#WisdomWednesday No.7 and Economic Moats

And how you can find them.

1 Key Investing Lesson - Economic Moat

“The most important thing to me is figuring out how big a moat there is around the business. What I love of course, is a big castle and a big moat with piranhas and crocodiles.” - Warren Buffett

The term economic moat refers to the ability of a business to maintain its competitive advantage over competitors, protect its market sure, and ensure long-term profitability.

Economic moats lead to sustainable value creation and as investors we want to buy companies that:

Create a lot of value

Create value for a long time

How to Figure Out If a Company Has an Economic Moat

Step 1

Create an Industry Map

List firm in order of dominance (size or market share)

Consider new entrants as well

Evaluate other factors that may impact profitability (labor, regulations etc)

Step 2

Construct a Profit Pool

This is slightly more complex but I’ll include an image example below of a completed Profit Pool.

A Profit Pool shows how an industries value creation is distributed over time.

Horizontal axis represents all the capital invested in the industry.

Vertical axis represents economic profitability.

Firstly, over the 10 year period we can see that nearly all airlines destroyed value.

Secondly, the trend this analysis shows is that there was a market share gain for lower cost airlines (United and Jet Blue). Though this has not necessarily translated into profitability.

Step 3

Consider Industry Stability

There’s 2 ways to do this.

Measure industry stability by looking at the absolute change in market share over a 5 year period, and then divide by the number of competitors.

The lower the absolute change, the more stable an industry is.

Pricing power

“The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business” - Warren Buffet

Step 4

Firm Specific Analysis

For every deep dive I do, I’ll discuss the below factors in more detail.

But to be concise here, firm specific signs to look out for are:

Production advantages

Distribution advantages

Purchasing advantages

Research and development advantages

Advertising advantages

High switching costs

Habitual products

Network effects advantages

Strong brand

To finish this section, let’s do another Buffett quote. Why not?

“The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantages of any given company and, above all, the durability of that advantages. The products or services that have wide, sustainable moats around them are the ones that deliver rewards to investors.”

1 Investment Idea - Fortinet

Talking of companies that have an economic moat…let’s talk about Fortinet FTNT 0.00%↑.

Let’s start with the industry:

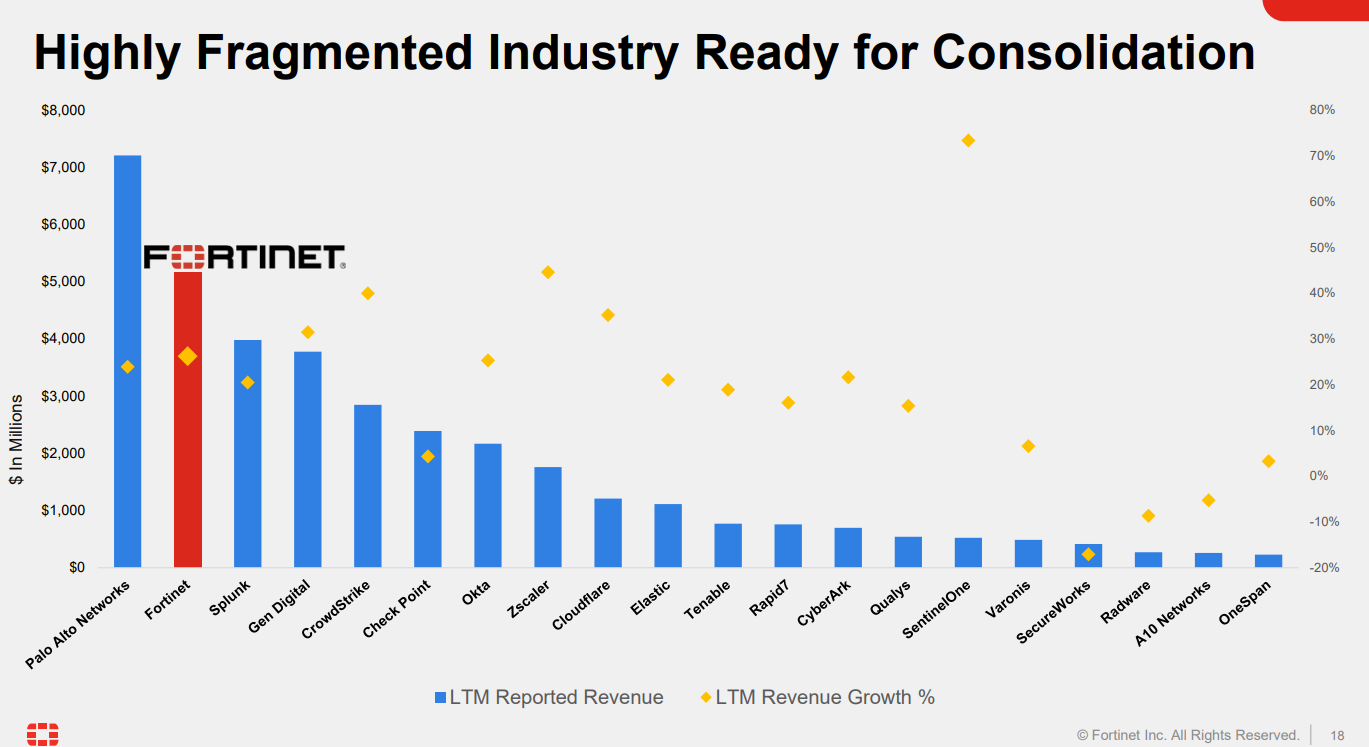

Fortinet is the 2nd largest cybersecurity company in the world. The life cycle of the sector is slowing beginning to consolidate and Fortinet are incredibly well positioned.

