Warren Buffett Investment Framework 📜

A Simple Way to Screen for Quality

It’s #WisdomWednesday!

If you haven’t subscribed yet, what are you waiting for?

Art vs Science Investing Debate

In today’s article, I’ll give you the exact Warren Buffett framework to picking quality stocks. But does this mean you’ll automatically invest like Buffett?

Of course not.

Why?

Because investing is a combination of an art and a science.

Morgan Housel says it best so I won’t try reword it:

“Gathering information is a science. Filtering out noise is an art.

Net present value is a science. Identifying the trust and passion of a CEO is an art.

Measuring what worked in the past is a science. Understanding why things are different now is an art".”

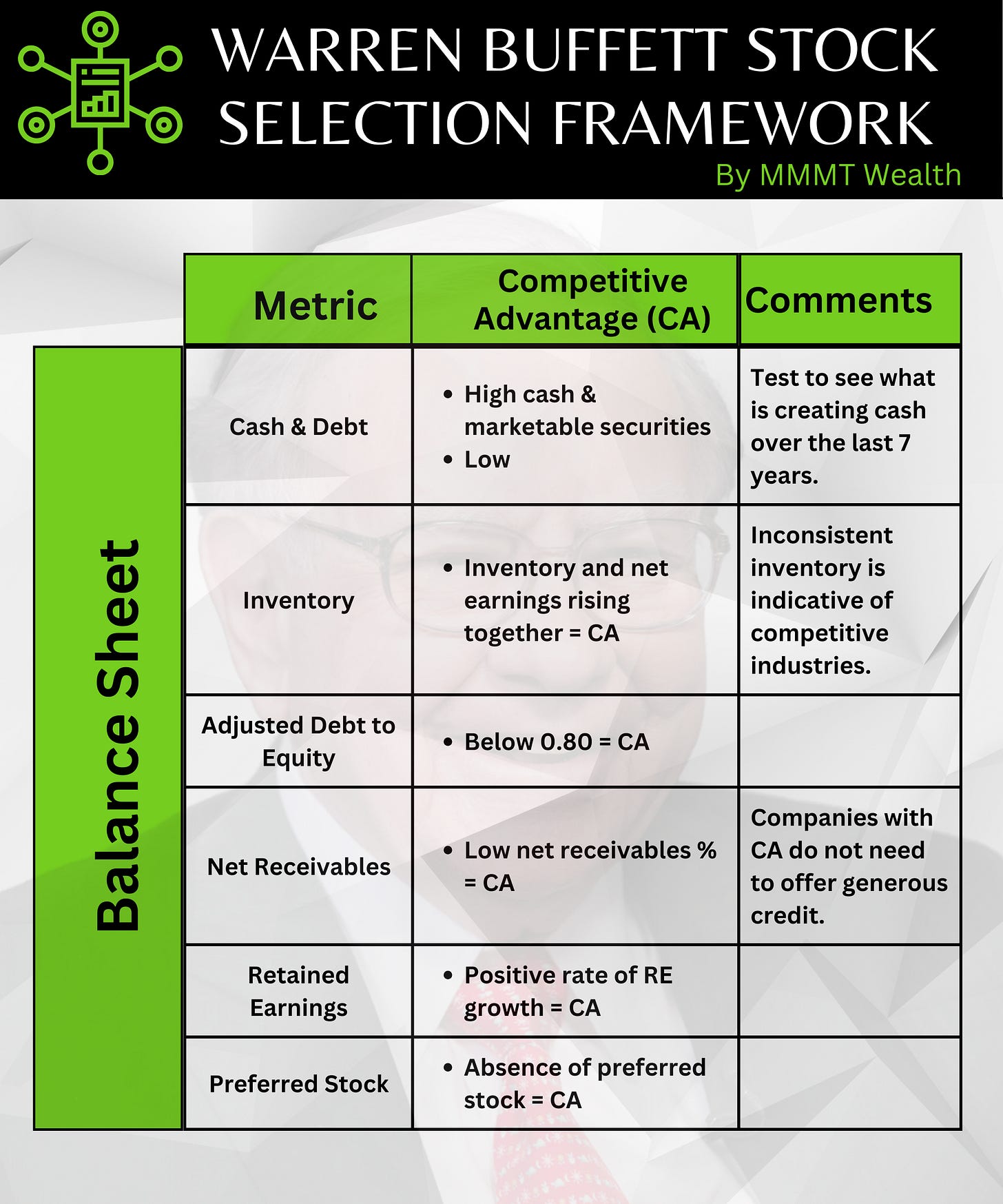

The Buffett framework below covers a fraction of the science behind investing. It’ll give you a specific method of finding quality companies very quickly.

