TMDX Q3 Earnings Review

Hi all 👋

Here’s my Q3 earnings review for TMDX 👇

Remember that I run a paid community on my Google Spreadsheet for just $16 a month. You get access to:

My portfolio (exact $ amounts)

My watchlist

My daily notes

My Investing Universe (+200 stocks analyzed by revenue growth, EBITDA growth, and EPS growth)

You can access my portfolio and spreadsheet here 👇

TMDX reported their Q3 earnings on October 29th which led to some very odd price action after the stock dropped ~15% after hours before starting the next trading day up around 1% which was ultimately all because of a very immaterial miss on revenue.

Given Q2 tends to always be a strong quarter followed by Q3 which is generally slightly weaker, TMDX have proved to be far more resilient in this quarter and so has the stock price. We of course saw a ~30% decrease from the 2025 highs of $142 in late June, but we’ve seen since the stock hold up. Compare this to what happened in 2024 and you’ll see a company that has become a lot stronger with a lot more investors happy to hold long term.

The Numbers & Trends

Revenue & Demand

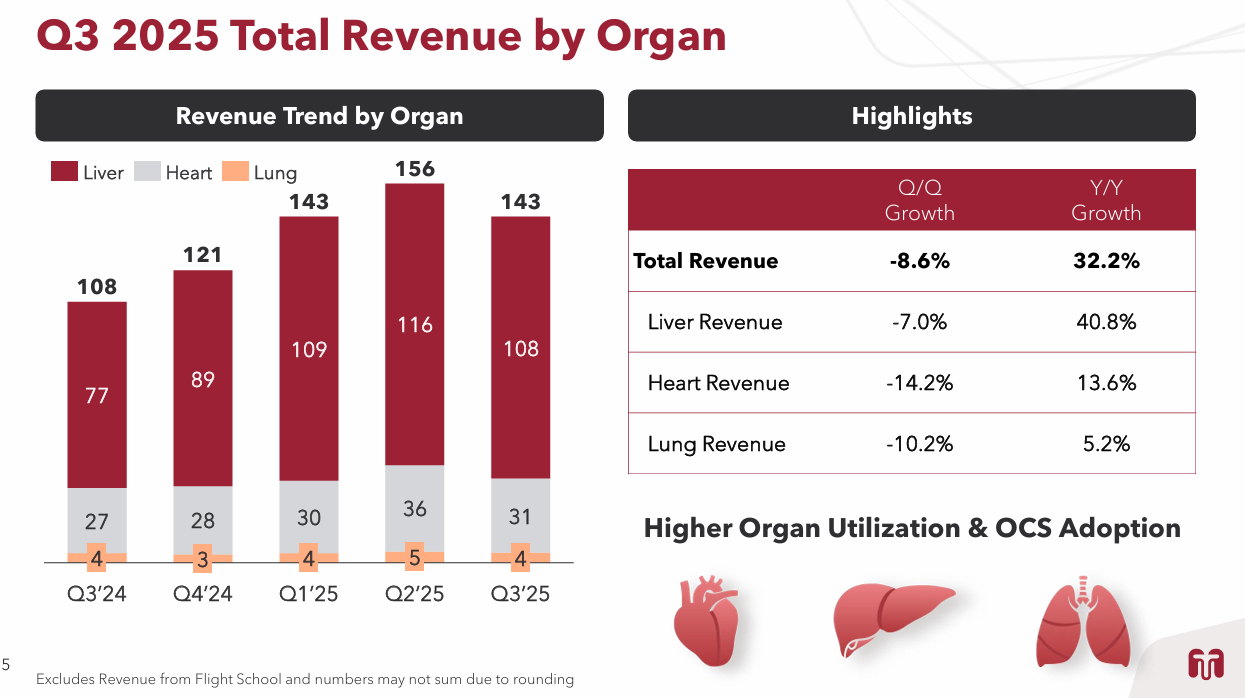

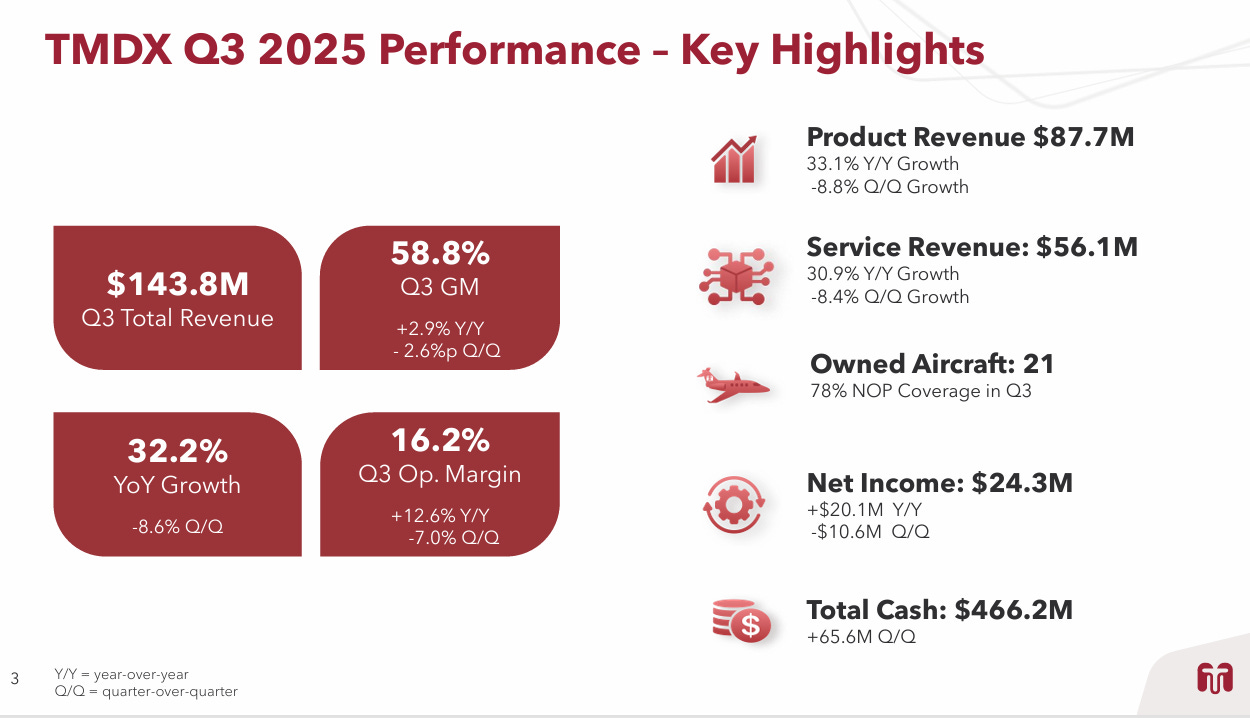

Total revenue came in at $143.8M in Q3 which was a 32% increase on Q3 2024, but a slight miss on estimates which were at $144.8M.

This is the slowest revenue growth rate TMDX have reported since Q4 2021.

But it’s also the 15th consecutive quarter that they’ve managed to keep revenue growth rates above 30%. which is incredibly impressive.

Revenue increase came mainly from increased utilization in OCS, predominantly in Liver and Heart. TMDX reported 41% growth in liver, 14% growth in heart, and 5% growth in lung.

It’s worth noting that this revenue growth rate came during a time of seasonal weakness in the US national transplant markets. I suspect the 32% growth rate will increase into Q4 again. I’ll be chatting on flight data briefly later and I believe we are already off to a very good start in Q4.

Logistics service revenue came in at $27.2M which offers 35% YoY growth.

International growth still remains a key midterm target for TMDX, but currently international revenue only comes in at $3.6M.

In the quarter, they announced plans to launch their NOP program in Italy and are now actively establishing 4 hubs to serve as a launch point for that program. They expect the Italian NOP launch in 1H 2026.

They’re also engaged with several other European countries to expand the program but no further information was given here.

TMDX expect international revenue will start to materially effect the numbers in FY27.

Profitability & Margins

Gross margins came in at 59% which was a 290bps increase compared to Q3 2024. This resulted in $84.6M in gross profit in the quarter driven by higher fleet utilization (I touch on this below), and cost efficiencies which are being built in logistics.

