#WisdomWednesday No.3 and The Best Lessons From the Great Charlie Munger

99 years of wisdom

It’s #WisdomWednesday here at Make Money, Make Time!

In this article we’ll take a deep dive into Charlie Munger, one of the greatest investors of all time. I’ve spent hours researching his investing principles and best life quotes so that I can provide the most value for you right here.

1 Key Investing Lesson

It’s impossible to pick out just one key lesson from the great Charlie Munger, so I’m going to give you 5 this week.

I believe these 5 tips sum up Munger’s investing principles as well as I can do.

Know your stuff

“You have to figure out what your own aptitudes are. If you play games where other people have the aptitudes and you don’t, you’re going to lose.”

Munger’s greatest strength was his knowledge of banks. He invested heavily into U.S. Bancorp, Wells Fargo, and Bank of America.

It goes without saying that it’s best to have deep knowledge of many industries, as this gives you the widest range of opportunities to exploit, but it’s not necessary.

People have made life changing money by simply understand one sector extremely well.

Margin of safety

Munger adopted the investing theory first introduced by Benjamin Graham - margin of safety.

Munger and Buffet always aimed for a margin of safety of 25%.

This decreases a lot of risk, and allows for above-average returns.

Buy undervalued stocks with a higher intrinsic value. This provides a cushion for further unexpected drawdowns.

“In engineering, people have a big margin of safety. But in the financial world, people don’t give a damn about safety," Munger said. "When you build a bridge, you insist it can carry 30,000 pounds, but you only drive 10,000 pound trucks across it. And the same idea works in investing.”

It’s a simple concept, but it’s difficult to do. I’ll dive into margin of safety in another article so make sure you’re subscribed so you don’t miss it!

Economic moat

Munger always bought companies with a strong economic moat. In other words, it’s a “protective layer against competitors.”

“One competitor is enough to ruin a business.”

Examples of companies with an economic moat that you probably haven’t considered before:

Moody’s

IDEXX Laboratories

Stryker Corporation

Rollins

Vail Resorts

WD-40 Company

MSC Industrial Direct

Compound Interest

Now we all know compound interest in investing is crucial. But here Munger is talking about compound interest of your knowledge.

"Spend each day trying to be a little wiser than you were when you woke up. Discharge your duties faithfully and well. Step by step you get ahead, but not necessarily in fast spurts”.

Few and infrequent

In life, and in investing, good opportunities don’t come around often. As Munger said, “Life is not just bathing you with unlimited opportunities.”

For this reason, when the quality stocks do appear, it’s vital that you go all in. Don’t worry about diversity. Why would you when the stock is great?

To Munger, investing in more than 10 stocks is over-diversified.

He says it best here:

“The whole secret of investment is to find places where it is safe and wise not to diversify.”

