#WisdomWednesday No.6 and One Huge Lesson From Munger

EBITDA / Bullsh*t. Same thing?

1 Key Investing Lesson - EBITDA

EBITDA is quite a controversial accounting metric, and Munger once said it’s essentially “bullsh*t earnings.”

And well, he’s not wrong.

Take a look at this One-Page visual I made:

What is EBITDA?

Earnings

Before

Interest

Tax

Depreciation

Amortization

This simply highlights what a company earns before costs like interest, tax, depreciation, and amortization are deducted.

The formula is:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

Before I get negative, let’s have a look at when EBITDA can be positive and useful.

It can sometimes provide a clear picture of the day-to-day operations of a Company because it excludes non-operating items.

EBITDA allows for an easy comparison to other companies.

EBITDA is actually very simple, and quick to calculate.

EBITDA is often used for valuation purposes (such as Enterprise Value / EBITDA).

But let’s dive a bit further…

EBITDA removes many important expenses and therefore is not the “bottom-line” profit of a company.

It does not represent the true profitability of a company, and is therefore quite misleading.

Free cash flow shows you what a Company actually earns after deducting all expenses.

So next time you see the word EBITDA, take it with a pinch of salt. It’s far from a fair representation.

1 Investment Idea - PDD Holdings

Now I’ve told you to ignore EBITDA, and focus on free cash flow…

Here’s 10 tech stocks that have the highest free cash flow (FCF) over the past 12 months:

Apple AA 0.00%↑ PL - $99.6B

Alphabet GOOG 0.00%↑ - $77.6B

Microsoft MSFT 0.00%↑ - $63.2B

Meta META 0.00%↑ - $37.6B

Alibaba BABA 0.00%↑ - $30.4B

Broadcom AVGO 0.00%↑ - $17.6B

Nvidia NVDA 0.00%↑ - $17.5B

Cisco CSCO 0.00%↑ - $17.5B

Amazon AMZN 0.00%↑ - $16.9B

PDD Holdings PDD 0.00%↑ - $11.9B

At current valuations, PDD Holdings has arguably the most upside potential over the next 2-3 years from the above list.

See the One-Pager I created below:

Financials

Fundamentally, there’s not much to dislike about PDD Holdings.

Revenue growth - 87%

Earnings growth - 18%

ROIC - 69.1%

Gearing - 0.12

Inside ownership - 35%

Net margin - 23.3%

FCF margin - 41.9%

Free cash flow (2019) - $14.7M

Free cash flow (2023) - $83.2M

The company is extremely strong.

Non-financials

Of course, PDD still faces regulatory challenges in China and U.S. and the recent growth in the stock could encourage regulators to get involved just like they did with Jack Ma.

For example, Google have suspended Pinduoduo app from the Play Store amid spyware concerns. There is also accusations from a short-seller than Temu contains spyware directly targeted at North American and European customers.

These concerns definitely have the potential to compress valuations of PDD 0.00%↑ despite the strong business growth.

Conclusion

I like PDD 0.00%↑ despite the macro risks. In my opinion, China is too powerful, and always will be. I don’t believe there will be too many material events that disrupt the future of leading Chinese tech companies such as PDD Holdings.

PDD is an extremely profitable company and its valuation is fairly attractive compared to other growth stocks globally. Once the short-term headwinds of China die down, stocks like PDD Holdings will get valued fairly relative to their growth, and not their regulatory difficulties.

I’m bullish on PDD.

1 Graphic

I’m writing this on (what would be) Mungers 100th birthday. 01/01/2023.

Here’s 10 lessons from the great Munger:

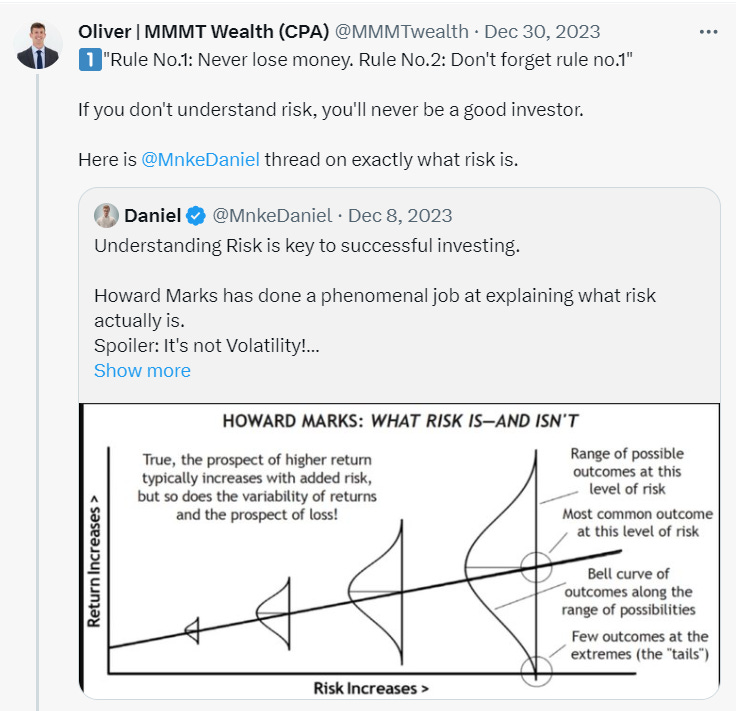

1 In Depth X (Twitter) Thread

To finish 2023, I wrote a post of my 10 favorite posts of the year. There’s some incredible knowledge to be taken from this thread.

You can see it here!

1 Quote

It can’t not be a Munger quote can it?

“The game of life is the game of everlasting learning. At least it is you want to win.” - Charlie Munger

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also me follow me on X.

About the author

Make Money, Make Time is written by Oliver, a qualified CA, and investor who has read over 300 investment books, and spends more than 50 hours per week researching stocks so that you don’t have to. Let’s level-up together!

I agree that EBITDA is misleading. Companies use it in their earnings calls when it's a good figure and don't use when it doesn't look good.

Hi Oliver, do you mind sharing where you are able to see the insider holding of PDD? My typical source, TIKR, doesn't seem to include the ownership.