UiPath (PATH) Deep Dive & Earnings Review

4th largest position

Here’s my PATH Deep Dive & Earnings Review 👇

Company: UiPath

Ticker: PATH

Market Cap: $9.7B

% Drawdown From Highs: 77.5%

Headquartered: New York

CEO: Daniel Dines

MMMT Near Term PT: $80

Contents

Introduction

Business

Opportunities

Q3 Review

Risks

Valuation

Technicals

Introduction

Paid subscribers will know that I’ve been buying PATH since late September/early October and I’ve been adding quite regularly. So much so that in the space of 2 months PATH became my 4th largest holding before earnings on Wednesday after hours.

PATH is now larger than SOFI, and only behind TMDX, NU, and LMND in terms of position size.

To be honest, I started buying PATH even before I completed all of my research. Sometimes you just get a gut feeling and I got it with PATH. I never started building the position significantly until I completed my research though. Today I feel very comfortable owning PATH based on what I know today and will continue to add to my position as and when. As always, paid subs will be updated the minute I do that.

As I will go on to explain, there’s still a lot of unknowns in the PATH thesis but ultimately sometimes you have to invest before products start to materially affect the numbers because by then it’ll be too late.

For about 70% of investments, I find myself searching for stocks within a theme that I like and then from there trying to find the best current disconnect between growth rates (revenue, EBITDA, or EPS) and multiples. With PATH when I first started investing analyst estimates for FY26 revenue growth was a mere 11% and for EBITDA estimates it was ~20%.

Occasionally that would be attractive, but I saw multiples in the range of 3x (revenue) and 12x (EBITDA). Those multiples for those growth rates aren’t that attractive and most of the time they wouldn’t interest me.

But I saw something different with PATH. They’d been shot down ~86% from 2021 highs because “RPA was dying”. They’d been consolidating in this $12 range for ~8 months and then they introduced Maestro in early 2025 which was their entrance into the Agentic AI era.

I then started to see some nice analyst recognitions. We had:

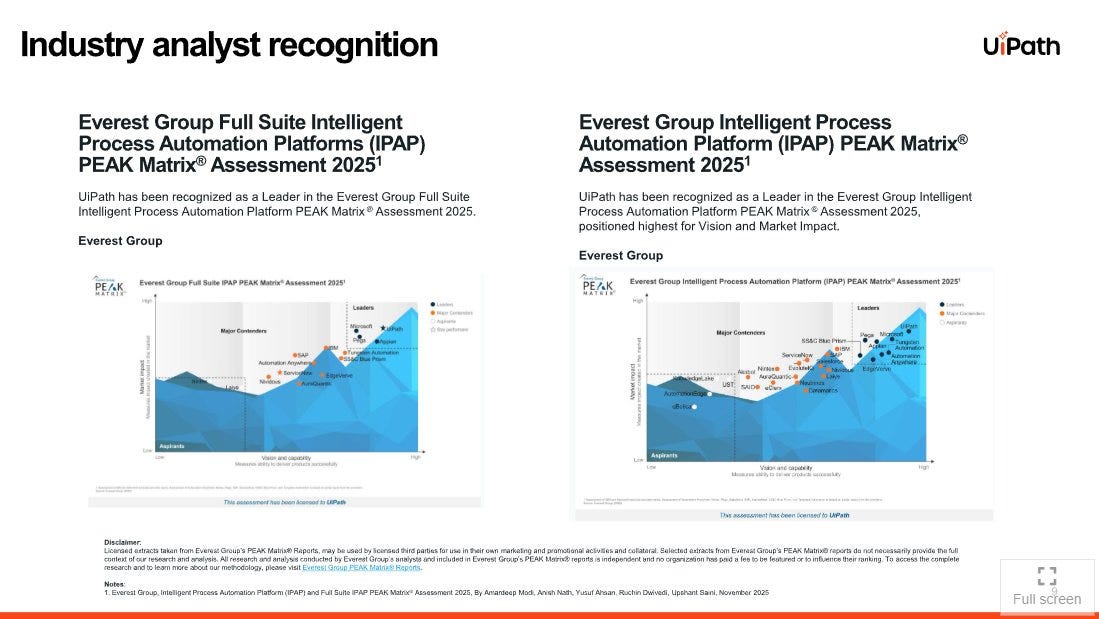

Everest Group who rated PATH as a top Agentic AI platform.