1 Investment Lesson - The Buffett Framework

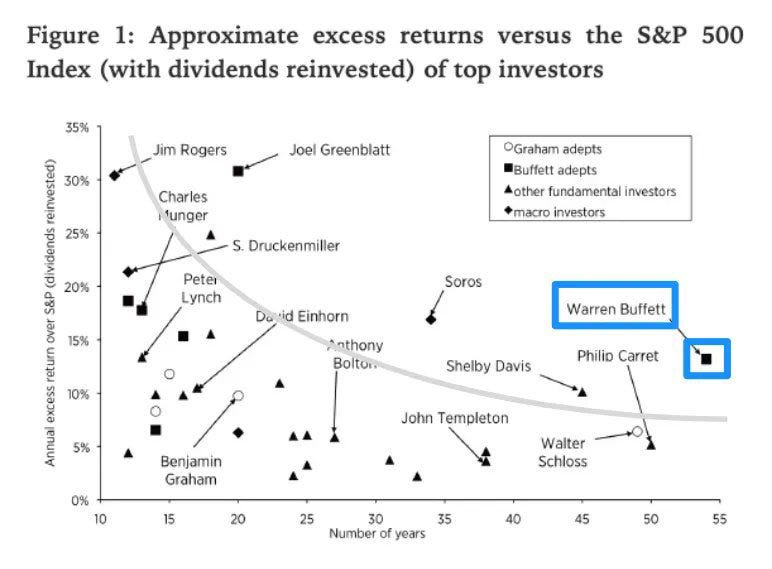

Warren Buffett compounded at ~13% in excess of the index for 55 years.

To put that into perspective, a $1,000 investment would turn into $50 million!

Today, I’m sharing with you his investment framework that he used to generate these returns.

