ZETA: Here's Why I'm Seeing a 3x Opportunity

Mini Deep Dive

Hi all 👋

Company Name: Zeta Global Holdings

Ticker: ZETA

Market Cap: $3.72B

Headquarters: New York

Shares Outstanding: 235.5M

CEO: David Steinberg

Revenue Growth: 35.6%

P/E: 23.6x

P/S: 2.9x

Outline

Introduction

Numbers

Opportunities

Risks

Valuation

Technicals

Introduction

I currently have a 3.2% position in ZETA as paid subs will be aware and we’re flat (+2.90%) so far so not much has happened to the share price but fundamentally for ZETA I’m a big fan. The stock is actually down 27% over the last year, but YTD we are only down 12% despite flying up to $23 in mid February.

Currently, I’m betting big on the second wave of AI as I call it - those companies who are using AI best in applications. Think cloud companies, software companies, InsureTech and in this instance MarTech. The NVDA’s, DELLs, ANET’s, and alike were all involved in the first wave of AI (infrastructure) and the big money has already been made on those. Today, it’s about finding those stocks for the second wave of AI that will inevitably come sooner than we may think.

I think you can tell I’m quite bullish on these kinds of stocks if you look at my portfolio 👇

What does ZETA do?

ZETA was founded in 2007 by the current CEO, David Steinberg who also has some very strong skin in the game (~11.2%) and also by former AAPL CEO John Sculley (who is now retired).

The company didn’t start necessarily as a MarTech as we think of them today. They started as an email/newsletter software company but the amount of data they gathered over time made them re-think the core vision for the company. They started to harness the power of big data, AI, and ML to build the Zeta Marketing Platform as we know it today which essentially is a single integrated platform that enables personalized marketing on a huge scale thanks to trillions of signals.

The majority of this change from an email/newsletter company to full scale MarTech happened via acquisitions at the beginning. They acquired:

Adchemy Actions (2013) - Added ML based advertising capabilities.

ClickSquared (2014) - Omnichannel SaaS campaign management.

Acxiom Impact (2016) - Marketing automation.

Boomtrain (2017) - ML to enhance decisioning in marketing workflows.

Temnos (2019) - Natural language processing to enable better prediction of consumer behaviour.

Today Zeta’s Marketing Platform (ZMP) is very complex, but highly successful. The numbers speak for themselves.

