Why Mexico Is a Great Investment 📈

There's many opportunities outside just your home market

It’s #WednesdayWisdom No.11!

In today’s article, I’ve got a quality investment idea for you, plus need-to-know investing advice, all in under 5 minutes.

If you haven’t subscribed yet, then now’s your chance!

1 Investing Concept - A Big Opportunity in Mexico

The S&P 500 has created astronomical wealth over the past 40 years.

But there’s many other global markets that have created incredible wealth too. For example:

Buffett invested heavily into Japan in March 2023. The Nikkei 225 is up ~31% since then but Buffett’s investments have returned even more than that.

The Nifty 50 (Indian market) has returned 24% over the past year.

How much longer can the US bull market last?

I’m not one to make macro predictions, because, quite frankly nobody knows.

But what I do know is the famous quote by Buffett:

“Be fearful when others are greedy and greedy when others are fearful”

Well, here’s the current fear & greed index:

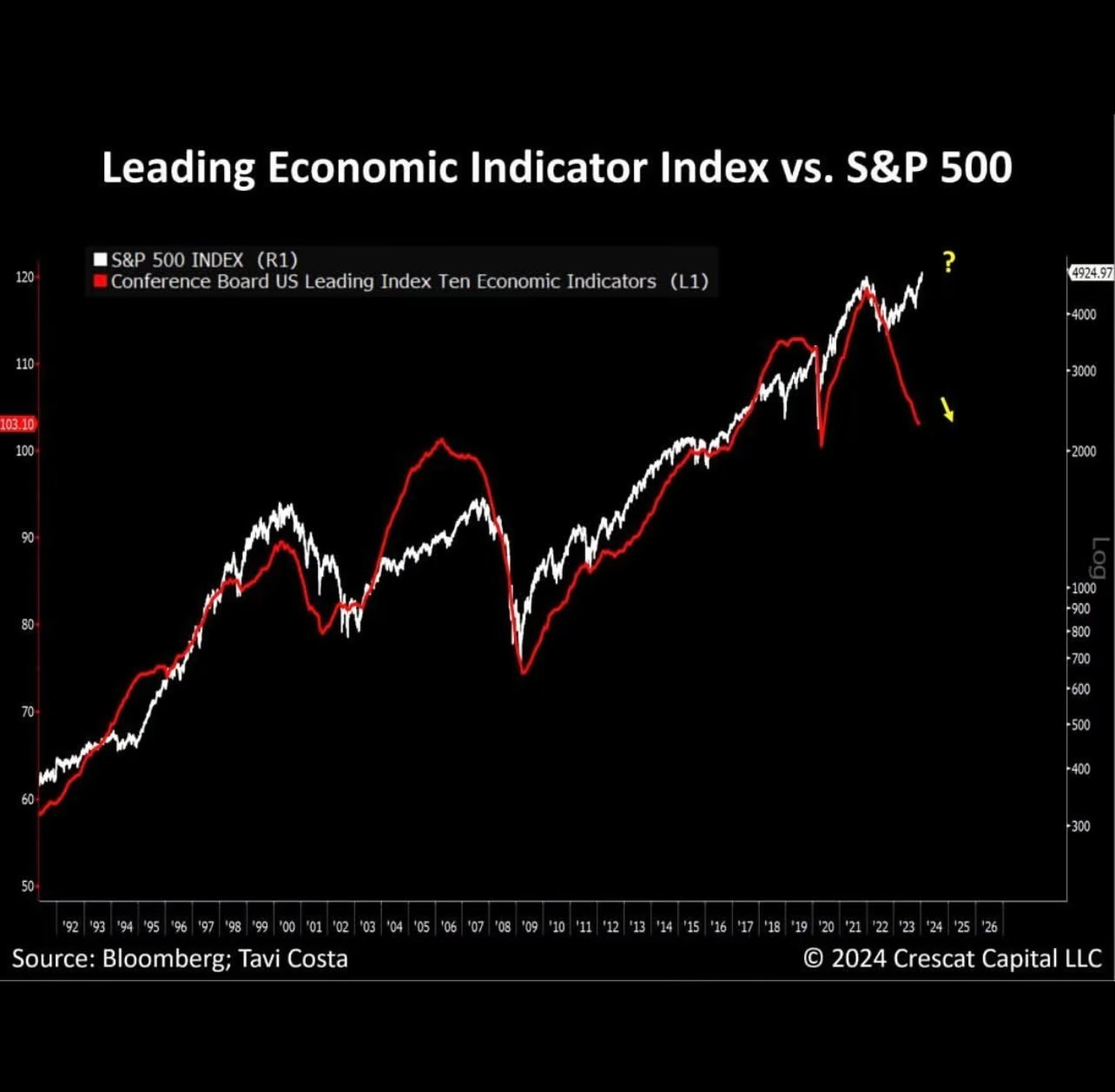

And here you can see the Leading Economic Indicator vs S&P 500.

I am not bearish on the US economy, but I have strong conviction that there’s great value investments elsewhere.

This is where Mexico comes in

According to the “Buffett Indicator”, a metric famously used by Warren himself to value a country’s stock market, Mexico has one of the cheapest markets in the world.

Buffet Indicator: Market cap of country’s stocks / Gross Domestic Product

Mexico’s Buffett Indicator is currently 32% vs the US at 180%.

The MSCI Mexico Index currently trades at a 17x price/earnings (US 24.7x).