And…5 stocks that pass this framework 📈

The Framework

5 Stocks That Pass This Framework

Adobe ADBE 0.00%↑

Cadence Design Systems CDNS 0.00%↑

Global Ship Lease GSL 0.00%↑

Novo Nordisk $NOVO.B

Veeva Systems VEEV 0.00%↑

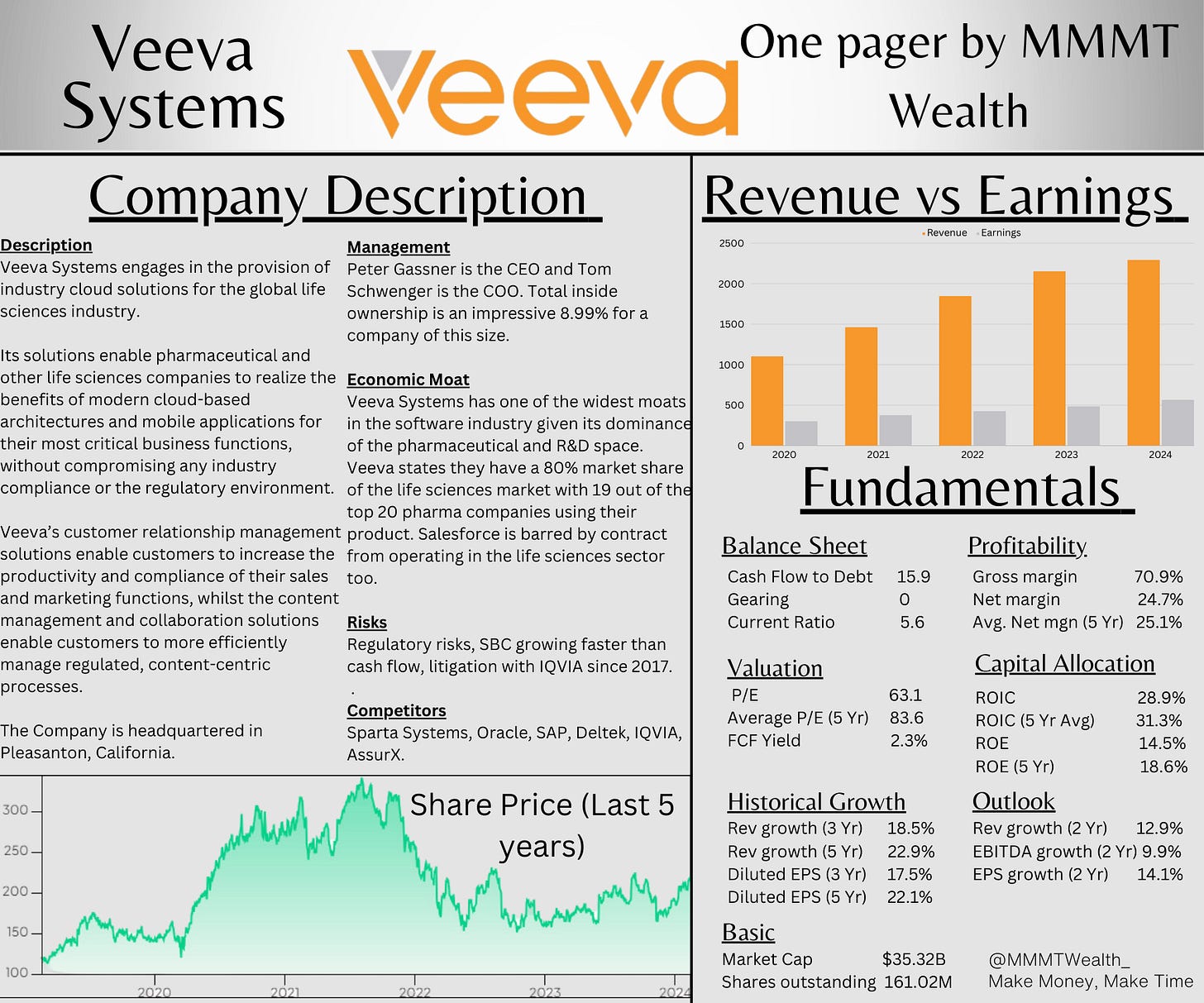

1 Investment Idea - Veeva Systems VEEV 0.00%↑

Here’s the One-Pager for this Quality Stock:

Veeva Systems VEEV 0.00%↑ provides cloud-based software for the life sciences industry where they dominate the market.

The Company offers software and data solutions, digital asset management solutions, analytics platforms, and customer reference data solutions as well as many other smaller offerings such as document management and regulatory submission management.

Here’s some numbers which show the quality.

Gross Profit Margin: 24.7%

ROIC: 28.9%

FCF Margin: 38.9%

5-Yr Annual Rev Growth: 22.9%

The Company has compounded at 26.1% since it’s IPO.

Veeva Systems has an extremely wide moat too. Why?

80% market share in the cloud-based software systems to life sciences industry.

Big player (and previous partner) Salesforce is contractually barred from operating in the life sciences industry.

Very high barriers to entry and specialized experience required to even attempt to build a product in such a complex environment.

Revenue retention rates are +120% indicating minimal customer losses and pricing power to increase revenue per customer.

1 Graphic

Podcasts are free education…just like my newsletter📈

Here’s 9 of the best investing podcasts. Do you have a favorite?

1 In-Depth X Thread

I wrote a thread on X this week giving you 5 Quality Stocks with Wide Moats.

Want to see the post?

1 Quote

Has to be a Buffett quote today doesn’t it?

“The best investment you can make is an investment in yourself. The more you learn, the more you’ll earn.” - Warren Buffett

So what are you waiting for? FREE education every Wednesday and Sunday right to your inbox 👇

That’s it for the day

I hope you found a lot of value this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me!

If you want to read more from me, subscribe to this newsletter, completely for free, and I’ll continue providing investors like you with the best insights on a weekly basis. You can also me follow me on X.

About the author

Make Money, Make Time is written by Oliver, a qualified CA, and investor who has read over 300 investment books, and spends more than 50 hours per week researching stocks so that you don’t have to. Let’s level-up together!

WB has been in the market longer than anyone else alive. His compound interest is unimaginable (even though he doesn't invest in index funds).