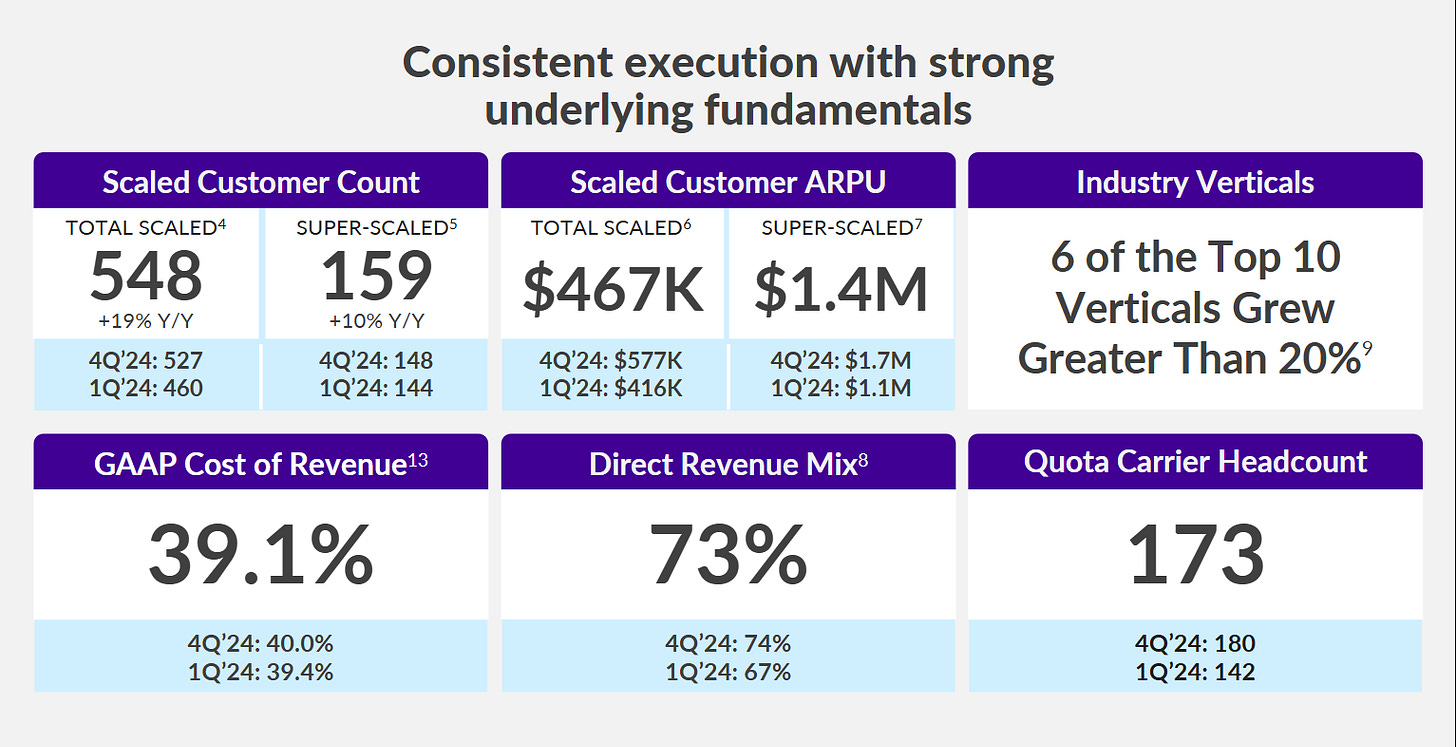

114% NRR (up from 111% in 2023). They’ve maintained NRR consistently above 110% since IPO.

17% increase in scaled customers.

13% increase in super-scaled customers.

40% of Fortune 100 as clients.

Customers across 15 different industries (consumer & retail, telecom, services, financial services, education, healthcare etc).

Numbers

I touched on the numbers specific to the marketing tech platform above (NRR, scaled customer growth etc), but now let’s look ZETA more from a broader lens.