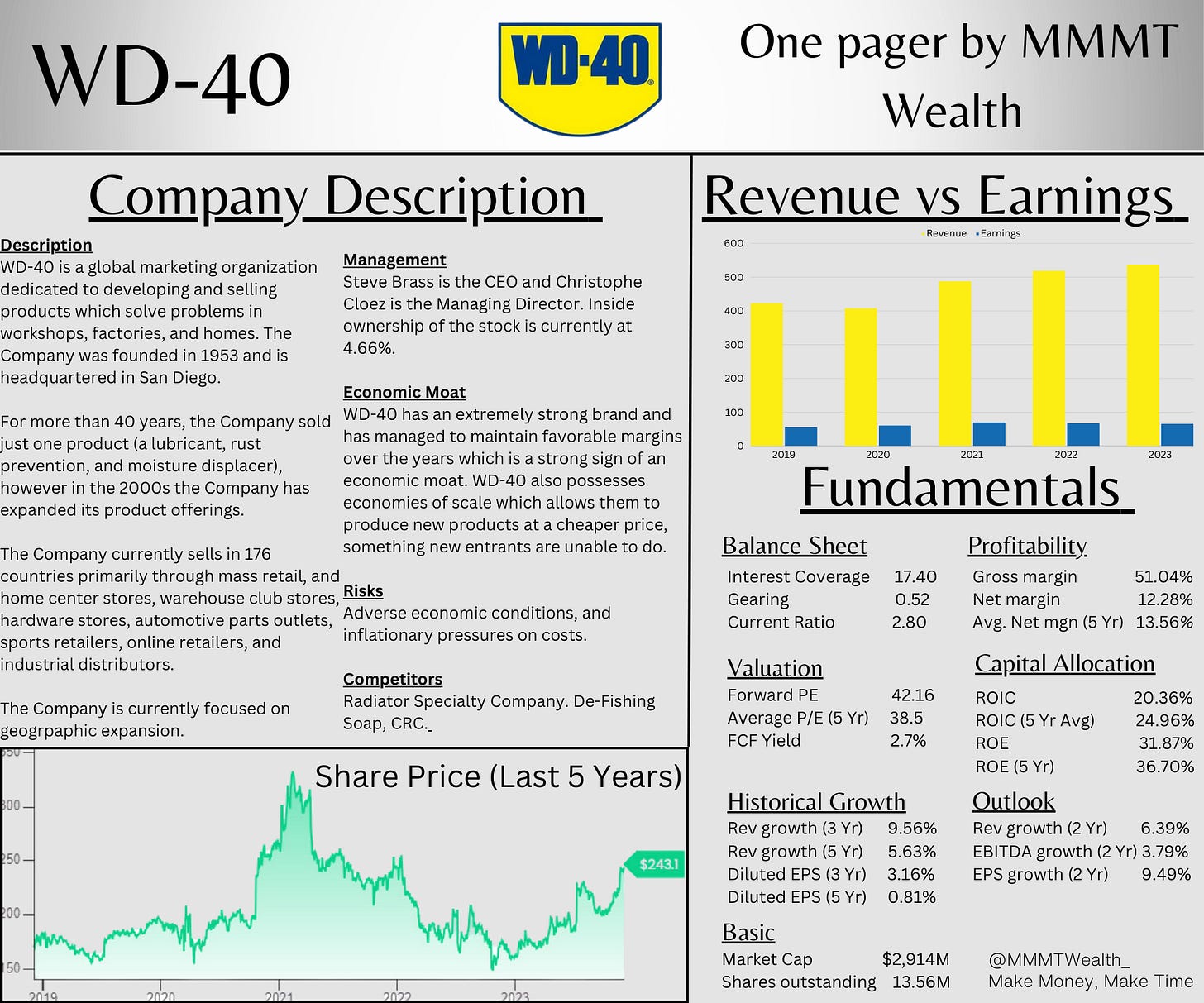

1 Investment Idea - WD-40

Now this isn’t a company that Munger owned, but it’s a company that fits a lot of his metrics.

ROIC

“Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns.

If the business earns 6% on capital over 40 years, and you hold it for 40 years, you’re not going to make much different than a 6% return - even if you originally buy at a huge discount.

Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with one hell of a result.”

Well, here’s the good news.

The 5 Yr average ROIC for WD-40 is 24.96.

The current ROIC is 20.36%.

This is a huge positive, and a great showing of the economic moat that WD-40 possesses.

Great margins

WD-40 possesses a gross margin of 51.44%, an operating margin of 16.7%, and a net margin of 12.28%.

A solid margin normally means that the company has a good economic moat, as they are able to increase prices with any associated increase in costs, without losing demand.

Although there has been a slight decrease in net profit margin (down from 13%), there has been a large uptick in FCF Margin.

This shows the efficiency in which WD-40 is converting it’s revenue into free cash flow.

As you’ll see below, this is vital.

Is now the right time to invest?

WD-40 is a quality stock, and therefore it should be on your watchlist, ready to go when the time is right.

Currently, I don’t believe there is enough margin of safety present to invest yet.

For example, the FCF Yield is currently way above the 5 Yr average and that is a sign the stock is arguably overvalued and lacking that safety that we need. Remember, Munger always strove for a 25% margin of safety.

But, put WD-40 on your watchlist. If we see a drop into the $220s or below, an investment could be reconsidered.

I’ll have a deeper dive on this stock come out shortly so stay tuned.

1 Graphic

Munger famously loved free cash flow (as all the best investors do), and had no interest in metrics like EBITDA or non-GAAP earnings.

The above graphic highlights just a couple of the reasons why free cash flow is a leading metric.

1 in depth Twitter Thread

Well, who else would this Twitter thread be on?

The day of the news of Mungers passing, I wrote a thread on some of the greatest investing and life lessons from Charlie Munger.

1 Quote

“It’s remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent". - Charlie Munger

1 Motivational Paragraph

People Want Relaxed Risk-Free Lives. Then They Wonder Why They’re Bored and Unhappy

There’s a deep unhappiness in today’s society. One of the main reasons for this is people’s desire to live a risk-free life that leads to comfort, boredom, fatigue, lethargy etc

To me, there’s a guaranteed result of a risk-free life.

Without taking a risk, you can essentially predict the rest of your working life with ease. It won’t change much, aside from some pay rises, and more responsibility, and ultimately more unhappiness.

Some people are ok with this. But many people hate the thought of thinking their life won’t change for the next 40 years.

But why does a risk-free life lead to unhappiness?

Humans are programmed for excitement and action.

When we refuse to take risks, deep down we know we are not living up to our full potential.

And the fact that years are passing by quicker than you can even fathom makes everything worse. The fact you can’t go back in time. The realization you’ve wasted 5 years of your life sitting in an office chair.

So go take a risk!

Don’t be stupid (referring to Munger’s quote above), but take a series of smart, calculated risks.

Don’t wait for change to approach you. It never will.

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also me follow me on X.

About the author

Make Money, Make Time is written by Oliver, a qualified CA, and investor who has read over 300 investment books, and spends more than 50 hours per week researching stocks so that you don’t have to. Let’s level-up together!