteria:

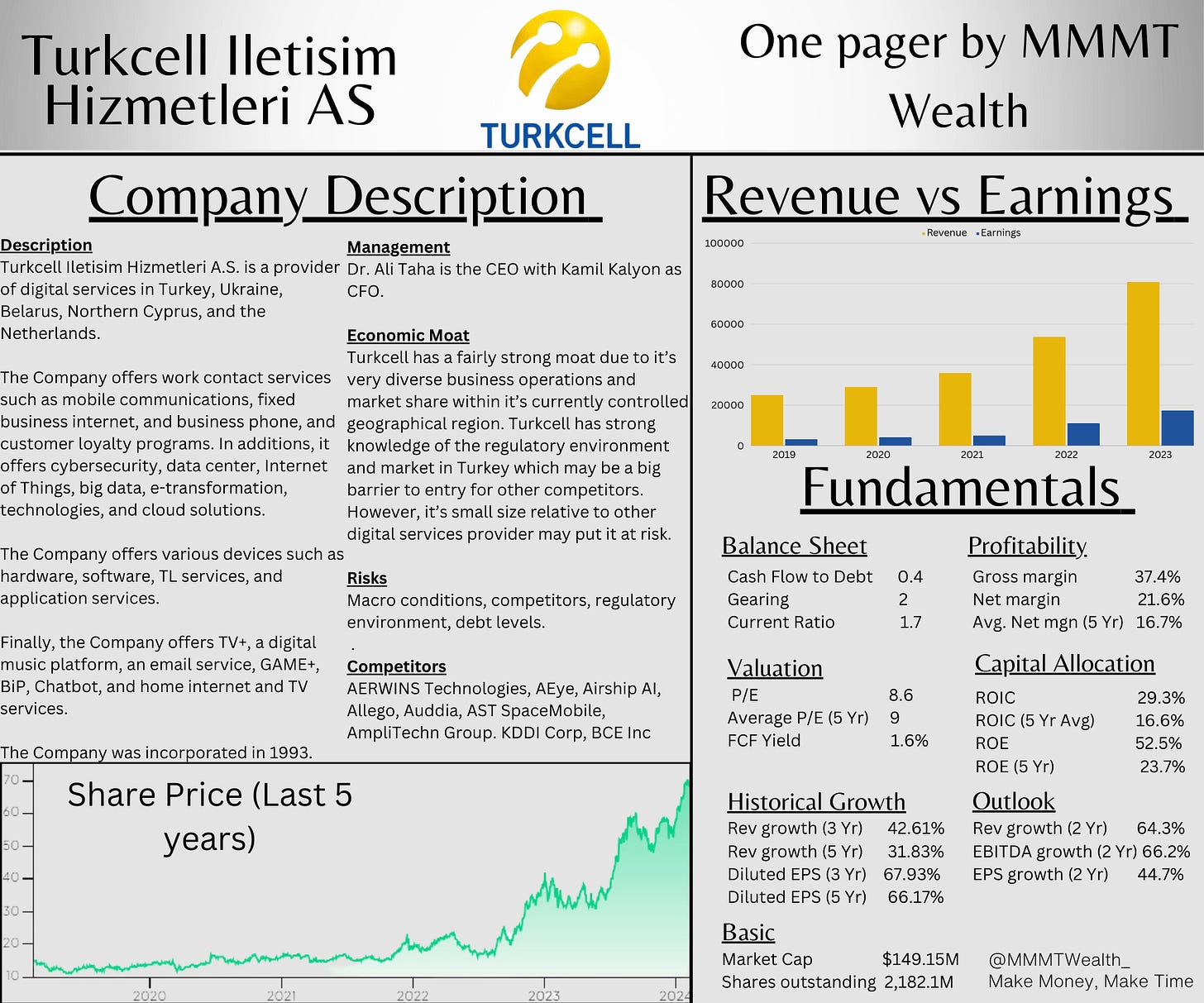

1 Investing Idea - Turkcell Iletisim Hizmetleri A.S.

Mohnish Pabrai has made big investments in Turkey over the past 5 years which are up huge amounts.

Although I wouldn’t recommend buying this company at current prices, it is one for the watchlist if you are looking for international exposure in the form of Turkey.

1 Graphic

Here’s Peter Lynch’s checklist visualized:

1 In-Depth Twitter (X) Thread

If you’re interested in small cap stocks just like Lynch, then have a read of this thread I put together on X.

1 Quote

Investing in quality companies can be life changing. It’s why I do what I do.

“If you invest $1,000 in a stock, all you can lose is $1,000, but you stand to gain $10,000 or even $50,000 over time if you’re patient.” - Peter Lynch

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also me follow me on X.

About the author

Make Money, Make Time is written by Oliver, a qualified CA, and investor who has read over 300 investment books, and spends more than 50 hours per week researching stocks so that you don’t have to. Let’s level-up together!

"Institutions bid up the stock price so they’ll be more likely to be overvalued." - this is fundamentally wrong (it's not against you, Oliver, it's against Mr. Lynch). Institutional buying and selling doesn't affect price. That's the point - they don't want to de discovered. They spend huge resources trying to obfuscate their activity.

Your edge in the stock market is when you manage to uncover what they're doing.