TransMedics Deep Dive Part 1 & Earnings Estimates

TMDX Part 1

Hi all👋

Want to see my previous deep dives?

Company: TransMedics

Ticker: TMDX

Stock Price Today: $95.81

Stock Price High: $175.66

Market Cap: $3.24B

Headquarters: Andover, MA

Outline

Introduction (Part 1)

Business Overview (Part 1)

Q1 Estimates (Part 1)

Competitive Advantage (Part 1)

Risks (Part 1)

Financials (Part 2)

Opportunities (Part 2)

Valuation (Part 2)

Introduction

TMDX is a big position in my portfolio that paid subs will have complete access to and know my average purchase price. It’s been a rollercoaster following TMDX over the last 12-18 months as it jumped from $57 back in 2023 all the way up to $170 in August 2024 only to fall back down to the mid $60 range in late 2024 with growth concerns followed by a well timed short report from Scorpion capital.

At the peak valuation in Q3 2024, TMDX traded at around 19x sales which although sounds hefty compared to the likes of many stocks, is actually not too bad considering ISRG (another high growth medtech) has been trading at ~18x sales or above for the last 12-18 months with much slower growth than TMDX.

TMDX has become quite a popular stock amongst retail investors over the last 9 months or so, and even more so post the short report, however I haven’t seen too many deep dives into the company, nor the opportunities ahead for TMDX over the next 3-5 years so I thought it was best to time this deep dive around their Q1 earnings reports and also give some estimates of the report before Thursday.

Business Overview⬇️

TMDX was founded by Dr Waleed Hassanein (current CEO) who owns ~1.8% of the company. He used to work as a cardiothoracic surgeon in Boston before coming up with the idea for TMDX after realizing there was a huge amount of unmet need for a organ preservation system that could keep organs alive and functioning in a warm state outside of the body. Although this doesn’t affect my investment decision, it sure is nice to invest in a company that are doing something great for humanity so huge props to Dr Hassanein for his years of work so far.

Previously, and still today, most of the innovations are around static cold storage but this leads to several challenges which are not present in warm storage (TMDX’s niche):

Organs are not physiologically functioning in cold storage making it very hard to assess an organs suitability or safety for a patient.

Organs avoid ischemia in warm perfusion because they are still supplied with oxygen and nutrients. During cold storage, they’re essentially in a dormant state.

Organs kept in warm perfusion can be repaired and improved. Cold storage cannot improve organ quality.

Warm perfusion essentially doubles (to triples) the preservation time of an organ.

The only companies competing in warm storage today are:

XVIVO Perfusion (Swedish)

OrganOx (UK)

I’ll talk about these companies in Part 2 when I look at the valuations, and show you exactly why TMDX is undervalued today. I also touch on them a little in the competitive advantage section.

All of the above essentially aims to increase the utilization rates of organs in the US which are currently at some pretty shocking numbers. Kidneys have about 28% non-utilization whilst heart and lungs exceeds 70%. This comes down to the fact that donor organs can’t last very well in cold storage, and if they do reach the recipient in the 4 hour time slot there’s no testing (or repair) that can be done to the organs before putting them in the body of the recipient.

This utilization issue is the main reason TMDX was formed, and the main reason they have NOP today. NOP stands for National OCS Program which is essentially their entire process of organ transplantation. Last year there were a total of 3,715 OCS cases and management’s publicly stated goals are 10,000, though they’ve said they believe they will eventually reach the 20,000-30,000 range per year once they’ve grown internationally and expanded into kidney transplants and perhaps pancreas.

The important thing to understand from an investor point of view is that the TAM for organ transplantation is relatively finite, but TMDX are playing a role in increasing the amount of organ donations per year. With cold storage, any DCD (donation after circulatory death) and DBD (donation after brain death) are very difficult because of ischemic damage happening very quickly, however, TMDX’s technology makes these transplants a lot more viable because the technology revives and/or preserves these organs.

This OCS technology product sales makes up ~61% of the total TMDX revenue. The other portion comes from service revenue which is the end-to-end transplant logistics and organ management service. Ultimately, the growth rates than TMDX has seen over the last 5 years or so have been spectacular. They’ve been growing revenues in the 90-200% range for the last few years which gave them a very nice stock price surge as the sales multiple was high in +25x range. That’s changed today.

