#WednesdayWisdom No.8 and Capital Allocation Overview

Here's everything you need to know about capital allocation

In this article we’ll focus on capital allocation, one of the most important jobs of management, and therefore one of the most important factors for investors to understand.

Later on in the article, I’ve given you a One-Pager of a quality company to invest in.

1 Investment Lesson - Capital Allocation

Capital allocation is perhaps the most important task for management.

And it’s also arguably the most important factor to look at when analyzing a company.

What is capital allocation?

A companies main aim is to generate cash, right?

Capital allocation is the step after this. It’s the decision about what to do with the cash earned.

The aim of management is to put the cash to work in order to generate the most attractive rate of return.

As investors, it’s our duty to look for companies which clearly define how they plan to allocate capital.

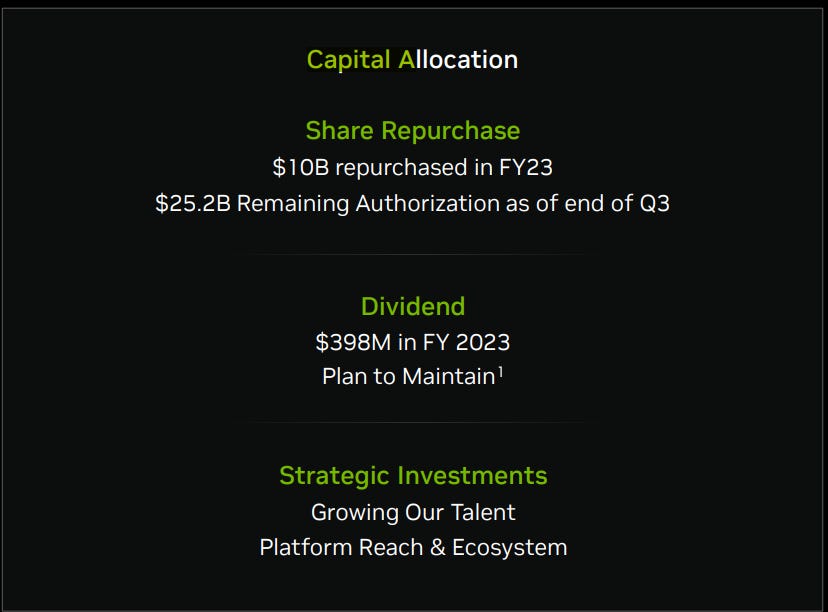

Here’s Nvidia’s capital allocation priorities:

Here’s Visa’s capital allocation priorities:

We need to invest in companies where management has a quality capital allocation track record.

Capital allocation options

There’s 4 main options for a company to allocate capital:

Organic growth

Mergers & acquisitions

Balance sheet/debt repayment

Return capital to shareholders (dividends/share buybacks)

1. Organic growth

You want to invest in companies that are able to reinvest earnings into organic growth opportunities that offer high rates of return.

To do this effectively, a company needs a high ROIC.

Let’s take a look at 2 scenarios:

Company A

Invested capital in year 0 = $100M

ROIC 5%

Company B

Invested capital in year 0 = $10M

ROIC 50%

Note: These numbers (5% vs 50%) are quite extreme, but this is for learning purposes.

With full reinvestment of earnings at the respective ROIC’s above, net profit over a 10-year period is as follows:

Where have these numbers come from…?

Let’s go through Company B:

ROIC = Net profit / Invested Capital

Therefore:

Net profit = ROIC * Invested Capital

Year 0: 50% * $10M = $5M

Invested capital then increases with net profit as both companies reinvest all earnings.

Year 1: $5M * (1+50%) = $7.5M

Year 2: $7.5M * (1+50%) = $11.25M

And so on…

Net profit for Company B after 10 years is 35x Company A.

That’s the power of a high ROIC.

2. Mergers & Acquisitions

M&A is risky in many cases and there’s many studies that has proven ~60% of M&A’s decrease the value of a business.

It’s very difficult to predict whether an M&A deal with be successful or not, so I advise caution when a company announces large acquisitions.

3. Balance sheet/Debt repayment

A company may decide to use their earnings to pay down debt.

This provides:

A healthier looking balance sheet

More flexibility

This is never a bad option in my opinion, but I’d prefer to see earnings reinvested into opportunities with high rates of return of course.

4. Return capital to shareholders

A company may decide to return capital back to shareholders via dividends and/or share buybacks.

Though the income is often appealing, a priority on dividends often signifies management has no attractive growth opportunities.

Share buybacks are bullish, but only when the stock is undervalued.

Want to learn more about share buybacks?

This article has everything you need to know.

Another visual

This study is by Mckinsey. It shows how important capital allocation is.

Over a 15 year period, companies that were proactive in their capital allocation outperformed “fixed allocators” by 120%.

1 Investment Idea - Crocs CROX 0.00%↑

Want an example of a quality company with a high ROIC?

Look no further than Crocs. See the One-Pager I created.

Since our focus of this article is on capital allocation, let’s take a quick look at Crocs priorities:

One of the most attractive parts about CROX 0.00%↑ is the brand strength so it’s great to see this remains a priority for management to maintain and strengthen the brand.

Debt paydown in this instance is promising since long-term debt rose considerably after the HEYDUDE acquisition in 2021.

Promisingly, we can see long-term debt is already trending downwards after the acquisition as is the debt/equity ratio which peaked in 2021.

This reduces the liquidity risks that were perhaps evident 2 years ago.

Fundamentally, CROX 0.00%↑ is a very solid business, with extremely strong brand loyalty.

2024 will likely be a bullish year for the stock that is starting to gain some attention from investors.

P.s. Inside ownership is 16% which is very attractive for a company of this size.

1 Graphic

Here’s a graphic I made on why you shouldn’t focus on EBITDA.

1 In-Depth Twitter (X) Thread

I wrote a thread on companies that David Tepper has invested in for 2024.

There some quality companies in there that may give you some investment ideas to research.

You can view the post here!

1 Quote

“The best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return.” - Warren Buffett

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also me follow me on X.

About the author

Make Money, Make Time is written by Oliver, a qualified CA, and investor who has read over 300 investment books, and spends more than 50 hours per week researching stocks so that you don’t have to. Let’s level-up together!

I agree about dividends, Oliver. This usually (not always) means that the aggressive growth phase is over and the company is trying to stabilise its stock price by getting investors to hold its stock.