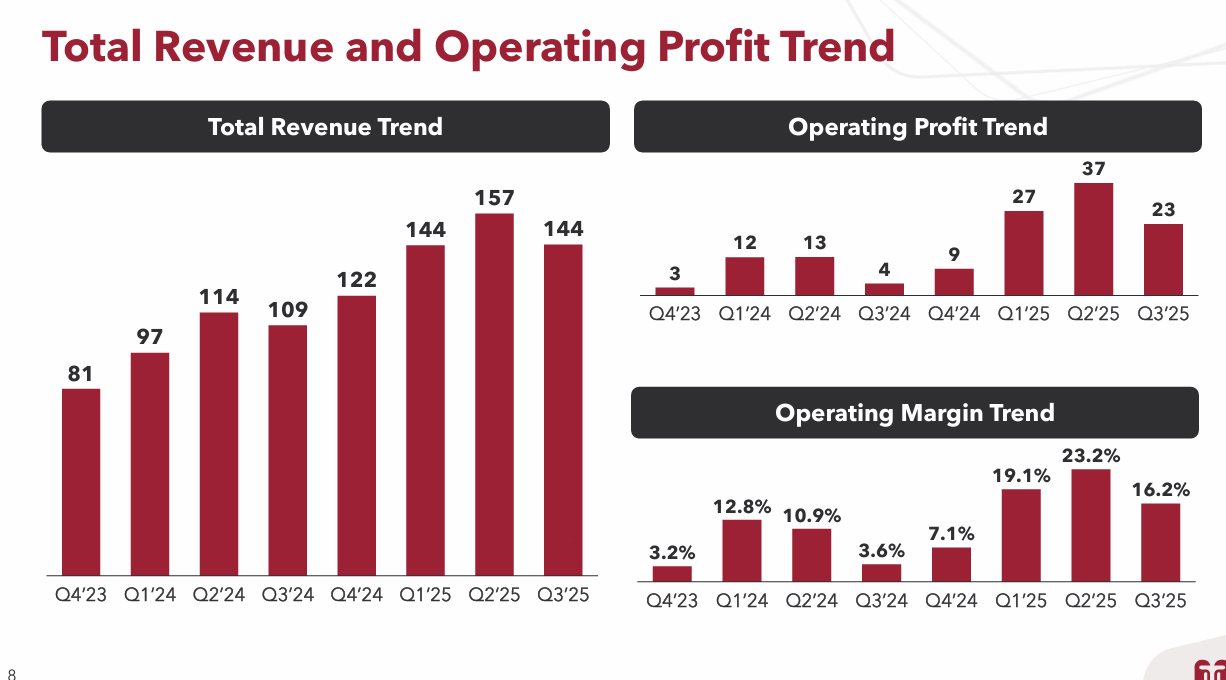

Operating income was $23.3M which was a 16.2% margin and offered 493% growth over Q3 2024 when operating margins were 3.6%.

This margin growth was impeccable and far above many (including myself) assumed. However, TMDX are still going through an aggressive CapEx cycle with international expansion, OCS Gen 3, Kidney etc so operating margins will likely fluctuate as capital continues to be deployed.

If you’re a believer in TMDX long term I think this quarter showed some very good evidence that TMDX’s vertically integrated platform will result in some solid margin expansion down the road. Recall that they reached these numbers in a period of seasonal weakness as well.

Guidance

TMDX narrowed the range for FY25 guidance to $595-$605m which represents a 36% YoY growth.

See my valuation section below for my thoughts on this.

Management also said they suspect gross margins to remain in the 60% range for the coming years, with some potential quarters that are slightly more volatile due to the large investments they’re making.

Other

TMDX now have 22 aircraft as of October (but owned 21 throughout the entirety of Q3).

More importantly than the number of aircraft they own, the % coverage of flights they operate themselves (core to the TMDX moat) has increased a lot as well. 61% in Q3 2024 vs 78% in Q3 2025. This leads to more internal control, lower costs per mission, faster turnaround, more reliability, and higher gross margins. This was key.

They’ve also hired more pilots which is now opening up the possibility of flights in the day and night boosting throughput without buying more planes. This is quite a bullish indicator that they suspect demand will continue to grow.

This is essentially further evidence that TMDX has built a deep, vertically integrated moat. Yes the core reason I first started to love TMDX was because of a technology that single handedly is growing an entire market and saving lives at the same time, but the vertical integration they have built on top of this incredible technology has 2x’ed the investment proposition I see in it. Yet, they still trade at multiples in line or below competitors who are growing slower and lack the vertical integration that TMDX has.

Waleed touched on preclinical development in the OCS Kidney market and said so far progress is very good.

He also touched on the Gen 3 OCS platform which will be covered in more detail in 2H 2025.

Earnings Call Highlights

“We expect to deliver at least 750 bps of operating margin expansion for the full year 2025 compared to 2024. While there could be additional upside, that will depend on our final sales performance and timing of our investment plan for Q4 by 2025. We continue to expect operating margins to reach or approach 30% by 2028.”

