UBER Earning Reports & Deep Dive

A Proud UBER Owner

Hi fellow investor👋

I don’t add any advertisements or any paywall to my newsletter so any like, comment, or share is so important for me to get my newsletter out to many more people!

Company: Uber

Ticker: UBER

Website: https://investor.uber.com/home/default.aspx

Current Stock Price: $74.15

52-Week High: $86.34

52- Week Low: $48.14

Market Cap: $156.14B

Headquarters: San Francisco, California

Number of Employees: 30,800

Before we get into the UBER earnings review and deep dive I want to tell you about the sponsor of this newsletter.

With AI changing the way the world works, what better place to learn all about it than with “The Rundown AI” - a free AI based newsletter.

Learn AI in 5 minutes per day. Get the latest AI news, understand why it matters, and learn how to apply it in your work. Join 750,000+ readers from companies like Apple, OpenAI, and NASA.

Sign up here to get free access to Rundown AI’s expert ChatGPT prompt guide.

Introduction

UBER has become the dominant force in basically all things transportation over the last few years as their market leading technology and platform started to really benefit from network effects. They’re in the process of building out their platform to essentially become the one-stop shop for the transportation of all humans and goods.

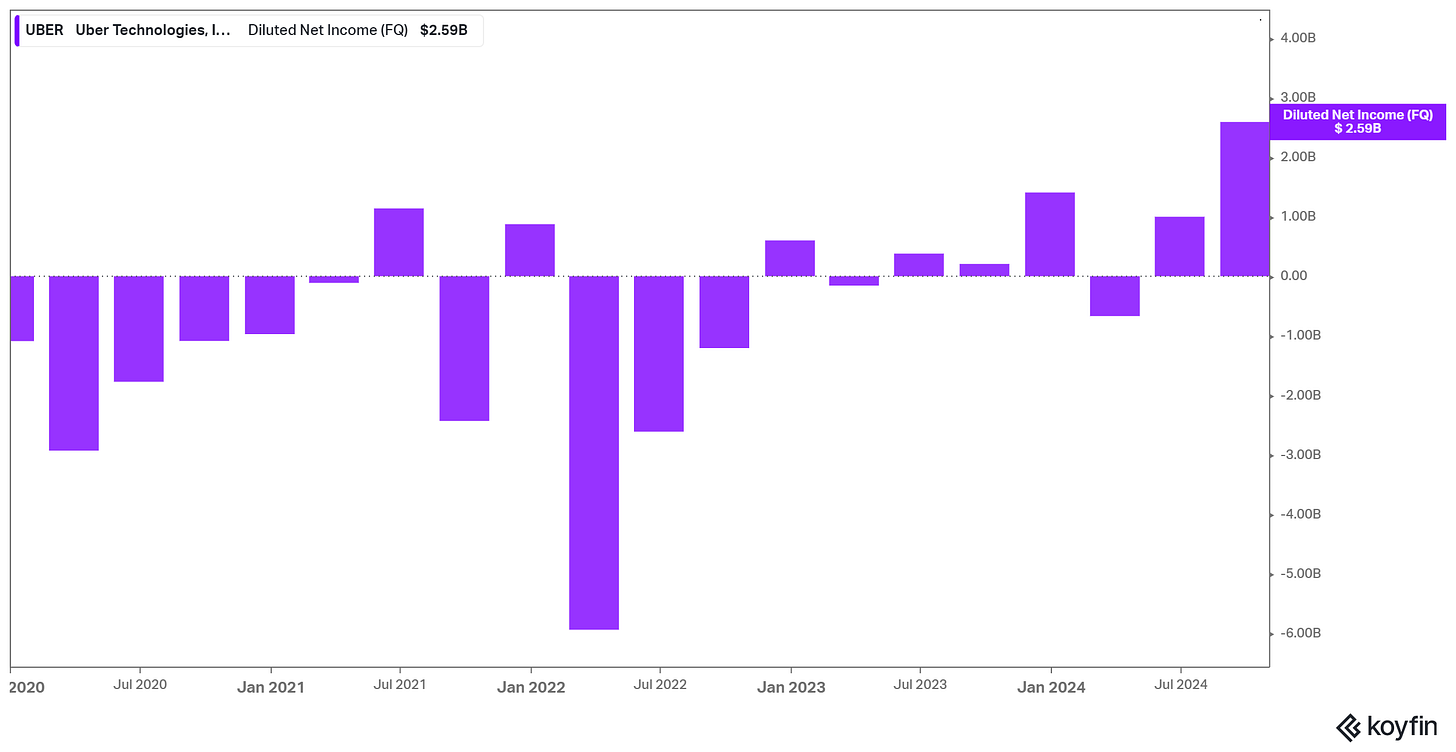

Back in 2022, UBER were really struggling to become profitable, but as they have continued to scale their Mobility and Delivery segments, customers are being driven to both via each segment. As a result, customer acquisition is becoming cheaper and cheaper and revenue is increasing at very strong rates.