Featured in TIME’s Best Inventions of 2025.

Gartner ranked PATH as a leader in Gartner Magic Quadrant for IDP.

I felt the hype around Maestro slowly starting. Then came partnerships with MSFT, NVDA, and Open AI. Then came new wins. It felt like PLTR back in 2023 all over again. And the chart didn’t look too dissimilar either.

Business

PATH was founded in 2005. They created their business around RPA (Robotic Process Automation) to tackle repetitive, rules-based tasks that bogged down back-office operations like data entry, invoice processing, or form filing for example. They essentially built “software robots” that mimicked human actions slashing manual labor by up to 80% for over 10,000 enterprise customers.

But as businesses grew more complex and more dynamic, PATH struggled to keep up and growth decelerated. As the rise of AI integration happened which exposed RPA’s limitations in handling unstructured data or dynamic processes, PATH had to evolve their business to include Agentic AI which they did in 2025 through Maestro.

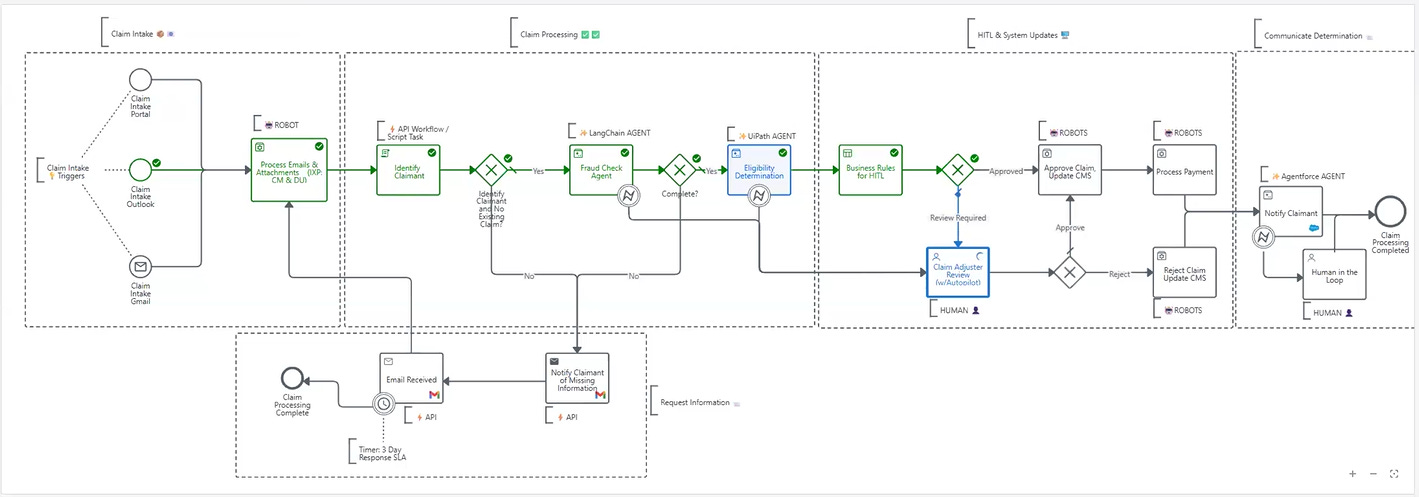

Today, PATH have Maestro at the core of their product. It visually models complex processes, routes tasks between AI agents (such as Copilot, Gemini etc), and assigns RPA tasks, all whilst providing real-time monitoring and compliance.

It’s important to understand that Maestro is just another layer to their RPA business. Agentic AI has not completely taken over the business and everything they do. RPA bots still perform certain rules-based tasks a lot better than Agentic AI can. Maestro just adds another huge layer to PATH’s end product.

PATH’s end product today essentially supercharges RPA’s stickiness by creating a huge, unified platform moat. Where traditional RPA bots weren’t designed for the tasks at hand, Maestro’s adaptive orchestration fosters network effects. Higher adoption pulls through 20-30% more platform usage, boosts NRR, and locks in multi-year expansions as customers scale from task level RPA to full Agentic AI ecosystems allowing PATH the opportunity to really fight to win a good portion of the $50B Agentic AI TAM ahead of them.