The industry will consolidate further and Fortinet’s pricing power will likely get even stronger than it is now (at a 76% gross margin).

Fortinet crushes all of these “general rules of thumb” aside from the liabilities to equity ratios.

But this isn’t a worry to me. Why?

Fortinet FCF: $2,063.8M

Fortinet Cash: $2,186.8M

Fortinet Interest Expense: $20.1M

Fortinet Long-Term Debt: $991.8M

They’re in a very strong position.

#WisdomWednesday’s aren’t for a deep dives. They’re just for briefer investment ideas and One-Pagers. I like FTNT 0.00%↑ a lot though. Maybe I’ll do a deep dive on it? Let me know if you’d like that!

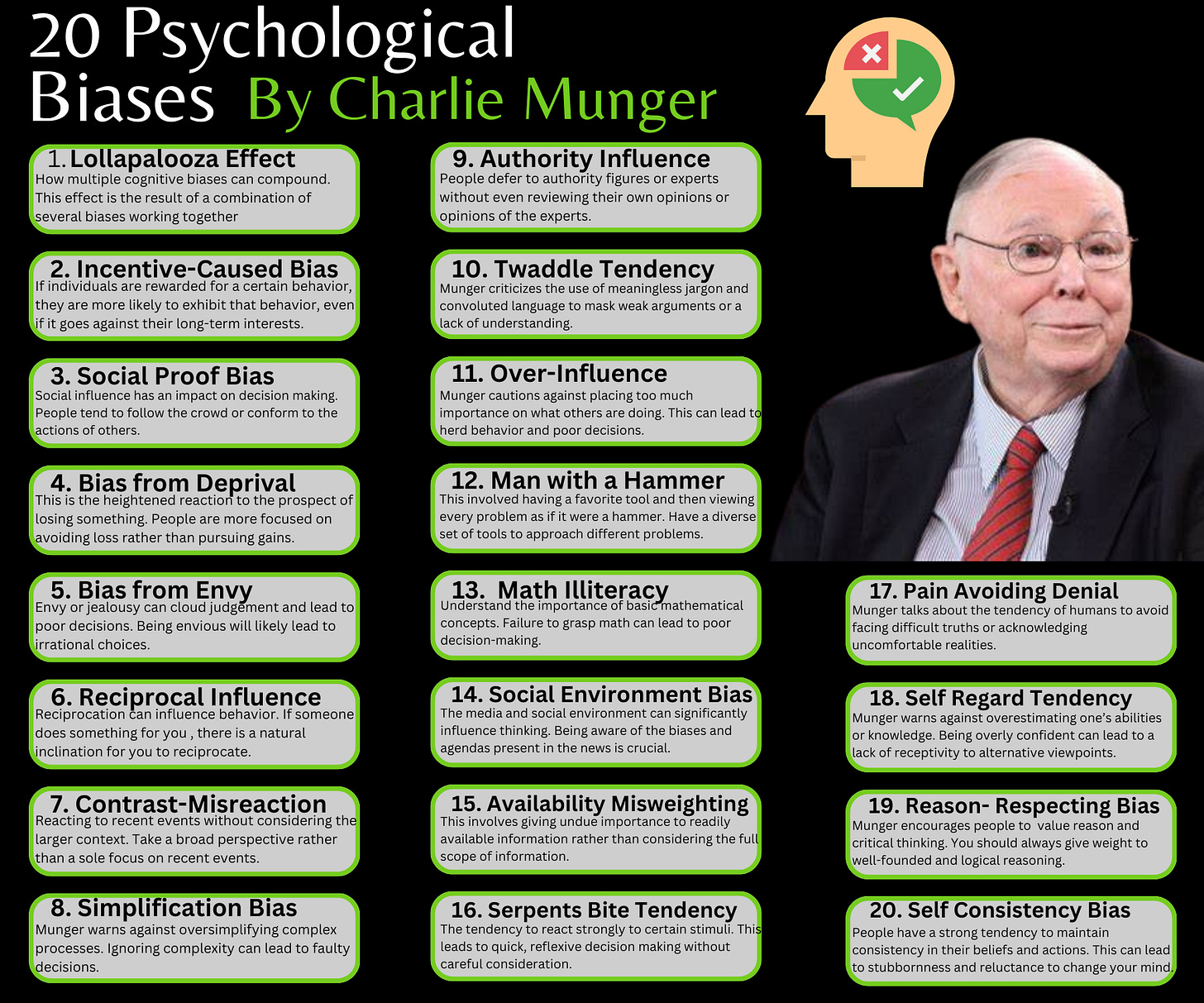

1 Graphic

Of course it’s important to understand how to correctly analyze a company, but it’s also important to understand how many different biases can affect your decision making.

If you’re aware of these, there is less chance they’ll affect you.

1 In Depth Twitter (X) Thread

I recently wrote a thread on Bill Ackman’s book recommendations.

1 Quote

"We think of every business as an economic castle. And castles are subject to marauders. And in capitalism, with any castle... you have to expect that millions of people out there are thinking about ways to take your castle away." - Warren Buffett

That’s it for the day

I hope you loved this article. As I develop on here, I’m sure there will be some changes to my structure and style, so please do leave some feedback for me.

Please subscribe to my newsletter where I provide investors with all the tools to outperform the market, and retire well before you’re 65. You can also me follow me on X.