One of the main reasons I began to love UBER was because they rapidly became one of the best free cash flow growth stories compared to all stocks. Look at this chart below which shows from an FCF CAGR point of view only PLTR is growing FCF quicker.

UBER are now at the stage of their life cycle where hyper growth is gone. Of course there are still many avenues for growth (international, ads, freight, grocery, retail, and rural areas), but there is now a huge focus on margin expansion and FCF and I think these will be the two big drivers of stock price appreciation over the next decade.

When I bought

I bought UBER in May 2024 at ~$66 so I’m currently up just over 10% which is lagging the broader market. As always, I didn’t buy UBER just to hold it for 6 months. I’ll be holding UBER for the long term and I do believe I’ll continue to hold it for many years as I think they have a good chance of being a key player in the AV space too. Any dips below $65 I’d consider adding more.

They’re currently trading at NTM EBITDA of 19.5x and NTM EV/Sales of 3.2x which I think is more than reasonable considering their growth trajectory and EPS growth potential but I’ll dive much more into this later.

Earnings Report

Numbers

Gross Bookings grew 16% YoY but missed estimates slightly.

Revenue grew 20% YoY to $11.2 billion (beating estimates) and income from operations was $1.1 billion, up $667 million over the year.

Adjusted EBITDA was up 55% YoY.

Cash & cash equivalents reached $9.1 billion in Q3 which are likely to be used to redeem $2 billion of debt.

Drivers and couriers earner $18.1 billion during the quarter which is a 14% increase YoY.

Monthly Active Platform Consumers reached 161 - a 13% YoY growth mainly as a result of improvements in Mobility and Delivery offerings.

Mobility

Mobility revenue grew 26% YoY to $6.4 billion, the biggest segment of UBER by far. This high growth was attributable to the increase in Mobility Gross Bookings but it wasn’t just revenue growth that was the positive news. Margins reached 30.5% which increased 220 bps YoY and 70 bps QoQ.

The US remains the biggest sector for UBER Mobility (just below 50% of revenue and over 50% of profitability), however the biggest growing has been seen in UK, Germany, Denmark, and Argentina where UBER are building relationships to re-open or strengthen the company in those countries. For example in Denmark, UBER is partnering with local taxi platforms to increase their demand whilst also protecting local taxi drivers. Likewise, partnerships in India and Brazil (70,000 drivers) will also massively increase operations in those nations.

Another positive from this quarter from the mobility sector was a new feature to improve UBER reservations for upcoming trips. Consumers can now add in flight details, see average wait times (prior to reservation), and see average costs in a city so that they easily plan their trip around these numbers.

The big opportunity for UBER Mobility now comes with focusing their efforts more outside of core areas like New York…because as Dara (CEO) said:

“In the U.S., especially if you look at noncore cities, it’s 60%-70% of the market, so the majority of the market is there. Generally it’s growing faster than city centers as well.”

It’s not an easy process though because building out supply and demand into areas that are very widely spready will be difficult. But it sure is an opportunity for Mobility (and Delivery) if done well over the next 2-3 years.

The other major growth avenue for UBER is the teen accounts which are up 40% YoY. Not only does this add a new demographic to the platform, but these teen accounts will slowly convert into normal accounts over the coming years which will massively expand the TAM.

I think the TAM potential is still pretty massive here for Mobility as they continue to add more demographics and geographies (both international new markets and rural U.S. areas) so although the hyper growth period for UBER is over, I’m convinced they can continue to grow revenues at +18% CAGR for the next 5 years.

Delivery

Delivery saw 17% YoY growth in gross bookings and 18% in revenue growth so growth has remained very strong with thanks to UBER’s cross selling capabilities between Mobility and Delivery (and vice versa). About 1/3rd of the Delivery audience now comes from Mobility meaning UBER are benefiting from very high growth rates, but also at very low customer acquisition costs.

Another reason for the high growth rates in Delivery is UBER’s ability to keep merchants coming to the platform to ensure the marketplace is continuously refreshed. This is happening at very good rates (~16%).

What I like even more is that the platform is improving to now include short-form video to allow merchants to showcase their dishes. It’s a fairly simple improvement but one that should increase demand. Further, UBER Eats launched Lists which allows users on the app to curate and share lists of their favorite restaurants with friends and other locals. This has only been initiated currently in New York and Chicago but it’s a great idea.

The ongoing opportunity for Delivery is the grocery and retail space which 16% of delivery customers now use compared to 14% last year. UBER have so far partnered with H Mart and Food City (grocery) and JD Sports, Pet Supplies, Michaels (non grocery). Currently, the grocery business is not there and the biggest brands in the US don’t have the incentive to join but with size and growth, the incentive for the big brands to join the platform will only increase.