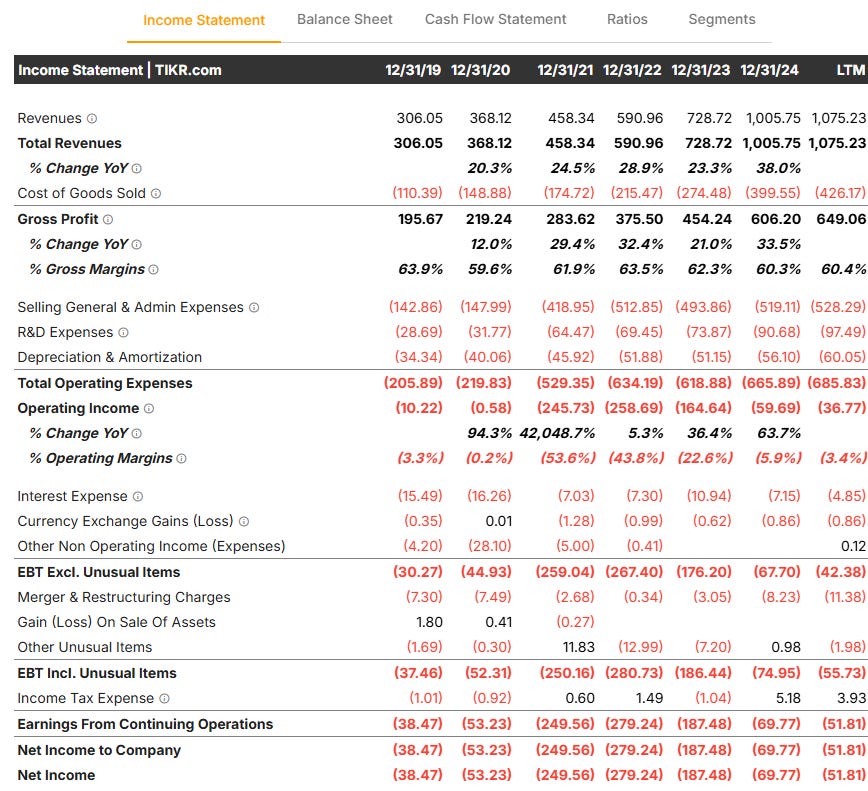

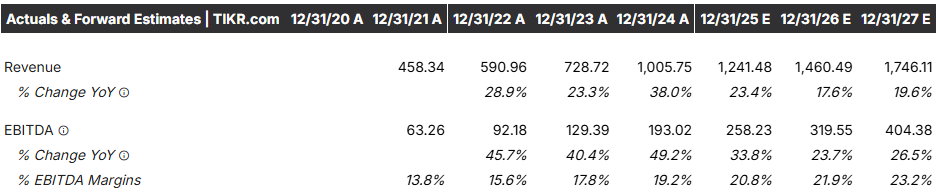

Growth

Revenue growth has been strong since 2020, consistently above 20%, although analysts are expecting revenue growth to drop below 20% YoY for the first time in 2026 onwards. This growth has been very stable though growing from $458M in 2021 to $1.005B in 2024, which is a CAGR of nearly 30% YoY.

This is testament to ZETA’s ability to win new clients, but more importantly their ability to retain and upsell current customers, especially their largest customers who spend +$1M per year on ZETA. Not only this but they’re winning customers in the fastest growing industries meaning those customers are looking to spend more and more to be competitive in big, high growth industries. Of the 15+ industries they operate in, 6 of the top 10 industries have forecasted growth rates of more than 20% YoY. This is one of the (many) reasons ZETAs NRR and scaled growth customers is so high. This has ultimately allowed them to beat revenue guidance every quarter for the last 3.5 years.