I’ll reiterate this in my valuation section but just quickly realize how much margin expansion this is relative to the 3.6% operating margins they reported in Q3 2024.

Analysts currently expect $1B in revenue by FY28. My assumptions are slightly higher than that. Anyhow if you give TMDX a 30% operating margin from there you’re looking at $300M in operating profit (more than TMDX’s revenue in FY23) and more than current analyst estimates of $225M by 33%.

If TMDX reach $300M in operating profit by FY28 then they’ll have grown at a CAGR of 68% over 4 years which is quite exceptional given EBIT multiple now is 46x.

“I think we have a number of tailwinds. What we’re seeing in terms of OCS adoption, organ utilization, it’s really fuelling the momentum of the OCS.”

This was in relation to managements slight increase in FY25 guidance to $600M (midpoint). This means they expect $155.3M in revenue in Q4 to reach the midpoint of that which as per flight numbers (currently on track to do 2,291 flights in Q4) adds up. I suspect TMDX do hit $600-$605M in revenue in FY25 which would mean they’ve grown revenues by 37% YoY. A NTM revenue multiple of 6.8x is far too low for a company growing at this rate, with this moat, and with this profitability.

In fact I ran a screener for the following characteristics:

Market cap ABOVE $2B

Fwd NTM/Sales multiple BELOW 7x

Revenue growth ABOVE 35%

Gross profit margin ABOVE 60%

Outside of mining and biotech, I got the following results:

KSPI

HIMS

UPST

SEZL

DAVE

TMDX

That puts TMDX in quite a small pool of quality stocks with some very good characteristics.

“The kidney program being introduced in 2027 will give us an access to an additional 23,500 to 25,000 procedures in 2027 and beyond, and that could even catalyze our growth beyond the 10,000 target into 20,000 beyond 2030.”

The kidney program represents a huge opportunity for TMDX, essentially 2.5x-3x’ing the current TAM. Additionally, the kidney market is a lot more standardized than heart or lung so the same level (if not more) of vertical integration by 2027 should mean that TMDX can truly replicate the same model very quickly into kidney. In numerical terms, I’m not sure on the revenue generation for kidney just yet relative to heart, lungs, and liver, but we’re looking at a multi-billion dollar opportunity for TMDX by 2030 as well as building a far more diversified and resilient company.

My Thoughts

Another very solid quarter for TMDX. Further proof of vertical integration. Strong demand relative to other Q3 quarters. Some nice insights on international expansion and their activity in Italy. And some very nice insights on their growth engines ahead for international, kidney, and OCS Gen 3.

Barely anything negative to say on the quarter and ultimately very happy that this is one of my largest positions.

Here’s what Waleed said re the stock:

“We’re very pleased because it shows how undervalued TMDX stock is, given the huge difference and improvement in OCS Liver and market share that OCS Liver have over any other platform in the market in the US.” - Waleed Hassanein when asked about OrganOx takeover.

I don’t love when a CEO talks about their stock… but Waleed is completely correct here.

OrganOx got acquired for $1.5B back in August 2025 by Terumo Corporation. On acquisition they were acquired for 27x 2024 revenue and 20x NTM sales which to me sounds fair given the multibillion-dollar industry in organ transplantation they built (more or less alongside TMDX).

TMDX now trades for 6.8x NTM revenue and 8.3x LTM revenue (so about 1/3rd of the valuation of OrganOx on a sales multiple basis). This gets even more insane when you consider than OrganOx were purely only in the liver market whilst TMDX operate in liver, lung, heart, and soon kidney. Importantly, TMDX also has a completely vertically integrated logistics business on top of their incredible technology.

When you consider SWAV was acquired for 13x revenue and Paragonix for 11.x revenue as well the multiples that TMDX trade at become almost too compelling for me.

Fundamentally they’re a company disrupting and almost building their own market. Valuation wise, they’re far too undervalued and my PT remains in the $300 range.

It’s a stock I’d be happy to own until 2030 and I fully suspect I will unless anything material happens.

I hope you enjoyed this article. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

Couldn’t agree more, but like you, TMDX is my largest holding, also, so again like you, I’m very optimistic!

I’m enjoying my subscription very much.

question on the portfolio, i see for instance 512.699 shares, is it a hypothetical portfolio or is it real, that you can buy fractional shares?

thanks