Today, PATH is in the process of selling this additional layer to their current Fortune 500 clients. This should become easier as they further begin to evidence data driven wins such as $100M+ in savings across clients so far.

Opportunities

I will keep referring to PLTR in this article. That’s not necessarily because I believe PATH will offer the same returns… but it’s because I learnt a lot from PLTR. I did actually invest in PLTR and returned about 150% return but I could’ve spotted it earlier if I knew exactly what was going on.

I won’t make those same mistakes with PATH.

In my opinion, PATH is currently sitting at the exact same inflection point as PLTR in early 2023. At that time, PLTR was viewed as a niche and unprofitable government contractor with slowing growth.

From there, they did 3 things:

They proved their platform (AIP).

They achieved GAAP profitability.

They provide rapid Time-to-Value (Bootcamps). PATH call this “ScreenPlay”.

PATH is in the process of 1. It’s likely to complete 2 this year. And 3 is still up in the air.

Anyway, based on the above, here’s the big opportunities I see for PATH over the next 2 years 👇

Margin Growth

PATH just posted their first ever GAAP profitable Q3 which is a nice signal.

PATH’s gross margins are very strong consistently above 80%. Their profitability issues stem from sales and marketing sales and marketing which made up 34% of revenue in Q3. This sounds a lot, which it is, but in the previous quarter it was 39%. Also, companies like HIMS are still at 39% even today. We’re seeing some nice operating leverage here as S&M drops whilst revenue continues to go up.

Likewise, R&D is ~15% of revenue today (17% in the previous quarter), so again revenue growth is growing faster than R&D expenses.

But even more exciting let’s compare these numbers to PLTR back in 2023.

PLTR sales and marketing expenses were 33.5%. PATH is 34% today.

PLTR R&D expenses were 18.2%. PATH is 15% today.

They’re following the PLTR playbook at the moment.

Importantly, material revenue growth hasn’t even started yet. This will likely be in the next 2-3 quarters (see section below).

I suspect operating margins will hit ~25%-30% by FY28. I’ll dive into what this means for the valuation down in the valuation section but here’s why I think we get there.

At the moment customer acquisition costs are high. Management is still trying to prove the product, and this includes lots of conferences, bootcamps, and long beta testing periods to personalize the product for each customer before they can truly evidence results. But what we’re slowly starting to see is material evidence backing up the product. (Check out Q3 Earnings Call Notes for specifics on this).

The more data PATH start to have to back up the product, the easier sales becomes. It happened with PLTR who were at ~33% of revenue for S&M in 2023. Today, they’re down at 23%. This is a natural shift that will come with:

More wins.

More big client wins.

More evidence of cost savings.

Ultimately the aim is to drop S&M expenses whilst accelerating revenue growth. This 10% drop in S&M expenses PLTR have achieved relative to revenue drops straight to the bottom line, which is exactly how you go from a marginally profitable company to a cash flow machine.

Aside from a reduction in S&M, PATH should see a natural flywheel allowing gross margins to expand further upwards of 80% just because of the standardization effect. Currently, every new enterprise client needs custom integrations, and dedicated servers. Over time, this becomes more standardized with more similar clients and also as the platform gets smarter allowing it to handle edge cases better. This is when the product shifts from very custom bespoke workflows to almost a one size fits all model.

I suspect gross margins can easily hit 85%-88% over the next 2 years based on the above.

Revenue Growth

For me this is the most critical component of where my PATH investment will end up over the next 2-3 years. My base case and bull case models rely on revenue growth expanding to upwards of 20% YoY.

The growth ultimately will come from layering more revenue streams, and stickier revenue streams, on top of its stable RPA core. The market currently sees PATH as a “license” business, rather than an emerging “consumption” business and I think a lot of investors are missing this important point.

Customer Stickiness

The real growth for PATH in the near term isn’t going to come from winning thousands of new clients. They already have 10,680 clients and 65% of the Fortune 500. Currently, NRR is at 108% meaning for every $100 a customer spent last year, they are spending $108 this year.

PATH is boasting 98% gross retention as nobody is walking away from their core RPA bots. Once a company has PATH automating payroll, or other processes like invoices or claims, they become very sticky infrastructure. The next stage is upselling with Maestro.