Profitability

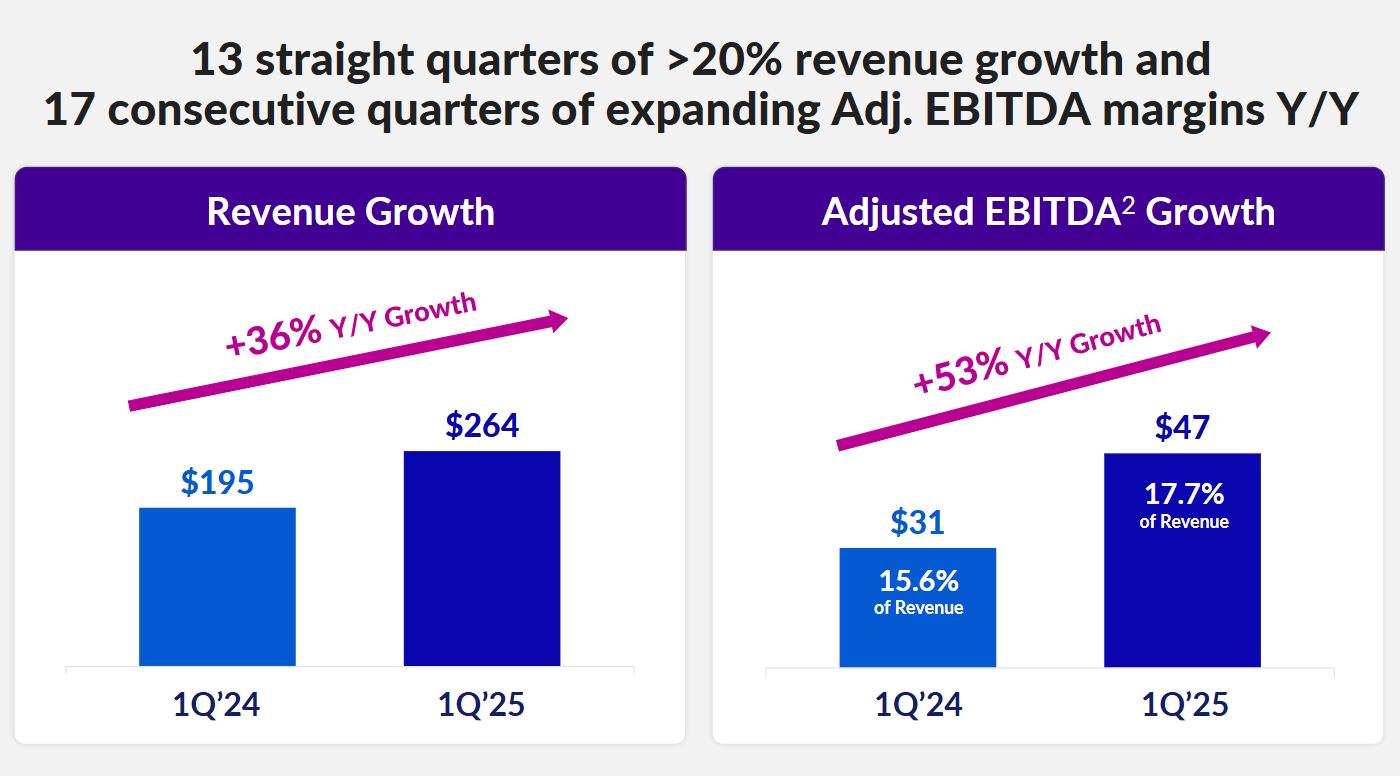

The really promising part of ZETA’s growth is that as revenue has grown, EBITDA has grown faster showcasing the operating leverage ZETA has created. EBITDA growth rates YoY have been 45.7%, 40.4%, and 49.2% respectfully from 2021 to 2024. This evidences that operating leverage is kicking in. Core costs don’t rise in line with any operations increase meaning as they add more customers (or cross sell existing customers), more incremental revenue falls mostly to the bottom line, driving faster EBITDA growth.

Ultimately, this gives characteristics of a high-quality SaaS company with recurring contracts rather than lower margin services. We’ll get into valuation later, but most SaaS quality companies trade for more than 13.8x EBITDA

Opportunities

Market Size

MarTech encompasses a lot (think CRM, data management, marketing automation, analytics, performance monitoring, content management, advertising technology etc). Ultimately data is a huge competitive advantage today, but the issue today for many corporations is managing all of this data in ways that actually give them a competitive advantage is very complex. With more data and more opportunities comes more systems that ultimately don’t all work well together.

This is where Zeta’s platform comes into play. It becomes completely unnecessary to have different systems, different subscriptions, and different licenses. Instead, companies just use ZETA. That’s the overarching reason many companies use ZETA (or competitors to ZETA) today.

The second reason is personalization. Consumer expectations are far higher today than they were a few years ago. People expect personalized interactions, personalized content, and personalized offers. There is no one-size fits all model anymore. And this is all made possible because of the quantity and quality of data that companies have today.

These points above have led the MarTech industry to be valued ~$454B with a forecast of $1.4T by 2030 (20% CAGR). This growth is driven by AI, analytics, automation, and other omnichannel solutions. So, with a potential 3x in market size by 2030, ZETA would hit +$3B in revenue by 2030 if they simply grow in line with the market.

ZETA’s growth however could be quicker than this as shown by their market share growth over the last few years. With $1.01B in revenue in a $454B market, ZETA likely have ~0.2% of the current TAM. If ZETA can grow to reach 1% of the market by 2030, there’s a $14B revenue opportunity over time but this is far out of reach for the time being. This does however show the enormity of the opportunity ahead in the MarTech space.

Macro Tailwinds

Enterprise marketing spend is outplacing overall ad spend, but most importantly the composition of corporate budgets is shifting towards 1st party data activation, personalization, and retention, rather than cookie-based advertising. This is where ZETA is very strong.

When you combine this with corporate pressure with AI “to do more with less”, the need for autonomous marketing becomes necessary. This essentially means ZETA isn’t just riding the marketing growth trend, but they’re also riding the AI efficiency megatrend which will be prevalent for the next decade or so.

Agentic AI

ZETA’s long-term vision is to move beyond AI-assisted marketing and towards full scale agentic marketing where AI autonomously plans, builds, and optimizes campaigns with little human intervention. This is what I refer to as the second wave of AI which is not being appreciated by the market just yet (think LMND, OSCR, NU… all of these companies are going to have huge revenue per employee numbers making them extremely efficient).

The longer term implications of this are pretty substantial as marketing workflows become fully autonomous. ZETA will become a central operating system for enterprise marketing teams with very strong unit economics, somewhat similar to how PLTR have positioned themselves as the central operating system for decision making in data analytics and AI. The core premise will be similar.

ZETA will be deeply integrated with CRM, CDP, messaging channels, and advertising just like PLTR is deeply embedded in internal databases, ERP systems, and supply chains leading to very high switching costs.