Of course, like any individual stock, the more quality the stock, the higher the valuation. There’s no difference here and it’s difficult to compare Mexico to the US.

However, there’s many reasons to be bullish on Mexico:

Fiscally healthy

Relatively low debts when compared to developed and/or emerging economies

“Nearshoring”/de-globalization due to USMCA trade agreement

However, whilst macroeconomic stability is a strong foundation for my idea here, the main reason Mexican equities seem attractive is because there are numerous very fundamentally strong companies with durable growth, strong moats, and quality management who allocate capital well.

Here’s 5 high quality Mexican companies:

Bolsa Mexicana de Valores - Bolsa runs the Mexico Stock Exchange. They help transfer custody and settle payments for stocks, bonds, and ETFs. Pretty strong moat there, right?

Grupo Aeroportuario del Sureste - Owns and operates airports in cities throughout Southeastern Mexico, Puerto Rico, and Colombia.

Grupo Mexico - Controls a portfolio of high-quality assets mainly in the mining industry.

Wal-Mart de Mexico (WALMEX) - Largest food retailer in Central America operating over 3,700 stores across names such as Walmart, Sam’s Club, and Bodegas Aurrera.

GMexico Transportes - Largest railroad operator throughout Mexico with several border & port terminal connections.

1 Investment Idea - Grupo Aeroportuario del Sureste ✈

My favorite company from the 5 above is Grupo Aeroportuario del Sureste.

Here’s the One-Pager:

Concise Investment Case:

Financially healthy company with debt levels trending downwards, an extremely high interest coverage ratio of 12, and cash flow to debt ratio of 1.1.

Annual free cash flow of $11.6M that is trending upwards (anomaly of COVID).