Here’s the core thing to understand. Enterprises are now deploying many AI agents at once - think MSFT CoPilot, Salesforce, GOOGL Gemini, Open AI, Claude etc etc. This creates very challenging integrations.

There’s been two new standards (MCP and A2A) which fix this chaotic integration and PATH is one of the very few platforms to support both. So importantly…what does this mean?

It means Maestro turns PATH into the operating system that lets all of these 3rd party agents integrate with each other and hand off work to each other without endless code.

This means PATH is not competing against these AI agents. They’re the layer that makes all of them together. It means the more MSFT Copilot is used, or Gemini, the more PATH is needed.

NRR

PATH’s NRR stands at 108% today, down from their peak at 119%, but it’s still expansionary meaning existing customers are spending more than 8% more YoY. Maestro is the layer that will driven upsell by orchestrating complex end to end processes than span across many different workflows.

TAM Expansion

The RPA market has a TAM ~$4B but agentic AI’s add on expands this addressable market to +$50B by 2030 (49% CAGR per Gartner). Maestro essentially shifts PATH from task-level bots to enterprise-wide orchestration.

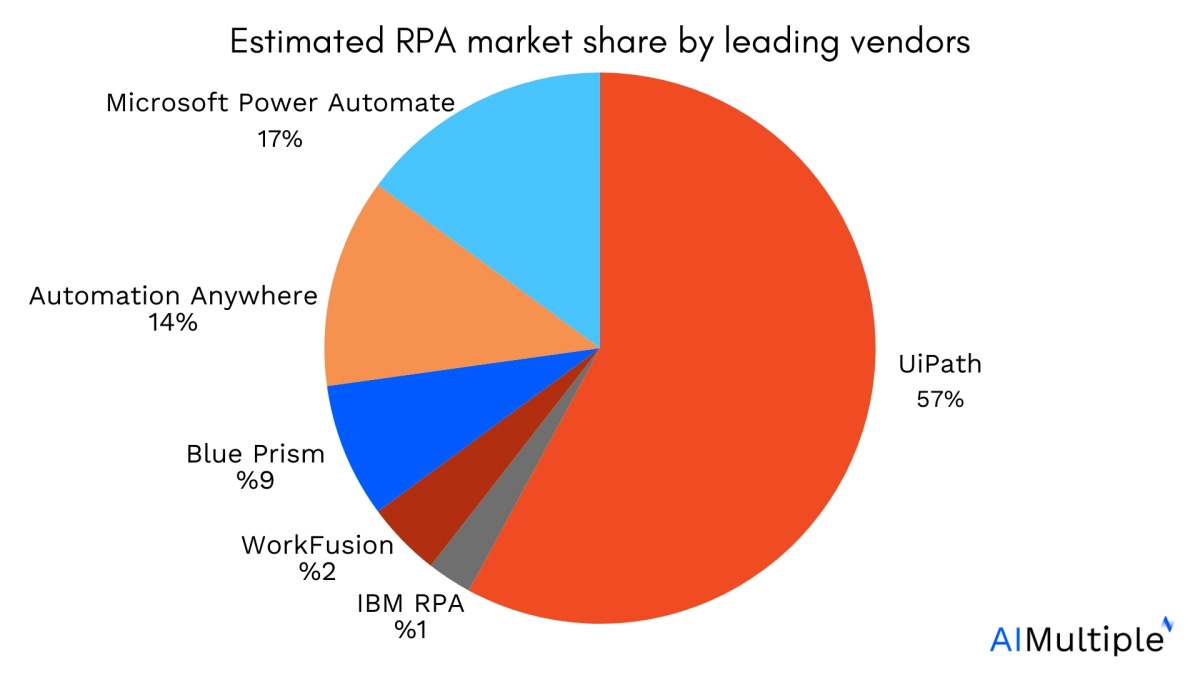

PATH Agentic AI report noted that 90% of U.S. IT executives see agentic potential in the processes with 77% planning investments in 2026, yet only 37% are live. This shows the massive greenfield ahead that PATH has to win. With brand awareness in the agentic field on the up and multiple awards (such as Gartner) becoming more regular, carving out a +65% market share in this sector seems feasible. That ultimately opens up a in this sector seems completely feasible. That opens up a $32.5B opportunity for PATH to go and win.

