This Weeks Important News (Mainly on NU)

NU SMCI NVDA PLTR BTC

Hi all👋

Coming in with my weekly Friday email updating you all on the markets this week and what I think are the most interesting/important stories to be aware of.

This week I’ve got a big section on NuBank, some updates on SMCI, NVDA, and PLTR as well as a little section on Bitcoin.

Enjoy this quick read!

NuBank | NU

Introduction

As you may know from my last newsletter, NU is now a stock in my portfolio that I am actively DCA’ing into. The stock has had a pretty horrendous last month dropping around 18% mainly all as a result of the Brazilian economic woes. For me, this is the kind of drop that I’ve been hoping for. Let’s address it all quickly.

Brazilian Economy

The Brazilian central bank issued their plan to tackle the $3.3b budget deficit. The main proposal points were:

Cut federal spending

Salary ceilings for highly paid government employees

Tax hikes for the wealthy

Tax exemptions for lower-income individuals

From someone who isn’t an expert on macro, this plan seems a bit underwhelming, and the market definitely thought this too. Lower federal spending hurts consumer and investor confidence in Brazil. However, the more important issue is that these plans aren’t likely enough to fund to huge deficits which will lead to higher inflation, and a weak currency.

All in all, we will likely see a fragile Brazilian economy for the coming months, and maybe longer, which will hinder the Brazilian stocks and the fundamentals of the companies within. The companies that will struggle the most are those that are very aligned to interest rates, and inflation…mainly areas like credit which is exactly why NU has fallen on this news.

My Thoughts

In the short term, yes I think NU will have some headwinds that they need to tackle which won’t be a quick and easy fight. I think we may see some Q4 and 2025 weakness in the fundamentals of NU, but also I believe investor confidence in companies operating in Brazil will be weakened for the next few months.

I have no idea on the timeline for when confidence in the region will ramp back up which is exactly why I believe a DCA strategy is the best option. I won’t be surprised to see NU drop into the single digits to be honest, but I thought I’d start investing now just below $12 to ensure I have got a position being built at what I deem to be a fair value for a company with the fundamentals of NU.

I think it’s also important to note here that NU’s expansion into Mexico isn’t a cheap endeavor. 50% of the total Mexico population doesn’t have a bank, meaning acquiring those customers is even more expensive than trying to get consumers to switch from more traditional banks to NU. However, the unit economics in Mexico are exceptional, arguably the best in LatAm and management still believe that they will reach breakeven there faster than they did in Brazil.

The credit cards and personal loan growth will face the most headwinds no doubt, but NU are developing alternative revenue sources at good speeds. These include payroll loans, investment backed loans, and FGTS (basically a Severance Indemnity Fund) which are all secured lending products are on the rise QoQ but still only account for 16% of total lending originations. I think management will push this area a bit more over the coming months to up their market share.

All in all, there are macro headwinds that will hinder NU. Long term, fundamentals will beat macro and NU will continue to dominate LatAm.

Super Micro Computers | SMCI

On Monday, SMCI jumped 31% after a special committee (internal committee) found no evidence of wrongdoing in their accounting practices, or misconduct by the board of directors all following the resignation of their auditor last month.

There are questions though about this special committee which included Susie Giordano who is already on the board of SMCI. Was it a “special committee” after all?

If you follow me on X, you probably know that I’m definitely no SMCI bull. I think it’s way too much of a gamble to put your money into a company where quite frankly there’s no evidence that the numbers are correct.

JP Morgan analyst Samik Chatterjee also agrees here and says that they are sidelined.

In my opinion, the key areas to wait for are whether BDO accept these “special committee” findings or whether they undertake their own independent review, and secondly whether NASDAQ supports the extended filing deadline.

These are all unknowns and as an investor I don’t work on unknowns. I work on facts and then create my opinion from those facts. Wouldn’t touch SMCI with a 10 foot pole.

NVIDIA | NVDA

There was some news this week from NVDA which continued to show their complete dominance in the market.

Elon’s AI company (xAI) secured priority access to NVDA’s Blackwell GB200 chips. Sentiment around this was very positive for NVDA which is continuing to win clients, continuing to keep clients (xAI purchased Hopper GPUs from NVDA back in November), and continue to be the company AI projects want to work with. This means that xAI are starting to ramp up and compete with OpenAI, Anthropic, and Google. It’s estimated that they’ll be purchasing 1 million GPUs which will be a total investment of $30B revenue for NVDA.

NVDA and TSM partner to product Blackwell AI chips at the new Arizona facility. This is probably more news for TSM in that they have another client for the Arizona plant, but still positive all around for both.

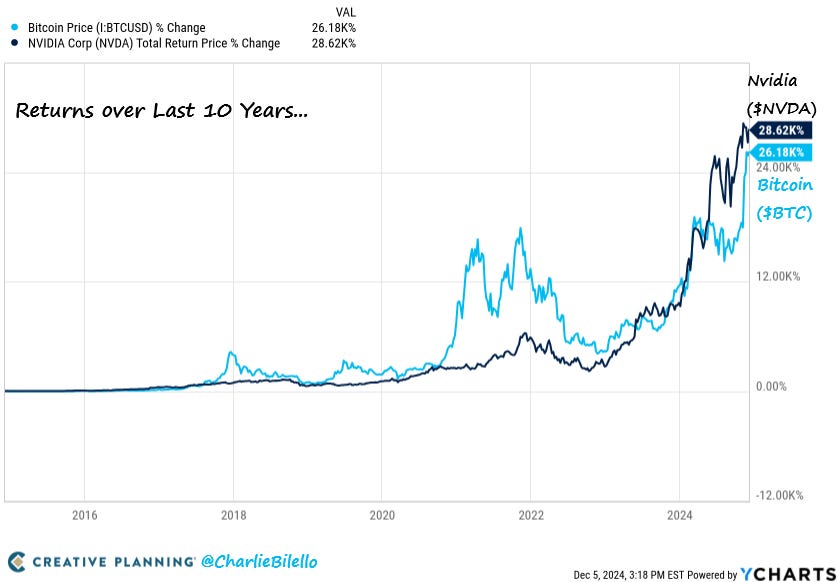

Whilst we are on NVDA, I saw this post earlier today.

There’s only one stock that has outperformed Bitcoin over the last 10 years - NVDA.

Palantir | PLTR

PLTR had another huge move this week to $71.8 meaning they’re now trading at 57x sales.

This move was very big considering there wasn’t really any huge news that came out this week. To me this signals a bit of a hysteria but I’m still holding PLTR. Admittedly, I have trimmed a bit because this valuation is just insane…but the company also is insane.

Here’s the 2 reasons PLTR jumped this week:

Likely QQQ inclusion - With QQQ inclusion which may be coming on December 13th, there will be a big jump in institutional buying which normally sees the stock price jump. Investors could be front running this.

Bank of America put a PT to $75 amid government growth rates to be higher than originally expected. This has been in line with the news that PLTR have been granted FedRAMP High Authorization for Palantir Federal Cloud Service signaling strength in the government business, and the government moat.

What a fantastic company.

I first wrote about PLTR on August 9th. If you read that and invested you’d be up 176%.

Bitcoin

As you know, BTC soared past 100k this week. I do own BTC myself but I won’t talk about it too much here.

What I thought was a nice idea though was to mention the 10 companies that hold the most BTC:

You guessed it…MicroStrategy

Marathon Digital Holdings

Galaxy Digital Holdings

Tesla

Coinbase

Hut 8 Mining

Riot Platform

Block

CleanSpark

Hive Digital

That’s it for today!

I hope you loved this article. Please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market. You can also follow me on X where I post 3-4x a day.