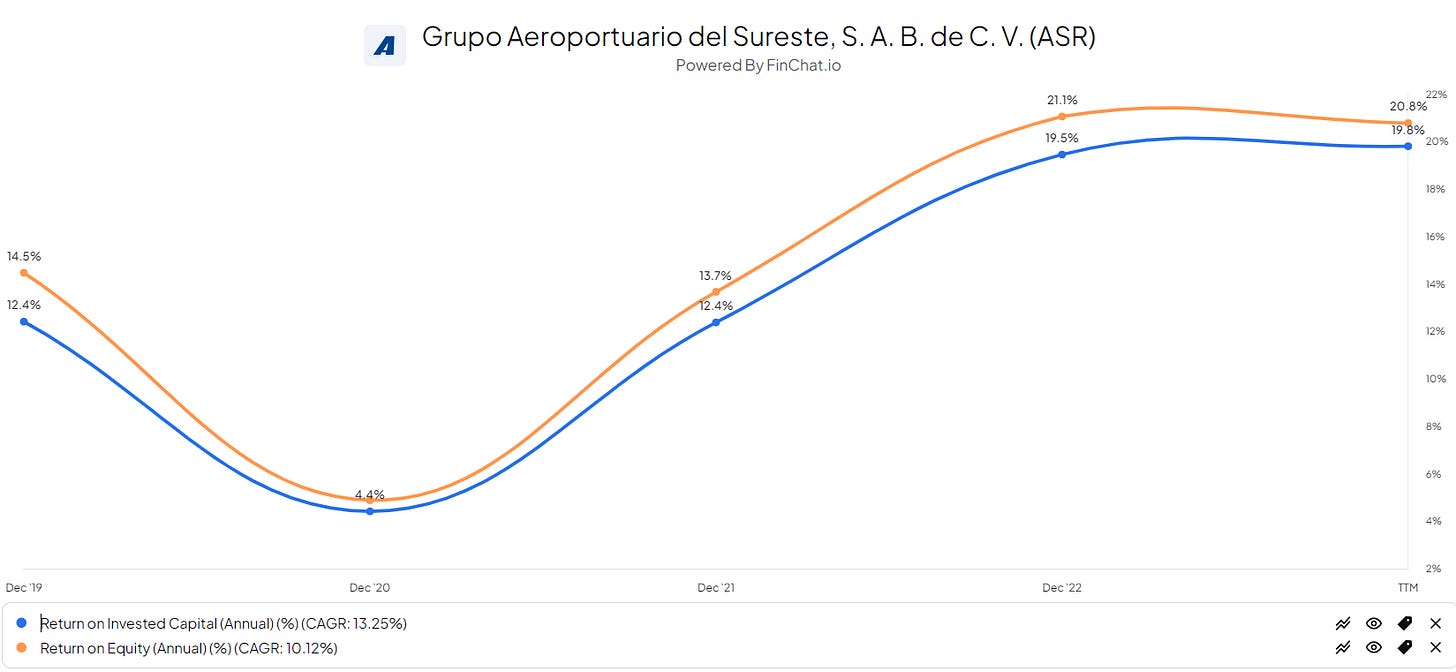

Very promising ROIC and ROE ~20%. I normally strive for +15%

Extremely profitable margins with net margins approaching 40%.

Total passenger traffic increased 3.4% compared to prior year with the biggest success in Puerto Rico.

1 Graphic

Have you ever struggled to read an annual report? If so, here’s a framework by the “Dean of Valuation” Aswath Damodaran on how you should work your way through a report.

1 In Depth Twitter (X) Thread

I profiled arguably the greatest CEO in the world - Satya Nadella.

Satya is the CEO of Microsoft which recently became the 2nd company to hit a $3T market cap. He’s very understudied, and perhaps underrated, so I thought I’d change that.

Here’s his best 10 lessons on investing and leadership:

1 Quote

Mohnish Pabrai looks for companies with a ROIC above 20% and with a strong competitive advantage.

It’s hard to argue that Grupo Aeroportuario del Sureste doesn’t fit this criteria.

“I look for companies that have a very high rate of return on capital - in the high 20% area. And I also look to see what their competitors are doing to reduce that return on capital. I want to find a business with a moat around it.” - Mohnish Pabrai

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also me follow me on X.

About the author

Make Money, Make Time is written by Oliver, a qualified CA, and investor who has read over 300 investment books, and spends more than 50 hours per week researching stocks so that you don’t have to. Let’s level-up together!

Interesting thoughts on Mexico, Oliver. And kudos to Mr. Nadella. He's a great CEO.