On top of this you’ve got the fact that PATH is very North America heavy opening up more greenfield in EMEA/APAC. Currently, PATH have partnerships with Saudi Aramco. In the EU, ISO 42001 allows for accelerated deal closures and shorter sales cycles so there’s a nice opportunity here for PATH to increase revenue quickly whilst diversifying away from North America a bit.

Q3 Review

Numbers

I went into Q3 earnings basing 90% of my time and focus on the earnings call and management commentary. We weren’t expecting numbers to materially change with Maestro just yet so focusing on the slow growth, and slim margins does not paint the picture of the investment case for PATH at all yet.

I sense we will start to see these in the numbers in the next 2-4 quarters in which case I’ll have to diligently look at the financials far more than I am today. But for the time being, it doesn’t change too much for me.

Anyway, here’s what the financials showed:

Demand

Total revenue: $411M which was 16% YoY growth, up from previous quarters 10% growth. This was propped up by Professional Services revenue but we did see some more deal closures in big accounts.

ARR was up 11% YoY to $1.78B

Total customers: 10,680 which includes 65% Fortune 500 penetration.

320 customers with $1M ARR. Previous quarter was 290.

NRR: 108%

Gross retention: 98%

Profitability

GAAP Operating Income: $13M which marked the first profitable Q3 quarter.

Gross Margin: 85% overall which is up 200 bps YoY.

Guidance

Q4 FY2026 revenue guidance was $415-$417M in revenue (estimated at $400M). This would mean we see 20-21% growth YoY.

FY2026 revenue guidance was $1.571-$1.576B (+15% YoY at the midpoint).

FY2026 Non-GAAP Operating Income was $265M-$270M which is a 17% margin.

Not bad numbers at all. I suspect they get a lot better over the next 2 years.

Q3 Presentation

The main narrative of the call was “stabilization” after quite a rough start to the year. Management touched nicely on the fact that revenue growth rates are slowly increasing again, execution is coming, and they hit a nice profitability milestone as well with Q3 GAAP profitability. I felt the hype around Maestro, but it could have been more. It wasn’t Karp-esque… but it was good. There’s no need to push it too much.

Recent Wins & Beta Testing Data

Much like PLTR calls in 2023 and 2024 where Karp repeatedly hammered home real-world ROI to shift perceptions towards PLTR becoming an AI powerhouse, PATH’s leadership are now attempting the same thing. They’re trying to demonstrate Maestro’s orchestration layer is delivering tangible valuable in production and not just pilots.

These wins/quotes below signal an inflection. Take note 👇

Large Investment Firm

“A powerful example is one of the world’s largest investment management firms…They’ve already demonstrated measurable impact through multiple agentic PICs integrating with ServiceNow, Confluence, and specialized LLMs to orchestrate end-to-end workflows and delivering 95% reduction in time to value and tens of millions in projected savings.”

“With more than 260 automations, they expanded this quarter to increase their adoption of Agentic Automation. And together with Ashling, has identified over 40 high-value cases expected to generated more than $200 million in savings over the next 3 years.”

USE Insurance Services

“A great example is USI Insurance Services which selected UIPath because of our multi-agent orchestration capabilities. Working with Lydonia, they are automating a complex workflow where UiPath agents and robots process incoming requests and generate output, all orchestrated by Maestro. USI expects over $32 million in savings over the next 3 years.”

Corewell Health

““A great example is Corewell Health, which plans to leverage IXP to automate the processing of referral information into Epic, in addition to improving efficiency and accuracy, they are on track to redirect $1.5 million of labor savings this year and expect over $3 million next year.”

Energie (Energy Utility)

“One example is Energie, which adopted UiPath test cloud to address testing challenges across SAP and its digital apps. With Agentic Testing and autonomous self-healing, they expect 30% better coverage, 1.5x faster cycles and almost $2.9 million in savings over 3 years.

Leading US Managed Care Provider

“A powerful example is the leading U.S. managed care provider that is leveraging UiPath agents, robots and Maestro to tackle a backlog of more than 140,000 provided appeals. They automated the entire workflow using agents to classify forms, robots to handle processing and Maestro to orchestrate the process. The result is a streamlined operation targeting 80% autonomy in year 1.”

Federal Sector Wins

“Expansions with the U.S. Coast Guard to modernize core systems and improve mission readiness through automation and AI.”