Although Mobility is currently seeing better numbers than Delivery, I think long term Delivery has more potential. It’s not just a food-delivery service anymore like people think it is with Uber Eats. In the next 5 years, it’s highly likely that they’ll be able to deliver almost anything to you.

Remember only 16% of Uber Eats users are using grocery and retail delivery so the runway here is ginormous. With the merchant growth, improved platform to entice consumers, better ads, and more liquidity, there’s no reason why Delivery can’t end up with a much higher TAM than Mobility.

Freight

Not too many updates here for Freight. There was almost no increase in the volume but it’s a macro wide issue at the moment that won’t last forever.

Advertising

Advertising saw revenues grow 80% YoY which is very impressive. UBER’s aim is to reach 2% of Delivery gross booking in advertising revenue and currently they’re sitting at about 1.5%.

The CPC (cost-per-click) and SMB are growing at the fastest rates and I see no reason for this to taper off. UBER has an incredible amount of traffic, it’s just a question of monetizing this traffic through improving their targeting of the CPC ads. This is something that will constantly improve so as long as the bigger picture budgets for ad spend don’t decrease significantly, I don’t see any reason for UBER struggling to get advertising to 2% of gross bookings.

UBER are also fully focused on Mobility advertising and they’ve done this through a partnership with T-Mobile which will bring “Journey TV”, essentially tablets, to 50,000 vehicles across the US. This should further improve advertising revenue.

Uber One

Uber One members reached 25 million this quarter which is up 70% YoY. Uber One is UBER’s membership program which basically brings prices down for products like Mobility and Delivery, but UBER obviously benefit from a recurring revenue source here, increased engagement, and improved retention.

Uber One members on average spend about 3x that of non-members so the strategy is clearly working very well. Currently about 35% of all core bookings (mobility and delivery) are done by Uber One members.

Partnerships & Autonomous Vehicles

UBER expanded their multi-year partnership with Waymo who now have their sights set on expansion into Austin and Atlanta starting next year. The big question here comes back to the competition between TSLA and Waymo that I’ve touched on briefly before.

These companies have different strategies. TSLA are playing the long-term game and building an AV that can be deployed in every city nationwide. Waymo are building an AV that learns the specific streets of those specific cities.

Therefore, Waymo’s models are much quicker and easier to learn, hence why they are being deployed already compared to TSLA. The question is will the first mover advantage win or will TSLA’s long-term strategy blow Waymo out the park?

Or…will UBER manager to build a partnership with TSLA too?

Anyway, this isn’t a time to debate about TSLA vs Waymo. But it is a time to appreciate UBER’s execution in building out their AV partnerships which now sits at 14. They developed partnerships with Cruise, Coco, Wayve, WeRide, and Avride just in this quarter alone and Dara hinted at many more in 2025.

“And so you will see deployments of other autonomous partners on the Uber network, so to speak, outside the U.S. coming up in 2025.”

Ultimately, UBER offers a very underappreciated value add for AV players like Waymo and BYD. UBER creates the demand for these AV vehicles

Valuation

Here’s the NTM EV/EBITDA and NTM EV/Sales multiples for UBER currently.

At 20.4% revenue growth, I think these kind of multiples seem reasonable. I do have some doubts here and there when you look at the figures for UBER’s competitor LYFT who are growing revenues at +40% and have an EV/Sales multiple of 0.9x.

However, it’s impossible to argue LYFT is a better company than UBER so I don’t take these numbers too seriously and I don’t think it’s a worthy comparison.

Currently the PE ratio for UBER is 36.9x with an EPS of $1.41 and a PEG ratio of 0.54x.

EPS is expected to be $2.29 by 2025, but estimates have consistently been beaten by UBER in all but 2 quarters since 2022. My expectations are that EPS will come in at +$2.5 due to further margin expansion (mainly thanks to Uber One and increased ad revenue).

At a $2.5 EPS and 40x PE ratio (still way below 3 year historical average) we have a stock price of $100, though I don’t see why a PE ratio of +45x isn’t feasible unless the macro conditions make it very difficult.

That would be a stock price of $112 or a 57% valuation increase.

My Take

There’s a couple of UBER analysts out there that think +$15B in FCF is viable by 2030. With a 25x EV/FCF multiple on this (currently 27x) then you have a $375B company which 2.4x from today.

Whatever happens I think UBER is undervalued today and there’s a very good amount of upside.

This quarter showed that trend towards huge FCF, solid revenue growth, and nice margin expansion. The core business is performing extremely well but I honestly believe the growth opportunities from here are extremely achievable over the next 3-5 years.

There’s really not much I don’t like about UBER and that’s why I’m a very happy owner.

That’s it for the day

I hope you loved this article. Please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also follow me on X.

An excellent summary, Oliver. I'm holding UBER. There's reason to believe the stock has more upside. What makes me confident is there's been more institutional accumulation over the past few months.