01/12/2026: Ideas For The Upcoming Week

The market keeps going and the SPY just had its highest weekly close ever. We’re back above the 8-day MA and the 21-day MA which we’ve been battling with for the last few weeks. I’ve consistently said that as long as the SPY stays above the 100-day MA I’ll remain bullish. A key level below the 100-day is ~653. For now, we’re way away from that level.

We’re starting earnings season again soon, so I think that’s the main catalyst ahead. As long as earnings remain strong, I don’t see a huge risk of downside yet but of course I’ll let the market lead the way and I’ll react quickly.

If you want real time updates from me throughout the week then consider becoming a paid subscriber. Definitely worth a try for a month and if you don’t like it you can cancel. I suspect you’ll find far more value in it than $16 a month though.

With it you get:

Access to my portfolio (with real monetary amounts)

Access to my spreadsheet. One of the most in-depth and helpful resources out there.

Access to the paid chat where I send ~5-20 messages per day.

Real time buy, add, trim, and sell alerts.

Defensive

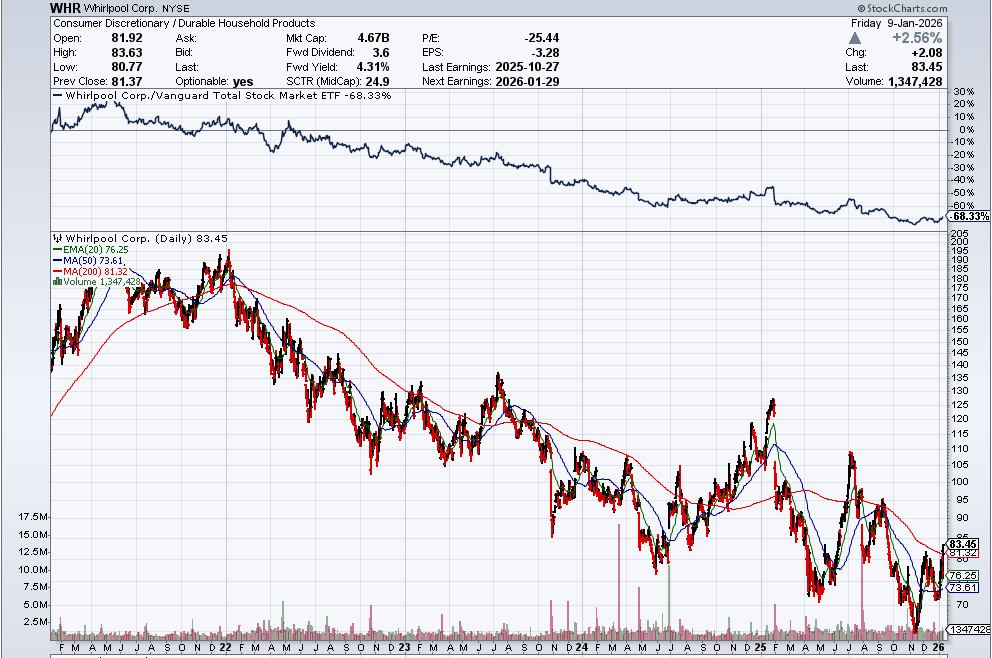

As per my watchlist (on the spreadsheet), Whirlpool (WHR) is sitting at a great technical level (back at 2002 levels) and valuation wise I think it makes complete sense here.

WHR is highly sensitive to existing home sales. When people move, they buy new appliances. Simple as that. Last week we saw Trump direct Fannie Mae and Freddie Mac to purchase $200B in mortgage-backed securities. This is a direct intervention to force mortgage rates down. We also saw Trump ban large institutional investors from buying single family homes to free up inventory for regular families and encourage existing home sales to start ramping up again.

This recent news hasn’t showed up in the data yet but we did see pending sales jump 3.3% in November 2025 which was the biggest jump in nearly 3 years. I suspect the numbers are showing signs of reversal. WHR stock also shows this. The stock is up 27% since the lows on November 11th on no stock specific catalysts.

Technically, we’ve also seen a break of structure with a higher high and a higher low. We’re now right at the 200 daily and if we break that I think there’s a very good suggestion of a new trend forming for WHR.

Fundamentally, this is not a stock that I normally invest in. It’s no disruptor nor is it one with strong EBITDA growth or anything alike. But it’s a key way to slightly lower the beta of my portfolio whilst profiting from a key long-term trend in home sales.

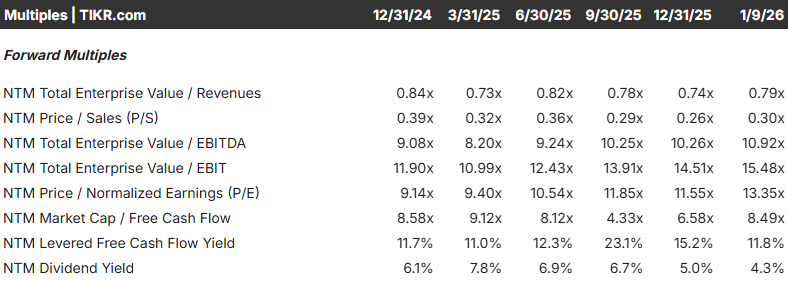

WHR currently trades at 0.3x NTM P/S and 10.9x NTM EBITDA for pretty limited revenue growth and ~10% EBITDA growth in FY26. As I said, I think the stock price for WHR is far more correlated to the home sale trend rather than sales and EBITDA multiples. With that being said, analysts expect $382M in FCF in FY26. That’s a huge jump from FY25 but very similar levels to FY24. WHR has historically traded ~20x FCF.

If WHR can return to a 20x multiple on $382M in FCF, then we hit a $7.6B market cap which is ~60% upside from today. I think at 2002 levels the downside here both fundamentally and technically is quite low.

Neutral Risk

My neutral risk play is a stock I invested in last week which we’re already up 7% on.

CRDO dropped ~25% before bouncing off this key support level I’ve highlighted on the chart below. It dropped on a couple of nonsensical news points regarding “cableless” design (not true) and a rumour that AMZN had dropped CRDO (also not true). I’m very bullish on the optics market which is where players like COHR and LITE operate, but CRDO currently dominate the AEC (Active Electric Cables) market.

The AEC market is likely to be the next big stage before optics perhaps takes over in 2-3 years. Still, optics is far too expensive today for data centers where data needs to be transmitted ~7-10 metres. AEC’s is by far the most cost-effective solution, and this is where CRDO have ~80% market share, hence 173% revenue growth rate estimates in FY26 (far above many optics plays).

A big bear argument on CRDO is that they’re not going to be a key player in optics which is also false. CRDO has built a strong optics portfolio with Bluebird and ZeroFlaps. Optics hasn’t become an afterthought at all for CRDO. They’re just playing the timeline perfectly (copper —> AECs —> optics). As AI demand continues to escalate, CRDO’s hybrid optical approach is set to benefit from all outcomes.

CRDO flashed up as “Very Bullish” on my spreadsheet before I started to dive in far more and ended up making the investment last week. You can access my spreadsheet here:

Higher Risk