From a margin perspective, TMDX are also very good which is promising for a company with such high growth rates. They have a blended gross margin ~60% (used to be higher) and they’ve been net profitable since Q4 2023 but have struggled to materially grow net margins since then.

Today we’re back at $95 which is a 47% decrease from the highs giving us potentially a huge (at minimum) 100% opportunity to get back to just above the highs of around $180. However, some slowing growth rates, and worries of the aviation fleet (which I believe is a huge net positive), as well as a short report, all led the stock to fall back into the $60 range back in early 2025.

Q1 Estimates ⁉️

TMDX announce earnings tomorrow (8th May after hours). I’ll have Part 2 of this Deep Dive out a day or two after which will look into numbers, the call, and the opportunities, and most importantly the valuation.

Make sure you’re subscribed so you don’t miss it👇

FY25 guidance is at $530-552 million in revenue which is a 20-25% increase in revenue YoY and Q125 estimates are at $123.4M.

Q1 2024 revenue was $96.85 million.

Here’s what I’m expecting for revenue based purely on simple flight numbers (which is basic I know) but relative to any other company in almost the entire market we can make much better estimates on revenue for TMDX. We can’t track what % of flights were using company owned planes and which used chartered planes so the below assumptions basically assume nothing has changed since Q4.

In Q1, there were 2,115 flights which which at a $66,000 revenue per flight gives us $139.59 million in revenue for the quarter which annualized gives us $558.36 million which crushes the upper end of guidance even assuming no growth QoQ. The issue with relying on flight data is that we don’t know:

Internal vs external flight ratio

Organ type mix

Adoption model

But generally based on prior quarters, we can assume revenue per flight is ~$65k to $70k per quarter. I’m being a bit more conservative with my assumption here at $66k which is on the lower end but I wouldn’t be surprised either if we hit the $68k range which could increase revenues to ~$143.82 million range. If they report in the $142 million or above range, then I don’t see how they can’t raise FY guidance above the current 20-25% growth rates which would be extremely bullish for the stock and could lead to at least a 10% + move.

Margins for TMDX are very hard to predict, especially in the early days of their aviation fleet which is still prone to some misfortune, or increased maintenance which could increase reliance on third party providers and reduce margins. Management have said that this is really the only variability that will materially affect margins at the moment, and aside from any big negatives here, there should be some modest margin improvement. I’d suspect gross margins in the +60% range.

SimpleFX

Let me welcome you to SimpleFX here👇If you’re looking for deposit bonuses, a huge range of instruments to trade, and no minimum deposits, SimpleFX is one of the best platforms out there.

You can sign up in the link below!

Competitive Advantage📊

The TMDX moat is very underrated. Before I get into it, let’s realize this:

Organ utilization rates in the US (and worldwide) are a huge, fatal problem. You’ve got kidneys at 28% unutilized, livers at 40%, and thoracic organs above 70% unutilized. Yet, the competition in this space to improve outcomes via warm perfusion (because cold perfusion doesn’t really improve utilization rates at all), is fairly minimal.

Why? Because the barriers to entry is so high. It’s technologically complex, expensive, requires a ton of logistics, and a lot of compliance with laws and regulations.

Here’s generally how I break down the TMDX moat:

Competition

There are a lot of suppliers of cold storage technologies, but as mentioned before this just increases the vulnerability of ischemic damage. This is why warm perfusion technologies have become slightly more commonplace because the organs remain metabolically active. This raises the question as to why there’s not a lot more competition, and it quite simply comes down to the extremely high barriers to entry (technologically complex, expensive, logistically difficult).

The only companies that are established in this space are:

XVIVO: XVIVO is a Swedish company that is quite established. They operate in cold storage and also warm perfusion. They’re publicly listed on the Stockholm exchange with FDA approved warm perfusion in heart, lung, kidney, and liver, whilst TMDX compete in heart, lung, and liver with kidney in the pipeline. XVIVO are a legitimate competitor to TMDX, but their operations in the US are currently limited.

OrganOx: OrganOx is a private company from the UK who only really compete in liver transplants. They also aren’t fully portable like TMDX. They may offer some competition in the liver market for TMDX but the technology does allow portability which is a huge advantage. It’s far more cost efficient though.

Vascular Perfusion Solutions: Not commercially available yet. R&D stages.