ZETA strives to be the single AI-driven hub for marketing just like PLTR has become the single AI hub for enterprise decision making.

PLTR has shown what is possible for those companies who use AI and data most effectively. They were the first company to truly operationalize AI at scale turning complex data analytics into actionable enterprise workflows. Though they were the first, we’re now entering a phase where entire industries will get their own PLTR moment.

Just as PLTR become the “AI operating system” for enterprise data and governments, ZETA are striving to become the “AI operating system” for marketing technology.

As I said before, marketing teams today are drowning in fragmented systems. ZETA unifies all of this into a single autonomous system. PLTR have proved that the model works. ZETA now have to replicate it in a new vertical.

Profitability Flywheel

One of ZETA’s most prominent growth drivers is their operating leverage, along with many other companies who are riding this second wave of AI. Although ZETA is ultimately known as a MarTech, the Zeta Marketing Platform is fundamentally a software and data infrastructure business meaning the bulk of ZETA’s costs are fixed costs. Once these fixed costs (AI models, data pipelines, and alike) are in place, adding a new client comes at a very small incremental cost to ZETA.

This is exactly why EBITDA growth has consistently outpaced revenue growth and will continue to do so (see chart below👇). You’ll also see in my model (valuation section) how prominent this will be over the next 3-5 years.

Ultimately over time this flywheel will lead to significantly higher FCF generation which will be further reinvested into AI, data enrichment, acquisitions, and more, all without heavy dilution or debt.

In essence, people are massively underestimating how ZETA is transitioning from a high-growth MarTech play into a SaaS platform with very good unit economics (and currently non-like SaaS multiples).

Upselling & Marketing Channels

ZETA have done an exceptional job at deepening wallet share with existing enterprise clients.

“Scaled customers” (those with +$100,000 revenue) already generate an average of $467k per annum per customer, whilst “Super Scaled” (those with $1M revenue per annum) customers exceed $1.3M in revenue per annum per customer. As with upselling across any company, the profitability from upselling is far superior to landing new clients because there’s no customer acquisition costs.

Looking at the numbers specifically, even if ZETA manages to increase ARPU by 20% per annum, the revenue potential is huge without needed to expand the customer base at all.

One way of upselling customers is by broadening the Zeta Marketing Platform to cover more channels such as connected TV, streaming, commerce integrations, retail media etc rather than email, SMS, and web-based messaging which is where ZETA is very strong today. Not only does this potentially add revenue per client, but it also increases stickiness and switching costs as enterprises begin to standardize more of their MarTech stack on ZETA.

Merger & Acquisitions

ZETA has benefitted massively from acquisitions and partnerships. It’s how they transformed themselves into a data rich SaaS platform from a marketing platform a few years ago. The next obvious step for ZETA is increasing their international footprint in Europe or APAC to gain clients there.

I’m not normally a fan of inorganic growth through M&A, but ZETA have proved consistently this is where they have a huge strength and this is how they can scale globally very fast.

Risks

Competition: ZETA competes directly with giants like ADBE, CRM, ORCL, and HUBS, all of which naturally have far superior R&D budgets. These incumbents could easily integrate AI-powered agents into their existing suites which limits the ZETA competitive advantage. However, as with companies like LMND, these companies weren’t originally built to be AI native companies meaning the shift isn’t as easy as one may think despite the huge budgets. There’s also the risk that ZETA get bought out by one of these companies for example. Management have mentioned this a lot recently

"But quite frankly, I've been spending a disproportionate percentage of my time taking calls from people trying to buy us over the last few weeks” - David Steinberg

Client concentration: ZETA relies heavily on large enterprises (TMUS, Aviva, Dollar General, Samsung, Toyota) meaning a small number of contract losses could materially affect ZETA. This is why the SMB market represents a massive opportunity for ZETA where they currently have very little penetration. ZETA could quite easily create a lighter SaaS version of its platform priced on a subscription basis like HUBS does for example. Though the ARPU would be far lower, the concentration risk gets removed.

Data Privacy Risks: ZETA stores sensitive first-party customer data meaning a big risk for them will always be cybersecurity, data breaches, and compliance. Regulations are becoming stricter meaning ZETA’s AI agents’ ability to leverage data may constantly change.

Now for the important part 👇Here’s how ZETA has at least 3x potential