“Automating disability claims and enhancing contact center service for veterans.”

These wins remind me exactly of PLTR’s earnings call back in 2023 and 2024. PLTR spent this period trying to prove that their product wasn’t just “hype”, but that it drove hard, dollar-based ROI.

I think PATH is currently at the same phase as mid 2023 for PLTR. The product clearly works. They wouldn’t be able to deliver 95% in reduction in time and tens of millions of dollars saved if the product wasn’t as good as they say it was. The main difference now is that PLTR generated a lot more hype around their product than PATH is doing right now. This likely helped with selling but also attracted a nicer multiple to the market when the numbers started to show up.

Ultimately, the call dropped hard metrics on agentic beta traction and demand. 950+ customers live with workflows (2x QoQ), 450+ building agents, and 1M+ agent runs executed. They’re converting pilot to production 2x faster than core RPA. This validates the $50B agentic TAM opportunity that we touched on above. PATH’s management are stacking proof and this should gradually shift multiples with more proof QoQ.

Risks

No deep dive would be complete without a solid bear case/risks section.

Slow Revenue Growth: PATH’s ARR grew just 11% in Q3. I highlighted I wasn’t too concerned with the numbers at the moment, but there’s a chance this growth rate doesn’t increase to above 20% like I believe it can. With delayed deal closures, struggle to upsell to Maestro, higher rate environments, and IT budgets being squeezed there’s every chance that Maestro doesn’t translate into the numbers we think it can. If that happens, PATH is arguably overvalued today. We could quite easily compress below 3x sale.

This is probably the main bear case right now. Bears see PATH as a short-term band-aid for legacy systems instead of a full overhaul. I argued against this as I believe PATH will be far more integrated into the ecosystem than people think. But I could be wrong.

Intensifying Competition: MSFT Copilot, NOW, and GOOGL are also all deepening their AI-RPA integrations. PATH’s moat with MCP/A2A is my thesis, but it’s yet proven at any material scale.

Profitability: This shouldn’t be a legit separate risk in my opinion, because with revenue growth will come operating leverage and with that will come profitability. Anyhow, PATH is still GAAP unprofitable on a trailing basis. SBC is still high, as is R&D and S&M expenses.

Broader Market Valuation: At 20.6x NTM PE, PATH looks reasonably priced below sector median by about 15%. There’s every chance we are in a software sector where valuations as a whole are too expensive and this sector median is skewed to the upside too much. As growth starts to slow down in the entire sector, which will inevitably happen at some point, we could see some significant multiple compression.

Valuation

Peer Multiple

Valuing PATH is not easy as they’re currently in this “no mans land” area. They’re no longer a pure play RPA company (more likely to be deserving of lower multiples), but they’ve also not fully proved to the market yet that they’re a “must own” AI platform like PLTR for example, though I suspect they will head that way soon.

Here’s the current PATH multiples on Friday 12/05/2025:

4.92x NTM Sales

20.90x NTM EBITDA

25.60x NTM PE

AI Premium Bucket

The below is my bull case.

The “Agentic” pivot works. Maestro becomes the operating system for many enterprises and growth re-accelerates to +20% YoY. 30% is completely feasible as well.

If this does happen we should see a re-rating to at least 15x sales, 30x EBITDA, and 40x PE in my opinion.

PLTR for example trades at 72x sales, 141x EBITDA, and 190x PE. By no means am I comparing PATH to PLTR. That would be naive to do at this stage.

NOW trades at 11x sales, 31x EBITDA, and 43x PE. This is the range I think PATH has potential to get to when they evidence product demand in the financials.

DDOG trades at 13x sales, 53x EBITDA, and 70x PE.

Strategic Workflow Bucket

The below is my bear/base case.

SNOW on the other hand trades at 17x sales, 114x EBITDA, and 181x PE. And management are also struggling with balancing its aggressive pivot to AI-driven growth. Also, in a bit of a “no mans area” but far less than PATH.

CRM trade at 5x sales, 13x EBITDA, and 20x PE. CRM are probably a fair peer to PATH right now, hence why we’re seeing quite similar multiples.

Ultimately, I think PATH ends up trading in the range of NOW’s multiples. That gives PATH a 2-3x opportunity just on multiple expansion. If PATH do start to win clients at extremely fast rates, then maybe we can get a 50-100% premium on NOW’s multiples.