The above competition should show that TMDX is currently in a league of their own when it comes to warm perfusion combined with portability. There’s no competition globally with as advanced technology as TMDX that I’m aware of. The only negative is if cold technologies or emerging technologies like NRP (normothermic regional perfusion) get better and become a better trade off when you consider cost and complexity. However, I’ll reiterate - when you combine the technology with the logistics and portability that TMDX offers, there’s nobody that close to them. The issue is they’re expensive and therefore for lower volume transplant centers, they may look for cheaper alternatives.

Aviation network

A big issue that TMDX has had is that they’ve consistently missed out on a large number of transplants because they didn’t have a reliable (internal) logistics company on demand. However, they’ve now become a medtech with one of the most impressive logistical operations out of any company I know with just over 20 planes in their portfolio. This is still early, and we’re still seeing quarters like Q3 2024 where margins are hurt a lot, but over time the margin profile is expected to improve with the aviation fleet that they now own via their acquisition of Summit Aviation.

Even before they invested into this fleet, they were a huge leader in portability of organs. Now they also have full control over the entire operation making any competition almost nonexistent. Remember this for when we talk about the valuation in Part 2.

First mover advantage

There’s companies that are trying to compete with TMDX like Vascular Perfusion Solutions for example, but they’re years behind. In this industry, FDA approvals take a very long time so even if a company is in the R&D stages, they’re still multiple years away from commercializing and becoming a serious competitor to TMDX who continues to snap up market share and get closer and closer to their aforementioned goal of 10,000 NOP transplants per year in 2028.

It’s bold to say, but I think TMDX will be the winner in a winner takes all market. Different transplant centers will use different techniques, but in terms of warm perfusion in the US (which is the best technique currently today), TMDX have established themselves as the clear leader.

Risk📉

Regulation: The industry is subject to regulation which for the most part if out of TMDX’s control with what they have to comply with. There’s quite easily a material affect to the business if regulations change slightly.

Aviation: TMDX are an organ transplant company with a new logistics arm that has to run almost perfectly 24/7 otherwise organs can quite easily be unutilized. It’s a very, very complex operation and although it adds a huge amount to the TMDX moat, it can quite easily effect the numbers materially as we saw a couple of quarters ago as planes went into maintenance and margins were materially affected.

Clinical and technological risks: The long term growth for TMDX relies on the results of trials which may take years. TMDX have put out timelines for their entry into the kidney market, so any delays here or trials that don’t go as planned would generally lead to a lot of stock volatility.

Dilution: Shares outstanding has increased 20% over the last 3 years. People massively underestimate how much this affects the stock price, but I’ll show you below how much it affects it. Over the last 6 years, shares outstanding has increased 59%. There’s not many companies out there with share dilution this bad.

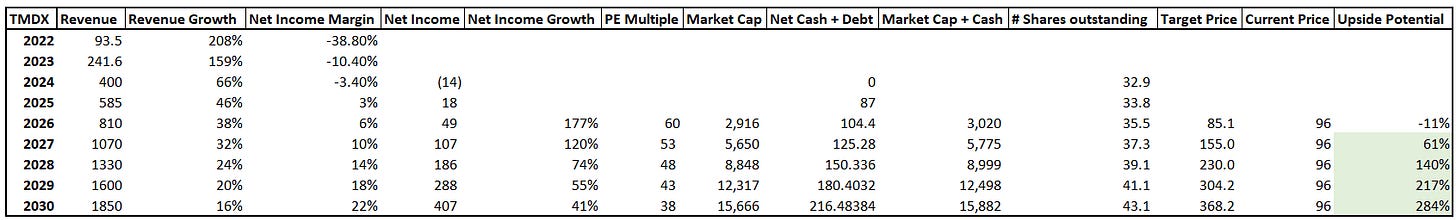

Here’s an old TMDX model (I’ll have an updated one in Part 2) showing 5% valuation per year.

Here’s the same model with no dilution showing a difference of 100% in the final stock price.

That’s all for today

I do hope you enjoyed this TMDX Deep Dive Part 1. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

Part 2 out soon!

I am a long term holder and rode this both up and down DCAing, know quite a bit about it still learnt a few new things. I am confident in the able leadership of Waleed to lead the firm to glory for long time to come. Great job with a concise and well structured article. Looking forward to next part and GL with the earnings.

Hard question to answer I bet, but I have no position on this company right now and reading this a day before earnings I can't help but wonder if you think it's worth trying to lump into before earnings?