Ultimately, PATH have significantly more potential to become far more deeply integrated into the broader AI ecosystem than NOW. PATH’s platform is becoming purpose built for Agentic AI positioning itself as the connective tissue for AI deployment. NOW excels in IT service management but is more siloed within its own ecosystem, hence why I think PATH does have the potential to trade at far greater multiples than NOW.

Assumptions

Here’s my assumptions for my valuation model. I will put the actual model in my Google Sheet in the next 2-3 weeks.

I put $80 as my near term profit target which I think we hit if Maestro turns out to be what I think it can be. From there, we will reconsider and see if I want to hold PATH further.

Here’s how I think we get to $80 (you’ll see it in far more detail in my valuation model for paid subs).

I think we hit $1.57B in revenue in FY2026, $1.92B in FY27 and $2.44B in FY28. That would essentially be 15%, 22%, and 27% revenue growth which I think is completely achievable if my Maestro bull case plays out.

$2.44B * 15x Fwd revenue multiple (upper end of mid-point between NOW and SNOW today) gives you an EV of $37.9B. If you add in net cash of $1.9B, you then have an equity value of $39.85B which would translate to between $75 and $80 depending on share dilution/share buybacks. I’m quite focused on revenue as the main valuation driver today because we are back in the “growth story” phase and the market needs to price in the size of the agentic AI opportunity, not the current profitability metrics. The market only really cares about demand right now.

Now that PATH is heading towards GAAP profitability though, we can start to look into EBITDA multiples though this is quite distorted by high SBC and other one-time items. It makes EBITDA a secondary valuation for me right now. Nevertheless, if PATH hits $2.44B in revenue in FY28, I suspect EBITDA margins will be in the range of 25% which means we see $610M in EBITDA.

$610M in EBITDA is 33% CAGR from today. From here to reach $80 share we’d need ~50x multiple plus net cash which means we’re putting PATH in quite a small basket of stocks trading for these kinds of multiples at this growth rate. Think PLTR (again), SNOW trading at +100x EBITDA for ~50% growth, CRWD at 55x for ~35% EBITDA growth, NET at 60x for ~45% growth and DDOG at 58x for ~38% growth.

Quite a small basket of stocks in nice industries do trade at these multiples, and I ultimately would not be buying PATH so heavily if I didn’t think it could also be included in this basket of quality.

Valuation Model

I will be reworking my Google Spreadsheet for 2026. On there I will include many different tabs with:

My exact portfolio

My adds, buys, sells, & trims (in real time)

My watchlist

My investing universe (will include 20+ megathemes with all stocks per theme ranked attractive or not)

Price targets and/or points of attractiveness for those stocks I’m interested in

Valuation models for top 5 holdings. On there you’ll see my PATH valuation model. I won’t be including it here for free.

Only $16 a month if you get in before the end of the year. In 2026, my price will be going up to $20 per month. Still very cheap for the value I offer.

Technicals

I wanted to include this session to ensure completeness of my Deep Dive, but I have barely looked at technicals once in my time investing in PATH. I suspect I’ll start to do it slightly more now as I focus on nice places to add but when you’re investing horizon for this stock is at least 5+ years, whether I invest at $16 or $18 or $21 doesn’t bother me at all when the ultimate PT is $80 (or even much higher).

With other stocks in my portfolio where conviction is high, but not quite as high as PATH, I’ll focus more on trying to get perfect entries but at the moment I don’t care here.

Ultimately, though in the short term these are the main levels to watch above. I suspect we get to $21-$22 level but there’s some resistance levels there which I doubt we break straight through. A pullback from those levels down maybe 10% or so could prepare us for the nice next leg up into the mid $20s.

I hope you enjoyed this article on PATH. If there’s any feedback or additional information that you think would be necessary, please do reach out to me and let me know or leave a comment below.

Very interesting article Oliver. I see your point. As an inexperienced user of RPA, the hardest thing for a big business to do is to fully integrate RPA into their very expensive IT systems. They rely on external business analysts/architects for implementation. If Path get this right, hopefully its an easier and cheaper process.

I've been following you on X for a while. It's the first deep dive I read from you and I'm very impressed 👍